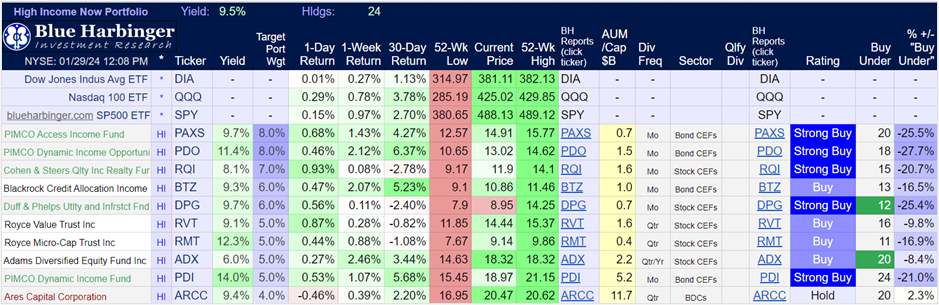

There is a new Top 10 in town with regards to our “High Income NOW” Portfolio. And the reshuffling is driven by two big themes (i.e. where the stock and bond markets are heading). No one has a working crystal ball, but the writing is on the wall for BDCs and Bond CEFs. In aggregate, the portfolio has 24 positions (including BDCs, stock and bond CEFs, REITs, dividend stocks and more) and the aggregate portfolio yield is 9.5%. Let’s get into the details.

For starters, here is a link to the updated Portfolio Tracker Sheet for our High Income NOW Portfolio.

As a reminder, names in “green text” have had their position size increased (red is decreased), portfolio weights are color coded (in addition to the actual weight, heavier weights are shaded in darker blue) and the ratings near the right side are driven by the “Buy Under” prices (changes are noted in red or green).

Two Big Themes for Income Securities

Absolutely no one knows where interest rates are going, but the market and the fed have reacted to the end of interest rate hikes in 2023 (bond prices are up and now steadier). And the fed and the market are increasingly expecting rate cuts this year. And when rates are cut, bond prices go up. This has a big impact on every corner of the market, but rate cuts most directly help bond prices (such as the bonds held in bond-focused Closed End Funds (“CEFs”).

Theme 1: Bond CEFs Look Healthy and Strong

You’ll notice our top 10 positions (in the High Income NOW Portfolio) are dominated by bond CEFs. Bond CEFs have posted strong returns over the last 2 quarters (as rate hikes ended), but they still have a long way to rebound as the funds are increasingly on solid footing to generate high income without price declines. And when rate cuts begin this year (as widely expected), look out above!

For example, many PIMCO bond funds currently trade close to NAV (or at slight premiums or discounts), and this compares favorably to history (when many of them traded at huge premiums). So many investors love big steady monthly distribution payments, and these bond funds are ideal to deliver that considering the skill and resources of PIMCO, combined with the disciplined use of leverage (borrowed money) which will magnify income and price gains on the way up.

Our #1 an #2 largest positions are both PIMCO Bond funds. In fact, we have increased the weight in our #1 and #2 positions, and there are two additional attractive bond funds in the top 10, including a BlackRock Bond CEF (BTZ) and another PIMCO (PDI).

Theme #2: BDCs Have had quite a run!

Business Development Companies (“BDCs”) are an excellent vehicle for income-focused investors because they are designed to pay high income (in fact they avoid taxation at the corporate level by paying out high dividends), but also because they have the sophistication to handle the financing arrangements that typical banks do not (and that banks cannot due to regulatory strictness following Dodd Frank for example). BDCs provide financing (mostly loans) to smaller (middle market) companies.

BDC performance has been very strong over the last year (as rising interest rates helped boost income from floating rate loans), and now many BDCs sit near the high end of historical ranges in terms of price-to-book-values and share prices. In and of itself, these metrics are not necessarily a risk, but it does leave less room for multiple expansion, and some of these businesses are just starting to show signs of cracks in the dam (for example, Saratoga—a BDC we recently wrote about—is having some increasing write-downs on both debt and more so on equity financing investments they have made).

We don’t believe BDCs are in imminent danger of collapse, but we do believe the risk-reward tradeoff is less favorable than it has been with the benefits of increased interest rates now largely baked in (and potentially set to reverse a bit with rate cuts later this year). Further, as compared to select bond CEF, BDCs are not as attractive as they have been.

As such only one BDC made it into our Top 10 High Income NOW Portfolio (Ares Capital (ARCC)). In fact, we still hold three BDCs (Ares, Oaktree (OCSL) and Main Street (MAIN)), but we have slightly reduced our position size in each of these positions as you can see in the portfolio tracker sheet.

Worth Mentioning

We do invest beyond just Bond CEFs and BDCs in our “High Income NOW” Portfolio, and we continue to see attractive high-income opportunities from select stock CEFs, individual dividend stocks and REITs (including a real estate CEF).

The Bottom Line

The market continues to present many attractive high-income opportunities, and we have included our top ideas in our High Income NOW Portfolio. We believe in prudent concentration, and that’s why we hold 24 positions in the portfolio (instead of just one or two). However, we have allocated the highest weights to our top ideas, and believe the aggregate portfolio provides a very compelling opportunity to earn big steady income and price appreciation in the months, quarters and years ahead.