The popular utility-sector closed-end fund (“CEF”) we review in this report is attractive for several reasons (e.g. big growing monthly distributions, evaporated premium and attractively priced), if you can handle the associated risks of investing. In this report, we run through all the details and then conclude with our strong opinion on investing in this big 8.8% yield CEF.

Reaves Utility Income Fund (UTG), Yield: 8.8%

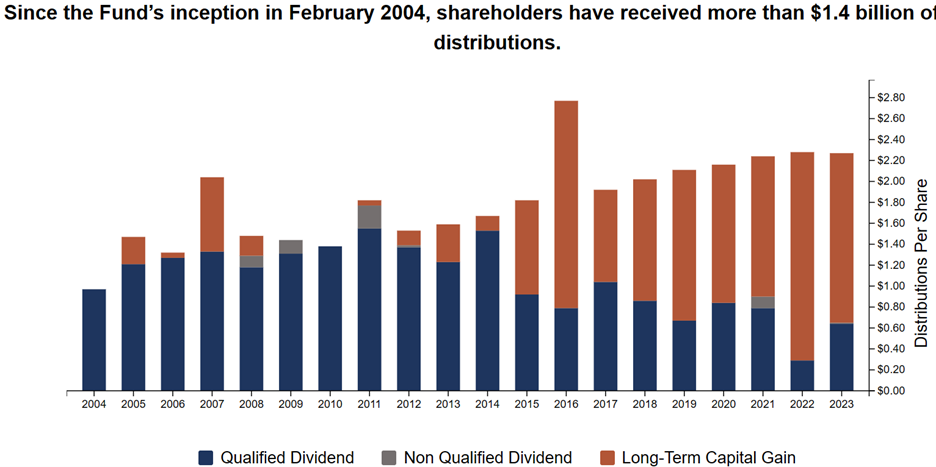

Since its inception in 2004, this utility-sector-focused fund has served many investors well. It has consistently paid a growing monthly distribution by investing mainly in the utilities sector (a sector known for low volatility and steady income payments).

What’s more, this fund can make an excellent addition to an income-focused TAXABLE investment account because of its specific objective of providing a high level of AFTER-TAX income and total return (consisting primarily of tax-advantaged dividend income and capital appreciation).

For example, you can see in the chart above the steady growing income (including several special distributions) and the breakdown between qualified dividends (typically taxed at a lower rate than the ordinary income tax rate of most investors when they receive non-qualified dividends) and long-term capital gains (also taxed at a lower rate than many investors ordinary income tax rate).

Why Invest in UTG Now?

Furthermore, there are several good reasons to consider investing in UTG now (besides just if you like big steady growing tax-advantaged monthly income payments).

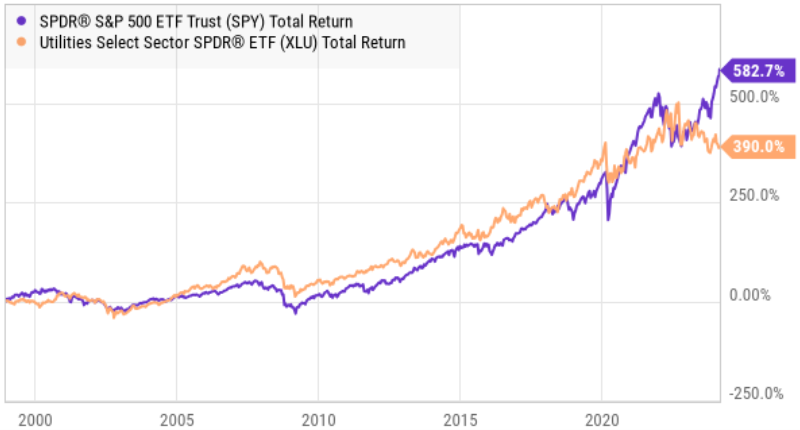

For example, the utilities sector is attractive from a contrarian standpoint (for example, you can the sector’s recent underperformance in the following chart).

The underperformance may be due to growth stocks overheating, but also due to the fed’s recent steep interest rates hikes which caused funds to flow out of the utilities sector and into certain bonds (now offering more competitive interest rates).

And if you are scared of a potential market pullback and high volatility, UTG can make an excellent investment now (especially now that interest rates have stabilized).

Additionally, UTG’s small price premium versus its NAV has recently gotten even smaller (recently only 0.63% premium).

One of the unique characteristics of CEFs (as compared to ordinary mutual funds or exchange-traded funds) is that CEFs can trade in the market at big price premiums and discounts as compared to the aggregate market value of all of their individual holdings. This can create opportunities and risks for CEF investors, and we generally prefer to NOT buy attractive CEFs at big price premiums.

Risks of Investing in UTG

Before purchasing shares of this attractive CEF, investors should be aware of the risks (in addition to the risk of widening/narrowing price premiums based on supply and demand for the shares).

Leverage (or borrowed money) is a risk factor. UTG typically borrows money (to magnify the income and the price appreciation), and the fund’s recent leverage ratio was 31% (meaning for every dollar of net asset value the fund purchases $1.31 of investments). This can be a great thing in the good times (when the market is going up), but it can also magnify losses in the bad times (when the market is going down). However, considering the general lower-volatility nature of utilities stocks, combined with the current contrarian pricing opportunity, we view the fund’s leverage ratio as attractive.

Return of Capital (ROC): According to the fund website:

“A return of capital consists of shareholders’ initial principal plus portfolio appreciation that has not yet been realized as a capital gain. CEFs are required to designate the portion of the distributions made in a given tax year as return of capital if they have not generated sufficient funds from interest income, dividend income, or realized capital gains to meet the actual distributions made to shareholders.”

ROC is a risk factor because it can reduce your initial cost basis in the fund thereby resulting in a larger (and perhaps unexpected) capital gains tax when you do sell shares.

The fund allows you to reinvest the distributions (which can reduce the ROC taxation risks), but of course that defeats the purpose for some investors who own the shares specifically for the big steady distributions.

The good news is that only a portion of the distribution is ROC, and some of the ROC is simply unrealized capital gains. Net-net, if you are an income-focused investor, this fund does a fine job sourcing the distribution prudently.

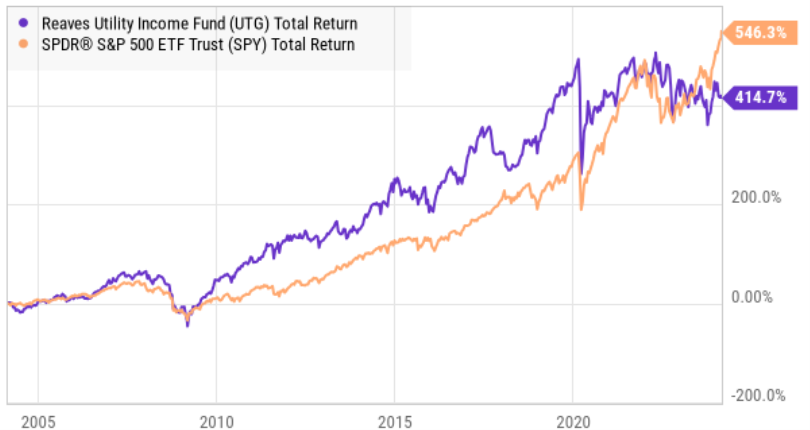

Lower Total Returns

Another risk factor with investing in this fund is simply lower long-term total returns (total return is price appreciation plus all dividends as if they were immediately reinvested). Here is a chart of UTG’s long-term total return versus the S&P 500 (SPY). As you can see, at times it has outperformed, but more recently UTG has significantly underperformed (and this chart assumes you are reinvesting dividends, which many people are not).

We view the recent underperformance as an attractive contrarian opportunity because arguably the rest of the market is overheating (driven by high-growth stocks in particular), and utilities sector investments can be an attractive benchmark-relative hedge.

Furthermore, utilities may have faced pressure as the fed aggressively hiked interest rates and many investors hiding out in utilities stocks have flocked to bonds as certain yields are now more comparable. However, now with rates stabilizing, the pain relative pain may be over, and utilities appear an attractive contrarian opportunity at this point in the cycle.

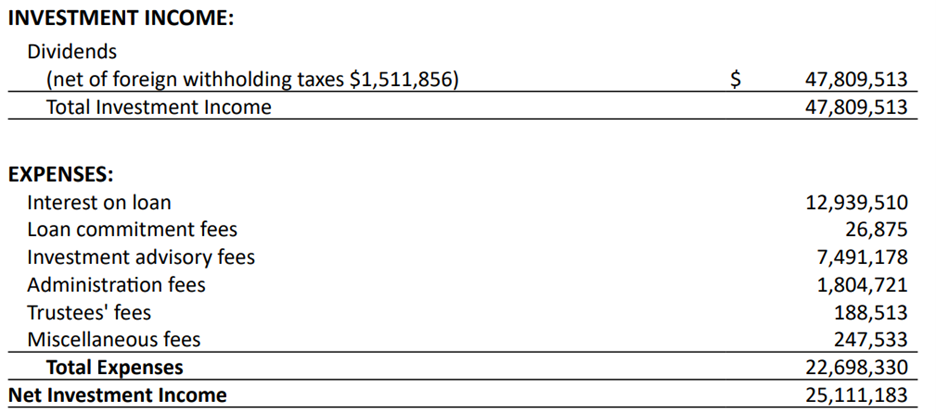

Fees and expenses are another risk factor to keep in mind. Specifically, the fund recently had an annual management fee of 0.72% and a total expense ratio of 2.32%.

Fees and expenses detract from your total returns as an investor. However, if you are focused on income as a top priority, this fund has delivered (despite expenses). Furthermore, the leverage (or borrowed money) helps offset some of the fund’s total expenses over the long-term and helps keep income and total returns competitive.

The Bottom Line

If you are an income-focused investor, UTG currently presents an attractive big-yield contrarian opportunity. The utilities sector is known for stability and may be attractive versus growth stocks now, especially as interest rates stabilize and prices have already adjusted to account for money flowing to bonds (which have gone from ~0% interest to now more competitive rates).

This fund in particular has done an excellent job paying steady growing income over the years and has effectively managed the distributions to be cognizant of taxes (this is potentially a good high-income fund for your taxable account, just be aware of the potential tax impacts or ROC on your future capital gains tax bill if you’re not reinvesting the dividends).

We do NOT currently own shares of UTG, but it is high on our watchlist for our “High Income NOW” Portfolio, and we may add shares soon.