Market fear spiked on Friday (the VIX was up 28.5%), and the Dow Jones experienced its biggest weekly decline in over 2 years (-4.1%). Interestingly, many higher yielding stocks also sold off significantly, and this article highlights ten that we believe are attractive and worth considering, especially following the selloff.

For starters, here is an interesting graphic from the Wall Street Journal that provides a variety of metrics that help put the decline in perspective.

One narrative is that the January jobs report (released Friday) revealed the strongest year-over-year wage growth (+2.9%) since June 2009, thereby stoking fears that inflation is coming and the fed will be forced to raise rates quicker than previously anticipated.

And not inconsistently, the CME FedWatch tool showed a similar expectation change, as shown in the following graphic (i.e. the implied probability of a rate hike at the next Fed meeting increased).

However, despite inflation fears (and the increasingly hawkish fed that could result), the economy remains strong, earnings expectations have recently risen significantly following changes to the US tax code, and per Briefing.com, earnings have largely been beating expectations this earnings season.

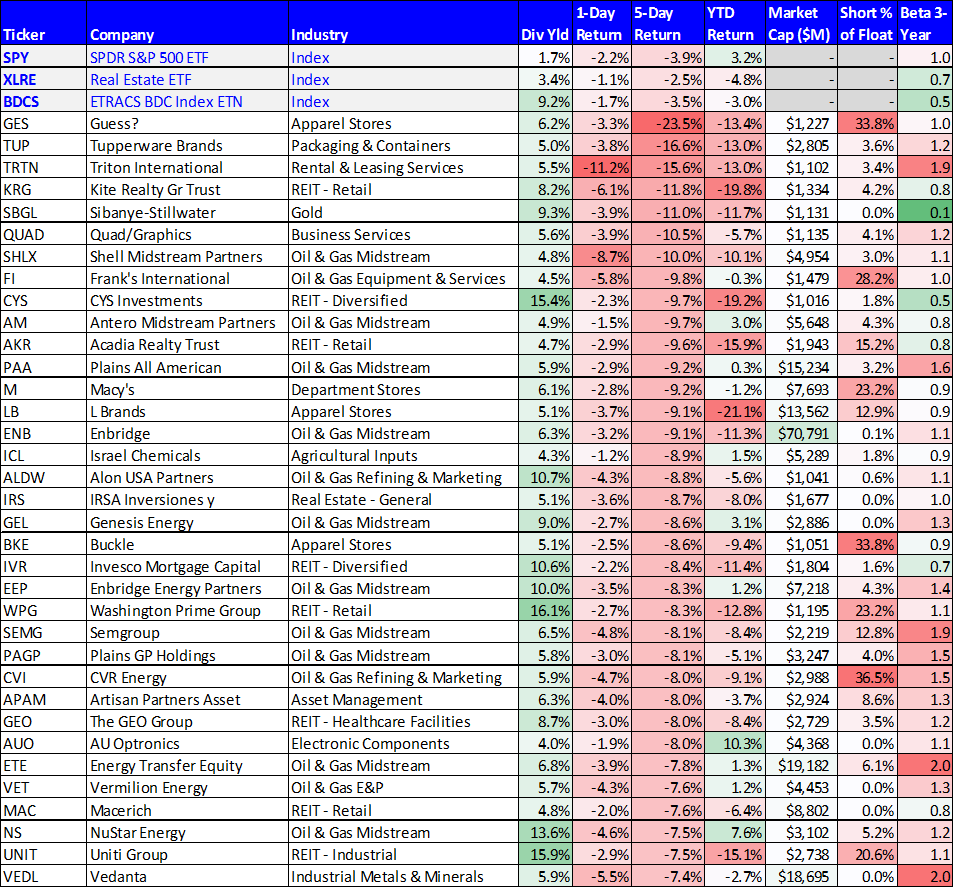

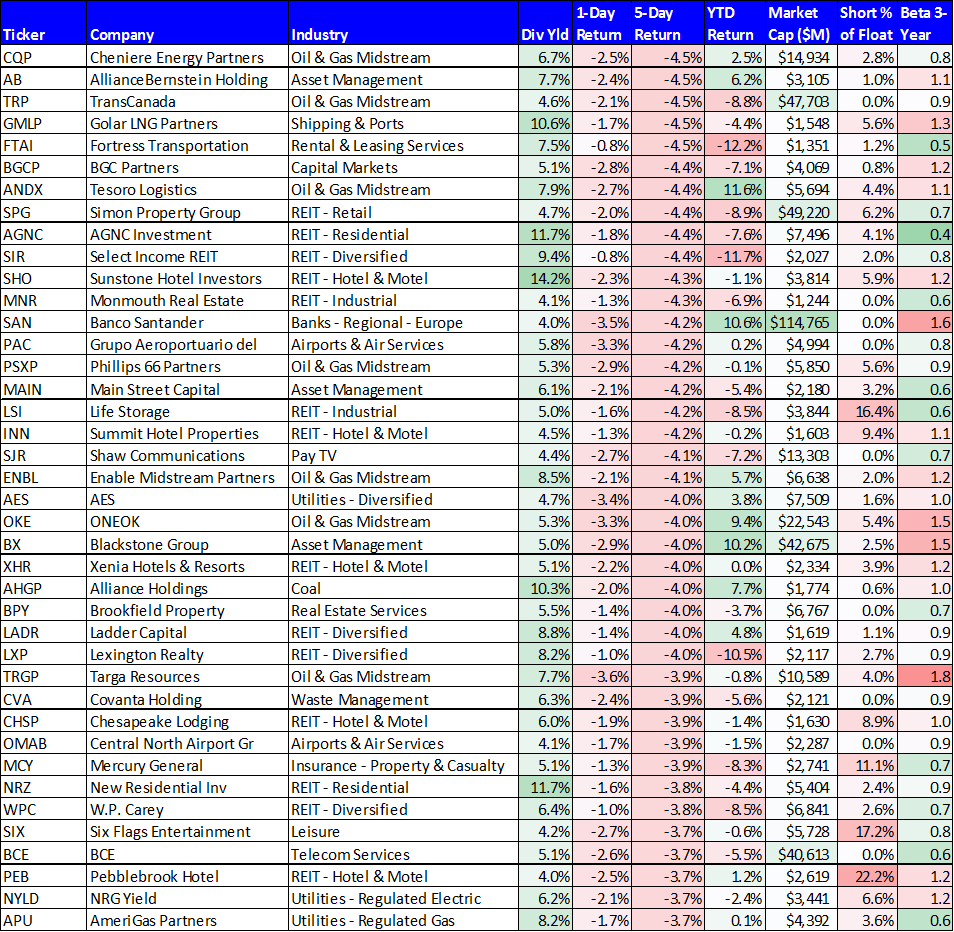

And no matter which side of the stock market fence you are on (the bull side or the bear side), here is a list of 100 equities that yield at least 4% and also sold off significantly last week (we required at least a $1 billion market cap to be included on this list).

In our view, this list is interesting, especially the way many of the traditionally low-beta stocks sold off more than the market, perhaps as a result of their perceived negative sensitivity to rising interest rates, which in our view is an over-reaction in some cases.

Without Further ado, here are the specific high-income equities on this list that we believe are attractive and worth considering.

10. Triton International (TRTN), Yield: 5.5%

Triton leases and sells intermodal shipping containers, the ubiquitous steel boxes that trade depends upon.

And shipping is an industry which benefits from the improving world economy and trade. Correspondingly, Triton is a high beta stock (beta = 1.9, per our earlier table), and thereby Triton “booms” when the economy is booming, and can also sell off when the market sells off. Triton was down 11.2% on Friday, and down 15.6% last week.

However, Triton is a business that has a lot of good things going for it, especially if you believe the economy will remain strong. For example, Triton benefits from economies of scale and financial strength (especially as the shipping industry recovers), as well as high fleet utilization and longer-term leases. We wrote about the attractiveness of Triton back in October in this article:

http://www.blueharbinger.com/members-weekly-dashboard/DayofWeek/2017/10/12/big-dividend-market-leader-improving-riskreward-profile?rq=trtn

And we concluded that article by recommending you “put Triton on your watch list, and then add the shares in the future if/when there is a share price pullback (i.e. wait for a dip buying opportunity).” And considering that dip has arrived, now is a good time to consider purchasing shares of Triton.

9. Realty Income (O), Yield: 5.1%

Realty Income is organized as a REIT, and it pays big steady monthly dividend payments. The share price has declined significantly in the last year, and particularly over the last week.

If you don’t know, Realty Income purchases commercial real estate leased to tenants under long-term net lease agreements, generally 10-20 years. The lease payments generated each month are used to support the predictable monthly dividend payments (currently 5.1% yield) to shareholders.

We wrote about the risks of Realty Income in 2016 here, and the price has come down significantly since those articles. However, we recently wrote about the increasing attractiveness of Realty Income in this members-only article:

Our basic thesis on Realty Income is that despite its recent poor performance, the company remains a financial powerhouse, with an attractive valuation (it’s trading at a compelling price), a big safe dividend yield (+5.1%), and like other REITs—we expect Realty Income’s price to eventually come soaring back. The company is expected to announce earnings on February 22nd.

8. Macerich (MAC), Yield: 4.8%

Despite the ongoing narrative that online retailers (e.g. Amazon) are going to put all brick and mortar stores out of business, Macerich is attractive retail REIT (they own the real estate from which brick and mortar stores operate), and the shares are worth considering. We like Macerich because it owns A-class properties (i.e. high rent and high sales per square foot). In our view, the B-class retail properties are in trouble (because there is too much supply and not enough demand), but many of the A-class properties are healthy and undervalued. Plus they offer big safe dividends. You can read about our views on Macerich (and retail REITs, in general) in this article:

Macerich has sold off sharply in the last week (see chart above), and we believe this makes for a more attractive entry point for long-term income-focused investors.

7. Main Street Capital (MAIN), Yield: 6.1%

Main Street Capital is a publicly traded business development company (“BDC”) that provides capital to private middle market companies. Main’s objective is to maximize total returns by generating current income from its debt investments, as well as capital appreciation, dividend income and realized gains from its equity investments. Among BDCs, Main’s investment portfolio offers one of the most attractive risk versus reward profiles considering its high quality assets, high returns, and low cost structure. Another positive characteristic is MAIN’s internal management and significant inside ownership. Also extremely attractive, MAIN continues to generate more distributable net investment income than it pays out in dividends, as shown in the following chart.

We wrote about MAIN back in late April of 2017, claiming it was overvalued back then, in this article:

However, the share price has since declined by 6.5% since then while its NAV and distributable income have both increased significantly. Because of MAIN’s attractiveness, it consistently trades at a premium, as shown in this next chart.

However, the above chart is now two weeks old, as MAIN’s price has sold off further, thereby making the shares even more attractive from a valuation standpoint.

6. AmeriGas Partners (APU), Yield: 8.2%

AmeriGas is the largest propane distributor across the US, with operations in all 50 states. It's organized as an MLP and it offers a big growing distribution yield, currently 8.2%.

Propane sales are sensitive to the weather (cold weather is good for sales), and we’ve had some cold temperatures this winter, which is good for AmeriGas. However, worth noting, despite the warmer than normal winters we’ve experienced in recent previous years, AmeriGas has continued to increase its distributions to unitholders.

We wrote in detail about AmeriGas at the end of December in this article.

And the recent pullback over the last week makes for a more attractive entry point, in our view. The company announced earnings on January 31st whereby they beat revenue estimates significantly, but that doesn’t yet include the main impacts (benefits) of this year’s colder winter. We continue to own shares of APU.

5. Uniti Group (UNIT), Yield: 15.9%

Uniti Group is basically a telecom REIT that pays a huge dividend. Your first thought may be that the telecom industry is ugly, and your second thought may be that anything that pays a dividend this high cannot be safe. It’s true this is a higher risk investment opportunity, but there are reasons to believe Uniti may have some very significant upside price appreciation ahead.

For starters, Uniti was created in 2015 when telecom company Windstream (WIN) spun off certain assets with the goal of unlocking value that it believed the market was not giving it enough credit for. Since that time, Uniti has been working hard to grow business that is not dependent on Windstream, and the company now depends on Windstream for only 70% of its revenues. Nonetheless, as Windstream has continued to struggle (like many telecom companies), Uniti has sold off too. We’ve written about Uniti il detail several times over the last 6 months, and you can check out a couple of those articles here:

The bottom line however is that Uniti’s assets have value, and the shares are attractively priced after the recent selloff. We don’t currently own shares of Uniti, but we may take a bullish position in the future. Uniti’s next earnings announcement is March 1st (Windstream’s is February 22nd).

4. Stag Industrial (STAG), Yield: 5.8%

STAG Industrial is a real estate investment trust (“REIT”) focused on the acquisition and operation of single-tenant, industrial properties throughout the United States. It also offers a big, relatively well-covered (83.9% AFFO payout ratio) dividend that is paid monthly.

Stag’s shares have recently sold off, and we believe this has created an attractive entry point for buyers. We’ve recently written about the positive characteristics (and risk factors) of Stag, in detail, in this article:

We concluded that article by recommending to readers that they

“understand how STAG's price will likely react under different market conditions. For example, when the market pulls back, the company tends to pull back more (this can create an attractive opportunity to add shares, so long as you believe the pullback isn't the first leg into a larger market-wide recession).”

We believe the recent market pullback is NOT the start of a larger market pullback or recession, and now is a more attractive time to purchase shares of this attractive monthly dividend payer.

3. New Residential (NRZ), Yield: 11.7%

New Residential is a mortgage REIT focused on investing in, and managing, investments related to residential real estate. We’ve had great success owning NRZ over the last two years (we continue to own shares), and we believe the recent selloff has created an attractive entry point for investors.

We’ve recently written about New Residential, in detail, here:

- New Residential: Time To Sell This 10.9% Dividend?

- New Residential: Despite Big Risks, 12.5% Yield Is Attractive

But the bottom line is that NRZ’s dividend is well-covered, and its business continues to have growth opportunities thanks to management’s constant smart decisions to evolve with the evolving industry.

2. Williams Partners (WPZ), Yield: 6.0%

This natural gas infrastructure company continues to benefit from lucrative long-term low-risk relationships with natural gas companies, as well as support from Williams Companies (WMB). However, WPZ recently sold off inappropriately and uncharacteristically as the overall market sold off and as the energy price rally has taken a breather so far this month. This double whammy drove the share price lower (temporarily, in our view), thereby creating an attractive entry point for investors.

Credit Suisse recently reinstated its outperform rating on WPZ with a $48 price target (it currently trades at $40.17). WPZ is expected to announce earnings on February 15th.

If you’re looking for a steady high yield, WPZ is worth considering. We own it in our Blue Harbinger Income Equity portfolio.

1. WP Carey REIT (WPC), Yield: 6.4%

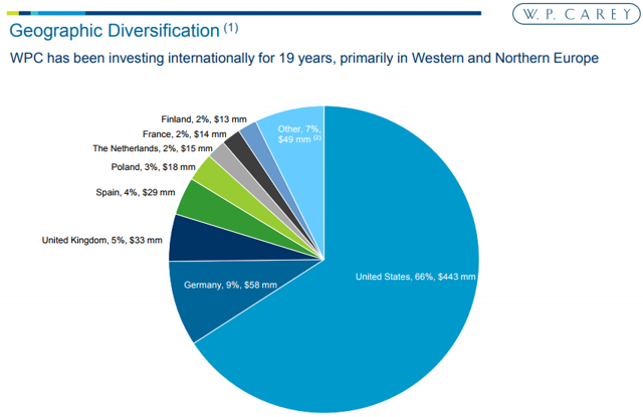

This in another attractive REIT that we own. However, unlike NRZ (a mortgage REIT), WP Carey is a property REIT with investments diversified across industrial, office and retail, to name a few.

WPC’s shares had been very strong (especially for a REIT) in 2017, they were due for a pullback, and the recent pullback in recent days (and weeks) has been healthy thereby creating a more attractive entry point, in our view.

We believe WP Carey has room to run considering its improved business strategy and the recent price performance and valuation.

In much of 2017, performance was helped by the weak US dollar considering WPC has significant operations in Europe. Further, we like WPC’s decision to exit its non-traded retail business which was a distraction and arguably a conflict of interest. This clears the path for the company to focus more fully on shareholders. For reference, here is a look WPC’s geographic diversification.

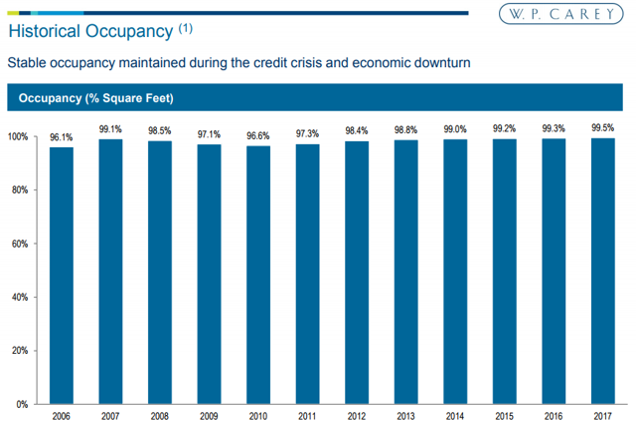

And very impressively, here is a look at the historical occupancy.

During its most recent quarterly earnings call, management lifted 2017 AFFO guidance to $5.25 to $5.35 (up from $5.10 to $5.30) per diluted share, which means it currently trades at only 11.9 times, down from an already attractive 13.45 times just four months ago. This is an attractively low price to AFFO ratio, in our view (and compared to peers). Also, as a result of financial health, WP Carey announced yet another dividend increase in December.

Overall, we believe WPC is an attractive big dividend REIT, the recent share price pullback has made it even more attractive, and we continue to own it in our Blue Harbinger Concentrated Value & Income (“CVI”) portfolio.

Conclusion:

Interest rate expectations impact different companies differently, but individual company valuations and future outlooks are always critical. Considering our currently strengthening economic conditions (in both the US and abroad), we don't believe last week's market declines are the first leg of a larger recession. We cannot predict daily market noise, but we'd always rather buy at a more attractive valuation than at a less attractive valuation. We believe this article highlights multiple attractive high-yield opportunities, especially after last week's market wide selling pressure.

You can view all of our current holdings here.