In a return to the basics, this week's Weekly provides details for a variety of safe big-dividend stocks that we consider very attractive. In fact, we own 3 of the stocks on the list, and the other 7 are very attractive in our view. You won't want to miss this article.

If you are an income-focused value investor, publicly-traded Real Estate Investment Trusts (REITs) may have recently caught your eye. These securities offer large dividend yields, and their performance has lagged the rest of the market significantly over the last year (due in part to rising interest rate fears). For example, the Real Estate sector ETF (XLRE) has gained less than 1% while the S&P500 is up over 17%. This article provides data on various categories of big-dividend REITs, and then provides a ranking of ten specific high-income REITs that we consider particularly attractive right now.

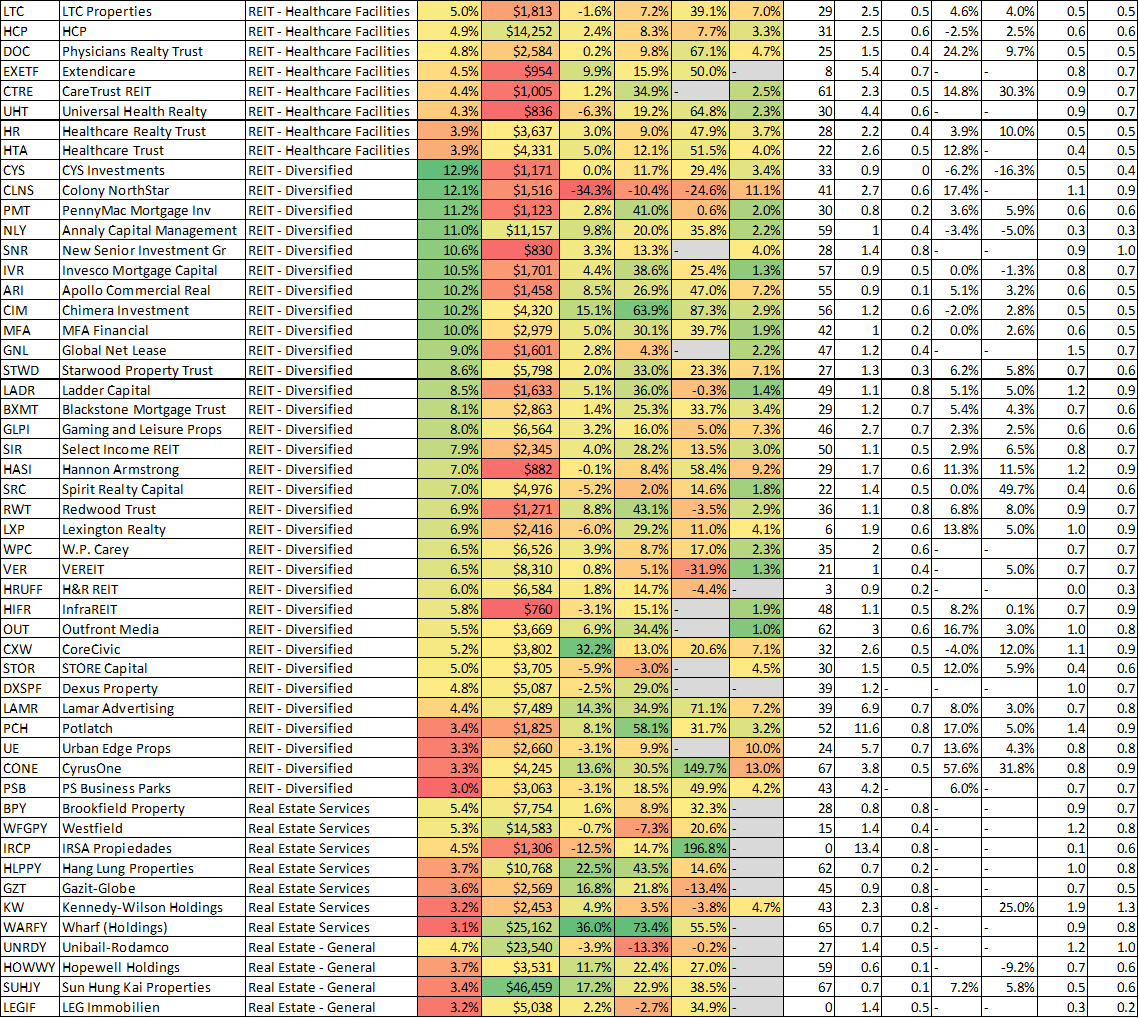

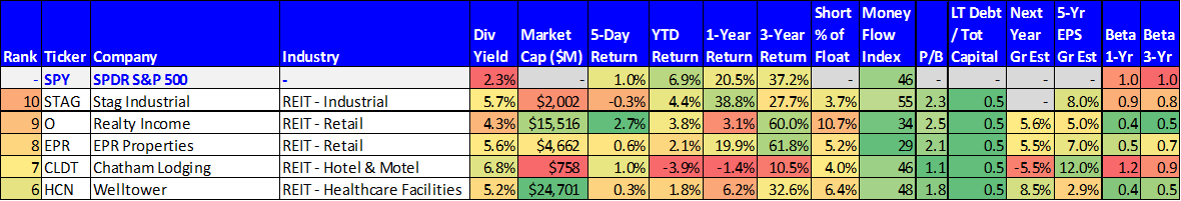

For starters, here is the data for 150 high-yield REITs organized by category.

You’ll notice that some categories of REITs (for example, Retail REITs) have performed particularly poorly over the last year, while other categories (for example, the skilled-nursing-facilities Healthcare REITs) have a very high level of short-interest. For your consideration, we have provided a ranking of ten specific REIT opportunities that we consider particularly attractive right now.

10. Stag Industrial (STAG), Yield: 5.7%

Big safe monthly dividend payments are what attracts many investors to Stag. And despite its relatively strong performance over the last year (+38.8%), its valuation is still attractive, and we like its business model in particular. Stag is an industrial REIT that focuses on secondary and tertiary properties (i.e. non-prime locations). Therefore, rather than competing for the best location properties, Stag invests in properties where there is demand but little competition. And Stag believes it can achieve high returns with relatively lower risk by diversifying away the idiosyncratic risks of these secondary and tertiary locations by owning a lot of them (i.e. don’t put all your eggs in one basket).

For your consideration, the following metrics show that Stag has a high-yield and an attractive valuation.

Part of the reason for the low-price/attractive-valuation is risk (i.e. even after diversifying into a basket of many properties, there are still perceived risks associated with non-prime location properties). Additionally, Stag tends to be a higher beta REIT than many of its peers, which means it’s more sensitive to overall market moves. And as the following chart shows, its dividend to FFO payout ratio is high (but still sustainable).

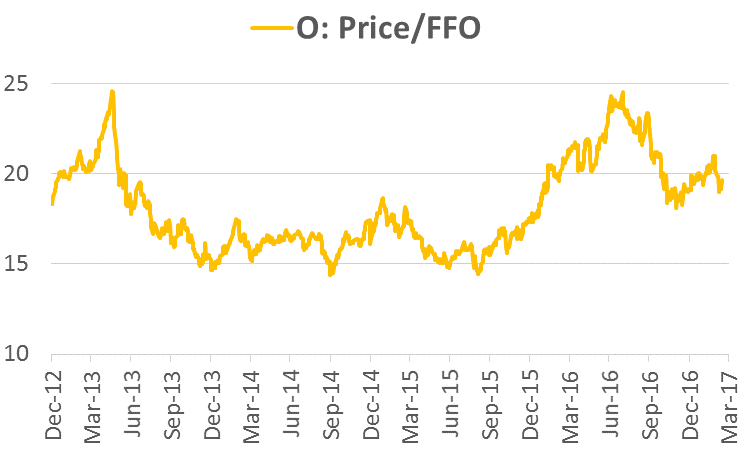

However, this next table shows Stag’s adjusted FFO is higher than its FFO, and therefore there is more cushion behind its dividend payment than first meets the eye.

Overall, we believe Stag’s dividend is safe, and its current price has some margin of safety. And if you are a long-term, income-focused investor, we believe Stag’s big dividend is worth considering.

9. Realty Income (O), Yield: 4.3%

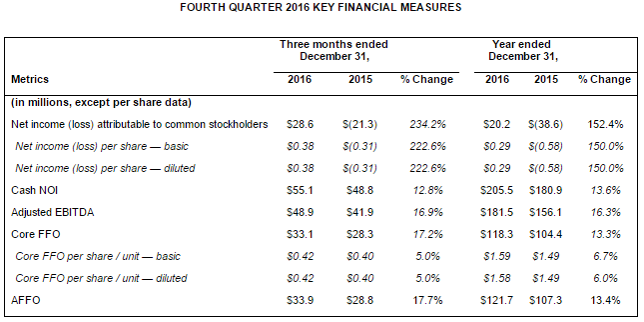

Realty Income is an income-investor favorite because it pays big safe monthly dividends. Additionally, the dividend payment has increased for 77 consecutive quarters. We believe O is worth considering now because its business remains strong but its valuation has come down. Specifically, the following chart shows that Realty Income’s price versus its Funds From Operations (FFO) has come down significantly since last summer (i.e. the shares are on sale).

If you are not aware, Realty Income is a large REIT that invests in commercial/retail properties spread across the US.

And it has a reputation as an attractive safe blue chip REIT as shown in the following graphic.

It’s also a Dividend Aristocrat (i.e. it has increased its dividend more than 20 years in a row), and it only expects to pay out ~ 83% of its adjusted FFO as dividends in 2017, which is a healthy margin of safety for this low beta company. If you are a long-term, income-focused, value investor, Realty Income is worth considering.

8. EPR Properties (EPR), Yield: 5.6%

If you like Realty Income, then you might also want to consider another retail REIT, EPR Properties, because it offers a bigger yield, and a more attractive valuation, in our view.

EPR divides its business into three segments, Entertainment, Recreation and Education, as shown in the following graphics.

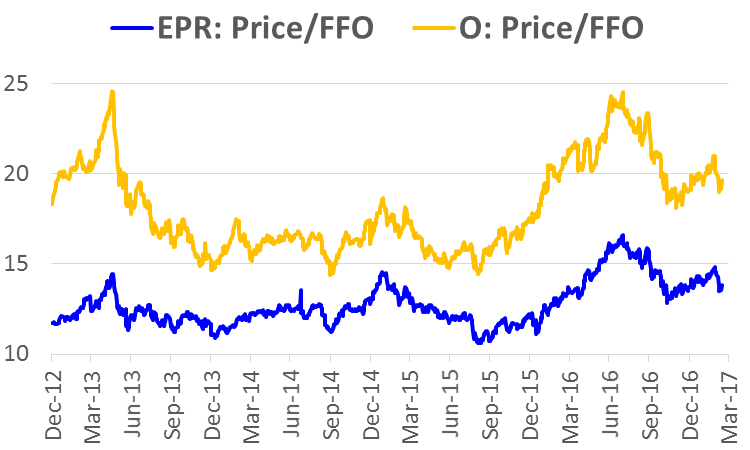

And what makes EPR particularly attractive to us is that not only has its price come down recently, but it also offers an even more attractive Price-to-FFO valuation than Realty Income, as shown in the following chart.

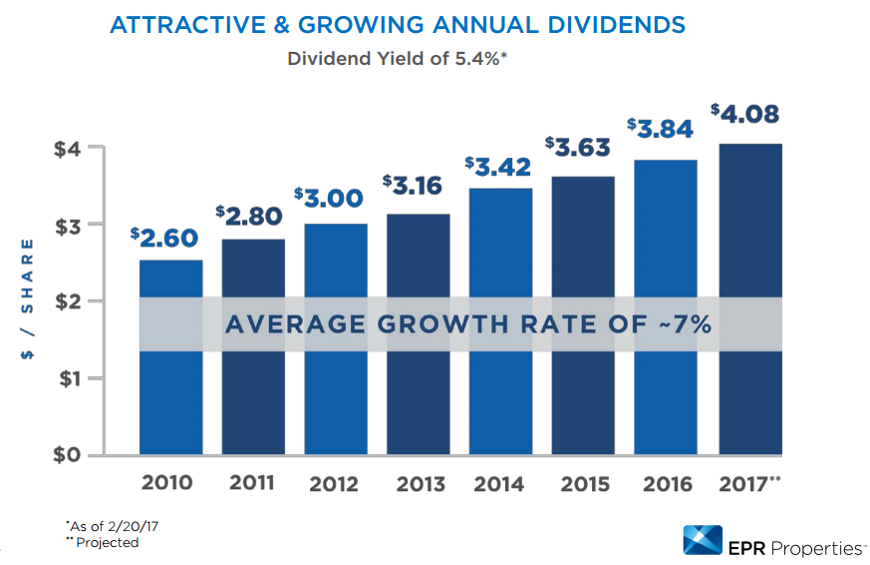

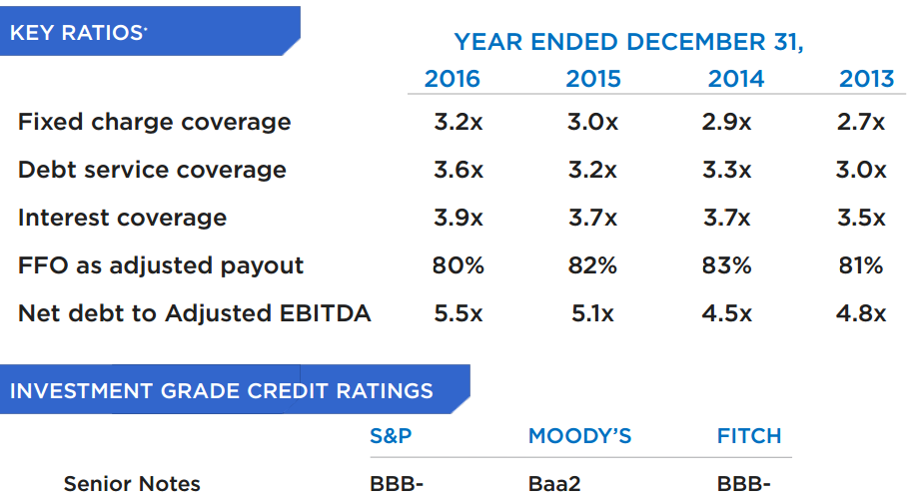

Plus, EPR is smaller, suggesting it has more room for continued growth (or it may even become an acquisition target). As this next table shows, EPR also has a very healthy and sustainable Dividend to FFO payout ratio.

Overall, we believe EPR Properties is worth considering if you are an income-focused value investor.

7. Chatham Lodging Trust (CLDT), Yield: 6.8%

Chatham is a big dividend hotel REIT. Its strategy is focused on owning and acquiring high quality select service hotels with premium brands in attractive, high-growth markets, as shown in the following graphic.

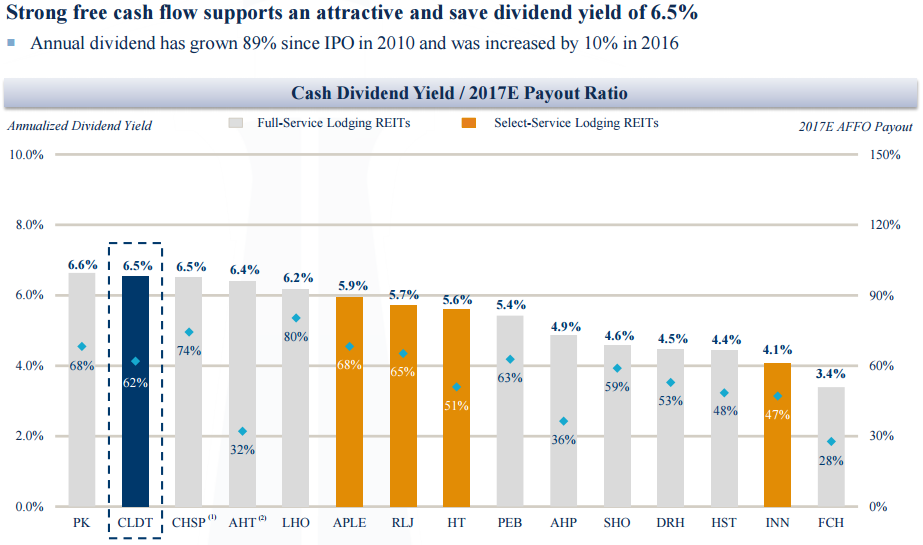

It also offers an attractive dividend yield that is very safe (the dividend is only 62% of AFFO).

The risk of investing in hotel REITs is that they have less long-term visibility into future funds from operations (i.e. its harder to predict future FFO when rooms are usually only rented for 1-2 nights at a time, whereas other REITs often use much longer-term contracts and leases). As such, Chatham also has a high beta and is more sensitive to ecomomic conditions than other REITs. However, hotel REITs are attractive from a contrarian standpoint considering their prices are generally down more than other REIT categories. And considering Chatam’s hotels are generally higher-quality for their category, and they are also located in costal areas with strong economies, we believe this is one big-dividend hotel REIT that is worth considering.

6. Welltower (HCN), Yield: 5.2%

Welltower is one of the more blue chip opportunities in the healthcare REIT space, its price has recently declined, and its valuation has become significantly more attractive.

Besides being the largest healthcare REIT, it pays a big, growing dividend. It’s also well-diversified across senior housing (triple-net and operating), outpatient medical, and long-term post-acute. The “post-acute” is somewhat risky considering other healthcare REITs (such as HCP and Ventas) have been shedding “skilled nursing” exposure because they don’t want to deal with the regulatory reimbursement risks (i.e. potential “repeal and replace” of the Affordable Care Act). However, we like that Welltower has some exposure to the upside in that segment.

We don’t currently own shares of Welltower, but we wrote about its attractiveness last August (see: Welltower’s Big Dividend: Weighing the Risks Ahead). Since that time its business has remained strong, and its price to FFO ratio has dropped to a compelling 14.97x. We also like that Welltower rents properties under group leases, rather than separate per property leases, because this makes it harder for tenants to drop underperforming properties.

Worth noting, of Welltower’s 1,414 total healthcare properties, 96 facilities are located in the UK, and 145 in are in Canada. This introduces diversification benefits and additional growth opportunities, but it also introduces additional operational risks for the company.

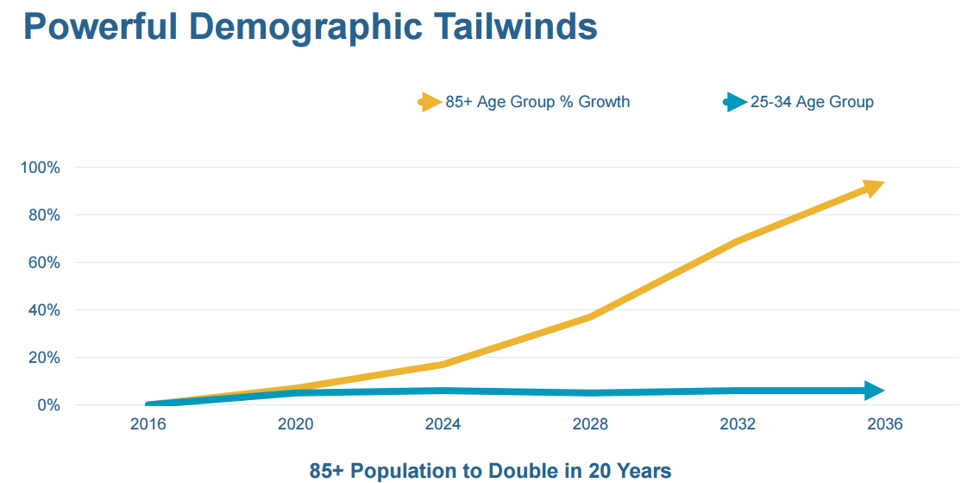

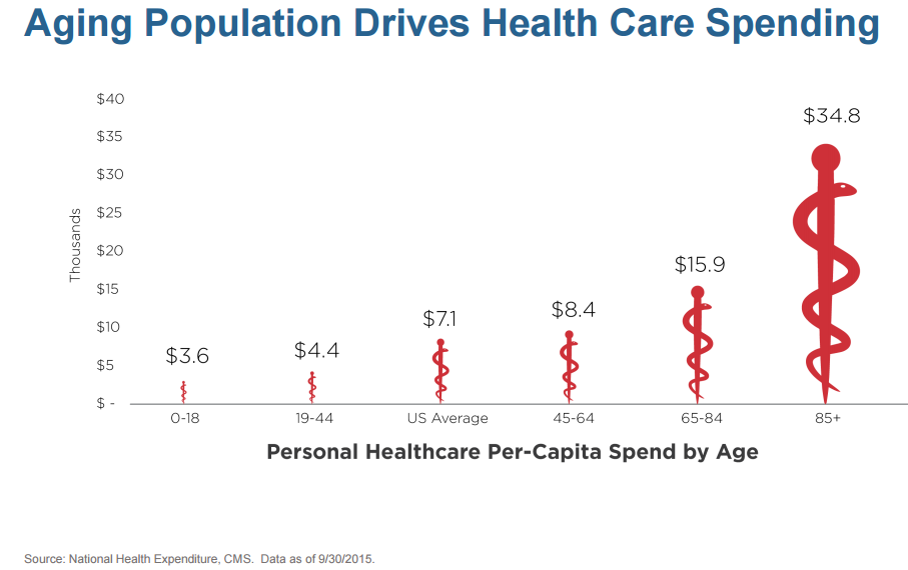

Additionally, we’d be remiss not to point out the strong demographic tailwinds Welltower has at its back, as shown in the following two charts about the growing healthcare demands of the aging population.

In our view, Welltower is a very high-quality REIT that pays a big dividend as is currently on sale. If you are an income-focused value investor, Welltower is worth considering.

The Top 5

Our Top 5 Big-Dividend REITs are included in a separate article (i.e. this week's Investment Idea), and you can access that article here...