In this report, we review municipal bond closed-end funds (CEFs). As a category, municipal bonds (i.e. bonds issued by state and local municipalities) can be compelling for investors in higher tax brackets because they are generally exempt from federal taxes (and often also exempt from state taxes if you own “munis” issued by the state in which you live). And owning “munis” through the CEF structure can sweeten the opportunity for some investors (especially considering price discounts are currently at historically high levels). In this report, we compare 50 big-yield municipal bond CEFs, considering current data and unique risks for the category, and using municipal bond NMZ as a specific example.

50 Big-Yield Muni-Bond CEFs

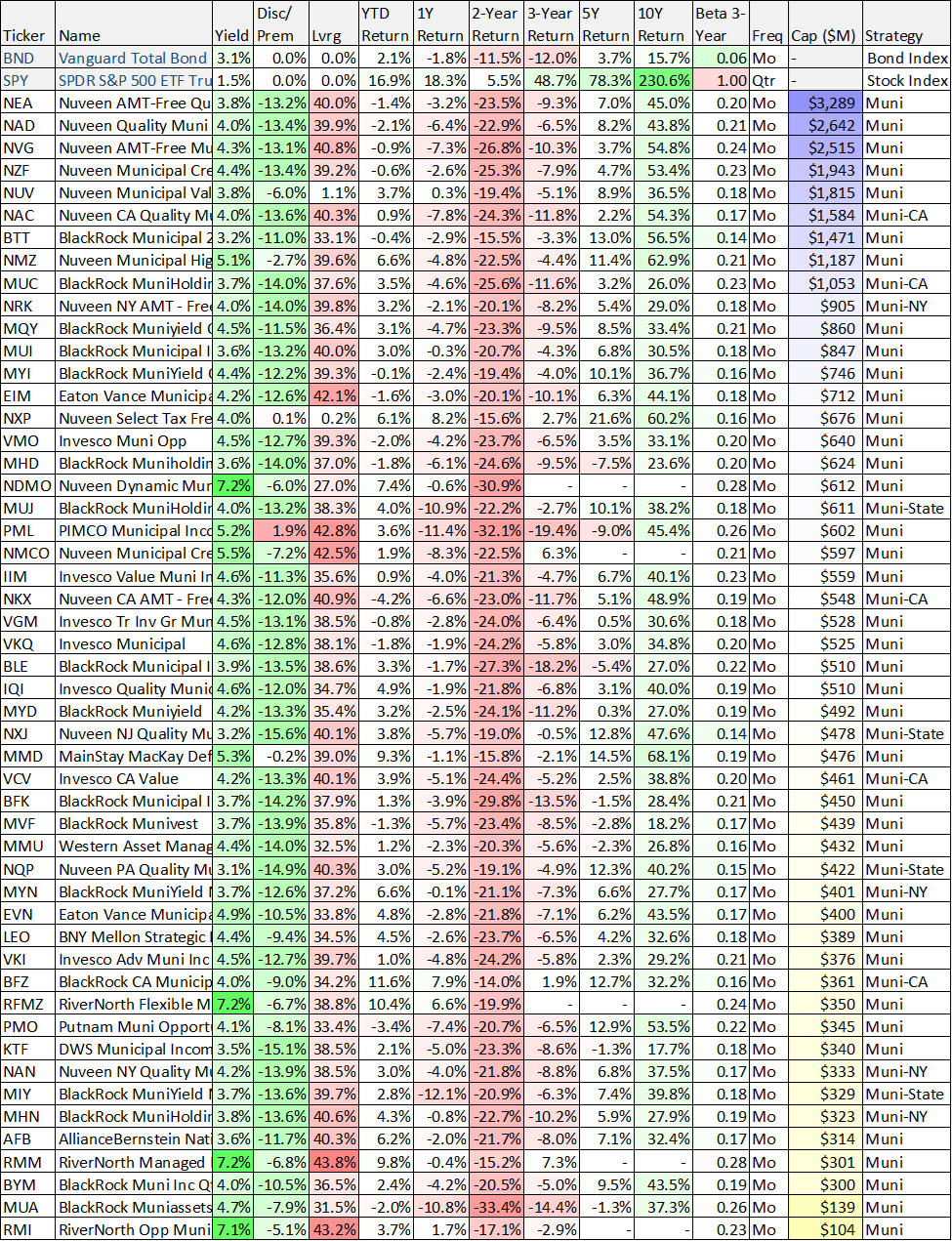

For starters, here is a look at recent performance data for 50 big-yield muni-bond CEFs. As you can see, the two year returns have been particularly ugly, and the reason is because as interest rates have risen—bond prices have fallen. And municipal bond funds often have more interest rate risk because they hold bonds with longer maturities and higher duration (more on this later).

Historically Large Price Discounts:

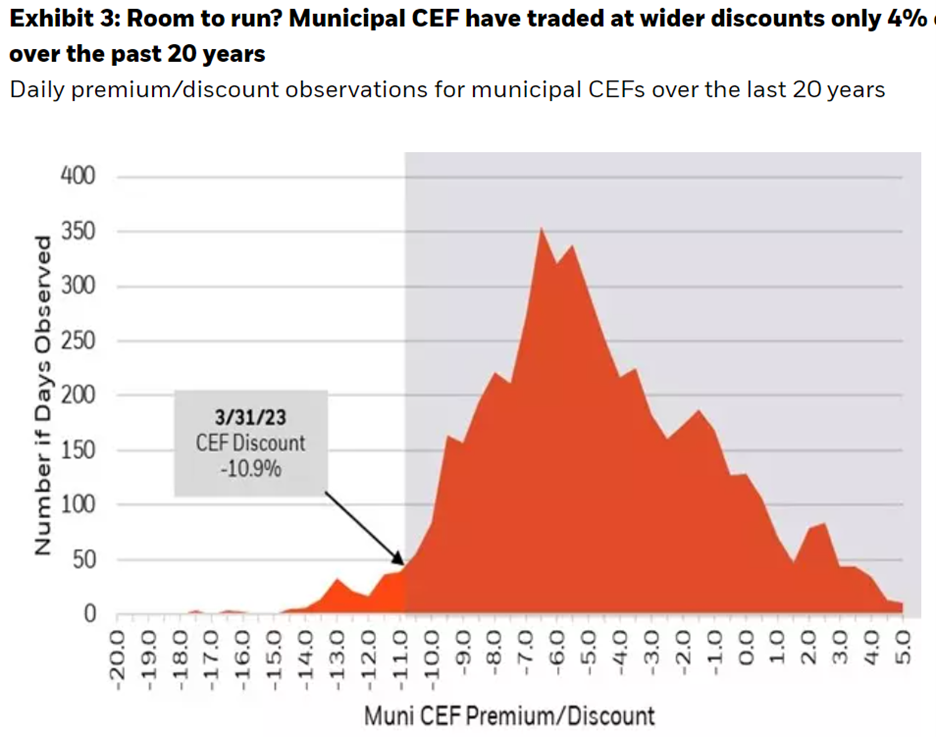

Also worth noting, muni-bond CEFs curently trade at unusually large discounts versus net asset value (as you can see in the table above), and this may represent a compelling time to “buy low” as interest rate hikes are expected to keep settling down (as inflation appears increasingly under control). For a little perspective, here is a look at just how large the current muni-bond price discounts are versus the last 20 years.

Tax Equivalent Yields

One of the most important factors when considering investing in municipal bond CEFs in the “tax equivalent yield.” In particular, because you don’t pay federal income taxes on these bonds, you can accept a lower yield (versus other bond categories) and still take home just as much “after tax” income. Tax equivalent yield is calculated as the “Tax Free Municipal Bond Rate” divided by “1 - Tax Rate,” as you can read about in this article. So depending on what federal income tax bracket you are in, all of the yields in our earlier table are actually higher on a “tax equivalent yield” basis.

You’ll also note in our earlier table that some of the muni-bond CEFs are California or New York state specific. This is because those states have particularly high state income tax that you may be able to avoid if you live in one of those states and invest in municipal bonds issued in that state.

Nuveen Municipal High Income (NMZ), Yield: 5.1%

We received an inquiry from a member about this muni-bond CEF in particular, so we’re sharing a few important considerations below. You can also read more on the fund’s website (including all kinds of important metrics) here.

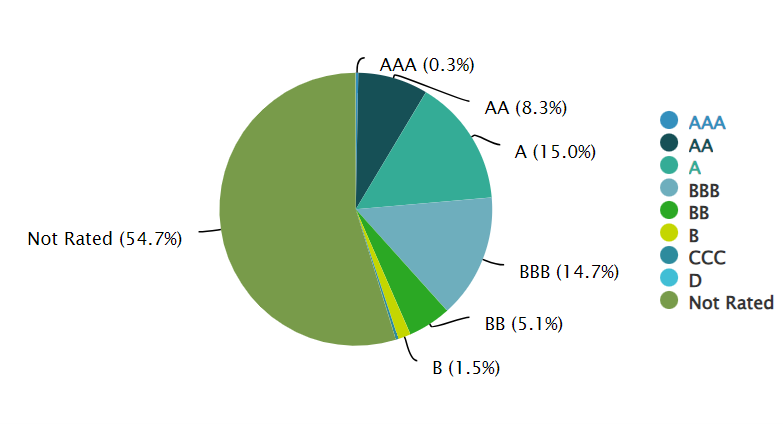

Credit Risk: For starters, municipal bonds are generally fairly safe (i.e. the default risk is fairly low). There are “general obligation” munis (basically backed by the credit of the municipality issue the bond) and revenue bonds (generally backed by the revenue of a municipal project—such as if your state’s baseball team issues a bond to build a new stadium and promises to use revenue from the stadium to pay back the bonds). However, some muni bond CEFs select riskier and safer types of muni bonds and that fact usually bears itself out in the yield (higher yields usually mean more risk, all else equal). NMZ has a slightly higher yield than many (but not the highest) and you can see some information on the credit quality of the bonds NMZ currently holds below (i.e. there is a significant amount of “investment and non-investment grade” bonds in this fund).

Leverage: Municipal bond CEFs also use leverage (or borrowed money), as you can see in our earlier table. This can magnify income and returns in the good times, but it can also magnify risks in the bad times. For example, as you can see in the 2-year return column (when interest rates were rising sharply) returns have been pretty bad over the last two years. Most bond CEFs are generally limited to a maximum of 50% leverage.

Interest Rate Risk: As mentioned, when rates rise, bond prices fall (all else equal), and in the case of municipal bond CEFs in general (and NMZ in particular) interest rate risk is usually higher (because they hold longer maturity bonds). In fact, NMZ has an average leverage adjusted effective duration of 18.07 years. This is a really long time for a bond fund, and it exposes NMZ to a lot of interest rate risk. If rates keep rising, this fund will continue to feel pain, but if rates fall then this fund will experience gains.

Distribution Consistency: A lot of municipal bond funds have been forced to reduce distributions over the last couple years as interest rates were closer to zero. However, again, a lot of market pundits believe the steep interest rate hikes are finally settling down (a good thing for bond funds like NMZ). You can view NMZ’s distribution history below (which is fairly similar to a lot of other muni bond CEFs).

Our Bottom Line:

Our bottom line on municipal bond CEFs in general (and NMZ in particular) is that we are cautiously optimistic about the market going forward, particularly if you are in a high income tax bracket. In particular, price discounts are historically large, and this may bode well for price returns going forward. Regarding NMZ in particular, its price discount is smaller than others, perhaps because investors have been chasing its slightly better long-term return track record and its slightly higher than average yield.

Just know that the higher yields are generally associated with higher risks (i.e. more of the CEF’s underlying holdings may default and not pay if the market goes into a deep recession). However, default rates on municipal bonds are historically very low, as you can read about in this article).

In summary, if you are a high tax bracket person, municipal bond CEFs look attractive currently as one part of a prudently-diversified portfolio. However, it depends on your own unique situation and personal investment goals.