Saratoga Investment Corp (SAR) is a small-cap BDC ($300 million market cap) with a big yield (12.4%) and some big risks. The company’s high leverage isn’t as bad as it seems (thanks to SBIC loans), but it could still become a problem considering continued depreciation/write-downs on a few of its larger investments. After comparing Saratoga to 40+ other big-yield BDCs, we review its business, valuation, dividend and risks. We conclude with our strong opinion on investing.

Overview:

Saratoga Investment Corp is a business development company (“BDC”) that provides debt financing and equity capital to middle market companies. If you don’t already know, BDCs were created by an act of Congress in order to help small (middle market) businesses. Specifically, BDCs can avoid corporate taxation if they pay out most of their income as dividends. And of course, this results in the big dividend payments that many investors love.

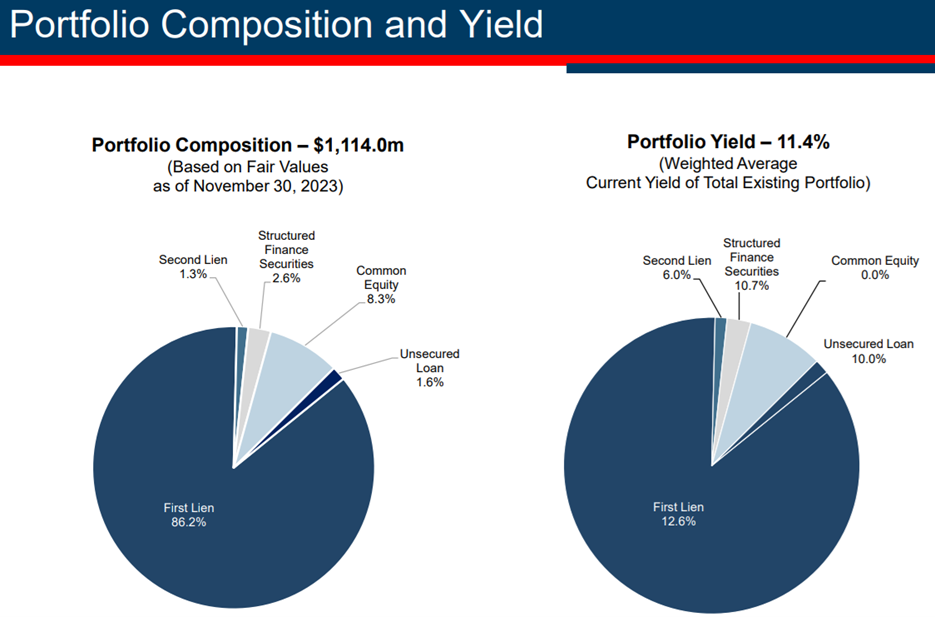

Saratoga provides mostly first lien loans, but other types of financing too, as you can see in the chart below.

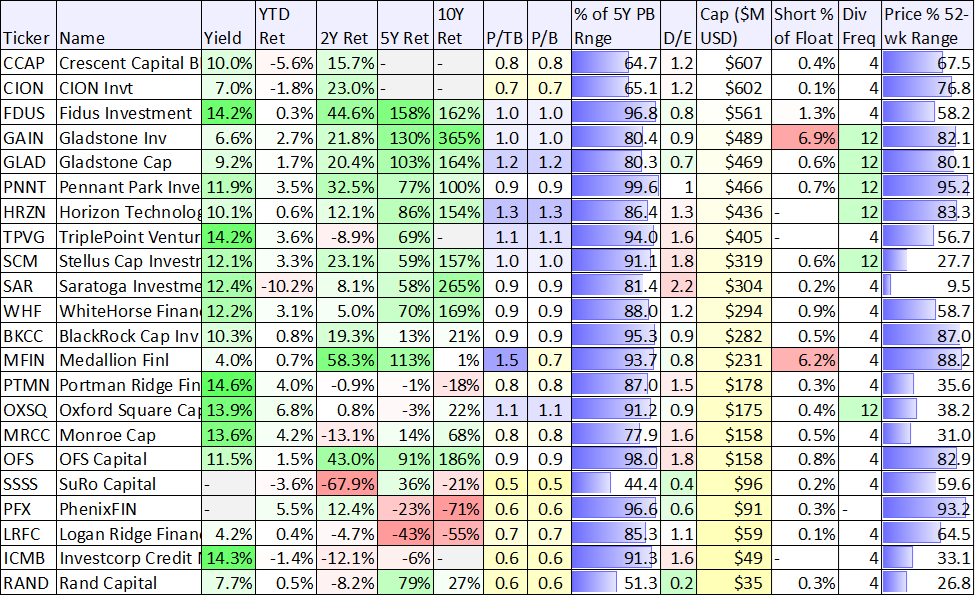

And as mentioned, Saratoga is a small cap BDC, and is smaller than most other BDCs in the table below.

Data as of 1/24/24, source: StockRover

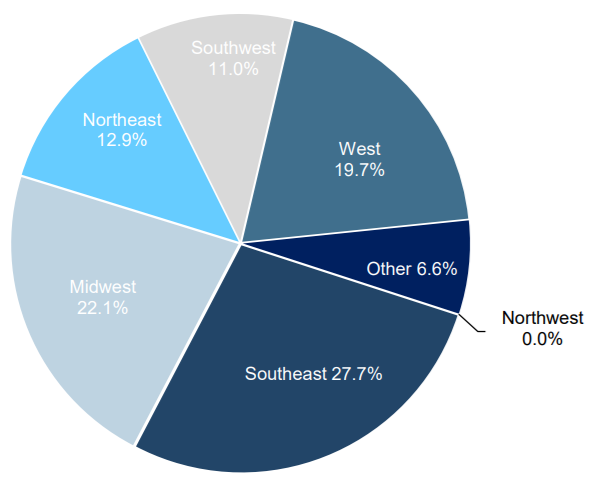

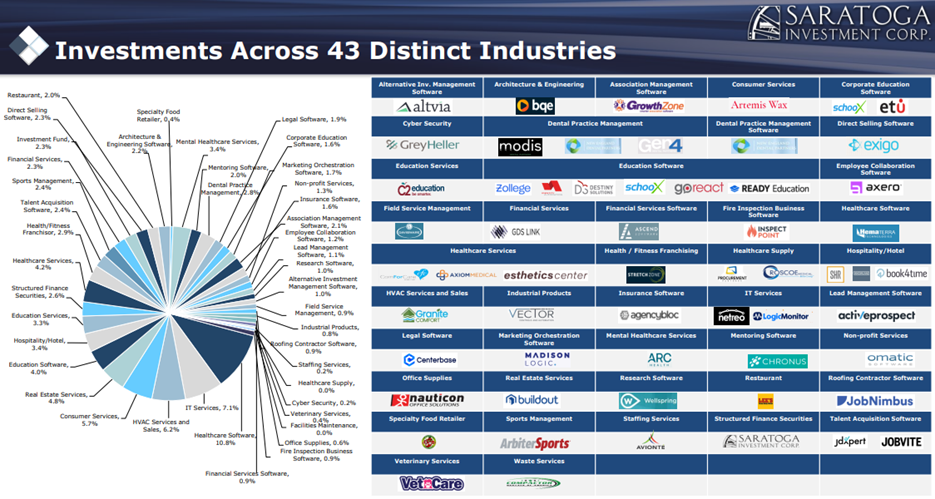

However, Saratoga is diversified across US geographies and a variety of industries, as you can see below.

SBIC Licenses:

One thing that makes Saratoga unique is that it has multiple SBIC licenses which allow it to make small business loans that are guaranteed by the Small Business Administration. So if the loans default, the SBIC makes Saratoga whole. And because of Saratoga’s small size (relative to other BDCs) these SBIC-guaranteed loans move the needles significantly and give Saratoga an advantage over its peers.

Debt and Leverage:

Additionally, SBIC loans are not included in regulatory lending limits. So, for example, even though Saratoga appears to have a much higher debt-to-equity ratio than peers (in our earlier table) the actual “regulatory leverage” is significantly lower.

Nonetheless, Saratoga still has higher debt than other BDCs (even after accounting for the beneficial SBIC loans). Here is how CEO Christian Oberbeck explained that on the company’s most recent quarterly call:

The other element, which you and others have commented on, is the leverage ratios that Saratoga has. And we kind of have a statutory leverage, and we also have a -- that we have to comply with. And then because of certain technicalities with SBIC accounting, we can borrow more than the statutory limits for a regular way BDC are…

…We've had lots of discussions on these calls about the character of our leverage. And a lot of people point to absolute leverage and say, okay, your leverage is X and that's "too high" or "higher than everybody else" and things like that. And we have said, well, at a point in time, that's right. But if you look at the dynamic of our leverage, and the term structure of our leverage and the absence of covenants and the absence of mark-to-markets and the absence of advance rates and all those types of things, our leverage is very well structured and very well structured for horror shows like when we had in COVID. When everything sort of fell apart, I mean, we were able to go forward and put money to work and support our portfolio companies and support our sponsors because our leverage structure was very solid and was not being perturbed by the external environment. We're very prominent BDCs in our universe. They had to write checks to cover out of formula asset-based loan requirements to basically stay in business.

And so, I think our leverage structure has been time and event-tested. And so -- but -- so we're very comfortable with it, as we said many times. However, if there is -- there are absolute metrics associated with leverage and the issuance of equity basically allow us to have more either cushion in a down environment or support opportunity in an up environment or up set of opportunities environment.

Recent Performance:

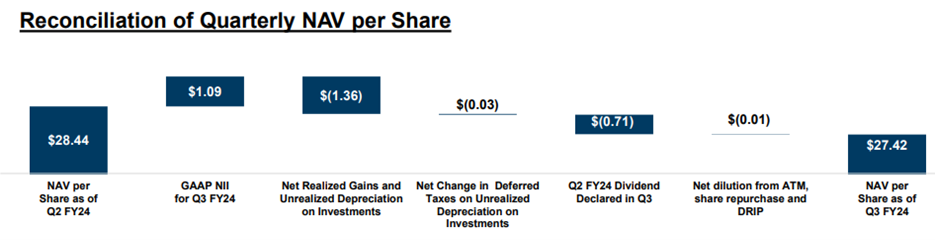

As mentioned, Saratoga is the worst performing BDC so far this year, with the shares down~10% so far (as you can see in our earlier table). This year’s decline is due mainly to a significant depreciation expense (i.e. valuation write-down) on multiple portfolio investments (including “yellow and red light” debt (Knowland, Pepper Palace, and Zollege), but also on equity positions (e.g. Netreo) and collateralized loan obligation and joint-venture holdings, as you can see in the -$1.36 figure below.

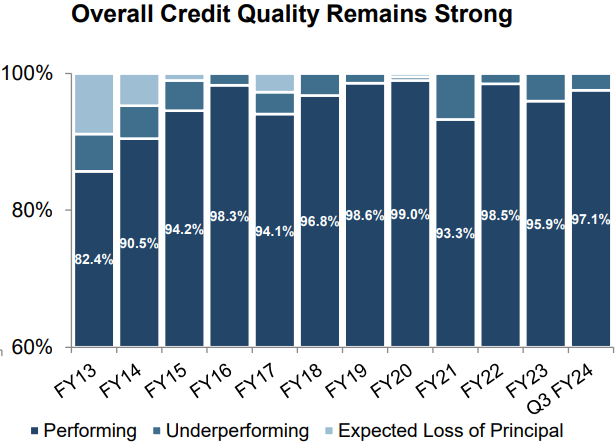

Important to note, it’s almost as if Saratoga management tries to hide the seriousness of these write-downs in its quarterly presentation, by quickly following up their disclosure with the following debt-only graphic (which makes things looks better than reality because it ignores equity, CLO and JV depreciation).

So even though the main BDC lending portfolio remains relatively strong (other than the new additional of Zollege to non-accrual status for missing October and November interest payments, thereby bringing the total non-accruals to three including Knowland and Pepper Palace), the other investments (equity investments, CLO and JV) are more concerning (more on this in the risks section).

Strengthening Maco Environment:

Also important to note, despite the recent share and NAV decline, Saratoga believes the macroeconomic environment is improving, post-covid, as attractive deal flow continues to open back up.

Furthermore, the company has been helped by increased interest rates, considering approximately 99.5% of Saratoga’s loans have floating interest rates (with interest rates currently higher than all floors), and the company’s debt is primarily fixed-rate and long-term (this combination is great for improving net interest margins).

Further still, Saratoga investment grade rating of “BBB+” was recently affirmed, and all of the firms baby bonds are callable within a year (thereby putting Saratoga in a healthy liquidity position with lots of dry powder).

Long-Term Valuation

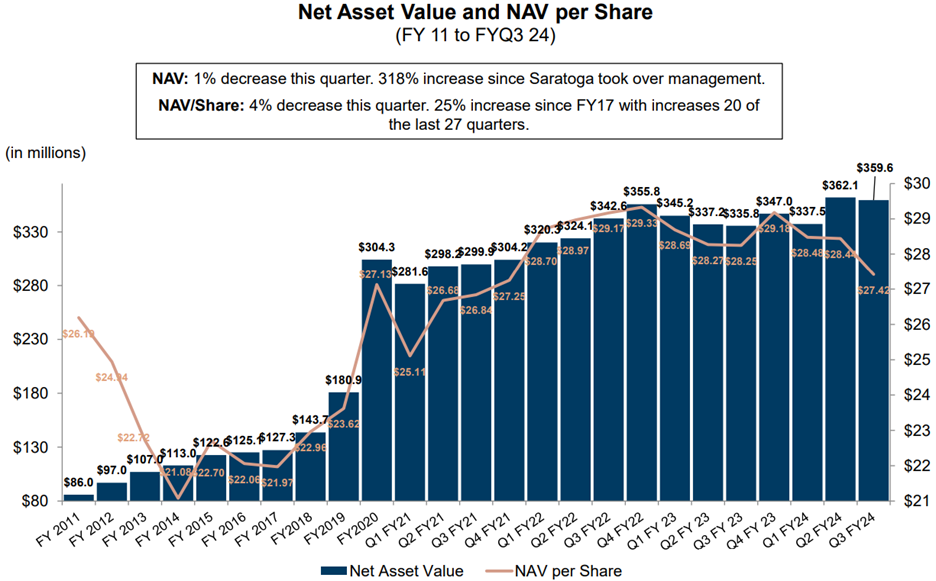

Here is a look at Saratoga’s long-term net asset value (“NAV”) and NAV per share.

Don’t be entirely fooled by the rising net asset value, considering Saratoga raised $10.0 million of equity at NAV during the fiscal third quarter (i.e. the mostly recently reported quarter). Instead, note the NAV per share declined (again, due largely to depreciation on underperformed assets). Any destruction to NAV reduces the company’s earnings power going forward.

Here is a look at Saratoga’s historical price to book-value.

Price-to-book is a basic, high-level, BDC valuation metric, and Saratoga currently trades at a discount (as the market reacts to recent business performance).

Also important, Saratoga has a long history of delivering a strong Return on Equity (ROE), although that metric has been weak in recent quarters as they deal with some equity depreciation (as mentioned). In particular, the company reports that average ROE over the past ten years has been 10.8% (exceeding the industry average of 6.3%), although ROE has been only 6.6% over the last 12 months (versus 7.5% for the industry).

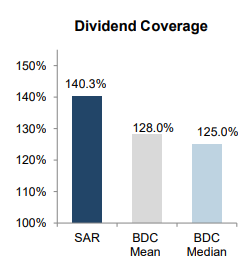

Dividend Safety:

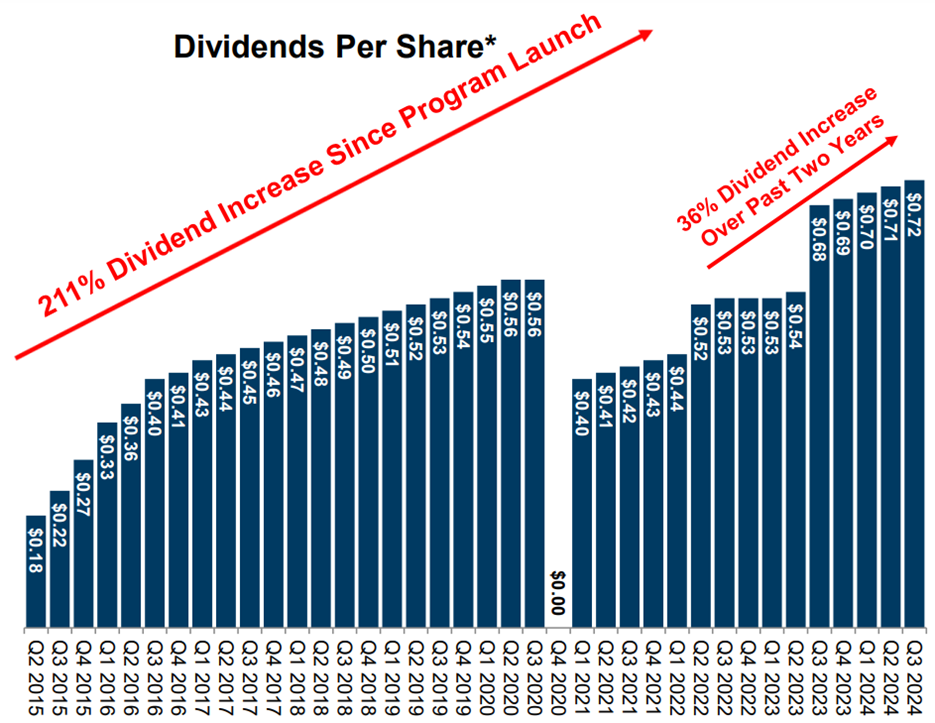

As you can see in the graphic below, Saratoga has a history of paying growing dividends, although it was temporarily suspended during covid. Some investors view the temporary suspension as a sign of weakness, however we view it as prudent as the company worked to protect liquidity during extraordinary times (government lockdowns). Rather than permanently destroying more NAV unnecessarily, Saratoga made the tough yet prudent decision to temporarily suspend the dividend (and they were in a better position going forward for it). However, if you are investing in Saratoga because you need the dividend for spending cash then that is a different story altogether.

The dividend is also currently well-covered as compared to peers.

Risks:

The big risk for Saratoga is basically more write-downs (depreciaton) on bad investments. As mentioned, the companies core BDC-lending portfolio remains fairly healthy and is not overly concerning. However, it is the company’s equity investments, CLO and JV that are concerning.

For example, of the $17.9 million in unrealized depreciation in the most recent quarter (that bascially drove the share price sharply lower), $6.5 million was related to the CLO and JV, while the core BDC potfolio actually had $4.3 million net unrealized appreciation. Deductively, that leaves us with some ugly write-downs on equity invesmtents, such as an $8.3 million write-down on Saratoga’s Netreo investment (both debt and equity).

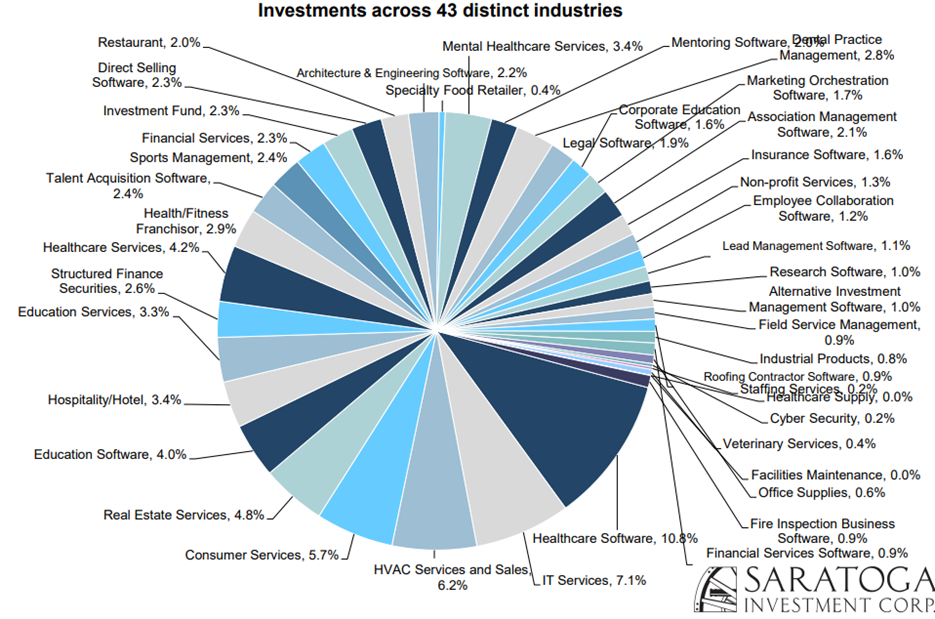

Netreo operates in the IT Service industry, which comprises 7.1% of Saratogas book (combined with on other IT Services investment, Logic Monitor, as you can see in the graphic below.

According to the lates quarterly earnings call, 25% of Saratoga’s unrealized depreciation over the last two years has been related to Netreo. And in the most recent quarter, Netreo was marked down by $8.3 million (that’s a lot considering the company’s total book value is $359.6 million).

This highlights the key risk of investing in a smaller BDC, like Saratoga. Specifically, individual investments can market up a larger more concentrated portion of the total pie, and if a few investments go bad, that can significantly impact overall BDC performance.

ETU was another investment that was written down by $1.8 million (in the most recent quarter), primarily related to Saratoga’s equity position. Education software (ETU and Zollege) has been another sore spot for Saratoga.

Conclusion:

Saratoga is starting to get really tempting at this point, but it’s hard to tell how much worse things can get with the company’s struggling investments (there is not a lot of transparency into each individual investment). Plus, Saratoga’s high leverage (even after adjusting for SBIC loans) could compound the problems if there are more significant write-downs ahead (i.e. they could get into an ugly forced sale situation to stay within leverage requirements—yuck!).

Saratoga’s shares now trade at a 0.9x discount to book value, a reflection of the risks. However, the overall BDC group has performed well and it’s hard to image too much relative upside from here (there are select exceptions, of course). We’re not a buyer of Saratoga at this point, but it remains high on our watchlist for now.