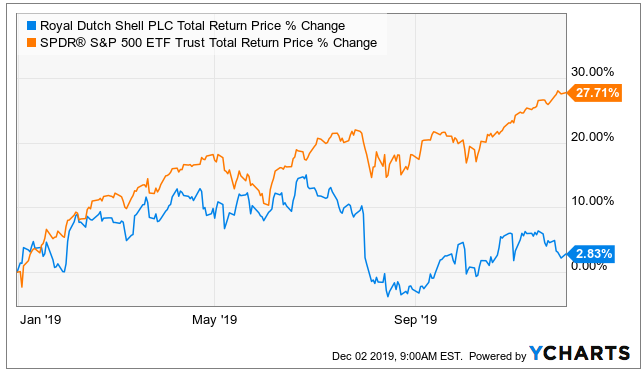

Royal Dutch Shell (RDS.B) is an integrated oil & gas company that offers a very safe dividend. The yield is currently a larger-than-normal 6.5% because the share price has underperformed the strong fundamentals of the business. The share price was down again last week (and it was down the whole month of November while the overall market sailed higher). This article describes an attractive income-generating options trade on Royal Dutch Shell that we believe is compelling to place today (and potentially over the next few days) as long at the price of RDS doesn’t move too dramatically before then.

The Trade:

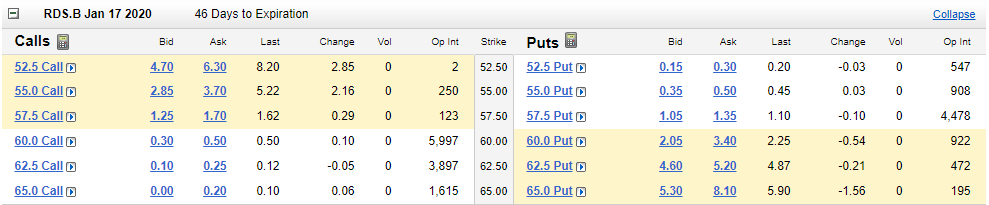

Sell Put Options on Royal Dutch Shell (RDS.B) with a strike price of $55.00 (4.5% out of the money), and expiration date of January 17, 2019, and for a premium of approximately $0.50 (this comes out to approximately 7.4% of extra income on an annualized basis, ($0.50/$55 x (45 out of 365 days)). This trade not only generates attractive income for us now, but it gives us the possibility of owning shares of RDS.B at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be happy to own Royal Dutch Shell, especially if it falls to a purchase price of $55.00 per share).

Note: If you want higher upfront income and a higher chance of owning the shares, consider selling the January $57.50 puts instead.

Your Opportunity:

We believe this is an attractive trade to place today and potentially over the next few days as long as the price of RDS.B doesn't move dramatically before then, and as long as you’re able to generate annualized premium (income for selling, divided by strike price, annualized) of approximately 7-8%, or greater.

Our Thesis:

Our thesis is basically that Royal Dutch Shell’s ‘B’ shares at a 6.5% dividend yield present an attractive risk-reward for income-oriented investors. The company has consistently grown dividends to shareholders despite the swings associated with oil and gas prices via a focus on improving efficiencies, asset portfolio and careful use of leverage. We expect the company to continue returning cash to shareholders in the form of dividends and buybacks in the near, medium and long-term. We also anticipate, that despite the sell-off, the share price will eventually grow into its large dividend payments.

We recently wrote a very detailed full report on Royal Dutch Shell, and you can access that full report here:

Important Trade Considerations:

Two important considerations when selling put options are dividends and earnings announcements because they can both impact the price and thereby impact your trade. In this particular case, both are largely a non-issue. First, RDS isn’t expected to go ex-dividend until mid-February—after this options contract has already expired. And with regards to earnings, RDS isn’t expected to announce earnings again until the end of January (also after this options contract expires). Had either of these events happened prior to this option trade’s expiration, we’d have to take a closer look at the potential impacts on the trade.

Conclusion:

Royal Dutch Shell pays a big attractive dividend, but the shares have sold off. We believe the sell off is an over reaction to the sector’s volatility, and it’s inappropriate considering the stability of RDS’s business and the stability of its dividend. If you’re looking for a big stable energy dividend to add to your portfolio, we’d not be opposed to owning RDS outright. But if you’d like to be even more sensitive to the market prices, while still guaranteeing attractive upfront premium income, this options trade is attractive today, and potentially over the next few trading days as long as the price doesn’t move too dramatically before then.