Markets ticked lower again this past week (especially for growthier stocks) and a lot of investors are now fearfully looking at their account balances and wondering if they should sell! However, in the contrarian spirit of the newly announced Splunk (SPLK) acquisition by Cisco (CSCO) we share a list of targets for the next big buyouts (yet to be announced), plus two attractive growth stocks now trading at lower prices.

Let’s start with the two growth stocks…

1. Celsius (CELH)

We’ve owned shares of this fitness drink company in our Disciplined Growth Portfolio since it traded in the $60’s. The price now sits around $169, significantly lower than the $206 share price just a few weeks ago. Celsius has been growing extraordinarily rapidly since landing a distribution deal with Pepsi (PEP), and as the share price has climbed—so too has the short interest (i.e. people betting against the company). As hard as it is to fathom (by a lot of purely quantitative investors especially), Celsius’ growth is real and likely not going away anytime soon. Rather, we expect sales and profits to keep growing based on the latest Nielsen sales numbers (which show Celsius just keeps climbing).

And the massive energy drink market opportunity suggest a lot more room to keep growing.

However, because there is so much uncertainty and volatility with Celsius, the shares have pulled back a lot harder than the rest of the market in recent weeks. And if you are a long-term growth-focused investor, now is a lot better time to add shares than just a few weeks ago (when the price was significantly higher). Long Celsius.

2. Enovix (ENVX)

Enovix is the most speculative stock we currently own, and we like it because it has a lot more upside (if the company can execute) than downside. And because the shares trade in the lower part of a technical range that could be a good indication of near-term price gains ahead.

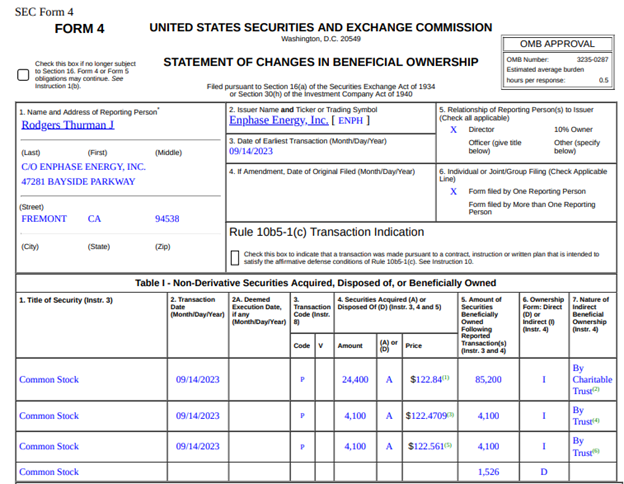

Enovix makes lithium-ion batteries that are a lot more efficient than traditional batteries. These batteries are not new, and Enovix doesn’t have any particularly attractive moat. However the timing for the technology may be increasingly right as the costs of implementation continue to fall. We also really like the leadership of new chairman TJ Rodgers, who has a track record for driving success at other organizations. Incidentally, TJ Rodgers also sits on the board of another Blue Harbinger Disciplined Growth Portfolio holdings, Enphase (ENPH), and Rodgers just bought more shares of that company this past week.

For reference, here is our earlier full report on Enovix.

3. Buyout Targets: Unprofitable Software Companies

Switching gears to “buyout targets,” news was released this week that Cisco Systems would be acquiring pandemic darling Splunk (SPLK), and thereby causing Splunk shares to jump dramatically in price!

Like many software application companies, Splunk shares soared during the pandemic (when interest rates were so low), but has come crashing back down to earth recently. And this lower share price makes it a much more attractive acquisition target for larger companies that are struggling to grow (like Cisco).

A lot of investors are completely turned off by high-flying pandemic-darling software stocks now that they have come crashing back down to earth, however from a contrarian standpoint they make much more attractive acquisition targets now that their prices are so much lower.

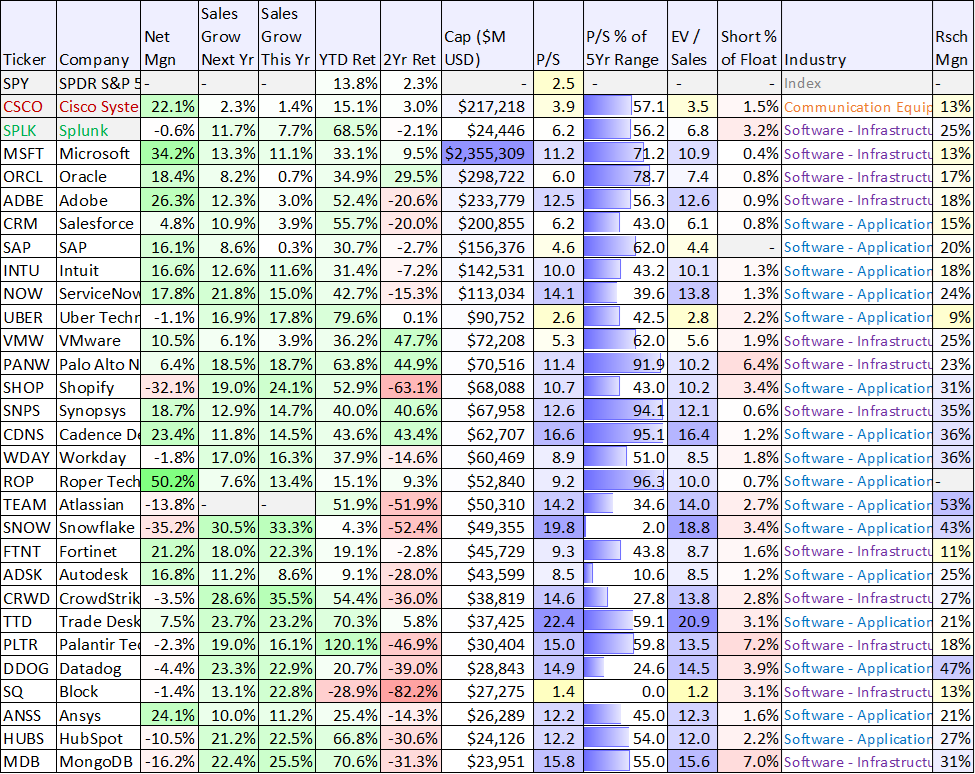

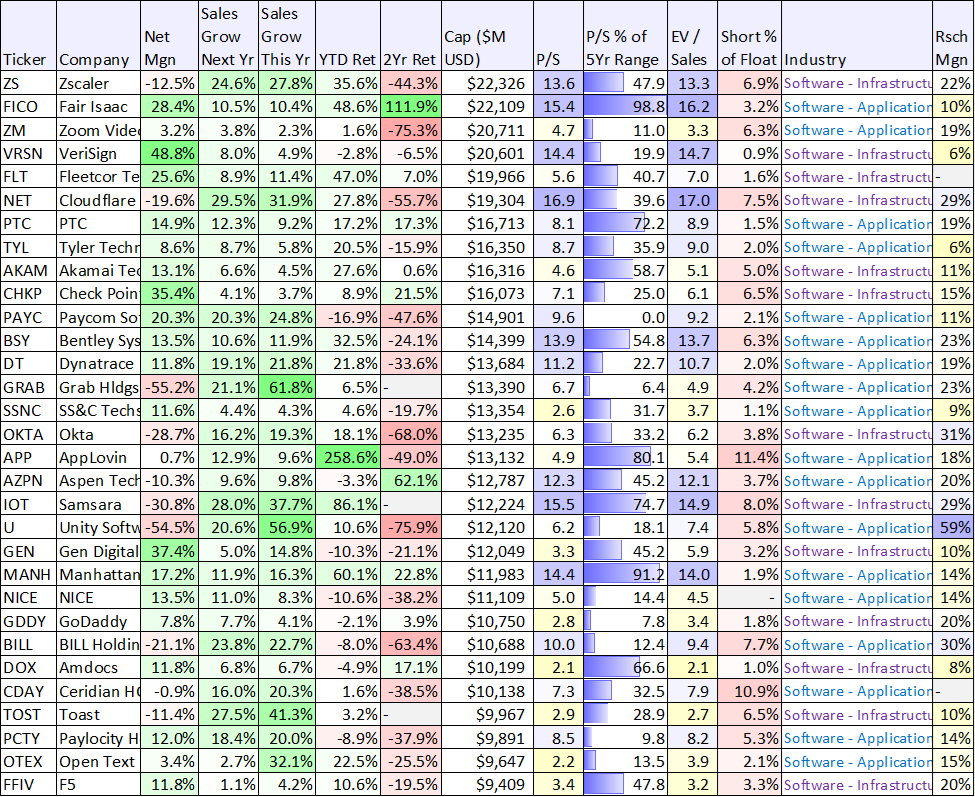

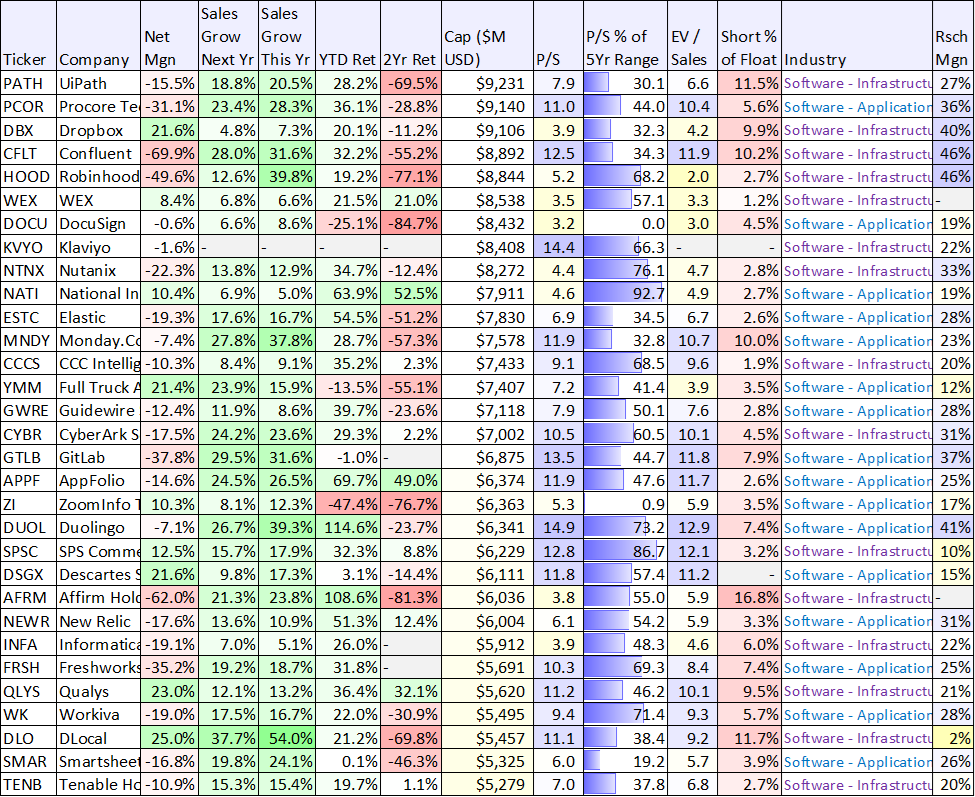

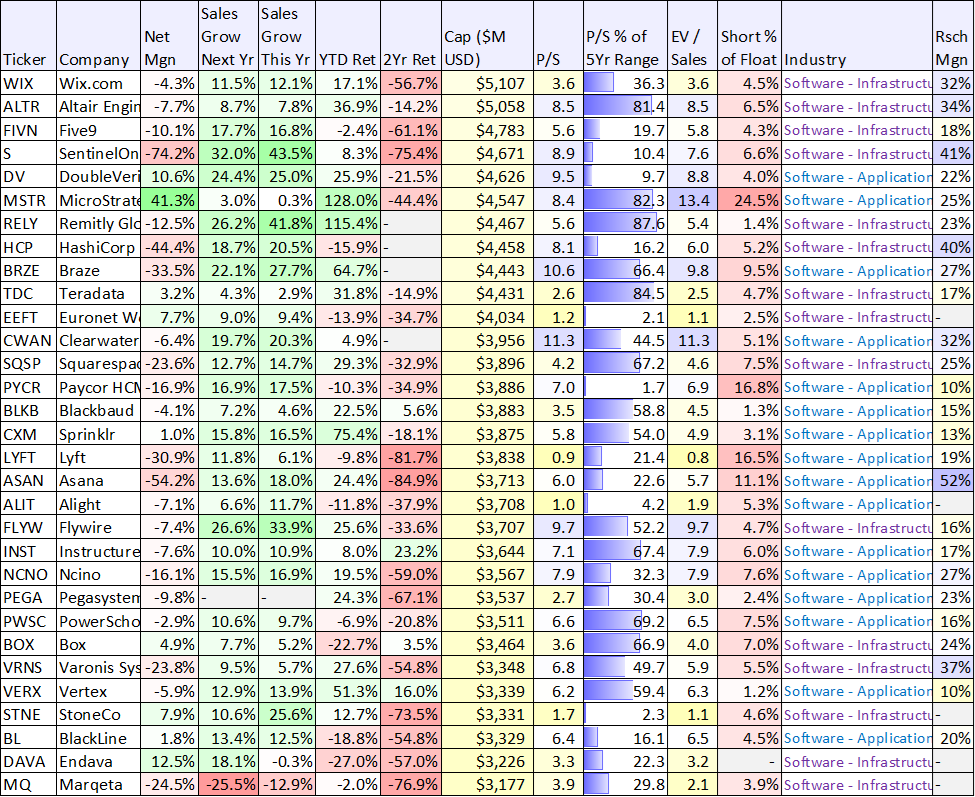

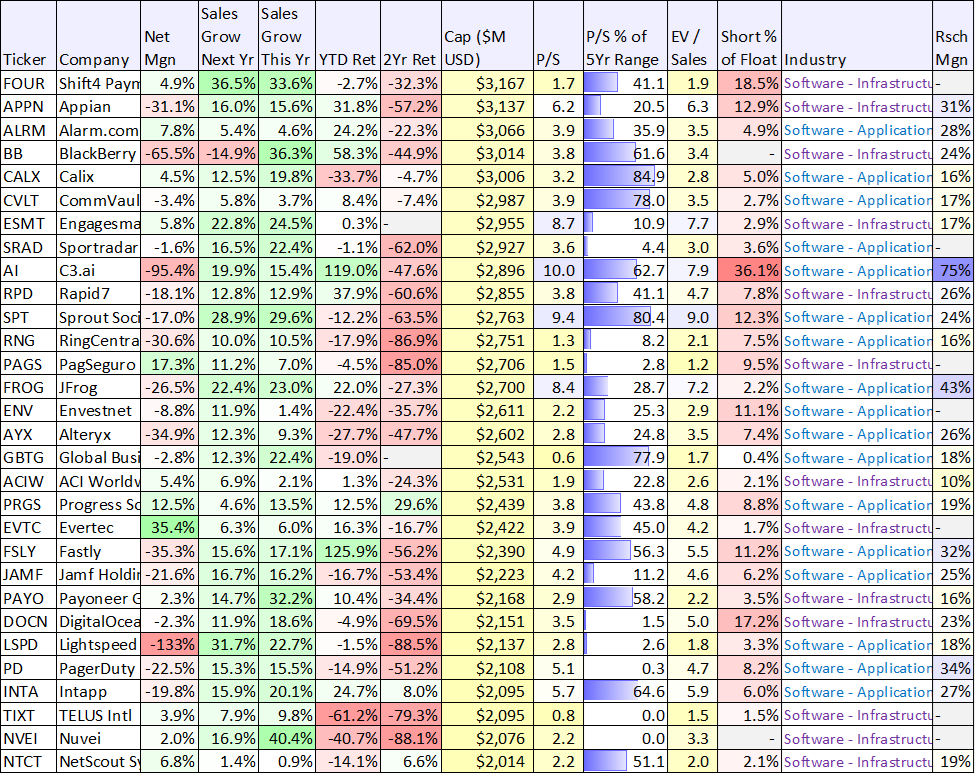

In particular, large companies that are very profitable (see high “net margin” companies in our table below) but struggling to grow (see sales growth rates in our table below), like to buy smaller high-sales-growth companies (like Splunk) especially ones that are struggling to achieve profitability on their own because of their smaller size (lack of economies of scales) and because its more expensive to fund growth now that interest rates are higher (borrowing money for growth is more expense) and now that share prices are lower (i.e. raising capital through share offerings is less attractive now because the shares aren’t worth nearly as much).

So in the spirit of buyout targets (we think there are a lot more to come in the quarters ahead because of current market conditions) here is a list of companies that may be ripe with future buyout targets (see below).

Specifically, negative (or low) profitability companies (see “net margin” column) with relatively smaller market caps (see market cap column) but that are growing rapidly (see sales growth columns) and trading at lower valuations as compared to a couple years ago (see 2-year return column and price-to-sales as a percent of 5-year range column), may likely get acquired in the quarters ahead.

As you can see above, Splunk was a likely target because it checks all the boxes. Other names that are likely being considered as buyout targets (by larger companies) likely include companies like Datadog (a Disciplined Growth Portfolio holding), Cloudflare (NET), Zscaler (ZS), Okta (OKTA) and many others!

Conclusion:

The bottom line here is that fear creates opportunity. Some investors may see the market declined in recent weeks and be tempted to panic and sell holdings out of fear. Others see opportunity, such as lower share prices and potential buy out targets.

And if you are truly a disciplined long-term investor—now is a more attractive time to be buying than it was a few weeks ago when prices were higher. However, if you don’t have as long of a time horizon (or you simply cannot stomach the high share price volatility from quarter to quarter) that can be a good indication that you should not be investing in high-growth stocks anyway.

We believe disciplined, goal-focused, long-term investing will continue to be a winning strategy. You can view all of our current portfolio holdings here.