This week's investment idea is a continuation of our Blue Harbinger Weekly. Specifically, this investment idea article contains more safe big dividend ideas that we believe are currently attractive. And we own several of these already within our Blue Harbinger Income Equity portfolio.

WIthout further ado, here are our Top 5 Big Dividend REITs...

5. Ventas (VTR), Yield 5.2%

If you like the healthcare demographics story and the big-dividend yield offered by Welltower, but you don’t like the Affordable Care Act risks associated with skilled nursing facilities, consider Ventas. Ventas is a healthcare REIT that offers the same dividend yield (5.2%), but spun off most of its risky skilled nursing facilities business into a separate REIT (Care Capital Properties (CCP)) in 2015.

And despite the arguably lower-risk business, Ventas trades at a similar price-to-FFO ratio as Welltower (Ventas is slightly more attractive at 14.75x).

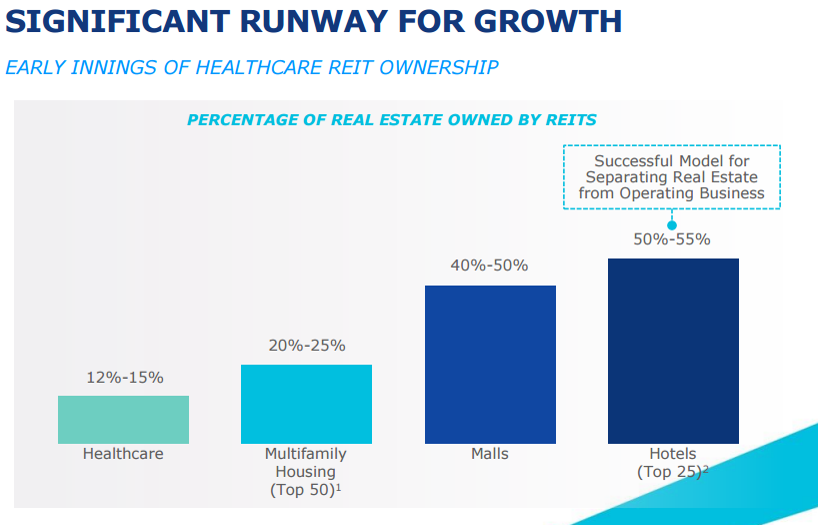

Worth noting, Ventas believes it has significant room for growth as shown in the following chart (realistically, this industry-wide opportunity may bode well for all healthcare REITs, not just Ventas).

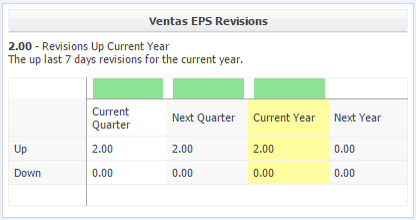

Also worth noting, analyst have a higher 5-year EPS growth rate for Ventas (+6.9%) than Welltower (+2.9%). And as the following chart shows, analysts have been increasing EPS estimates upward.

Overall, if you’re into big safe dividends trading at attractive prices, Ventas may be worth considering for a position within your diversified long-term, income-focused, investment portfolio.

4. Omega Healthcare (OHI), Yield: 7.9%

Whereas Ventas shed risky skilled-nursing facilities, and Welltower invests in some skilled-nursing facilities (a small portion of its overall portfolio), Omega is focused almost exclusively on skilled-nursing facilities. And in this case, we believe it is a risk worth considering.

In our view, Omega is an exceptionally attractive, undervalued, big-dividend healthcare REIT. It’s currently on sale due to uncertainty surrounding Congressional efforts to repeal/replace the Affordable Care Act. Simply put, investors are afraid. Omega’s price has also been dragged lower as the entire REIT sector is down due to rising interest rates fears. In our view, both of these fears are baked-in and overblown, and Omega currently represents an exceptional contrarian opportunity to invest in a big safe dividend.

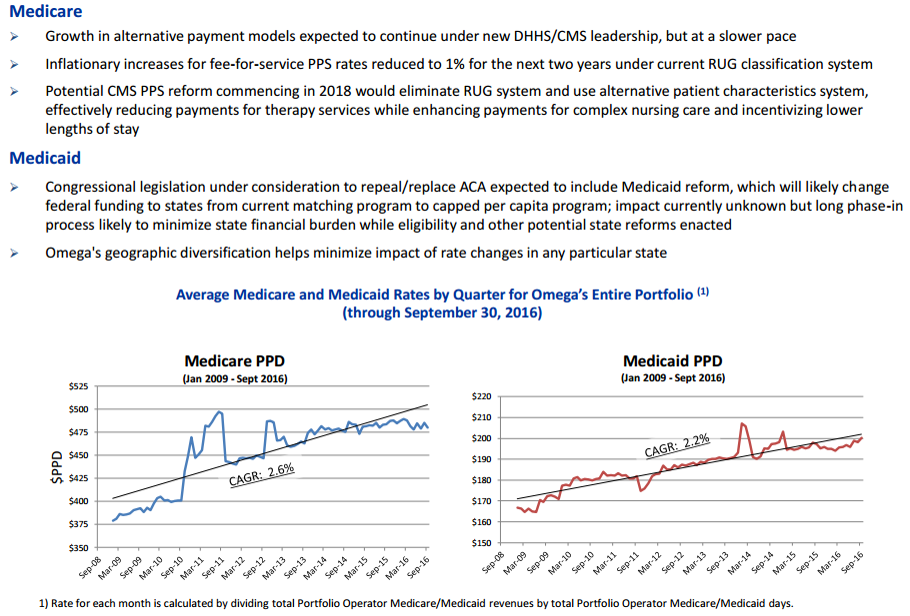

With regards to healthcare reform, here is what Omega had to say in its most recent investor presentation.

Specifically, Omega believes the healthcare reform fears are overblown because alternative payment models will expand under Medicare. And regarding Medicaid, the phase-in process will be long thereby allowing states to offset the burden, and Omega’s geographic diversification will help minimize the impact of rate changes in any one state.

On a comparative basis, skilled-nursing facilities REITs (like Omega) have lagged the overall healthcare REIT space because of the regulatory reform uncertainty. Yet these REITs still have some of the highest short interest as fearful investors continue to place their bets. Worth noting, despite the high short-interest, Omega has a relatively high expected annual earnings growth rate of 15.8% over the next five years (largely because the demographics of a growing aging population with increasing healthcare needs are strongly on Omega’s side).

Also, as we mentioned previously, the entire REIT group has sold off because investors are afraid that rising rates will negatively impact these highly levered companies (i.e. they use a healthy amount of debt to run their businesses). However, this fear is already significantly baked in (the prices are down), and Omega has the strong ability to continue to generate FFO to cover and grow its dividend. In fact, Omega just raised its dividend (again) and announced that their earnings expectations continue to rise. http://www.omegahealthcare.com/investor-relations/news-and-market-data/press-releases/2017/02-08-2017-214452232

Overall, we recognize Omega faces unique regulatory reform risks, but we believe it is a risk worth taking. If you are an income-focused value investor, Omega is absolutely worth considering.

3. EastGroup Properties (EGP), Yield: 3.4%

If you are uncomfortable with the risks associated with healthcare REITs, you may want to consider industrial REIT, EastGroup Properties. Unlike Stag (another industrial REIT, ranked #10 in this article), EastGroup invests in prime locations. Specifically, EastGroup is customer focused, and location sensitive, and the company competes on location, not rent. EastGroup clusters its properties around transportation hubs, and they operate in the following locations.

One of the main reasons we like EastGroup is because its dividend is very safe. For example, the dividend is currently only around 61% of the company’s FFO as shown in the following graphic.

Additionally, EastGroup has paid 148 consecutive quarterly cash dividend, and increased or maintained the dividend for 24 consecutive years. The dividend has Increased 21 of the last 24 years, and increased in each of the last five years.

EastGroup’s price-to-book value (3.8x) looks expensive relative to peers, but in reality this metric is high because of the high quality of its properties, and this should be viewed as a sign of safety, not increased risk. If you believe in the real estate mantra of “location, location, location,” and you are looking for a safe healthy dividend, then EastGroup Properties is worth considering.

2. New Residential (NRZ), Yield: 11.4%

New Residential is a big-dividend mortgage REIT that provides capital to the mortgage industry through three main segments:

Excess Mortgage Servicing Rights: A mortgage servicing right (“MSR”) provides a mortgage servicer with the right to service a pool of mortgage loans in exchange for a fee. An MSR is made up of two components: a basic fee and an Excess MSR.

Servicer Advances: Servicer advances are generally reimbursable cash payments made by a servicer (i) when the borrower fails to make scheduled payments due on a mortgage loan or (ii) to support the value of the collateral property.

Non-Agency Securities & Associated Call Rights: NRZ acquires and manages a diversified portfolio of credit sensitive real estate securities, including non-Agency Residential Mortgage Backed Securities (RMBS) and call rights on select RMBS.

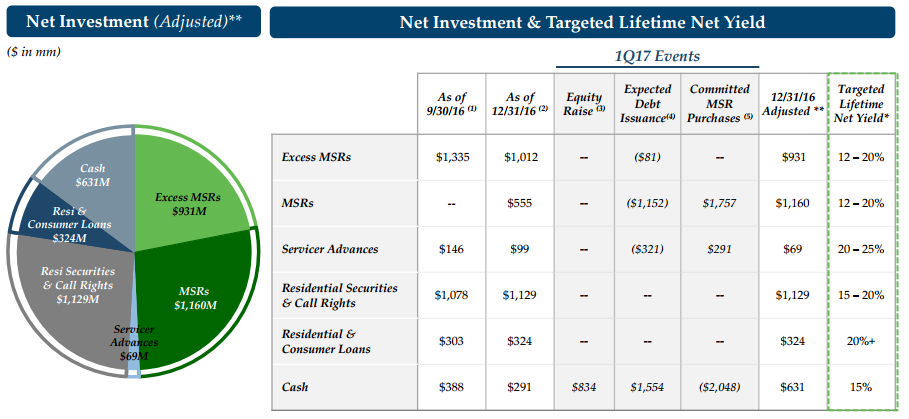

And as shown in the following graphic, NRZ believes they can support their big dividend by generating attractive returns (greater than their high dividend yield) across their investments.

For example, NRZ believes MSRs can provide lifetime yields of 12-20%, Servicer Advances can provide 20-25% net yields (and they’re considered very safe), and Residential Securities, Call Rights and Loans can provide returns of 15-20% or more (and they complement the excess MSRs). These high yields give investors a flavor for how NRZ supports its big dividend.

By way of background, NRZ emerged in the mortgage servicing space following the financial crisis as banks had to shed risk and the mortgage markets became more complex. And even though the unique circumstances that existed following the financial crisis have faded, we believe this company has the ability to continue delivering big returns for many years to come. Specifically, mortgage markets and associated regulations remain complex, and NRZ provides valuable services that other financial institutions are not prepared, willing, or allowed (by regulation) to deliver.

We also like that NRZ continues to find attractive opportunities to grow its business. For example, in the most recently completed quarter, New Residential acquired or agreed to acquire MSRs totaling $154 billion UPB for an aggregate purchase price of approximately $1.1 billion. Also, in January 2017, New Residential agreed to acquire approximately $97 billion UPB of seasoned Agency MSRs from CitiMortgage for a purchase price of approximately $950 million.

Worth noting, NRZ recently completed a public offering of additional common shares to help finance its growth. Generally speaking, the market does NOT like it when a company issues new shares because it can be dilutive to the value of existing shareholders. However, in the case of NRZ, we much prefer to see new shares issued at a higher price. Specifically, shares have rallied 38% over the last year, and now is a much better time to issue shares than a year ago because the company is receiving a much higher price than they would have a year ago (the shares are trading over book value). We also like that the proceeds are being used to fund specific growth initiatives.

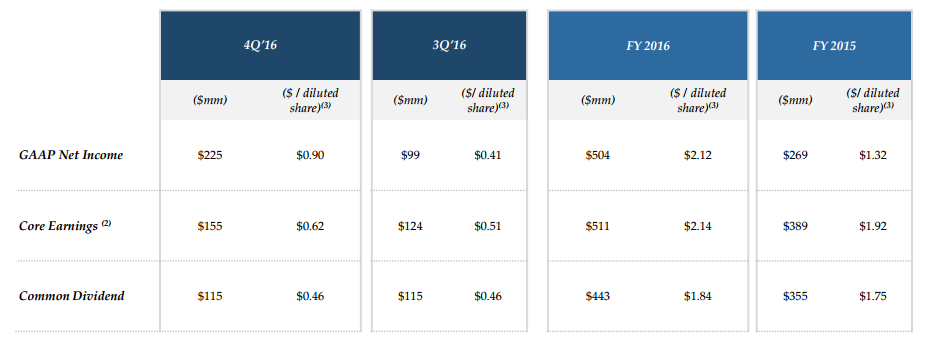

Why now? Even though NRZ has recently delivered strong returns, the company continues to have a strong book of business that will keep delivering. As a testament to the strength of the business, we like that NRZ has enough cash to support the big dividend and grow the business. For example, the following table shows NRZ’s core earnings continue to cover the dividend with a comfortable cushion.

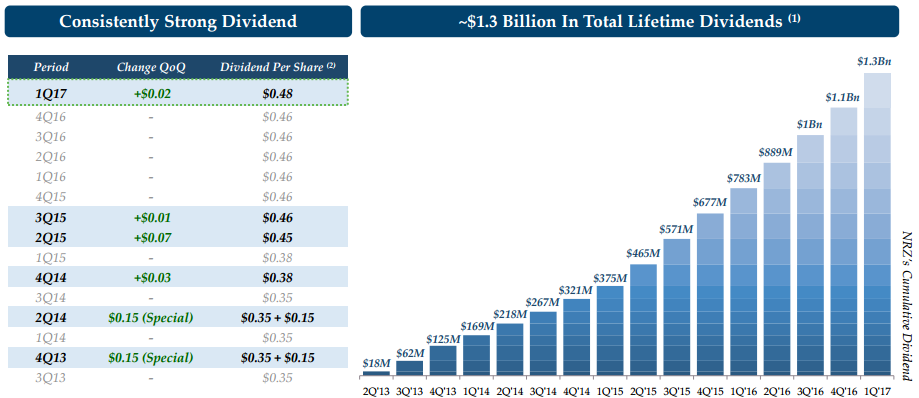

And for reference, this is a dividend that has continued to grow since the company went public, and it was recently increased again this quarter as shown in the following graphic.

Overall, if you are an income-focused investor, we believe NRZ is worth considering for an allocation within your diversified investment portfolio.

1. W.P. Carey REIT (WPC), Yield: 6.5%

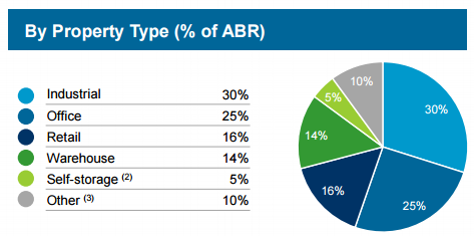

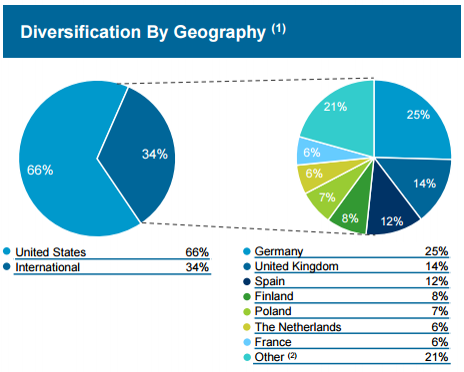

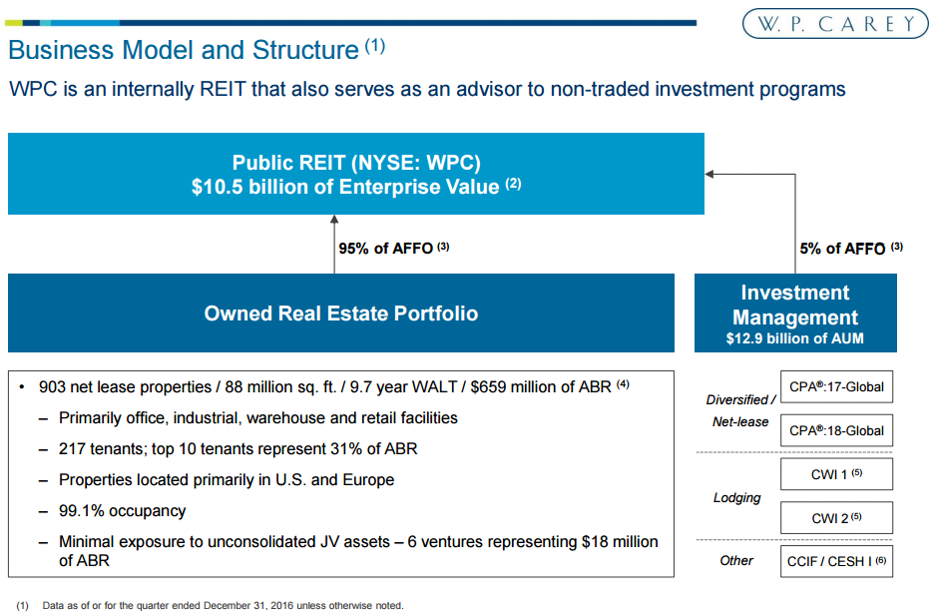

W. P. Carey is an internally managed publicly-traded REIT specializing in sale-leaseback investments of commercial real estate primarily in the U.S. and Europe. The company invests in primarily office, industrial, warehouse and retail facilities, as shown in the following graphics.

As the following chart shows, W.P. Carey’s dividend has been growing, and the payout ratio is a conservative 76.7%.

Particularly attractive, WPC’s occupancy rate has been historically very stable (and high) even during the financial crisis. This is important because it helps ensure the company can keep paying out its big dividend payments.

Important to note, WPC also serves as an advisor to non-traded investment programs as shown in the following graphic.

The investment management unit is important because it allows WPC to spread its costs over a growing basis. And it also contributed 5% to AFFO in 2016.

And from a valuation standpoint, WPC currently trades at an attractive 13.86 times FFO.

Also, WPC’s price is attractive from a contrarian standpoint as it has significantly underperformed the market over the last several years because of the interest rate and REIT sector challenges in general (as described previously), but also because of the unique challenges of operating a third of its business outside of the US and in Europe. The Eurozone and the UK have faced significant economic challenges in recent years that leave more room for improvement and growth, in our view.

If you are looking for an attractive, high-income, contrarian, value investment, W.P. Carey REIT is worth considering.