The company we review in this report is a leading omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software to enterprises. The company enables its clients to engage consumers across various channels like email, social media, web, chat, Connected TV, and video. In this report, we analyze the company’s business model, its market opportunity, financials, valuation and risks, and then conclude with our opinion on whether the shares offer an attractive balance between risks and rewards.

Key Takeaways:

Robust platform consolidating the fragmented marketing landscape

Growing TAM fueled by data and AI innovation

Expanding customer base and increasing revenue contribution from high-value customers provides revenue stability

Promising revenue growth and operating leverage driving improved profitability

Healthy balance sheet supported by positive FCF

A PDF version of this report is available here.

Overview: Zeta Global (ZETA)

Zeta was founded in 2007 by David A. Steinberg and former Apple CEO John Sculley under the name XL Marketing. The company underwent a name change to Zeta Interactive in 2014 and later adopted its current name, Zeta Global in October 2016. The company was founded with the vision that data would revolutionize the interaction between marketers and consumers for achieving successful business outcomes. The company has over 1,000+ customers across verticals including financial services, consumer, telecommunications, etc. It went public in June 2021 and raised over $200M.

The value proposition of Zeta’s platform is that it provides a holistic front office solution, allowing customers to integrate their marketing technology suite seamlessly across various domains. Businesses can execute a comprehensive marketing strategy from a unified platform, engaging customers through both organic and paid channels. Additionally, Zeta provides exclusive data on over 535M individuals, facilitating precise audience targeting - a unique feature not readily available in the market.

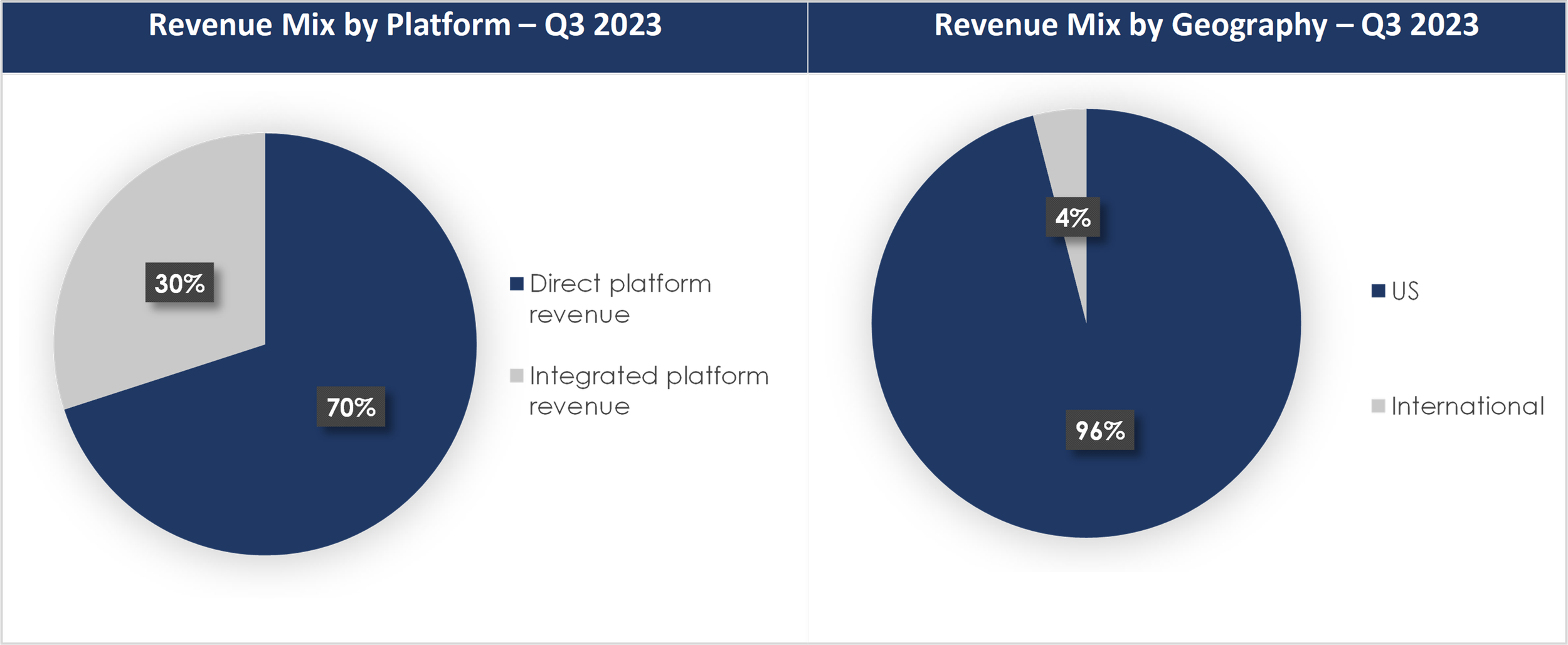

The company’s revenue primarily stems from the utilization of its technology platform, involving subscription fees, volume-based utilization fees, and fees for professional services. The platform revenue is categorized into direct platform revenue (revenue generated exclusively through the company’s own platform) and integrated platform revenue (revenue generated by leveraging the platform's integration with third parties). In Q3 2023, direct platform revenue constituted 70% of the total revenue. In terms of geographical distribution, the majority of revenue (96%) was generated in the US, with the balance 4% originated from international markets, as shown in the following chart.

Source: Company 10-Q

Robust Platform Consolidating the Fragmented Marketing Landscape

Despite significant investments in data and technology, marketers face challenges in personalizing the majority of customer interactions. Achieving personalization at scale is essential for enhancing customer experience, fostering loyalty, and increasing lifetime value. Consequently, there is a trend of replacing older marketing technology solutions with modern platforms that offer enhanced engagement, intelligence, and data capabilities. This is precisely where Zeta plays a role, addressing the gap left by outdated systems and vendors while offering a reduced Total Cost of Ownership and increased Return on Investment.

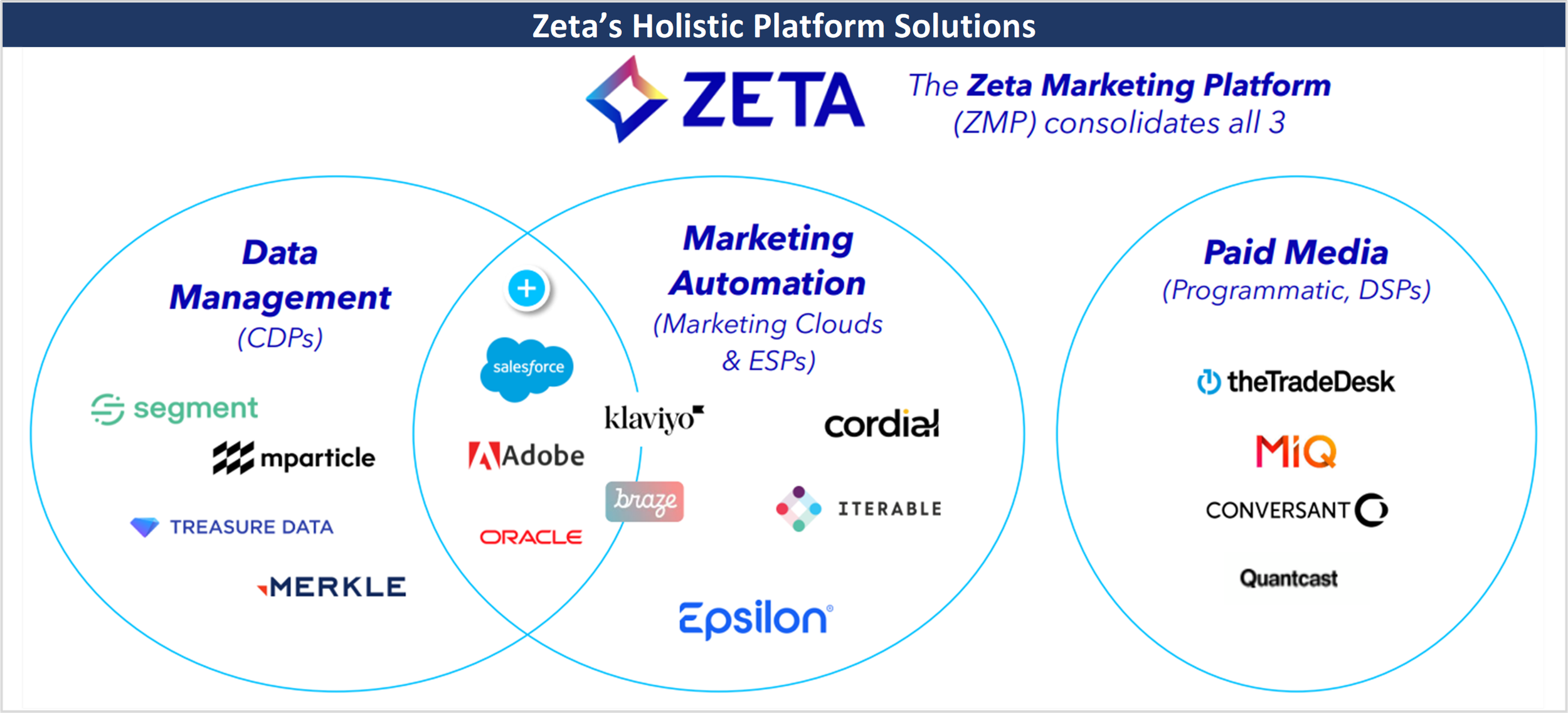

The Zeta Marketing Platform (ZMP) stands out as one of the most comprehensive omnichannel marketing platforms. Utilizing sophisticated machine learning algorithms and the industry's largest opted-in data set, the ZMP analyzes billions of data points to predict consumer intent. The platform engages consumers through native integration of marketing channels and API integration with third parties, allowing real-time learning and optimization of each customer's marketing program. It also facilitates personalized consumer experiences at scale across various touchpoints, empowering customers to create and manage marketing programs through automated workflows and advanced dashboards.

Source: Investor Presentation

Growing Total Addressable Market (TAM) Fueled by Data and AI Innovation

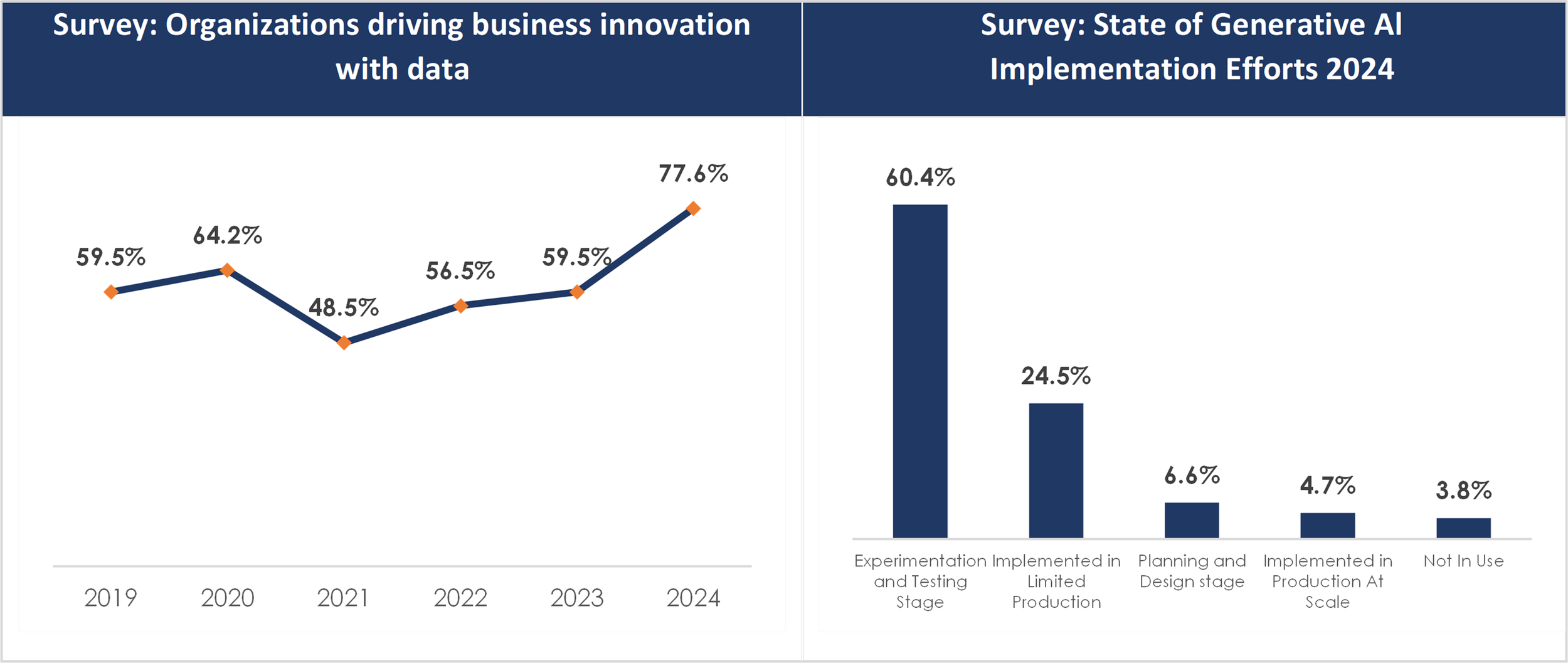

The AI/ML market is undergoing a pivotal shift, with global organizations recognizing the crucial role of integrating data and AI into conventional business processes. According to the 2024 Data and AI Leadership Executive Survey conducted by Wavestone, the percentage of organizations leveraging data for business innovation has shown substantial improvement, rising from 59.5% in 2019 to 77.6% in 2024. Generative AI has emerged as a practical business tool with transformative potential. Despite its potential, the adoption of Generative AI is in its early stages, as evidenced by 60.4% of organizations being in the early experimentation and testing phases. Only a small percentage, 4.7%, have successfully implemented Generative AI at scale in production, indicating significant growth potential for AI implementation.

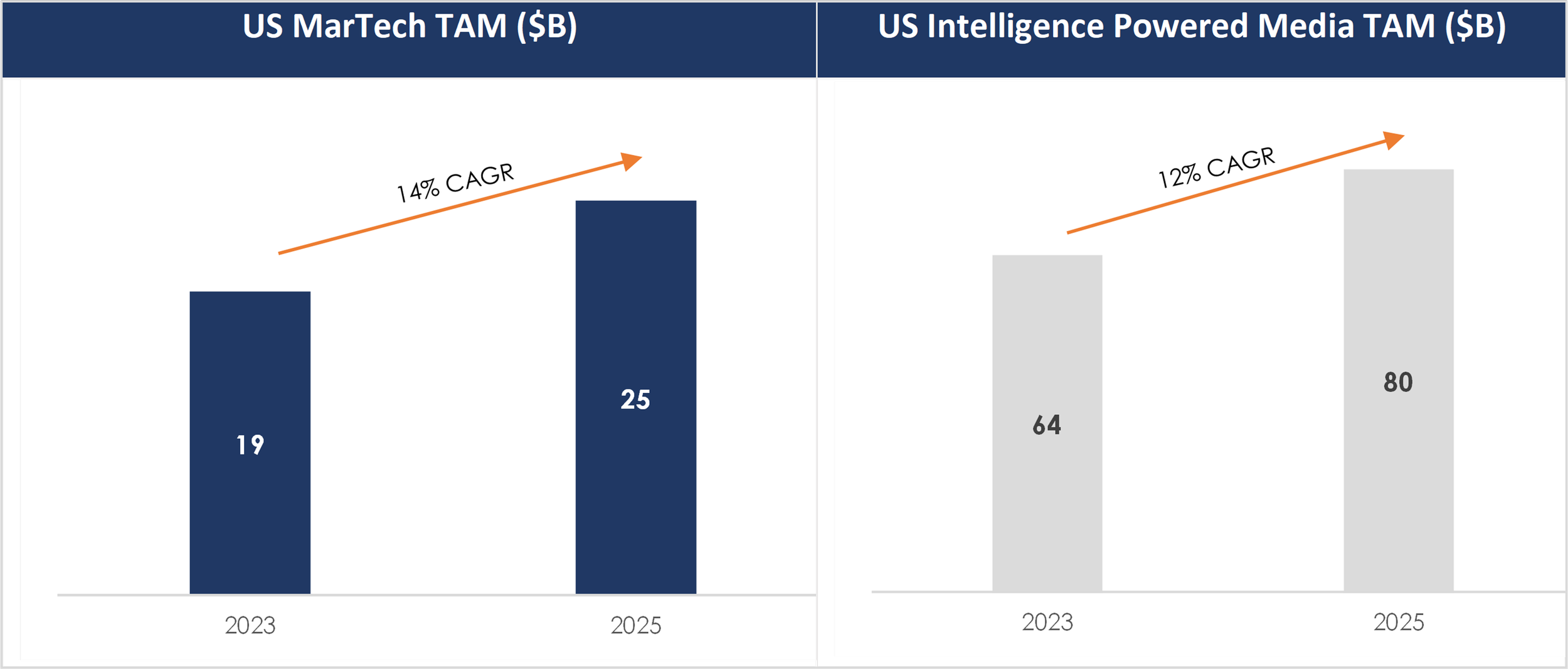

Marketing is one of the areas of business operations where it is widely predicted that AI will drive enormous change. In fact, a McKinsey study found that, along with sales, it is the single business function where it will have the most financial impact. This has significantly broadened the addressable market to $83B and with one-third of media spend expected to shift to intelligence-powered solutions, Zeta has ample opportunity to boost its market share.

Source: Investor Presentation

Expanding Customer Base and Increasing Revenue Contribution from High-Value Customers Provides Revenue Stability

In Q3 2023, Zeta added 15 new scaled customers (customers from which the company generated at least $100K in revenue on a TTM basis) sequentially, ending the quarter with 440 total scaled customers, up 13% YoY. Notably, this marked 10 consecutive quarters of sequential scaled customer expansion. Super scaled customers (revenue exceeding $1M) also witnessed healthy growth, increasing by six sequentially to 124, up 17% YoY. The newly acquired scaled customers span diverse industries, including travel, hospitality, education, and advertising/marketing, implying less concentration risk for Zeta.

Driven by multi-channel adoption by scaled customers, the company also achieved its 13th consecutive quarter of double-digit growth in Average Revenue Per User (ARPU) for scaled customers, with ARPU reaching $418K in Q3 2023, up 10% YoY.

Source: Investor Presentation

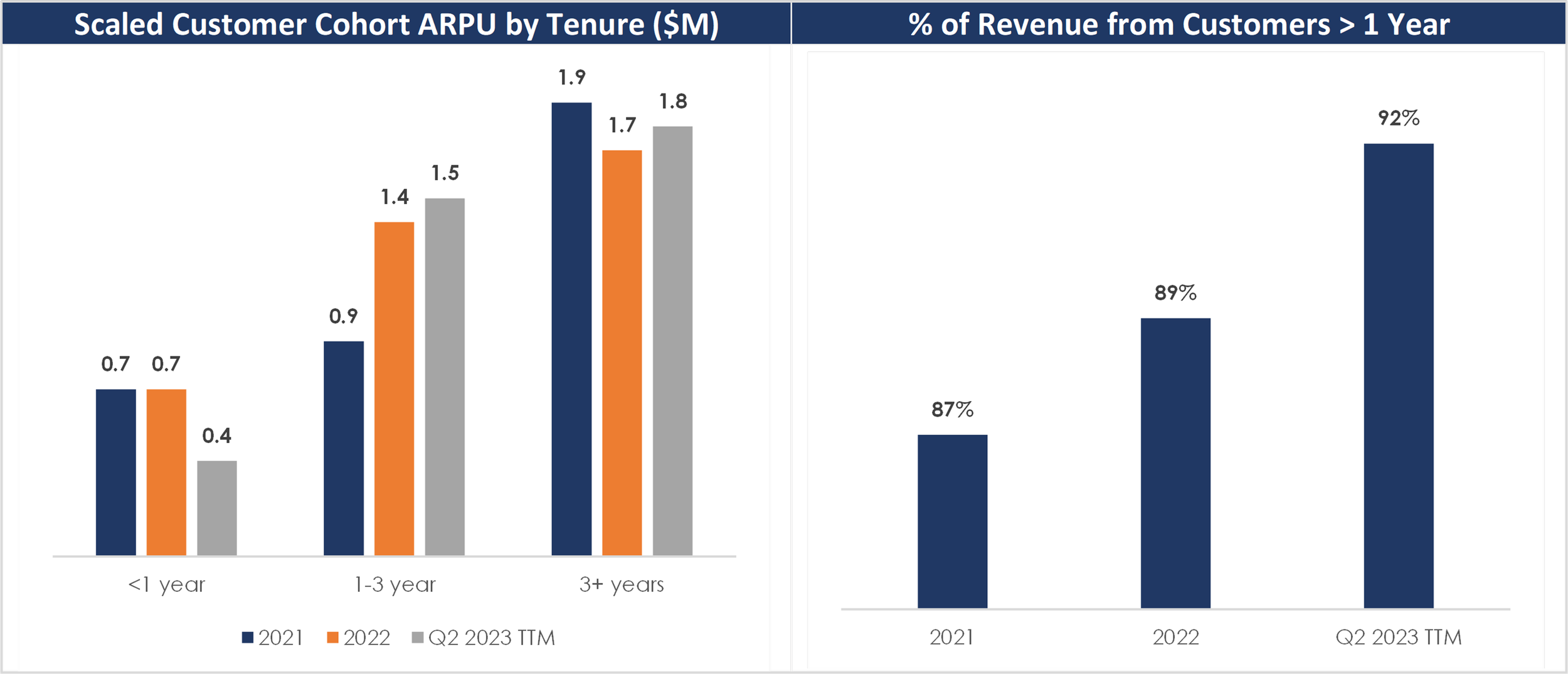

Another encouraging trend, as observed in the chart below, is that scaled customers consistently increase their spending over time on the data platform. Customers with less than one year on the platform spend an average of $400K, while the one to three-year cohort spends $1.5M, and the more than three-year cohort spends over $1.8M. The proportion of revenue derived from customers with a tenure exceeding one year is also increasing for Zeta. This suggests that the intelligence embedded in its platform is driving improved ROI for customers, subsequently contributing to higher spending and customer retention.

Source: Investor Presentation

Promising Revenue Growth and Operating Leverage driving Improved Profitability

In Q3 2023, total revenue increased 24% YoY to $189M, driven by the sustained momentum in scaled customer additions and partially offset by headwinds in the insurance and automotive verticals. On an organic basis, which excludes M&A and political candidate revenue, total revenue was up 26% YoY this quarter. For the full year 2023, management expects total revenue to be in the range of $723M - $727M, representing growth of 22% to 23%.

Zeta's disciplined control over expenses and improved productivity led to a notable acceleration in its adjusted EBITDA, increasing 51% YoY to $34M. The adjusted EBITDA margin also saw a significant rise of 310 basis points YoY, marking the 11th consecutive quarter of expanding adjusted EBITDA margins. Despite ongoing net losses on a GAAP basis, the positive trend of leveraging expenses against revenue, attributed to savings in G&A and the culmination of past investments in sales and marketing infrastructure, bodes well for future profitability. For the full year 2023, management expects adjusted EBITDA margin to be 17.4% - 17.5%.

Source: Company Filings

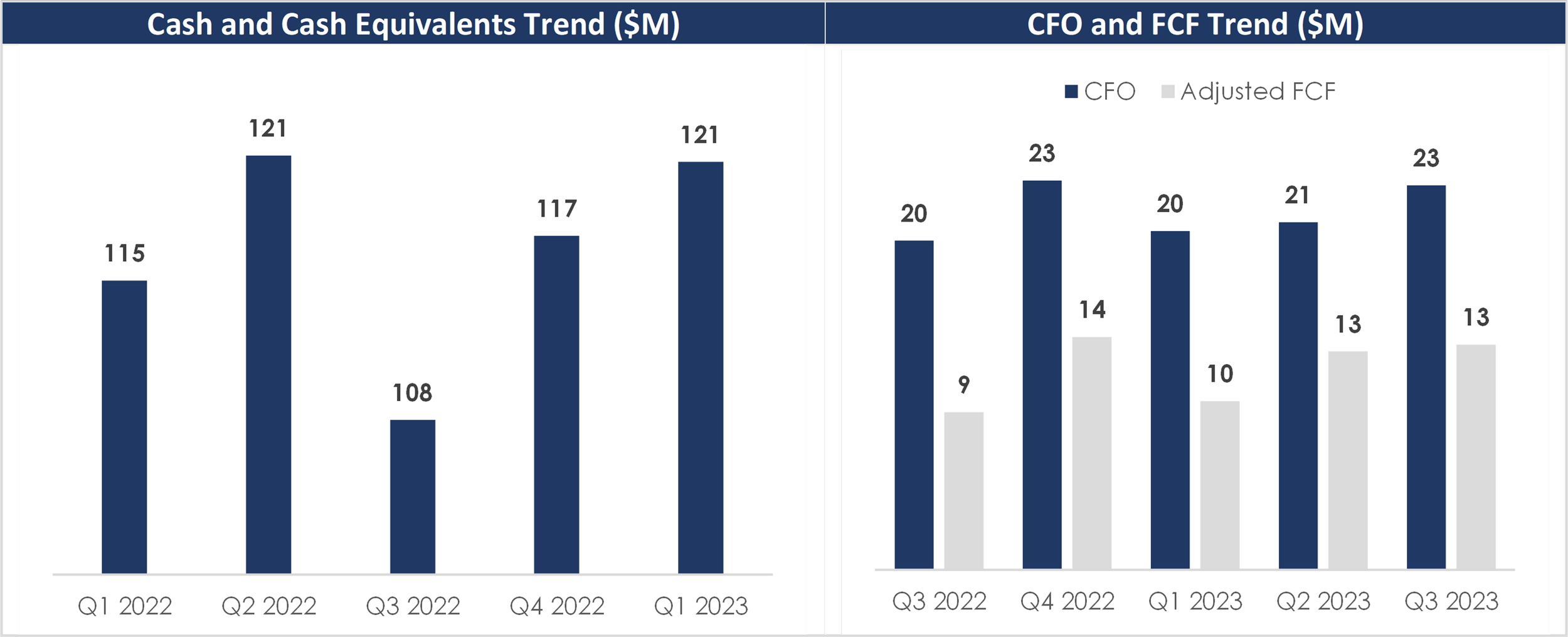

Healthy Balance Sheet supported by Positive Free Cash Flows

Zeta ended Q3 2023 with $121M in cash and cash equivalents. It carries a long-term debt of $184M, with a significant portion (~ $157M) scheduled for repayment in 2026. The company continues to drive robust cash flow generation. Cash flow from operating activities was $23M, up 17% YoY with free cash flow of $13M, up 43% YoY. Given its strong cash flows and manageable long-term debt, Zeta's balance sheet remains solid.

Source: Company Filings

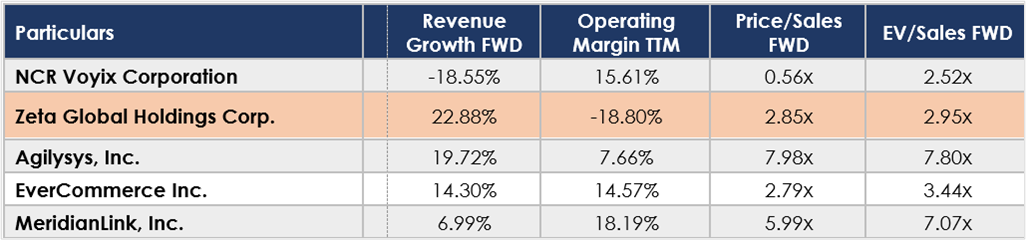

Valuation

Zeta is presently valued with a forward price-to-sales multiple of 2.9x, at par with the industry average. However, considering the company's strong revenue growth projections, solid cash flow generation, and consistent progress toward profitability, we believe there exists considerable potential for an upward reassessment of multiples.

Source: Seeking Alpha

Risks

Intense competition: The company operates in a highly competitive industry and must continually adapt to evolving trends. The emergence of superior technologies or new entrants could impact revenue, potentially leading to market share reduction and necessitating price adjustments with lower profit margins. While Zeta faces formidable competition from industry giants such as Oracle, Salesforce, and Adobe, its notable strengths lie in superior product offerings and a distinctive approach. These attributes have garnered recognition from prominent market research firms like Gartner, Forrester, and IDC, showcasing Zeta's ability to stand out and compete effectively against rivals, despite their greater financial resources and brand recognition.

Dependency on flexible master service agreements: Zeta's business model relies on flexible master services agreements that allow customers to adjust spending or terminate services with limited notice. The potential for customers to shift spending or terminate services abruptly could lead to revenue fluctuations and impact the company's ability to maintain stable profit margins.

Conclusion

In the contemporary economy, leveraging data-driven marketing is crucial for organizations seeking to optimize their return on investment. Zeta's identity-driven marketing platform, utilizing proprietary data and AI predictions to enhance customer acquisition, expansion, and retention efforts, aligns with market trends. With consistent performance improvement and cost reduction, it is well-positioned to meet the rising demand for efficient and effective marketing technology solutions.

The company has demonstrated consistent growth in customer additions and the expanding revenue, robust cash flow generation, and positive trajectory toward profitability contribute to its financial strength. Looking ahead, key catalysts for growth include cross-selling existing solutions, capturing a greater share of clients' marketing spend, introducing new features, and expanding its global market presence.

Considering the current risk and reward dynamics, we view ZETA as an attractive opportunity for patient, long-term investors, who are looking to capitalize on the growing trend of increased reliance on data and AI driven marketing solutions.