“When the markets are good, like the current long running bull market… we must all fight risk creep in the portfolio.” That’s according to a recent LinkedIn note from Blue Harbinger friend, Brian Coker, CFA. It’s also a good segue into the topic of this week’s Blue Harbinger Weekly: High-Level Risks and Opportunities for 2018.

As the earlier quote reminds us, “the markets are good.” It’s been a “long running bull market.” But let’s not allow rosy market conditions now, blind us from the risks of a market pullback and/or a return to volatility.

For some perspective, here is a look at recent market performance as measured by the S&P 500 (SPY) compared to the “Market Fear Index” (VIX), since the financial crisis.

The fact that the market has climbed significantly and relentlessly higher, while fear (the VIX) has essentially evaporated, is leading many investors to take on more risk than perhaps they should. For example, Bitcoin Mania is driving otherwise rational investors to allocate their hard earned investment dollars to a “cryptocurrency” that exists only electronically (i.e. it generates no income, and there is no physical asset). Eight to nine years ago, during the depths of the financial crisis, do you really think investors would have been throwing money into Bitcoin the way they are right now?... Yet, under today’s market conditions, they are… this is called “risk creep.”

Another example of risk creep is the group of stocks known as “FAANG” (Facebook, Amazon, Apple, Netfix and Google (now Alphabet). The FAANG stocks have risen dramatically in recent years, and investors keep investing a larger portion of their assets in FAANG. This is another example of risk creep. As a reminder, after the tech bubble burst, many investors were scared to death of “tech stocks,” yet now they cannot get enough of them.

Prudent Diversification:

At Blue Harbinger, we believe our readers agree with the notion that it’s inappropriate to “put all your eggs in one basket.” Prudently diversifying across multiple attractive opportunities can reduce risk and keep expected returns high. For example, we don’t put all of our money in one or two stocks, or in one or two market sectors, for that matter. We diversify prudently.

What’s Been Working (2017):

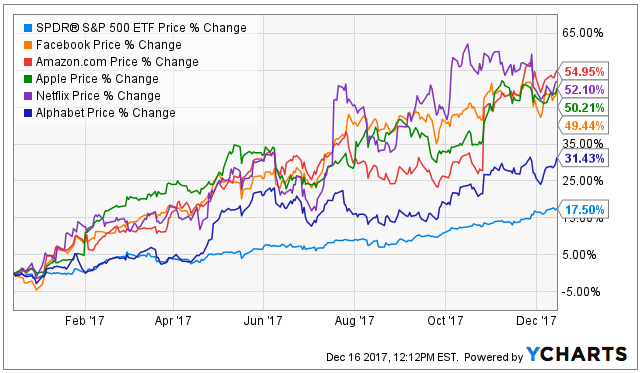

For Starters, here is a look at how well FAANG stocks have performed in 2017 relative to the S&P 500.

And here is the same chart after adding in Bitcoin (GBTC).

We’re not saying any of the FAANG stocks are imminently going to crash, but just based on their price appreciation, they may be making up a significantly larger portion of some investors’ portfolios, and it could be a good time to consider taking a little “risk creep” off the table.

Here is a broader look at how market sectors and styles have been performing this year, and a few contrarian opportunities stand out.

For example, REITs (VNQ) have barely budged in price his year while the S&P 500 is up very significantly.

What Looks Good for 2018:

A-Class Retail REITs:

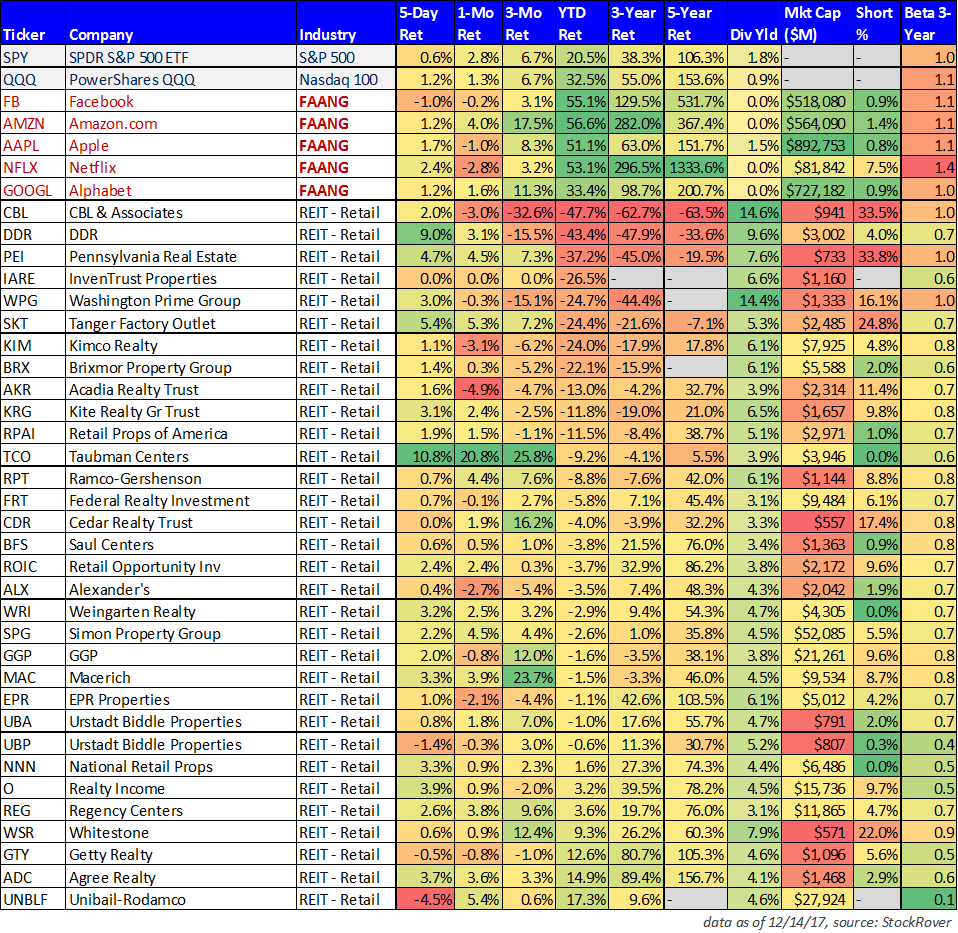

There are likely some good contrarian REIT opportunities if you’re looking to reallocate a little bit of your portfolio’s risk creep to more reasonably priced less-volatile opportunities. In particular, we wrote about Retail REIT opportunities this week. In this article: Amazon Insurance: 5 Attractive High-Income Retail REITs, and you can see more specifics on how retail REITs have performed in this table.

And for reference, as we wrote in the article linked above, we like some of the A-Class retail REITs like Macerich (MAC) and Taubman (TCO).

Small Caps:

Another contrarian investment area we like right now is the small cap space. These stocks tend to be more US-focused (i.e. they’re generally too small to have too much international exposure), and they may benefit from Washington’s new tax plan. Plus, small caps tend to perform better than large caps over the long-term, and they’re particularly attractive from contrarian standpoint right now. We have been allocated investment dollars within some of our client portfolios to small caps, and we have a specific allocation to small cap via IWN RVT and RMT within our Blue Harbinger holdings.

Energy and Energy Related:

Another area that performed poorly in 2017 in the Energy Sector, and we believe there are select attractive contrarian opportunities that may do quite well in 2018. For example, we like Tsakos Energy Navigation (We Own This Big Dividend with Big Upside Potential). We also continue to own Phillips66 (PSX), a company we believe is only just beginning to receive the credit it deserves from the market for its growing midstream business (the market still values it too heavily based on its refining business--an industry that gets a lower valuation multiple due to its volatility… midstream is far less volatile because of long-term contracts).

Conclusion:

Our current bull market rally has been raging on for years now. And “risk creep” is real. If you are managing your own investments, you need to understand what types of risks you are comfortable with. If you view our current “sunny day” market conditions as an opportunity to reallocate some of your big winners into some more diversified contrarian opportunities, then now may be a decent time to do it. We like small caps, select energy, and A-Class Retail REITs.We don’t know when, but volatility will eventually return, and when it does you may wish you had addressed your portfolio’s “risk creep” sooner.