Palantir provides sophisticated software platforms for data analysis, leveraging advanced AI and machine learning techniques. Its software effortlessly integrates structured data like spreadsheets and unstructured data like images and social media posts into a single centralized database, enabling visualization and analysis of all information. The company is further leveraging its AI expertise with AIP, a novel platform that introduces support for large language models and generative AI to its current offerings. In this report, we analyze Palantir’s business model, its market opportunity, financials, valuation, risks, and finally, conclude with our opinion on whether an investment in the company’s stock offers an attractive balance between risks and rewards.

Key Takeaways:

Strong durability of platform with expanding capabilities and integrations.

Large, growing market with significant secular tailwinds.

Expanding customer base and increasing revenue contribution from high-value customers provides revenue stability.

Promising revenue growth and improving profitability.

Healthy balance sheet and cash flow generation.

A PDF version of this report is available here.

Overview

Palantir traces its origins to 2003 when its founders (Peter Thiel, Alex Karp, and Stephen Cohen) envisioned a counterterrorism platform, inspired by Thiel's anti-fraud efforts at PayPal post-9/11. Initially operating discreetly, Palantir served the US intelligence community. However, the company’s popularity rose in 2010 when it was reported that the US Army used Palantir software to track down high-value targets in Iraq. Since then, Palantir has become widely known for its collaboration with government agencies around the world. Moreover, in recent years, the company has diversified into commercial sectors such as finance, healthcare, energy, and transportation. Today, its software finds applications in counterterrorism, fraud detection, disaster response, supply chain optimization, healthcare analytics and more. As of December 2023, Palantir's software has been adopted by over 60 industries globally, serving a total of 497 customers.

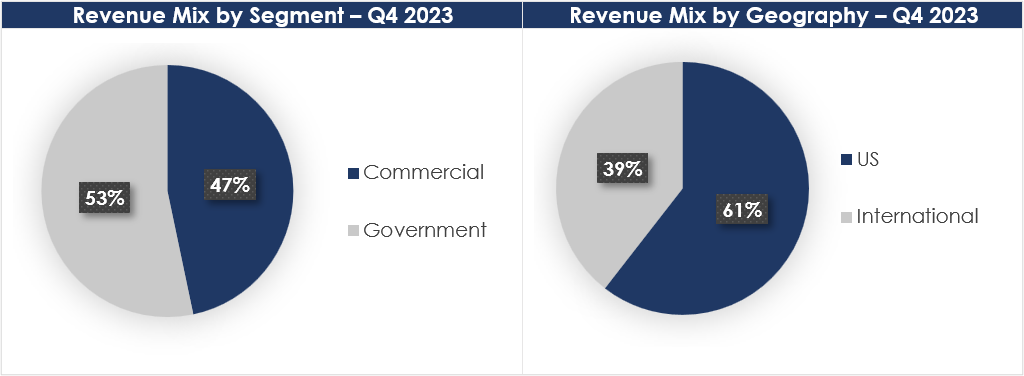

Palantir has developed three main software platforms: Gotham, Foundry, and Apollo. Gotham and Foundry empower organizations to consolidate vast volumes of data into a cohesive asset reflecting their operations. Apollo, introduced commercially in 2021, is a cloud-agnostic tool, enabling customers to run their software in virtually any environment, ensuring continuous critical system operations. Palantir recently introduced its latest offering, the Artificial Intelligence Platform (AIP). AIP is tailored for both commercial and government sectors, aiming to leverage recent advancements in AI by integrating Palantir's existing software platforms with large language models (LLMs).

The company’s sources of revenue are Palantir Cloud Subscriptions, On-Premises Software Subscriptions and Professional Services.

Palantir Cloud Subscriptions: Customers subscribe to access Palantir's software hosted in Palantir's environment. These subscriptions include ongoing operation and maintenance (O&M) services.

On-Premises Software Subscriptions: Customers purchase software subscriptions granting them the right to use Palantir's intellectual property in their own environment.

Professional Services: Palantir offers professional services to support customers' use of the software. These services include user support, configuration, training, and ongoing support for data modeling.

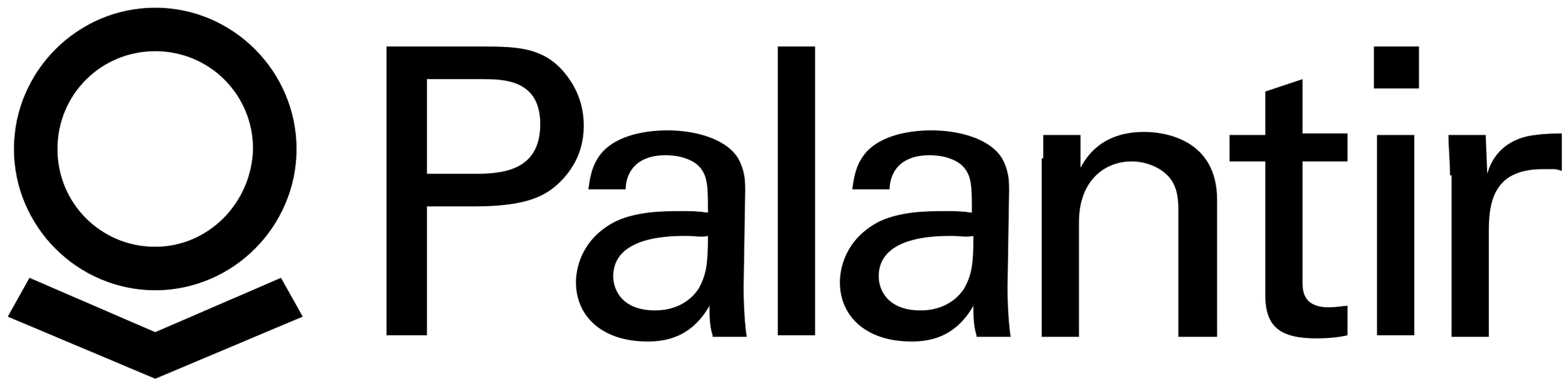

The company operates through two segments: Government and Commercial, which accounted for 53% and 47%, respectively to the company's total revenues in Q4 2023. In terms of geographical distribution, the majority of its revenue (61%) is generated from the US and the rest from international markets (39%), as shown in the chart below.

Source: Investor Presentation

Strong Durability of Platform coupled with Expanding Capabilities and Integrations

Palantir's software platforms serve as the essential backbone for integrating customers' data and operations seamlessly. Their vertically integrated design caters to users with diverse technical proficiencies, fostering effective collaboration within the platforms. From integrating new data sources to conducting daily workflows and making critical decisions, various stakeholders, including data engineers, analysts, data scientists, business users, and senior leaders, can leverage the platforms' capabilities. Furthermore, each platform features user-facing applications tailored to specific industries and sectors, enhancing its durability and stickiness within the respective domains.

Source: Company 10-K

Palantir is emphasizing its AI expertise with Artificial Intelligence Platform, a platform integrating large language models and generative AI into its existing platforms. AIP targets customers in both commercial and government sectors, offering them the opportunity to harness recent AI advancements. It uniquely enables users to link large language models with their data and operations, aiding decision-making. Since its launch in May last year, AIP has gained significant traction, particularly in the commercial sector, driving strong growth for Palantir. The company has been hosting "bootcamps" to demonstrate AIP's capabilities to commercial clients, with these training sessions proving highly effective in converting customers.

Source: Investor Presentation

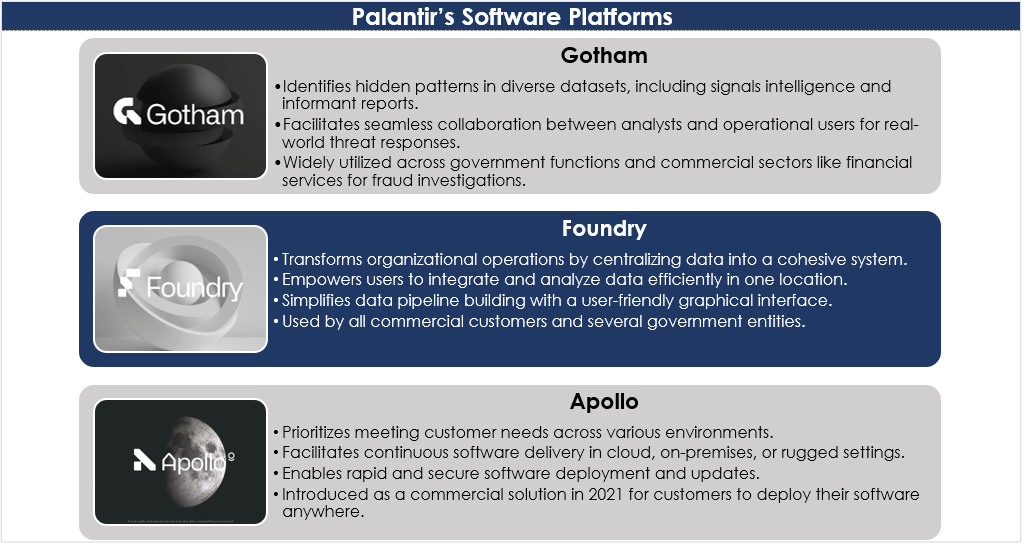

Large, Growing Market Opportunity with Significant Secular Tailwinds

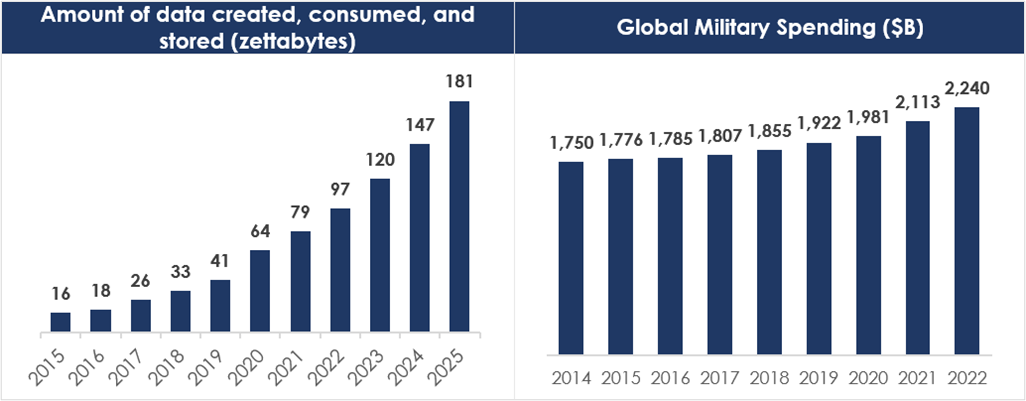

The global big data analytics market is projected to reach $745B by 2030, with a robust CAGR of 13.5% from 2023 to 2030. This growth is fueled by the increased demand for data-driven decision-making. As the volume of data surges from interconnected devices and social media, businesses face a pressing need to swiftly process and analyze this data to extract actionable insights. According to the 2024 Data and AI Leadership Executive Survey conducted by Wavestone, the percentage of organizations leveraging data for business innovation has shown substantial improvement, rising from 59.5% in 2019 to 77.6% in 2024.

With its expertise in seamlessly integrating, interpreting, and extracting value from data, Palantir is well-positioned to capitalize on the enduring trends of mobility, data expansion, and cloud migration. Additionally, as a preferred vendor for governments, the company is poised to benefit from the ongoing increase in the IT allocation within global military and defense budgets.

Expanding Customer Base and Increasing Revenue Contribution from High-Value Customers Provides Revenue Stability

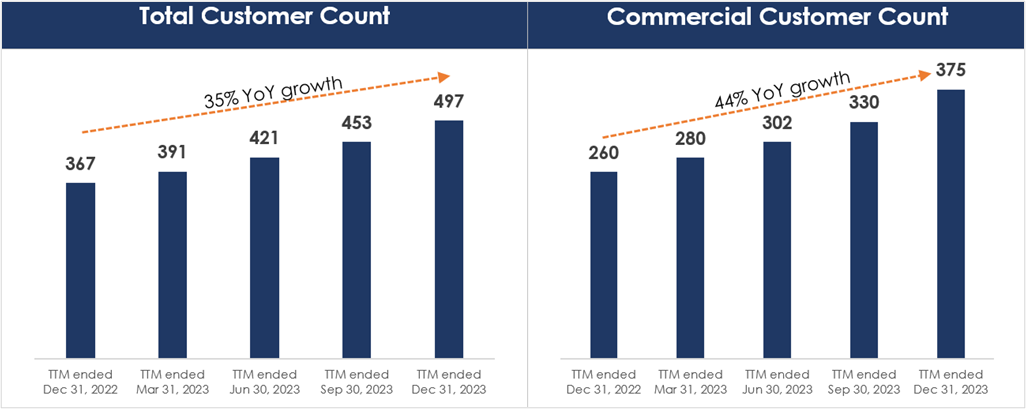

In Q4 2023, Palantir gained 44 new customers, totaling 497 by the end of FY 2023, marking a 35% YoY increase. This growth was primarily driven by the commercial segment, which saw a 44% YoY rise, reaching 375 customers. The company is actively implementing numerous real-world use cases with AIP, further boosting its momentum and contributing to both new customer acquisitions and expansions with existing clients.

Source: Investor Presentation

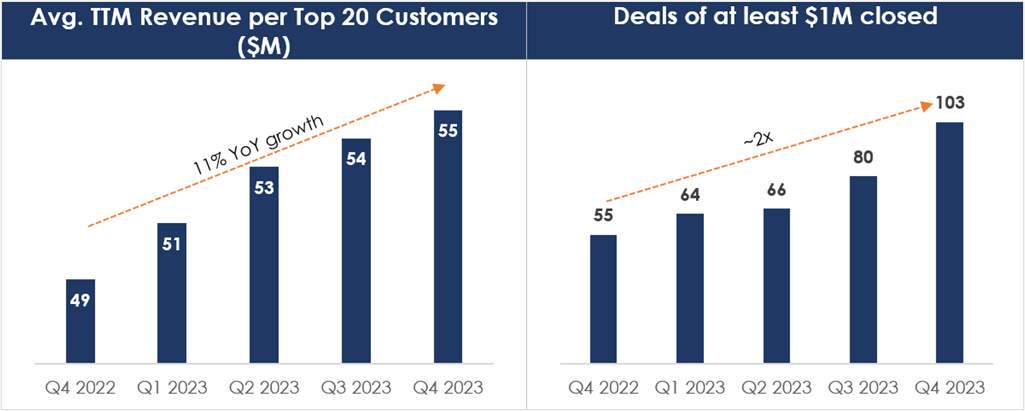

Revenue from top clients also experienced a notable uptick, with Q4 TTM revenue from the top 20 customers climbing by 11% YoY to $55 M per customer. Palantir closed 103 deals of at least $1M, ~2x from a year ago. The company’s net dollar retention rate was at 108%, underscoring its ability to successfully upsell to existing customers while maintaining high levels of customer satisfaction.

Source: Investor Presentation

Promising Revenue Growth and Improving Profitability

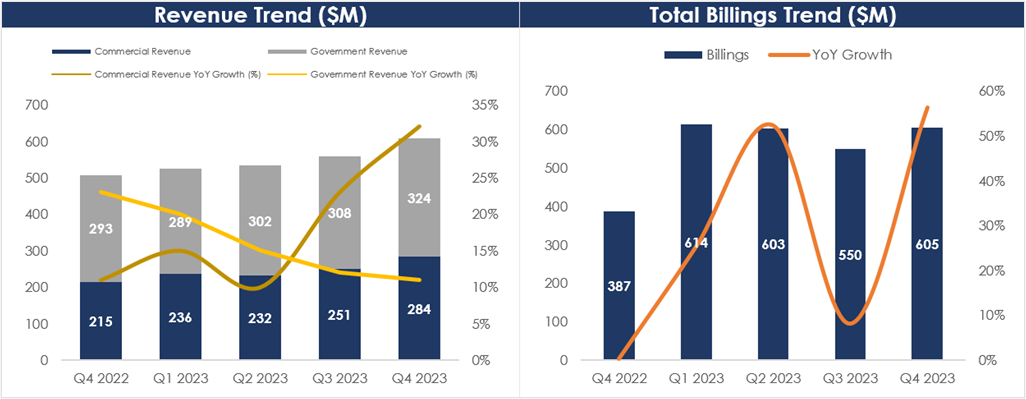

In Q4 2023, total revenue increased 20% YoY to $608M, driven by the US commercial business, which surged 70% year over year. This impressive performance was largely fueled by the positive momentum in AIP. In Q4 2023, Palantir reported 56% YoY growth in total billings, reaching $605M, demonstrating strong product demand and successful contract acquisitions.

The company generated $2.23B in revenue in FY 2023, an increase of 17% over the prior year. Full year commercial revenue grew 20% YoY, surpassing the $1B mark for the first time. For FY 2024, Palantir expects total revenue of about $2.7B, representing a 21% YoY growth.

Source: Company Filings

“The demand for large language models from commercial institutions in the United States continues to be unrelenting. Every part of our organization is focused on the rollout of our Artificial Intelligence Platform (AIP), which has gone from a prototype to a product in months. And our momentum with AIP is now significantly contributing to new revenue and new customers.” - Alexander C. Karp, Chief Executive Officer & Co-Founder

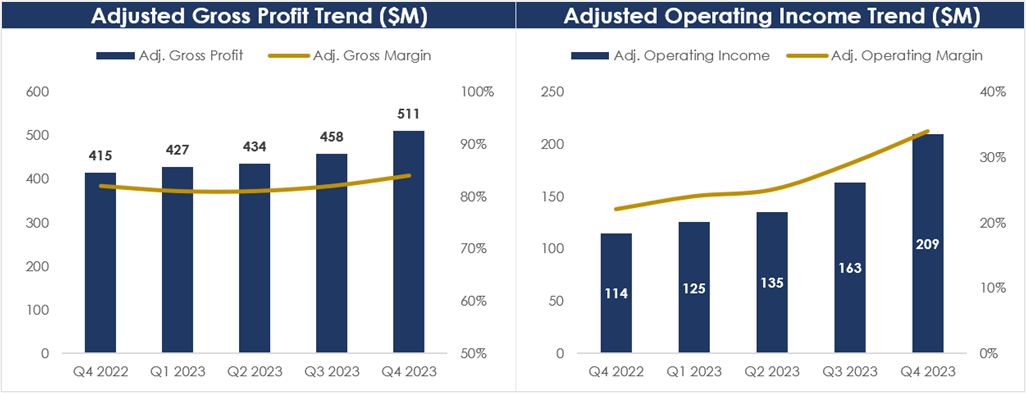

On the profitability front, the company reported healthy gross and operating margins, driven by continued improvement in unit economics. Adjusted gross margin was 84% in Q4 2023, up 200 basis points as compared to last year. Adjusted operating margin continued to expand, reaching 34%. For FY 2023, the adjusted gross margin and operating margin were reported at 82% and 28%, respectively. Palantir’s strong bottom-line performance in 2023 allows for increased investment in research and development. The management team expects expenses to rise in Q1 2024, but the focus remains on managing expense growth below revenue growth for the full year, aligning with goals of sustained profitability.

Source: Company Filings

Healthy Balance Sheet and Cash Flow Generation

Palantir ended Q4 2023 with $3.7B in cash, cash equivalents, and marketable securities and no debt on its balance sheet. Cash Flow from Operations (CFO) and Adjusted Free Cash Flow (FCF) saw notable increases in Q4 2023. CFO rose to $301M from $79M, while FCF climbed to $305M from $76M compared to the previous year. The company's robust balance sheet, along with its strong cash flow generation, demonstrates financial stability and ensures that it has ample liquidity to fulfill its short-term obligations and pursue growth initiatives.

Source: Company Filings

Valuation

Palantir's stock has experienced a remarkable rally, surging over 200% over the past year. Better-than-expected revenue coupled with improving profitability are driving significant gains for the AI stock. Investors' optimism is growing, particularly towards the company's Artificial Intelligence Platform (AIP), which is driving robust growth in the commercial segment. That said, the stock is still nearly 30% below its all-time high reached in 2021.

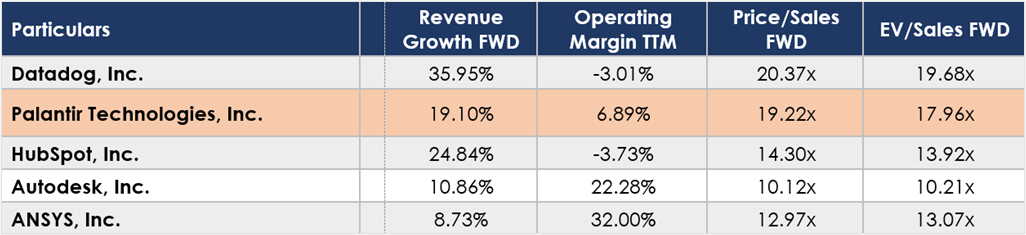

In terms of valuation, PLTR currently trades at a price-to-sales multiple of 19x on a forward basis, slightly higher than its peers. However, considering Palantir's strong financials and promising growth potential, particularly with the expansion of the addressable market through AIP, we believe this premium is warranted.

Source: Seeking Alpha

Risks

Intense competition: The data analytics and software solutions market is marked by intense competition and is expected to remain so in the future. Numerous companies are developing products that compete directly or indirectly with Palantir’s platforms. Competitors range from large enterprise software firms to government contractors and emerging companies. To stay competitive, the company must invest significantly in research, development, services, and marketing.

Long sales cycle: Palantir's business model requires intensive sales efforts and deals with unpredictable sales cycles. The company invests heavily in understanding potential customers' needs and demonstrating the value of its platforms. These sales cycles, which can range from six months to over a year, involve evaluations across various organizational levels. Such efforts demand significant resources, including senior management involvement, without guaranteed success. Failing to justify these investments could negatively impact Palantir's financial health and overall performance.

Conclusion

Data stands as the focal point of decision-making in both modern governments and commercial enterprises. Palantir acts as the catalyst, enabling customers to navigate extensive datasets and devise solutions to emerging challenges. The company’s platforms cater to all end-users, including developers, data scientists, product owners, and executives, ensuring universal value and interoperability. Palantir actively pursues challenging tasks, leveraging strict government clearances, complex data environments, and lengthy sales cycles, which serve as significant barriers to entry for competitors.

Palantir's latest offering, the Artificial Intelligence Platform, is driving substantial revenue growth. The rapid expansion of sales to commercial customers in recent years suggests that they will soon constitute the majority of overall revenue, potentially leading to accelerated sales growth going forward. This, along with improving margins and healthy cash flows, positions the company well to capture growth opportunities.

Considering the current risk and reward dynamics, we view this as an attractive opportunity for patient, long-term investors, who are looking to capitalize on big data and AI tailwinds.

We are currently long shares of Palantir in our Blue Harbinger Disciplined Growth Portfolio.