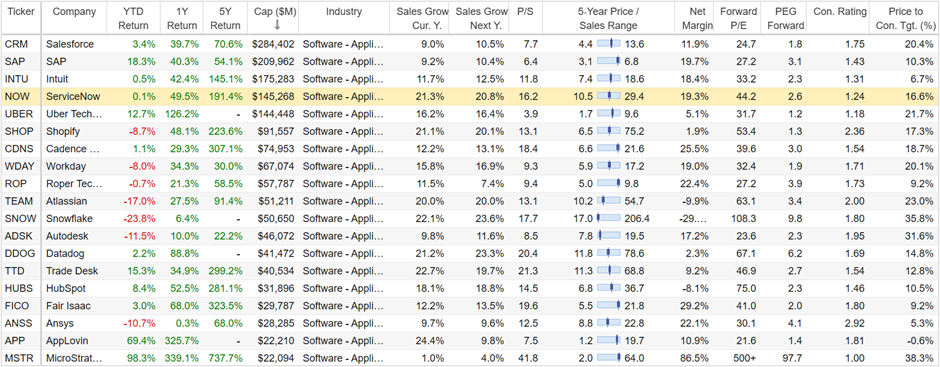

QuickNote: ServiceNow is actually a fantastic “software application” business, with high profits (29-30% Non-GAAP net margins, 19.3 GAAP), strong customer retention (98%+ renewals) and high revenue growth (above 20%). But what about the valuation?

Sharing a few quick data points (and comps) following the company’s latest earnings announcement.

As you can see in the table above, ServiceNow continues to grow faster than peers (and with higher net margins). Yet its valuation (Price-to-Sales and Price/Earnings to Growth) remains reasonable. Wall Street likes the business to (“strong buy” 1.24 consensus rating, with 16.6% upside).

The company just announced earnings that beat expectations, yet the shares have sold off a bit (as the entire market has sold off a bit too).

The Big Question

The big question for ServiceNow is whether it can keep growing at such a high rate for an extended period of time (i.e. many years)? And considering enterprises across the globe continue to migrate to the cloud (and the renewal rate is so high) I think the answer is Yes—NOW can keep growing, and Yes—the current valuation is still attractive.

The above chart does a good job of explaning just how sticky and powerful the company’s customers actually are (i.e. “land and expand”).

The Bottom Line

ServiceNow is a great business, with a reasonable valuation (as compared to its ongoing growth trajectory). It’s also a high beta stock (that can rise and fall with the overall market). But long-term (many years) this one is most likely going much higher (and at a faster rate) than the overall market.

We continue to be long ServiceNow in our Blue Harbinger Disciplined Growth Portfolio (and have no intention of selling anytime soon).