The stock we review in this report is hated. And it is hated for multiple reasons. However, the market is misinterpreting some of the data, and the fear is overdone. After reviewing the details of this impressive dividend aristocrat (including its business, dividend safety, valuation and risks) we conclude with our strong opinion on investing (hint: we currently own shares in our Income Equity portfolio).

The 3M Company (MMM), Yield: 5.9%

Founded in 1902 and headquartered in St. Paul Minnesota, 3M Company has increased its dividend for 64 years in a row. The company is perhaps best known for scotch tape and post-it notes, however this industrial conglomerate divides its business into four segments:

Safety and Industrial: Offers industrial abrasives and finishing for metalworking applications; autobody repair solutions; closure systems for personal hygiene products, masking, and packaging materials; electrical products and materials for construction and maintenance, power distribution, and electrical original equipment manufacturers; structural adhesives and tapes; respiratory, hearing, eye, and fall protection solutions; and natural and color-coated mineral granules for shingles.

Transportation and Electronics: Provides ceramic solutions; attachment tapes, films, sound, and temperature management for transportation vehicles; premium large format graphic films for advertising and fleet signage; light management films and electronics assembly solutions; packaging and interconnection solutions; and reflective signage for highway, and vehicle safety

Healthcare: Offers health care procedure coding and reimbursement software; skin, wound care, and infection prevention products and solutions; dentistry and orthodontia solutions; and filtration and purification systems.

Consumer: provides consumer bandages, braces, supports, and consumer respirators; cleaning products for the home; retail abrasives, paint accessories, car care DIY products, picture hanging, and consumer air quality solutions; and stationery products.

3M has significant competitive advantages (such as economies of scale, economies of scope, and many patents) and as a result it consistently delivers high margins and impressive free cash flows (as we will explain in more detail later in this report).

Two (2) Big Reasons 3M Shares Are Currently Hated:

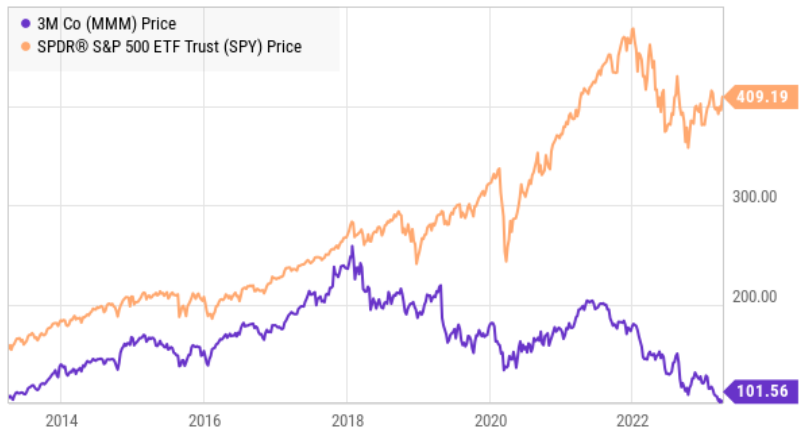

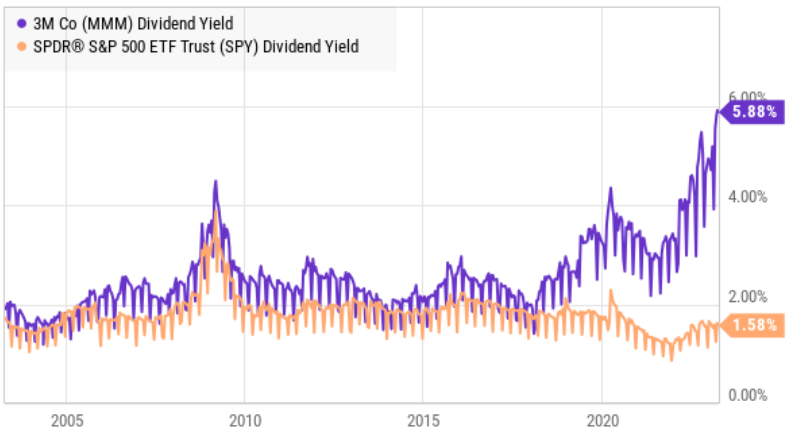

3M is currently hated by many investors, and this has resulted in the share price falling significantly (and the dividend yield mathematically rising) as you can see in the following charts.

Lawsuits: Lawsuits are the first big reason 3M shares have fallen so hard. And there are multiple big lawsuits pending. First, according to this report:

More than 200,000 veterans sued 3M subsidiary Aearo Technologies, claiming that its foam earplugs were defective and didn’t guard them from hearing loss. 3M has argued the earplugs worked properly when soldiers were trained on how to use them.

Next:

3M also was sued for making perfluoroalkyl or polyfluoroalkyl substances (PFAS) that contaminated drinking water and soil. They’re called “forever chemicals” because they take a long time to break down… The chemicals were used to make firefighting foam.

3M is waiting on two court decisions related to Aearo (earplugs) that are expected in April, and then in early May, appeals related to two earplug lawsuits will be heard. 3M’s liability in these cases could be in the billions of dollars. For example, regarding earplugs, Morningstar analyst Joshua Aguilar estimates:

“a liability of just over $4 billion based on inflation-adjusted comparable cases and the number of cases pending.”

And for PFAS “forever chemicals,” he estimates:

“about $14 billion in legal liabilities related to PFAS based on comparable environmental and product liability cases.”

These are big potential liability numbers which we will consider further in the valuation section of this report.

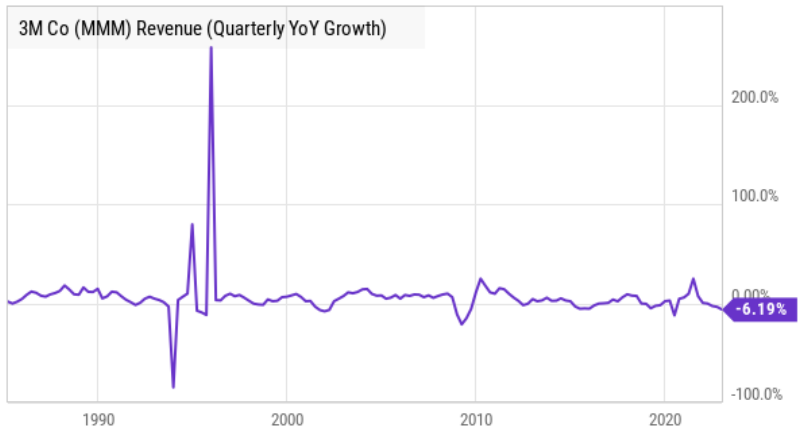

Low Growth: 3M’s recently lower growth forecasts are another big reason many investors don’t like (i.e. “hate”) the shares. For example, the company has been dealing with macroeconomic challenges, and a lot of investors simply believe the economy is increasingly focused on high tech thereby essentially making 3M an outdated dinosaur.

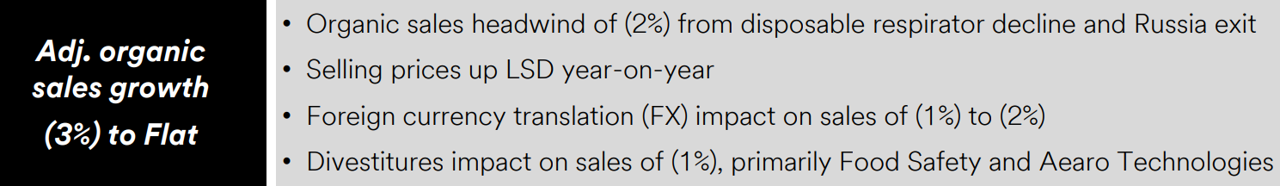

And for perspective, 3M estimates adjusted organic sales growth of -3.0% to flat for 2023 (per its latest quarterly financial release).

However, the low growth rate is somewhat misleading. First, the company is still dealing with some Covid disruption challenges (which should eventually normalize). Further, sales growth is facing headwinds from divestitures, foreign currency translation and an exit from Russia.

And while these shorter-term disruptions have created fear in the minds of many investors, we don’t view them as existential threats to 3M’s business, but rather as shorter-term challenges that the business can (and likely will) overcome. As we’ll cover more in the next sections, 3M remains a highly profitable business, with powerful cash flow, significant competitive advantages and viable long-term products.

For a little more perspective, here is an update on the business from the most recent quarterly earnings release:

Dividend Safety:

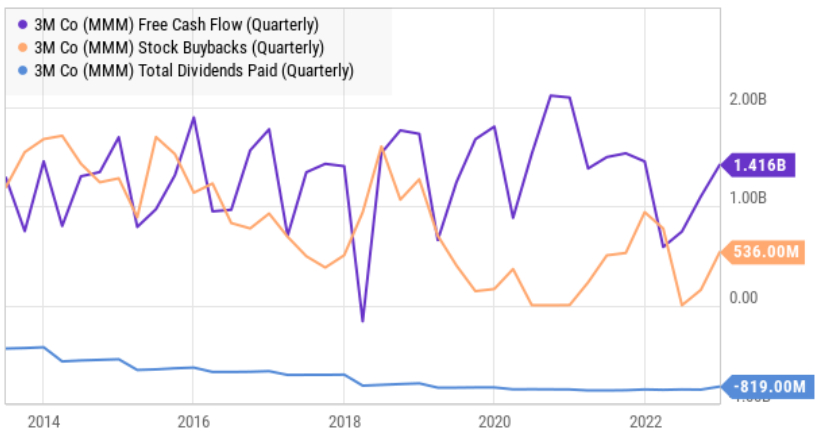

3M has increased its dividend for 64 years in a row—a truly impressive feat. And a look at the company’s cash flows reveals the dividend is actually very safe. Specifically, 3M is a very high margin business (~44% gross and ~17% net margins, impressive!) with very strong cash flows. For example, you can see in the chart below, 3M consistently generates free cash flow in the general range of $1 to $2 billion per quarter, and returns a comfortable margin of that to shareholders through growing dividends and prudent share repurchases.

3M also finished the most recent quarter with over $3.6 billion of cash on its balance sheet, and the company has a high investment grade credit rating (it’s also been paying down debt—another good thing). Even though 3M’s rate of dividend growth has slowed (prudently) in recent years, we view the dividend as very safe, and expect the long-term track record of dividend increases to comfortably continue (i.e. the dividend has historically had periods of slower and faster growth).

Valuation:

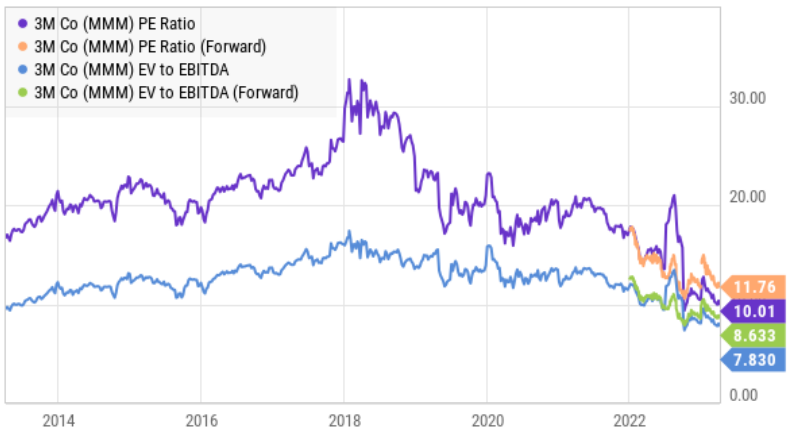

As we saw in our earlier chart, despite the near-term disruptions and risk, 3M continues to generate very strong free cash flow. It also has consistently generated strong earnings per share (“EPS”) yet its total market cap has fallen (as you can see in the chart below).

We believe the market is correctly fearful (and discounting the share price) because of the two big risks factors described earlier. However, we believe the market has taken the risk too far, and the shares an underpriced.

From a price-to-earnings ratio, 3M shares are clearly on sale. As you can see below, the shares trade well below historical averages.

And even if we factor in a liberal $18 billion liability related to lawsuits, the shares are still priced too low. For example, the current market cap of $55.9 billion already reflects more than $70 billion of losses over the last year as investors appear overly fearful in our opinion.

For a little perspective, when Dow Jones Industrial Average cohort, Johnson & Johnson provided clarity on its own lawsuits just this week, those shares shot up in price. And we expect something similar (and perhaps more dramatic) as we get more clarity around 3M in the months and quarters ahead. However, the CFO’s current stance on the litigation liability creates dramatic uncertainty and fear in the market. For example, the CFO recently said:

“We can't predict what that number is going to look like, and therefore, the guidance that we've given you of [adjusted] EPS of $8.50 to $9 excludes those litigation matters,”

For more perspective, Morningstar analyst Joshua Aguilar believes the shares have 29% upside (versus the current market price), and had this to say on March 27th:

After reviewing 3M's restated financials to account for its exit of all related PFAS chemicals manufacturing, we maintain our $131 fair value estimate. We model just over a 2% five-year adjusted sales CAGR and a midcycle operating margin of nearly 21%. We value 3M at about 15 times our 2023 adjusted EPS expectation of $8.68.

In our view, 3M’s shares are significantly underprices and the dividend is healthy and will continue to grow.

Risks:

3M currently faces a lot of risks, which has created uncertainty and fear, and this has contributed to the currently reduced share price. The big risks are the pending lawsuits (as discussed) and the notion that the company is out-of-date and faces increasing competition from newer companies with advancing technologies (some argue it’s hard to attract top-tech talent to 3M’s Minnesota location and out-of-date culture). However, in our view, these fears are warranted but overdone as the company remains a cash flow machine with healthy go-forward business prospects.

Conclusion:

If you are a contrarian dividend-growth investor that likes to buy businesses (stocks) when they are out of favor, now is an attractive time to consider investing in 3M. Despite the risks and fears, the business and dividend growth are both healthy, and the shares are significantly undervalued. There is no guarantee that things won’t get worse (especially in the short term), but over the long-term we believe 3M shares will be trading significantly higher, and collecting a 5.9% dividend yield makes waiting for the recovery easier. We believe in prudently-diversified, goal-focused, long-term investing, and we currently own shares of 3M in our Blue Harbinger Income Equity Portfolio.