If you like high income investments, two things are likely true: (1) you are aware of the big double-digit yields offered by PIMCO closed-end funds (“CEFs”) and (2) you’re likely disgusted by the returns of said bond funds over the last few years. However, the tide has shifted as interest rate hikes have ceased (and may reverse). And as we correctly predicted, the brief price discount on PIMCO’s PDI (versus NAV) has evaporated and the shares now trade at a premium. What’s special is BOTH the premium and share price will likely increase dramatically in the months, quarters and years ahead. We explain in this short report and also share data on 100 other big-yield CEFs (many also paid monthly) for comparison purposes.

PIMCO Dynamic Income Fund (PDI), Yield 13.8% (paid monthly)

PICMO is the leader in bond CEF management, and widely respected by many for its wide resources and expertise in providing income-focused investors the steady income they demand.

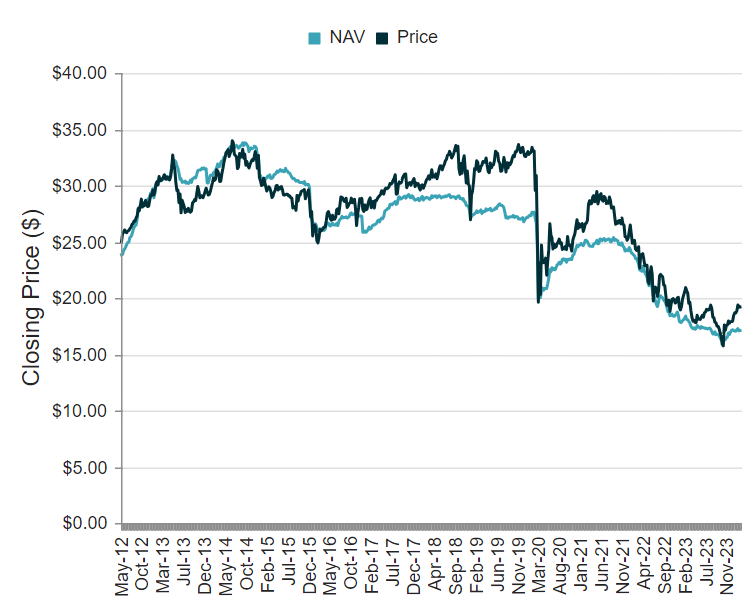

However, when interest rates rise, bond price fall. And the US fed’s historically rapidly interest rate hikes (to fight inflation after the pandemic) has led to historically ugly price declines for PDI, as you can see in the chart below.

The Good News X 2:

The good news for investors is two-fold. First, rate hikes appear over, so now PIMCO can get back to actually generating price returns from skill instead of being washed out by the fed.

And two, investors will likely continue to pile into these shares for months and quarters ahead, thereby driving the price premium versus NAV even higher. It is not uncommon for a PIMCO fund to trade at very large premiums to NAV, and PDI has historically traded at much higher premiums than the current 12.2%.

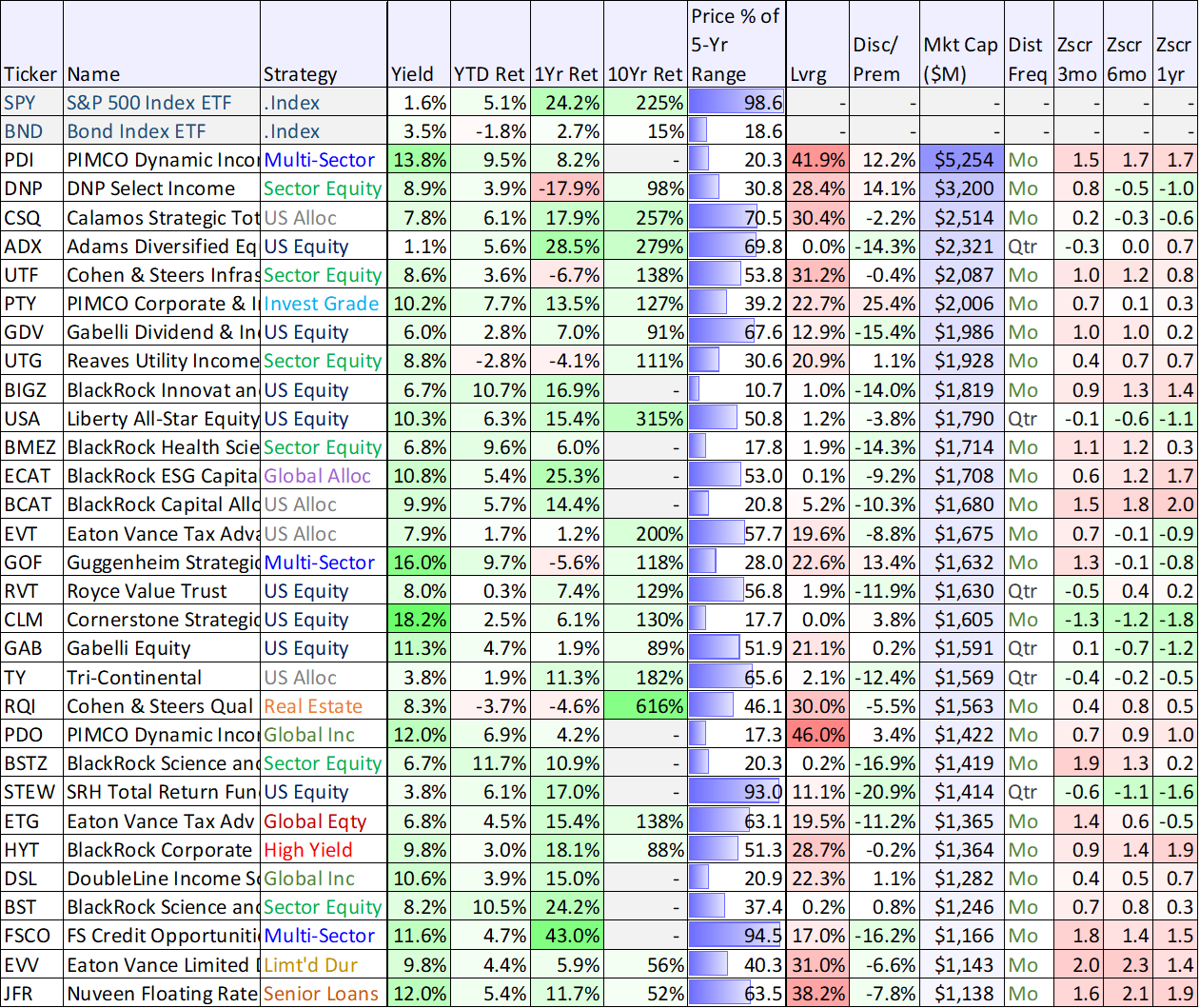

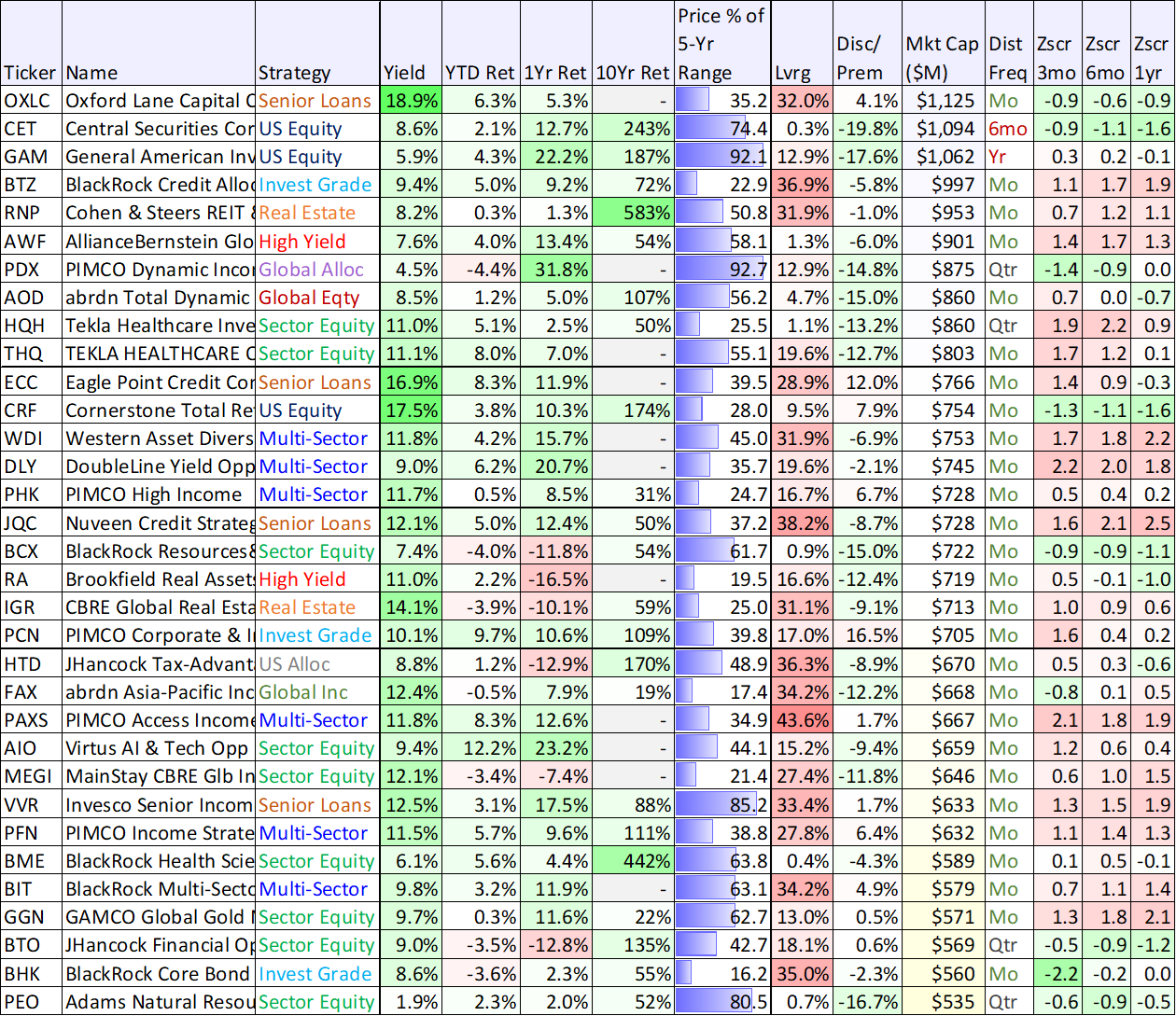

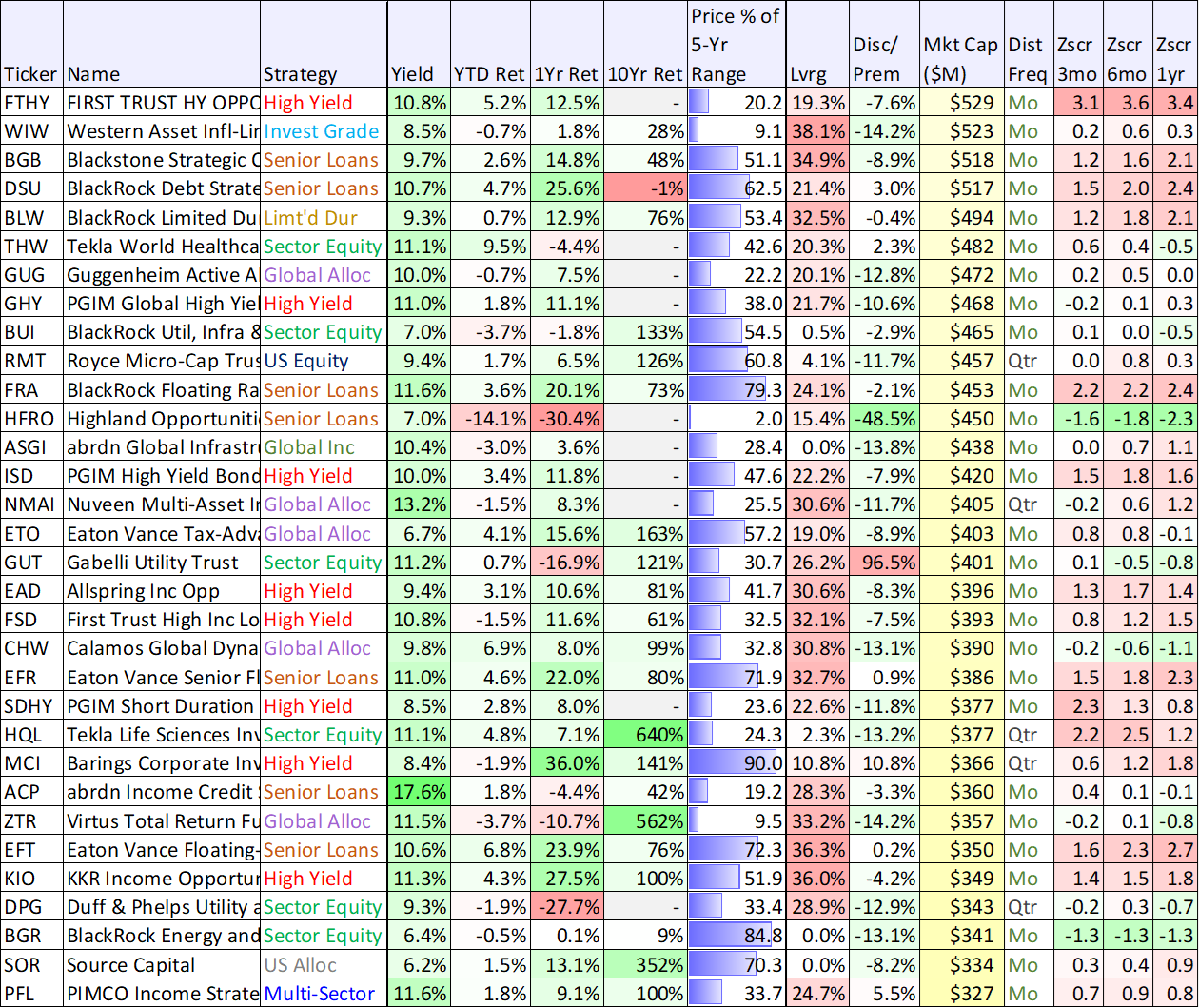

100 Big-Yield CEFs Compared:

For perspective, here is comparative data on over 100 big-yield CEFs, across various categories. The data is as of Friday’s close (2/16), and PDI (the largest) sits right at the top.

data as of Friday’s close 2/16. Source: StockRover and CEFConnect

The Bottom Line:

Despite strong gains this year, we believe PDI (and other bond CEFs) have dramatically more upside ahead as the market adjusts to now steadier interest rates and the possibility for cuts later this year (again, rate cuts by the fed are good news for bond funds like PDI).

Further, investor sentiment has shifted from hating bond CEFs (many, such as PDI, were trading at discounted prices (versus NAV)). And the current premiums (versus NAV) will likely increase as investors pour into this currently attractive asset class.

We are long shares of PDI in our Blue Harbinger High Income NOW Portfolio, and have no intention of selling anytime soon.