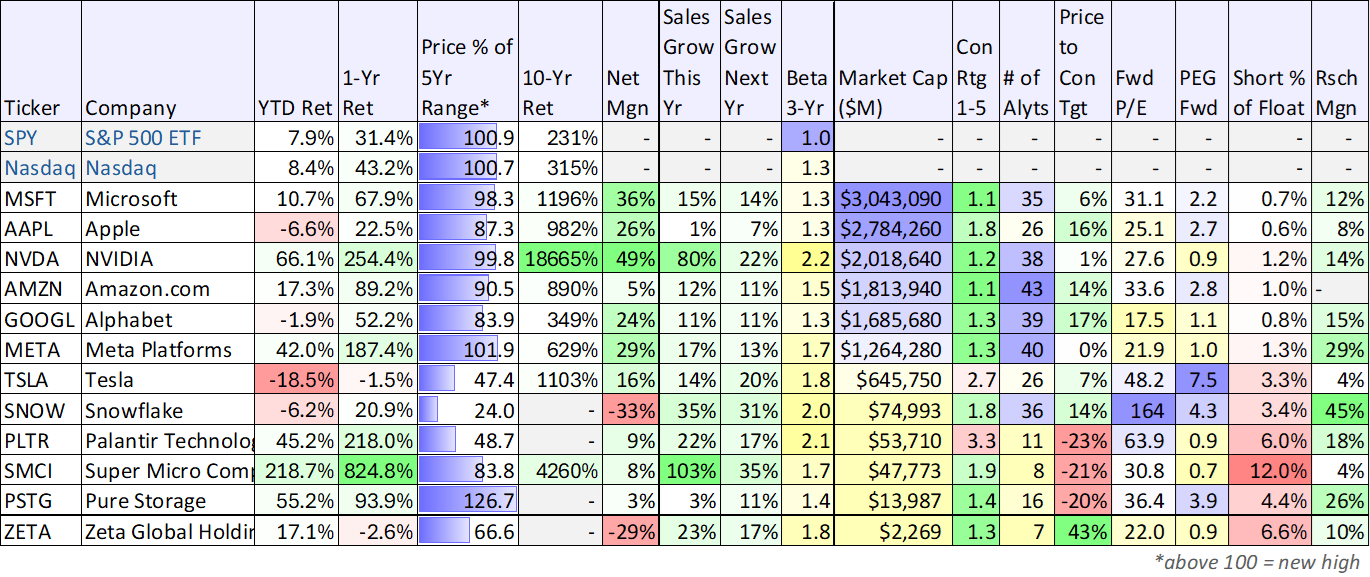

Despite the Nasdaq hitting new all-time highs this week, select disruptive growth stocks still have massive long-term upside potential, particularly certain names benefitting from the Artificial Intelligence (AI) mega trend (which, by the way, is still just getting started). In this report, we share 7 top ideas, with a special focus on “Big Data” AI stock Palantir, and then conclude with our strong opinion on investing in disruptive growth stocks at this point in the market cycle.

data as of Friday’s close, 3/1/24

1. Palantir (PLTR)

Palantir shares are up over 40% this year following an outstanding quarterly earnings report in February whereby record revenue and profits were achieved (driven by demand for the company's artificial intelligence ("AI") platforms). CEO Alex Karp boasted that Palantir's results make it eligible for inclusion in the S&P 500 (a good thing). However, S&P just released its latest update for the index, and Palantir has been snubbed (Super Micro Computer (SMCI) apparently leapfrogged Palantir and received the nod instead).

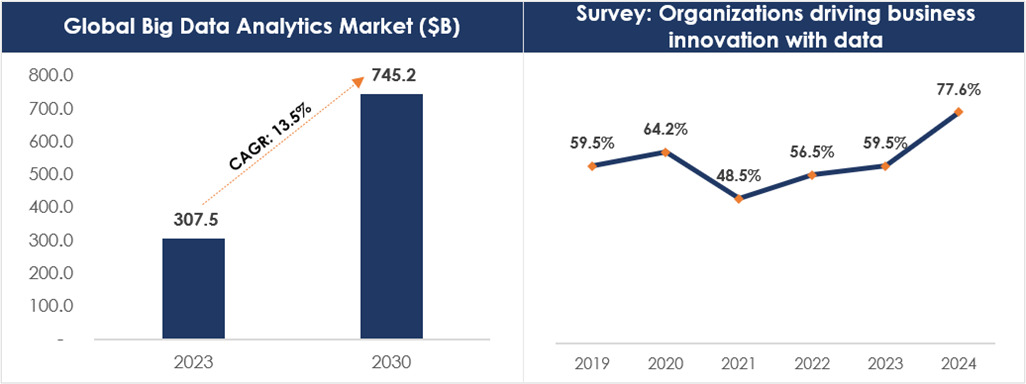

Yet despite share-price volatility, the business growth trajectory continues to accelerate (for government and commercial customers), and the company's extraordinary AIP Platform leads in a huge long-term secular market trend (i.e. Big Data Analytics).

More specifically, Palantir provides sophisticated software platforms for data analysis, leveraging advanced AI and machine learning techniques. Its software effortlessly integrates structured data like spreadsheets and unstructured data like images and social media posts into a single centralized database, enabling visualization and analysis of all information. And the long-term market opportunity continues to grow.

You can dive deep into our views on Palantir in the following full report whereby we analyze the company’s business model, market opportunity, financials, valuation, risks, and then conclude with our strong opinion on why it’s such an impressive business.

2. Nvidia (NVDA)

Jensen Huang, the CEO of Nvidia and godfather of AI, will deliver his live keynote at Nvidia’s GTC Presentation (stands for “GPU Technology Conference”) on March 18th, and it will create another opportunity to impress the market yet again (watch the teaser video here). To the dismay of conservative investors, the disruptive nature of Nvidia’s GPU chips has been so extraordinary that the shares keep climbing higher (+250% over the last year, and +2,000% over the last 5 years), yet the valuation (for example PEG ratio) remains attractively low. Nvidia shares can be extraordinarily volatile (they’ve fallen 55% or more from their all-time highs four times since 2000), but the long-term trend remains sharply higher as Nvidia leads in AI and the big-data digital revolution.

3. Super Micro Computer (SMCI):

Super Micro Computer makes servers and other hardware that houses semiconductor chips from many customers, and Nvidia is one of their biggest. SMCI shares are up +222% this year (and +837% over the last 1-year) as explosive growth in AI data is driving the business extraordinarily higher. And most recently, S&P announced Super Micro is being added to the S&P 500 index (a good thing for the shares that may send more short sellers running).

What’s more, SMCI has the capacity (and business relationships) to continue growing dramatically higher, as CEO Charles Liang explained on the January quarterly earnings call:

The exciting news is that, finally, we are entering an accelerating demand phase now from many more customer wins…

I feel very confident that this AI boom will continue for another many quarters, if not many years. And together with the related inferencing and other computing ecosystem requirements, demand can last for even many decades to come, we may call this an AI revolution.

4. Pure Storage (PSTG):

Been pounding the table on Pure Storage for a while (+55% ytd, +95% over the last 1-year), as this under-the-radar AI beneficiary continues to experience accelerating growth. The company provides data storage technologies/solutions, and it is solving two big non-AI legacy problems:

existing data storage arrays were selected to provide just enough performance for their primary function, leaving little performance left for AI access, and…

existing storage arrays are not networked, limiting access to AI apps not provisioned directly on their primary compute stack. Long Pure Storage.

During this past week’s quarterly earnings call, CEO Charles Giancarlo shared a very positive outlook, explaining:

I have high confidence of returning to double-digit revenue growth, given our platform strategy, our growing product portfolio, our cloud operating model, and strong customer demand for our Evergreen and Fort Works subscription offerings.

5. Zeta Global Holdings (ZETA):

Zeta (~$2.3 billion market cap) is a leading omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software to enterprises. The company enables its clients to engage consumers across various channels like email, social media, web, chat, Connected TV, and video. The company has a robust platform that consolidates the fragmented marketing landscape. It also has a growing Total Addressable Market (TAM) opportunity fueled by data and AI. You can access our full report on Zeta here

6. Meta Platforms (META):

To put it bluntly, CEO Mark Zuckerberg is a creep (his company has massive amounts of your personal data), and Meta Platforms is a virus (the cookies track you across browsers everywhere, whether you realize it or not). However, if you can’t beat them, join them. Despite recent strong gains, Meta shares still have tremendous upside courtesy of expanding data capturing capabilities (through AI on Facebook, Instagram and now WhatsApp) and a low valuation (PEG ratio) as compared to growth. Meta is extraordinarily profitable, spending gigantic on innovation (R&D) and the CEO is playing to win.

7. Snowflake (SNOW)

Despite beating revenue and earnings expectations, Snowflake shares dropped 20% on last week’s earnings announcement as forward sales guidance disappointed (the company is still growing revenues very rapidly at scale, just not as rapidly as Wall Street expected), and CEO Frank Slootman announced his abrupt retirement (he’ll still remain Chairmen of the Board). We view this as a buying opportunity considering expectations have now been lowered (easier to beat) and the new CEO, Sridhar Ramaswamy, has already been leading Snowflake’s AI strategy. This is a great acknowledgement of the incredible AI opportunities ahead for this very impressive high-growth big-data company.

Conclusion:

Investing in disruptive high-growth stocks at this point in the market cycle (i.e. when the Nasdaq is at all time highs) may seem like a bad idea to some investors. But if you have a long-term time horizon (many years) then short and mid-term volatility should bother you less. Yes, these companies may suffer volatile price pullbacks at some point in the future. However, the companies listed above have tremendous long-term growth trajectory thanks to the disruptive mega-trends they are benefiting from (namely, big data and artificial intelligence).

We are currently long 6-out-of-7 of these companies (we don’t yet own Zeta) in our Blue Harbinger Disciplined Growth Portfolio and have no intention of selling out of our positions any time soon. Disciplined, prudently concentrated, long-term investing continues to be a powerful winning strategy.