Many income investors love Ares Capital (ARCC) for its big dividend yield and long history of healthy performance. But considering the current market environment, are the shares still worth owning? Or are there better BDC options available? In this report, we share comparative data on over 40 big-yield BDCs, and then dive deeper into Ares (including its business, valuation, dividend safety and risks). Next, we briefly consider two Ares alternatives (Blue Owl and Hercules Capital). Finally, we conclude with our strong opinion on investing in these specific big-yield BDC opportunities, especially with BDC earnings season right around the corner.

40+ Big-Yield BDCs Compared

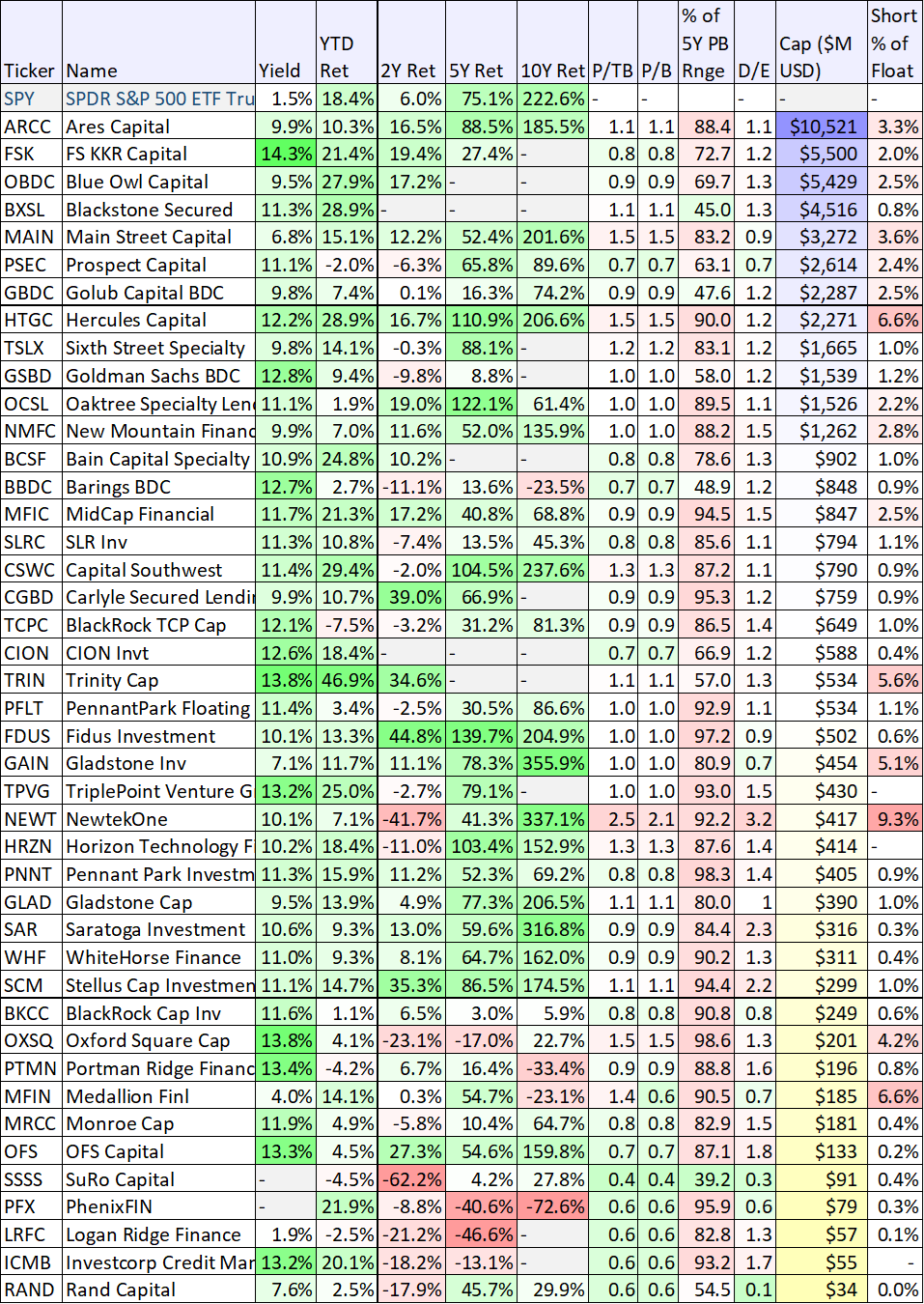

Before getting into the specifics on Ares (plus Blue Owl and Hercules), let’s first have a look at updated comparative data on over 40 big-yield BDCs. The table is sorted by market cap (and Ares is at the top).

A few things stand out about this data. For starters, you’ll notice the dividend yields are large (this is because BDCs can avoid corporate taxation by paying out income as dividends). You’ll also notice that year-to-date total returns are fairly strong (and much better than most of the two year return numbers), as the threat of a deep recession seems to lessen. And on a 10-year basis, very few BDCs have outperformed the S&P 500.

Further still, the price-to-book values (a very basic BDC valuation metric) are fairly mixed considering some trade at a premium (above one) and some at a discount; however most are closer to the top of their 5-year range. Lastly, short-interest is a bit higher for some BDCs (an indication that investors are betting against the shares). We’ll have more to say about these metrics, as we go through more details on specific BDCs in the following sections.

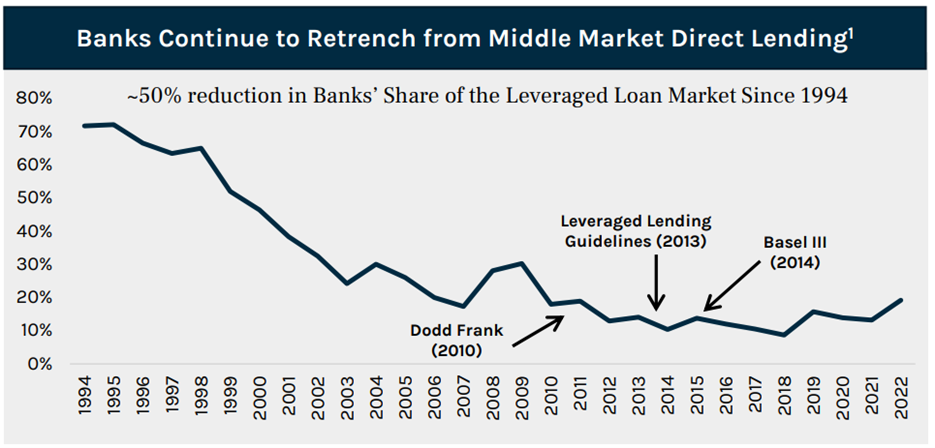

Also worth noting, BDC’s have benefited over the years as traditional banks have backed aways from middle market direct lending (due in significant part to increasingly-stringent bank regulations, such as Dodd Frank and Basel III requirements).

And more currently, banks may be backing away from this lending again (good for BDCs), considering the current market environment. For example, here is what Ares Capital CEO Kipp DeVeer had to say about it in late April:

We believe that the banks remain constrained on new activity due to concerns regarding both capital and liquidity and which we believe makes our broad range of flexible capital solutions even more valuable.

Current Market Conditions: Fear, Credit Spreads and Interest Rates

Before getting into more detail on specific BDCs, it’s worth briefly considering the current macroeconomic environment. For example, despite fears that the fed’s efforts to combat inflation (by aggressively hiking interest rates) would drive us into a deep recession, the market has been strong this year (the S&P 500 and most BDCs are up).

BDCs are particularly sensitive to the market cycle because many of the portfolio companies they provide financing too are smaller and don’t necessarily have the deep financial wherewithal to easily survive an economic slowdown. As such, paying attention to portfolio company performance during the upcoming earnings releases will be a critical metric to watch (specifically, are significantly more portfolio companies going into the riskier “non-accrual” status, or are they weathering the economic challenges without major incident?).

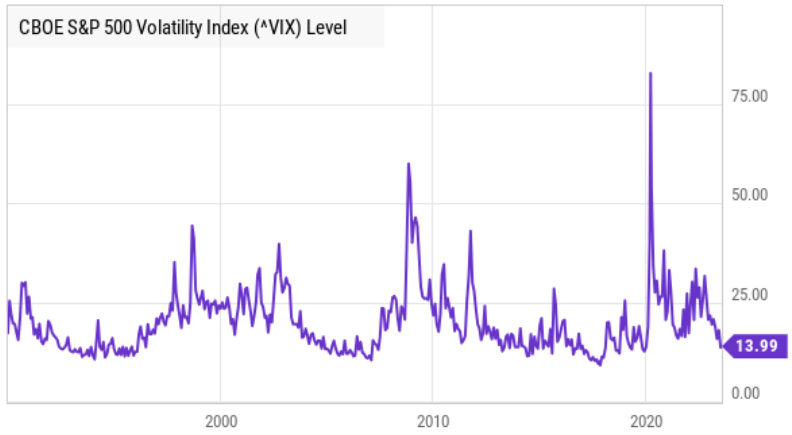

As you can see in these next two charts, the investors do not seem too concerned about the market right now. For example, the market “fear index” (VIX) is low by historical standards.

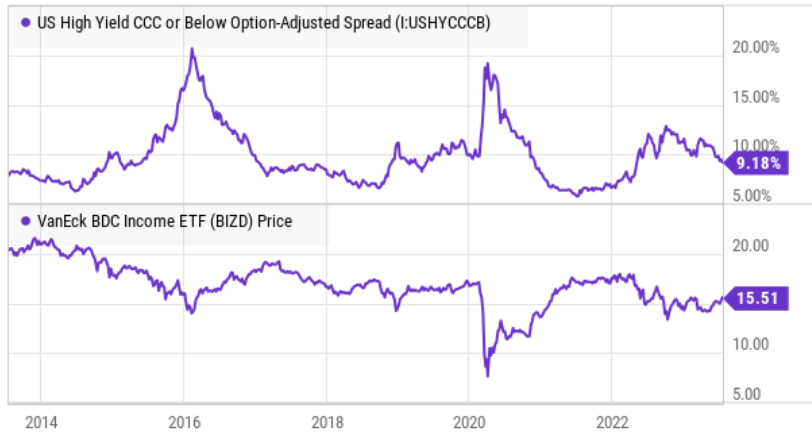

And credit spreads are also low, which is another indication that the market isn’t too worried about increasing defaults on riskier loans (similar to many of the loans made to BDC portfolio companies, see the inverse relationship below between credit spreads and BDCs).

Lastly, the market “greed index” is elevated (see below) an indication that investors may be getting too confident.

And this is a good reason why paying attention to the upcoming BDC earnings announcements (mostly over the next two weeks) will be so important (because we’ll see how companies are faring in the current macro environment). And BDC earnings season will kick off with Ares Capital on July 25th (a very popular and trusted big-yield BDC), so let’s have a closer look at that one first.

Ares Capital (ARCC), Yield: 9.9%

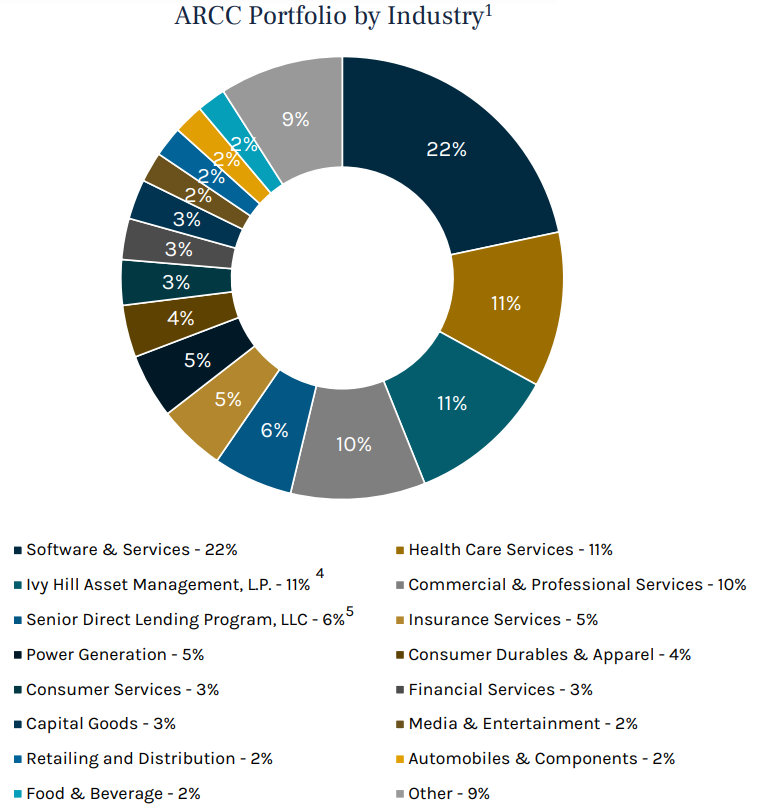

Ares is the largest publicly-traded BDC in the US, and it has a well-diversified portfolio of investments (mainly loans to businesses in need) across market sectors and industries, as you can see below.

Ares also has an investment grade credit rating and a well run business. The company describes itself as:

“a patient, long-term investor with permanent capital… able to hold large positions and [with] the ability to offer sponsors and management teams enhanced certainty of execution.”

And as compared to other BDCs, Ares standouts for its financial strength and industry leadership position.

Current “Non-Accrual” Loans

As a BDC investor, one important metric to watch is loans in “non-accrual” status. These are basically high-risk loans where the borrower is NOT making interest payments per the terms of the agreement. The number of non-accrual loans typically goes up when a lender does a bad job of underwriting the loan, or when market conditions (i.e. the economy) gets particularly challenging.

Here is a look at Ares historical non-accrual loans up through last quarter. And as you can see they’ve been on the rise, but they’re still relatively low as compared to historical standards.

Here is what Mitchell Goldstein (Co-Head of Ares Credit Group) had to say about non-accruals at the end of last quarter:

Our nonaccrual rates continue to be well below historical levels. Our nonaccrual rate at costs picked up modestly to 2.3% from 1.7% last quarter but remains well below our 3% 15-year history average and the KBW BDC average of 3.8% at the same time through year-end 2022.

Deal Activity Level:

Another important metric to watch for a BDC is the deal activity level. Specifically, when market conditions are challenging, the number of new deals underwritten by a BDC can slow down (and this can mean slower future growth). And in the previous quarter, Ares explained they’ve seen an increase in the number of deals they’ve evaluated, but the actual number of new deals has slowed down considerably. Specifically, here is what CEO Kipp DeVeer had to say on the quarterly call:

To this end, we've already seen a 14% quarter-over-quarter increase in the number of deals we evaluated during Q1, and this deal flow represents a broad set of industries.

However…

In terms of the new deal flow, our selectivity rate on new transactions in the first quarter is one of the lowest in 5 years. The merits of our investment -- of our origination strategy and our rigorous focus on credit quality allows us to continue to invest in high free cash flow and recession-resilient businesses, and this supports our strong overall credit performance. Despite the more challenging market backdrop, the overall growth and profitability of our borrowers continues to be healthy with a year-over-year weighted average EBITDA growth rate of 8%.

And…

Even though the new deal activity remains slow, we believe the size and quality of our incumbent portfolio drives differentiated access to attractive investments. As we have often said, we benefit from originations where we have incumbent relationships, and this quarter was no different as over 80% of our transactions were to existing borrowers.

Further still, the lower deal flow is helping Ares stated objective to deleverage its balance sheet, as per Kipp DeVeer:

I'd say, number one, we did have a stated objective to deleverage the balance sheet modestly, which we accomplished, and that's one way to do it.

And…

The second point was to your last comment, I do think that we don't think the environment for investing in high-quality companies at really attractive rates of return is going away anytime soon. So we probably took a pretty patient approach to the quarter.

So in the upcoming earnings release, it will be really important to consider how the new deal flow has been evolving for Ares.

Rising Interest Rates:

Interest rates are another important consideration for BDC investors. On one hand, rising rates can be very good for BDCs because they earn a wider net interest margin (i.e. the rate they lend at minus the rate they borrow at), especially if they have a significant amount of floating rate loans. On the other hand, rising rates can create increasing stress on portfolio companies (i.e. borrowers) because it becomes more expensive to service their debt. Here is what Ares had to say about interest rates on their previous quarterly call (i.e. they’ve been helped by higher rates so far):

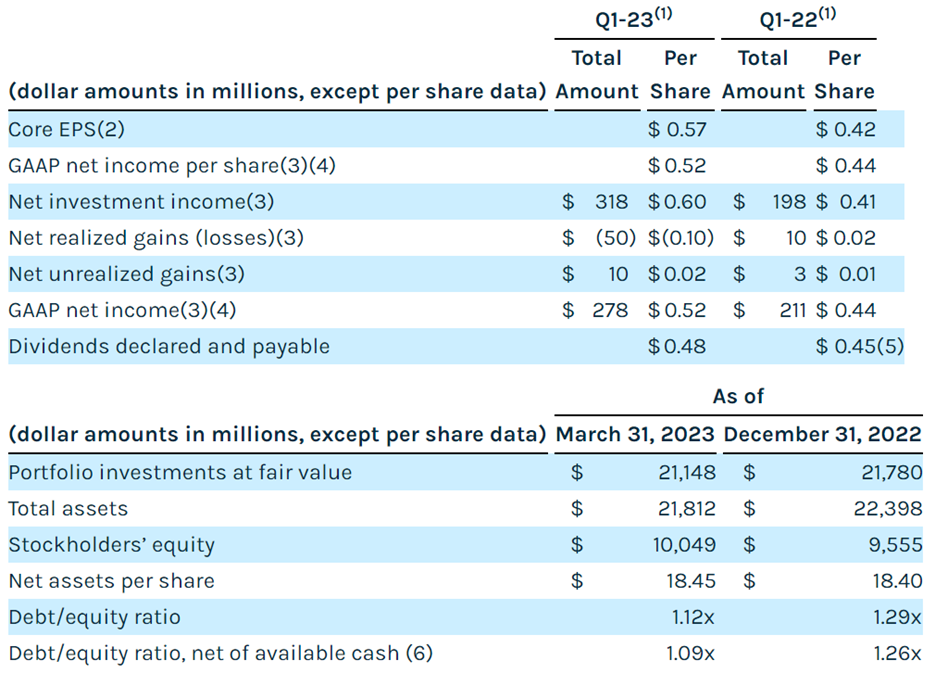

Our core earnings per share of $0.57 increased 36% year-over-year, primarily driven by the benefit of higher interest rates on new investments.

And…

The weighted average yield on total investments at amortized cost was 10.8%, which increased from 10.5% at December 31, 2022, and 8.1% at March 31, 2022. The yields on our portfolio reflect the continued increases in interest rates.

Thus far Ares has been helped by rising rates. And it’ll be important to learn about the tradeoff between higher rates and potentially higher non-accrual loans in the upcoming earnings release.

Dividend Safety:

Ares’ dividend safety is an important consideration for many investors (especially considering it’s the main reason many of them invest). The quarterly dividend was most recently $0.48, and it has been increased in each of the last two years (the last time it was reduced was during the financial crisis of 2009 when it fell from $0.42 to $0.35). And as you can see in the following table, net investment income covered the dividend in the most recent quarter, although that is not always the case (it fell short in the same quarter a year earlier).

Note: Worth mentioning, you’ll also notice in the table above that Ares has been successful in deleveraging (a stated goal mentioned earlier) as the debt/equity ratio has fallen to 1.12x from 1.29x. This creates more financial stability (strength), and also gives the company more "dry powder” for when future attractive deal opportunities arise).

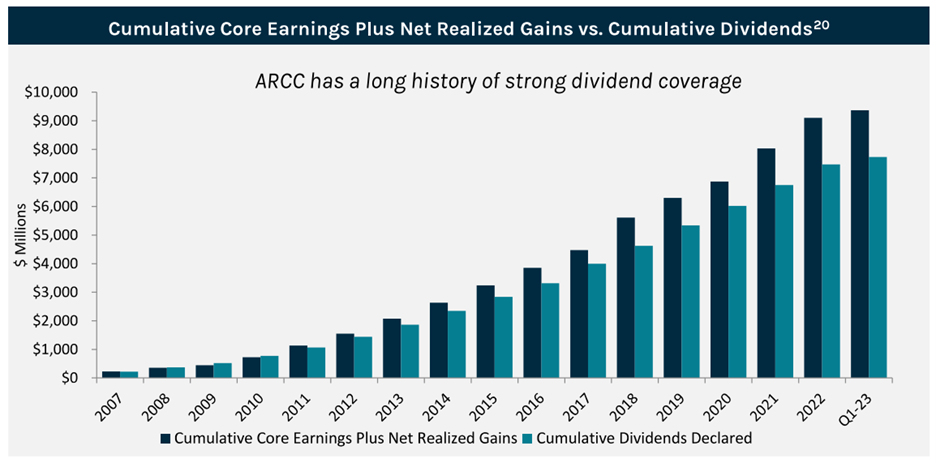

Importantly, the longer-term trend (see chart below) shows Ares has a long history of strong dividend coverage (a good thing for investors).

Valuation:

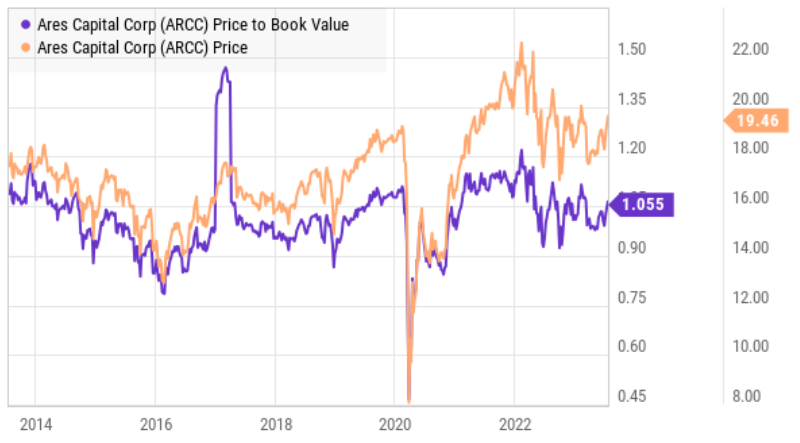

One of the most basic ways to value a BDC is the price-to-book ratio. And Ares currently trades at just over one, which is fairly consistent with its longer-term range (and times it has traded at bigger premiums or discounts).

The book value has been helped recently by low credit spreads (because this indication of lower risk can result in assets being valued higher on the books). However, if deal flow slows then the rate of book value increases (and dividend increases) will also likely slow. For reference, you can see the price-to-book value ratios of many BDCs in our earlier table.

Risks:

The biggest risk for Ares is basically if the economy falls into deep recession then many of its portfolio companies won’t be able to pay the interest on their loans (and more will go into non-accrual status). Similarly, if interest rates continue to increase significantly this could cause more stress (and more defaults) on loans. However, it can also result in more net investment income from rising credit spreads, especially on floating rate loans (as discussed earlier).

Fortunately for Ares, it is one of the largest and most diversified BDCs. Unlike some smaller BDCs, no single loan makes up too much of Ares business (so this helps reduce risks). Further still, Ares reduced leverage and investment-grade credit rating also provide financial strength and stability that other BDCs do not have.

Hercules Capital (HTGC), Yield: 12.2%

Switching gears, another BDC that we like (and currently own) is Hercules Capital. Hercules is smaller and less diversified than Ares, and it has a special focus on venture debt and growth capital (often considered riskier and more volatile).

Notably, Hercules also has a significantly higher price-to-book value and more short-interest (as you can see in our earlier table). We purchased shares of Hercules earlier this year at a significantly lower price following the fallout (and market panic) from the Silicon Valley Bank collapse (BDCs were trading significantly lower then, particularly venture debt and growth capital BDCs, like Hercules).

Growth companies (such as growth stocks as well as the private growth companies Hercules lends to) have experienced strong gains so far this year (as the market has started to recover from a terrible 2022 for this same group). Hercules is worth watching closely considering its higher valuation and the current state of the economy. For example, if the upcoming fed announcement is more dovish on future interest rates—that could be good for Hercules.

Important to note here, Hercules’ current high P/B value may actually be more of an indication that the book value is too low (and will be written up at the next quarterly announcement on August 3rd) not necessarily because it is over valued.

Blue Owl (OBDC), Yield: 9.5%

Blue Owl (formerly Owl Rock) is another BDC that looks very attractive on many important BDC metrics. The shares have been a strong performer for us this year (they’re performing significantly better than other BDCs). However, we recently sold 100% of our Blue Owl shares due to some internal management conflicts.

Specifically, the trade comes on the heels of reported drama among the founders of “Blue Owl.” We have no indication that the internal drama will cause any problems for “Blue Owl” (the shares may continue to do perfectly fine going forward). However, where there is smoke, there is often fire. And considering two of the Blue Owl founders have retained attorneys because the third founder refuses to resign, we’re more comfortable just getting out of this one. We replaced Blue Owl with this BDC instead.

Conclusion:

The bottom line is that we like Ares Capital, and we continue to own the shares. We have no intention of selling considering the healthy yield, healthy financials and strong overall business. However, we will be watching this upcoming earnings announcement for clues and information about non-accrual loans, interest rate impacts and deal activity in particular.

Ares announces quarterly results first among the BDCs (expected on Tuesday, July 25th, pre-market), and it may give clues about the health of the BDC market and what is to come for other BDCs. We continue to own Hercules as well, and we expect Blue Owl will most-likely continue to perform well too (even though we recently sold the shares based on concerns about the management team).

Overall, BDCs continue to pay big dividends, and they can be an important part of a high-income-focused investment portfolio.