This members-only article is a continuation of our free public article, titled Top 8 High-Income REITs, however this members-only version includes the top 4 (we currently own three of them). Without further ado, here are the top 4...

4. MedEquities (MRT), Yield: 7.9%

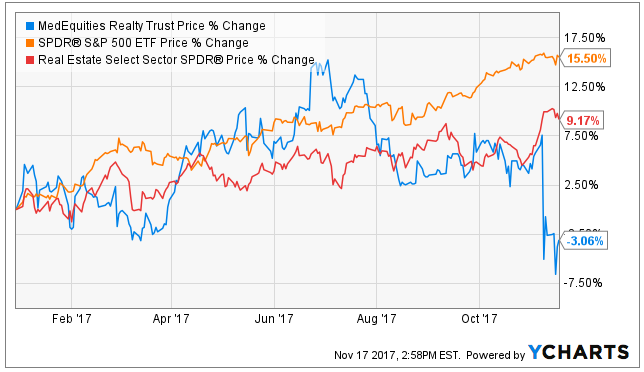

Switching from retail REITs to healthcare REITs, we believe MedEquities is an interesting big-dividend contrarian investment opportunity that is worth considering. Especially because the shares just sold off following last week’s earnings announcement whereby the company actually beat earnings estimates and raised guidance.

The shares sold off because a group of skilled nursing facilities that the company owns in Texas violated lease covenants, and the market panicked. Its important to note that these facilities are still paying 100% of their rent, and overall they’re becoming a smaller portion of MedEquities business as MedEquities continues to grow. If you are interested in learning more about this opportunity, we wrote about MedEquities in extensive detail in our members-only report:

- MedEquities: Market Cycles and Dip Buying

3. New Residential (NRZ), Yield: 11.5%

This is another big dividend REIT where we believe the risks (and there are risks) are outweighed by the rewards (i.e. the big dividend and price appreciation potential).

Before you go chasing after this big dividend yield, it’s worth taking the time to understand the risks, and for your reference we have highlighted what we consider to be NRZ’s biggest risks (and strengths) in this article from back in July (we believe these risks and strengths are still relevant and worth considering).

More recently, NRZ announced earnings at the end of October, and the company again exceeded expectations, beating estimates for earnings and net investment income. And very importantly, core earnings beat estimates by 10 cents and exceeded the dividend payout by 14 cents (a good thing for dividend safety). The chatter has already started about if/when NRZ will announce the next dividend raise—however, considering it’s already so high—we’re more than happy for the company to keep the dividend at its current level with strong support from growing healthy net investment income.

2. EastGroup Properties (EGP), Yield: 2.8%

Like Stag, mentioned earlier in this series, EastGroup is an industrial property REIT, but unlike Stag, EastGroup owns prime location properties, and that’s why we like EastGroup more than Stag. Specifically, we believe EastGroup has continued strong growth opportunities as the economy continues to grow and remain strong. And if we do experience a recession (we’re NOT predicting one anytime soon) EastGroup will fare far better than the riskier Stag because EastGroup’s properties will remain in demand.

In some sense, EastGroup is what a REIT is “supposed” to be. Specifically, EastGroup pays a healthy dividend yield, and the dividend yield helps reduce its overall volatility. It still has sensitivity to the ebbs and flows of the market because it’s an industrial REIT, but it's stronger and safer than many other investment opportunities. For more information on EastGroup, consider our recent report:

1. W.P. Carey REIT (WPC), Yield: 5.6%

WPC has been on fire this year, and we believe there is still more room to run considering its improved business strategy and the fact that (despite this year’s rally) it’s still underperforming over the last 1-year.

The performance has been helped by the weak US dollar considering WPC has significant operations in Europe. Further, we like WPC’s decision to exit its non-traded retail business which was a distraction and arguably a conflict of interest. This clears the path for the company to focus more fully on shareholders.

At its most recent earnings announcement on November 3rd, WPC again beat FFO guidance significantly, and beat revenue guidance significantly. Further, the company raised its full year 2017 guidance. Specifically, WPC raised it’s 2017 AFFO guidance range to $5.25 to $5.35 per diluted share.

Also very important, WPC’s quarterly cash dividend was raised to $1.005 per share, equivalent to an annualized dividend rate of $4.02 per share.

And worth noting, WPC’s CEO Mark DeCesaris is to retire, effective Dec. 31, and he will be replaced by current President Jason Fox. We expect this to be a smooth transition with no major impact to operations.

For your reference, the following graphic shows WPC’s property-type and tenant industry diversification.

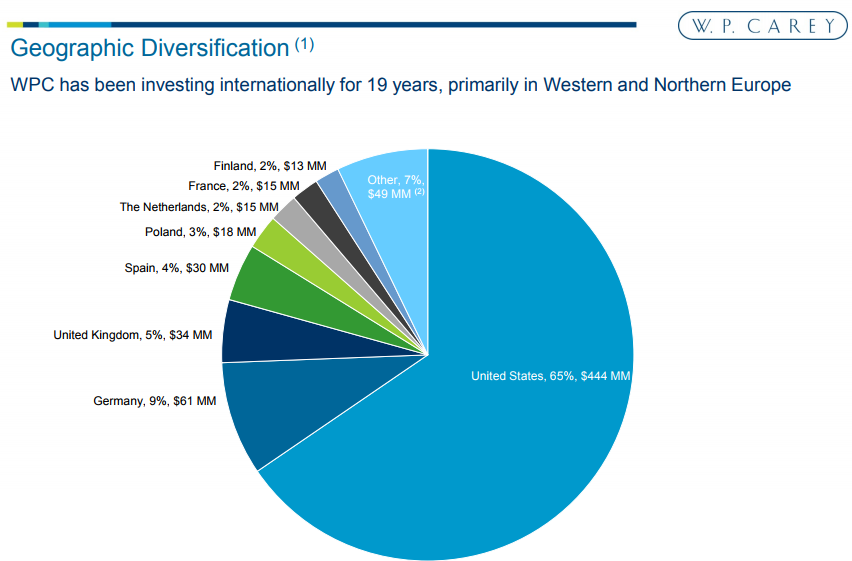

And here is a look at the geographic diversification.

And very impressively, here is a look at the historical occupancy.

You can read more about our views on WPC within this members-only article from back in March. Overall, we believe WPC is an attractive big dividend REIT, and we continue to own it in our Blue Harbinger Concentrated Value & Income (“CVI”) portfolio.

- For reference, you can view all of our current holdings here.