Unfortunately, many investors make the mistake of chasing the highest yielding securities without doing their homework. We believe in owning healthy yielding securities. This week’s Weekly highlights a group of healthy yielding securities. We also provide details for several specific high yielders with significant long-term price appreciation potential, including one we own in our Blue Harbinger Income Equity Portfolio.

For starters, the group of healthy yielding securities to which we refer is the "Dividend Aristocrats." Specifically, we’re talking about the select group of companies that have raised their dividends every single year for the last twenty years. For example, there are 108 of them in the S&P High-Yield Dividend Aristocrat Index, and we’ve listed all 108 of them in the following table.

Many of the companies included on this list are attractive in our view, but not all of them. For example, Target currently offers a relatively large yield, but we are not interested in chasing after that yield…

Target (TGT)

Target currently offers an impressive 4.5% dividend yield, but we are not interested in owning the shares. The yield is high because the share price has fallen. And the shares have fallen because the growth prospects are not encouraging.

Specifically, as shown in our earlier dividend aristocrat table, analysts expect Target’s five year EPS growth rate to be negative! This is because Target faces challenges from online retailers like Amazon. Also, Target has no real competitive advantage considering its products are not differentiated and it is not the cost leader. Additionally, Target’s revenues and operating margins are declining as shown in the following charts.

Further, Target has a high level of short interest (6.0%), especially for a dividend aristocrat, as investors are starting to line up just to bet against this one. As a company, Target’s business is getting worse. And as a stock, Target is a dividend aristocrat that we are not interested in owning.

Next, here are seven dividend aristocrats that we consider attractive.

7. AT&T (T)

If you are afraid the market’s eight year rally (since the financial crisis) may be coming to an end, and you’d prefer to invest in something that has lower volatility and pays a very healthy dividend, then you may want to consider stalwart dividend aristocrat, AT&T. The company has relationships with literally millions of customers, and it has plenty of free cash flow (as shown in the following chart) to reinvest in its network and to support its big dividend payments.

Additionally, AT&T (along with Verizon) has a far superior network than the many smaller telecoms that are struggling (for example, Frontier). And finally, if you are a contrarian, AT&T’s price has lagged the overall market so far this year (it’s down nearly 2%, while the S&P 500 is up nearly 5%).

6. MDU Resources (MDU)

With widely recognized AT&T at #15, we move to the lessor known MDU Resources at #14. MDU is engaged in regulated energy as well as construction materials and services. In some regards, investors get the best of both worlds with MDU because the regulated energy business ($92.7 million in 2016 earnings) provides the safety and security of a regulated business (this helps keep the dividend very safe), and the construction materials and services business ($136.6 million in 2016 earnings) provides growth opportunities. For example, MDU expects growing demand in construction and services due to the $305 billion, five-year highway bill for funding of transportation and infrastructure. Also worth noting, on January 1st MDU closed on the sale of its 50% interest in its Pronghorn processing plant to further reduce their exposure to commodity prices. Importantly, MDU has paid a dividend for 79 consecutive years, and they’ve increased it in each of the last 26 years.

Also worth noting, if you are a contrarian, MDU’s price and forward price-to-earnings ratio have come down this year, as shown in the following chart (i.e. it’s on sale).

5. AbbVie (ABBV)

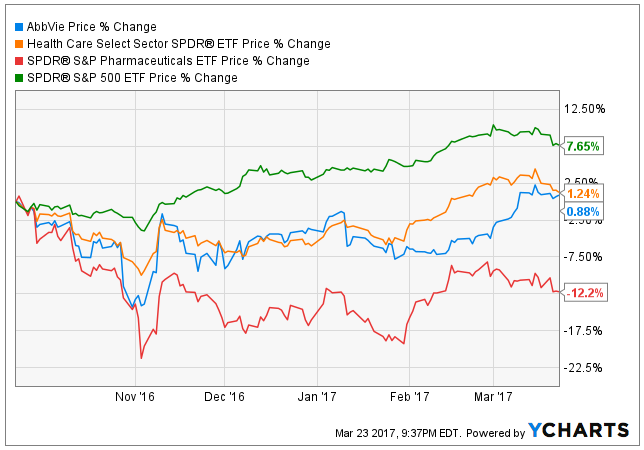

With all of the political uncertainty surrounding healthcare reform in the U.S., the healthcare sector has been beat up. And If you are a contrarian investor (i.e. “be greedy when others are fearful”) you view this as an opportunity.

AbbVie is a research-based biopharmaceutical company engaged in the discovery, development, manufacture and sale of a range of pharmaceutical products. And as the following chart shows, the sector has underperformed over the last six months.

We like AbbVie because it’s cheap. As our earlier dividend aristocrat table shows, AbbVie has plenty of free cash flow to keep covering its big dividend (63.6% payout ratio), and analysts are forecasting significant growth over the next one and five years (+17.8% and +14.6%, respectively). Yet, despite the growth, AbbVie’s price-to-forward-earnings ratio has come down as shown in the following chart (i.e. it’s on sale)

From a fundamentals standpoint, Humira (AbbVie’s immunology drug) has high margins and will support the dividend for more than at least a few years while AbbVie’s healthy pipeline (focusing largely on promising cancer drugs) continues to develop.

4. Consolidated Edison (ED)

Next on our list is a very low risk, low beta, utilities company. Consolidated Edison is a holding company providing steam, natural gas, and electricity to southeastern New York, including New York City. As the following chart shows, utilities have missed out on most of the “Trump rally,” but with increasing interest rate expectations largely affirmed and the Trump rally potentially about to run out of steam, Consolidated Edison is a safe place to put your money, and to collect a big dividend.

The company has raised its dividend for 42 consecutive years, and is committed to continuing its streak. Also, considering its geographic location, it should continue to experience growth, as analysts are forecasting 4.7% growth next year and 3.5% per year for the next five years.

3. Chevron (CVX)

If you like big-dividend contrarian opportunities then Chevron may be right up your ally. Given the declines in energy prices since mid-2014 and the environmental agenda of the previous guy in the White House, Chevron has significantly underperformed the S&P 500 in recent years as shown in the following chart.

However, growth is expected to pick up from new projects including the Gorgon and Wheatstone projects.

In fact, per our earlier dividend aristocrat table, analysts are expecting 32.8% EPS growth next year, and an average of 61.3% over the next five years. Granted oil prices are always a wildcard, but through growth (or through asset sales if necessary), Chevron has the wherewithal to support its big dividend for many years to come. If you are a long-term, income-focused, contrarian investor, Chevron is worth considering.

And finally, here are two dividend aristocrats that we consider particularly attractive (one of which we own in our Blue Harbinger Income Equity portfolio.

2. Tanger Factory Outlet Centers (SKT)

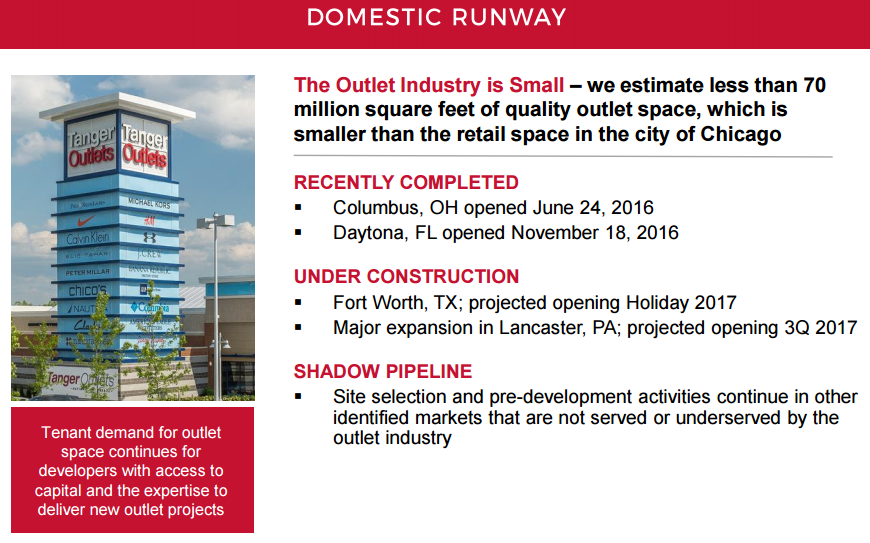

Some investors turn their noses up at anything related to retail shopping because they believe the Internet will put them out of business. In our view, this is one of the reasons Tanger Factory Outlet Centers (SKT) is currently offering an exceptional investment opportunity for income-focused investors.

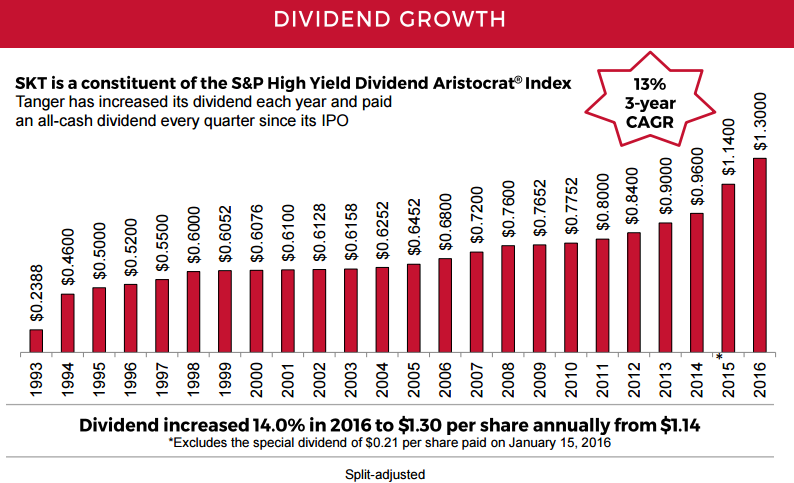

SKT owns and operates outlet centers in the US and Canada, and the company is a fully-integrated, self-administered real estate investment trust (REIT). REITs are generally required to pay out at least 90% of their earnings as dividends, and this helps explain why SKT’s dividend yield is relatively high. And as the following chart shows, the company has underperformed the S&P 500 in recent years, which makes for an attractive contrarian investment opportunity in our view.

Despite the company’s recent stock price underperformance, the business is still sound. Specifically, outlet malls has been one of the few bright spots for many retailers, and SKT has continued room for growth as shown in the following graphic.

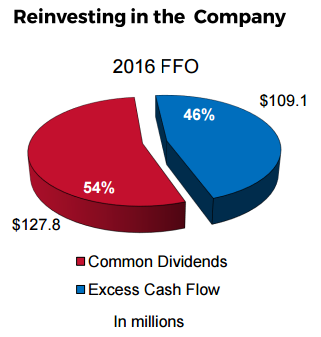

Also, as the following graph shows, SKT’s Funds From Operations (FFO) handily covers is dividend payments, a good sign for dividend safety and growth.

Another factor that has been impacting the REIT sector in general is fear related to rising interest rates. However, we believe the fear is already fully-baked into security prices and Tanger has the wherewithal to continue paying its big dividends. Overall, if you are a contrarian, income-focused value investor, Tanger is worth considering.

1. Procter & Gamble (PG)

Boring?.. Yes. Powerful?.. Absolutely! We own Procter & Gamble in our Blue Harbinger Income Equity portfolio, and if you are looking for a big safe dividend, combined with significant and steady long-term growth potential, consider Procter & Gamble. The company produces branded consumer packaged goods, and we believe it is one of the most attractive long-term dividend aristocrats available.

For some recent background, Procter & Gamble has shed a variety of unprofitable brands over the last five years thereby positioning itself for increasing profitability in the future. For example, its cost of capital (5.67%) is far below its return on invested capital (13.47%, according to Guru Focus) which mean every dollar it invests is now creating significant value for its shareholders. It’s price-to-earnings ratio has also come down making now an increasingly attractive time to buy.

Further, P&G is significantly invested in emerging markets, an area that we believe will drive significant growth in the years ahead. Emerging markets have significantly underperformed the US in the last five years which is a big reason why P&G has not performed better, and a big reason why we believe the company will performed better in the future (i.e. we are contrarians, we believe in reversion towards the mean, and we like emerging markets right now).

If you are looking for a big safe dividend with steady long-term growth potential, Procter & Gamble is worth considering.

Conclusion

Overall, don’t chase after the highest yield securities without doing your homework. We strongly prefer owning companies with healthy dividends. For more healthy dividend ideas, please refer to part two of this series…