This report is a continuation of our free public report titled "15 Attractive 7% Yields Worth Considering" except in this members-only version, we share the Top 5. We believe all 5 are extremely attractive high-income opportunities, and we own all of the top 5.

5. Triangle Capital (TCAP), Yield: 9.7%

Triangle Capital (TCAP) is a Business Development Company (BDC) with an enormous 9.7% dividend yield. And in our view, Triangle remains a very attractive opportunity for income investors. In fact, we continue to own it in our Blue Harbinger Income Equity portfolio (we purchased it in May 2016 two days after the dividend cut). Specifically, we like Triangle because of its conservative management team, it is an often overlooked opportunity, it is well-diversified, its valuation remains attractive, and because its big dividend is very rare and very attractive. Additionally, its price has come down slightly since we did our last full write-up (read the write-up here), and we believe it currently presents a compelling opportunity for income-focused investors.

4. Tekla World Healthcare Fund (THW), Yield: 9.8%

If you like big yield and significant price appreciation potential, then this particular closed-end fund (CEF) is worth considering. It’s a sector-specific CEF (healthcare) that yields nearly 9.8% (paid monthly). And not only is the sector an attractive contrarian play for multiple reasons right now, the fund is trading at a large 6.9% discount to its NAV which suggests it may have even more upside rebound potential. We did a full write-up on THW back in January, and it has delivered some gains since that time, but it’s still on sale and has significantly more upside potential ahead, in our view.

For reference, you can access some of the latest data from Morningstar on this fund here.

And you can read our full write-up on THW here.

Mortgage REITs – They’re very different than equity REITs!

Compared to equity REITs (which we covered earlier), Mortgage REITs are an almost entirely different beast altogether. Mortgage REITs invest in residential and commercial mortgages, as well as mortgage backed securities. However, like equity REITs, mortgage REITs also generally avoid paying US federal income taxes if they pay out at least 90% of their taxable income to shareholders as dividends. Below, we have listed an example of a mortgage REIT that we believe is worth considering if you are an income-focused investor.

3. New Residential (NRZ), Yield: 11.2%

Arguably not an mREIT, we’re still putting NRZ it this category because it does invest in mortgage backed securities, it’s often lumped in (and trades like) other mREITs, and the company often refers to itself as an mREIT (even though less than 50% of its investments are actually in mortgage backed securities).

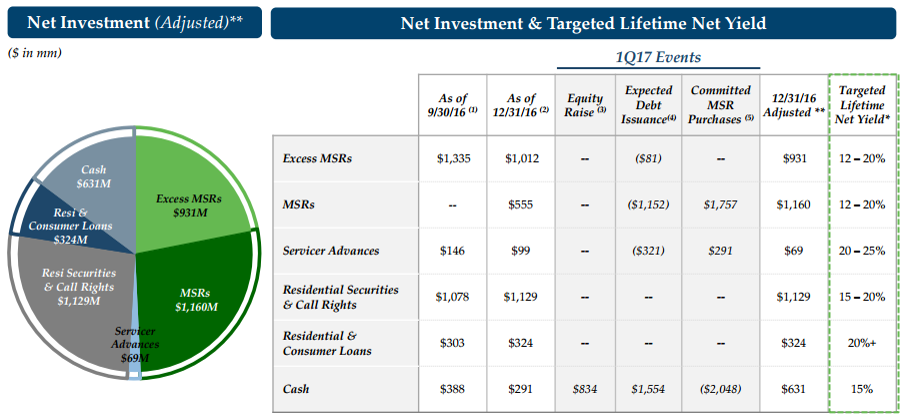

The reason we like NRZ is because of its investments in Mortgage Servicing Rights. “MSRs” provide a mortgage servicer with the right to service a pool of mortgage loans in exchange for a fee. And as shown in the following graphic, MSRs make up a large portion on NRZ’s business, and they have the ability to continue delivering big returns (12-20%) despite our current rising interest rate environment.

The value of MSRs are negatively impacted by decreasing interest rates because that causes mortgage prepayment speeds to increase (people refinance when rates decline). However, our current rising interest rate environment is a good thing for NRZ because fewer people will refinance, and NRZ will keep collecting the fees from servicing those mortgages. Unless we hit another housing crisis where folks start defaulting on their mortgages altogether, NRZ MSRs will likely keep providing big returns so NRZ can keep supporting its big dividend payments.

And worth noting, NRZ continues to have high yield expectations for its other non-MSR investment too (as shown in the earlier table). Also, NRZ’s current dividend coverage ratio is a healthy 116% (2016 core earnings were $2.14/share versus a dividend of $1.84/share).

From an NRZ risk perspective, the bank de-risking conditions that followed the financial crisis and led to the lucrative creation of the separate MSR business are in the rear view mirror now, but that doesn’t mean NRZ won’t keep earning big yields on its existing MSRs, it just may not be able to grow the business as rapidly as it did in the years right after the financial crisis. Also, investors should keep NRZ management and ownership on their radar. Specifically, Softbank recently purchased Fortress (FIG), and NRZ is externally managed by an affiliate of Fortress. The purchase is expected result in zero immediate changes to NRZ’s business, but that doesn’t mean there won’t be impacts down the road. And finally, we own shares of NRZ (we purchased them in May of 2016).

2. Royce Value Trust (RVT) and Royce Micro-Cap Trust (RMT), Yields: 7.4% and 7.7%

We view these two small cap Closed End Funds (CEFs) as a pair because we bought them both at the same time (in January of this year) to give us exposure to small and micro-cap stocks, and to deliver big income payments. We also really like the management teams, the discounted prices (versus NAV, currently over 12% discount for both as of 4/10/17), the low fees, and the current holdings.

For reference, you can access some of the latest data from Morningstar on these funds here and here.

And you can view our full write-ups on these two funds here and here.

1. Adams Diversified Equity Fund (ADX), Yield 7.6%

This particular closed-end fund (CEF) offers an attractive 7.6% yield, an amazing track record of top-notch management, and currently trades at an exceptionally attractive discount (it trades at a 15.7% discount as of 4/10/17) to its net asset value (NAV). We are also very comfortable with its holdings, particularly its sector exposures, and believe it’s poised to deliver very strong future returns.

The Adams Diversified Equity Fund (ADX) is an internally managed, closed-end fund that is focused on generating long-term capital appreciation and committed to paying at least 6% in annual distributions (paid quarterly). It also provides exposure to a diversified portfolio of large cap equities, and pays close attention to risk management. Oh, and its successful, long-term, track record dates back to 1929!

For reference, you can access some of the latest data from Morningstar on this fund here.

And you can read our full write-up on the Adams Diversified Equity Fund here.