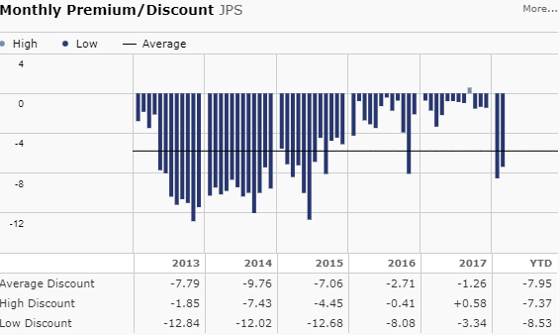

Preferred stocks can be attractive to investors because they offer higher yields and lower volatility than common stocks. They can also be attractive to the companies that issue them because they offer more flexibility than bonds in terms of payment requirements. Currently, preferred stocks have sold-off (as shown in the following chart) largely due to continued expectations for increasing interest rates, especially from new Fed Chair, Jerome Powell.

However, some preferred stocks are less sensitive to interest rates than others depending on company specific situations.

For your consideration, here is a ranking of some attractive preferred stocks that we believe are worth considering...

Public Storage, Series F (PSA-F), Yield: 5.3%

We believe Public Storage common stock is undervalued, and this gives us increased confidence in the safety of Public Storage preferred shares, which happened to be trading at a discounted price and offering a higher dividend yield of 5.3% (versus only 4.0% for the common shares).

Before getting into the fundamentals of the company, there are a few things you should know about the preferred shares. For starters, they are cumulative preferred shares, which means the company is “on the hook” for making up any missed dividend payments, if there are ever any missed dividend payments. However, because preferred shares are higher than common shares in the capital structure, PSA would eliminate the dividend on the common shares just to free up cash to pay the preferreds if they ever needed the cash. However regardless, it gives us comfort that PSA has plenty of extra cash right now, as evidenced by the dividend on the common shares (and because debt is a very low percentage of the companies total assets).

The next thing you should know about PSA-F is the shares become redeemable by the company starting on 6/2/22 and at $25. This eliminates the chances that the company redeems the shares away from you before then, so it provides more confidence that you’ll keep receiving those big income payments at least through 6/2/22.

One downside is that dividends issued by REITs (such as PSA) are not eligible for the reduced dividend tax rate, so it basically puts the income on par with income receive from a fixed income security like a bond. Not the worst thing in the world, just something to keep in mind (we have examples of preferred stocks that offer lower tax rates, later in this report).

From a fundamentals standpoint, a few things we like about Public Storage is that it is the largest self-storage facilities company, and the demand for self-storage in increasing, especially in markets where supply is limited, such as Los Angeles and San Francisco. Plus as baby boobers continue to downsize, this helps keep demand high. Importantly, PSA's revenues and net income both continue to rise, and profit margins are very high.

Finally, the shares trade at a discount to their $25 redemption value, which is what has driven the current yield higher than the stated yield of 5.15%. If you’re looking for a stable source of income, these shares are worth considering.

Digital Realty, Series J Preferred (DLR-J), Yield: 5.5%

Digital Realty is a data center REIT that we have written about it (and used to generate income via options) multiple times, and it also offers preferred shares if you’re looking for a safe 5.5% yield. The company’s common share price has been down in recent months as investors question the rate of future growth for data centers, but the company has still raised the dividend on the common shares just a few weeks ago (an indication of health).

The dividend yield on the common shares isn’t horrible (it’s currently around 3.9%), but the preferred shares offer a higher yield (5.5%) that may be more attractive to some income focused investors because it comes with a lot less volatility. As a reminder, we like the common shares outright (as we wrote about here: Digital Realty: Despite Fearmongers, Dividend And Price Will Rise). However, depending on your personal preference, you may want to consider the preferred shares due to their higher dividend yield and lower volatility.

Nuveen Preferred & Income Securities Fund (JPS), Yield: 7.8%

(High-Yield, Double Discounted Price, and Monthly Income Payments)

JPS is a closed-end fund, and it invests at least 80% of its net assets in preferred securities. Its primary objective is to provide high current income, and It currently offers a 7.8% yield. It also trades at an unusually large 6.2% discount to its net asset value.

And as we mentioned earlier, preferred securities in general have sold off moderately lately thereby making this fund particularly inexpensive at the moment (from both an NAV and technical standpoint).

This fund has a variety of additional attractive qualities. For example, JPS makes monthly distribution payments to its investors (and historically those distributions have consisted of 100% income, 0% capital gains distributed, 0% return of capital). Also attractive, like many closed-end funds, JPS has access to borrowed money at low institutional rates (the leverage ratio is currently 33.3%). Using leverage is common among closed-end funds, and it can prudently help keep income attractive. Further, this fund’s management fee is very low for a closed-end fund at only 0.77%.

If you are looking for a steady source of income, this fund offers an attractive 7.8% yield (paid monthly), and it also trades at a double discount (one from the fund’s discount to NAV, and two because preferreds have sold off, and sit at a more attractive price). If you’re looking for a discounted source for high income, this fund is worth considering.

Medical Billing Transcriptions Corp, Perpetual Preferred (MTBCP), Yield: 10.6%

Medical Transcriptions Billing Corp. is an IT company that serves the healthcare industry, particularly small and mid-sized private practices. And the 10.6% yield on its preferred shares are attractive, especially considering it's paid monthly, and the shares trade at only a slight premium to the $25 face value.

MTBC announced solid earnings on March 7th (revenues were in line, and they beat earnings expectations by $0.14 per share). And this is continuing a positive trend for a company that has recently gotten its debt under control, and continues to turn the corner as revenues and EBITDA continue to rise.

We wrote about this company is detail in January (see: Preferred Yields 10.9% (Paid Monthly), Growing Revenue, Shrinking Debt), and if you are an income-focused investor, MTBCP is worth considering for the higher-risk portion of your prudently diversified investment portfolio.

Tsakos Energy Navigation, Series D Preferred Shares, Yield: 8.8%

Tsakos Energy Navigation is a provider of international seaborn crude oil and petroleum product transportation services. Business continues to get better for Tsakos following the industry wide challenges in recent years, and we believe investors are incorrectly interpreting and extrapolating poor past performance. Before getting into the details of the business, let’s consider the yield of Tsakos stock.

Tsakos common shares currently offer an attractive 5.9% dividend yield, and it has multiple series of high-yield preferred shares offering current yields ranging from 8.0% to 9.2%.

We’re highlighting the Series D shares in this article (because they trade at under $25), but there are important differences between the preferred shares that investors should be aware of. For starters, they offer different yields (obviously) and they become redeemable (by Tsakos) at different dates, as shown in the above table.

One of the most commonly overlooked characteristics of these preferred shares is that series B and C shares include a “Failure to Redeem” clause whereby the B shares would breach the conditions of the clause if not redeemed (by Tsakos) by 7/30/19, and the C shares would breach if not redeemed by 10/30/20. Arguably, this makes the B and C series shares “safer” considering the company has a higher incentive to pay them off by the aforementioned dates. And the D and E series offer higher current yields because they don’t contain the same clauses and they don’t become redeemable until later dates. We believe all of the shares are increasingly compelling for income-focused investors, for a variety of reasons, including macroeconomic and company-specifics.

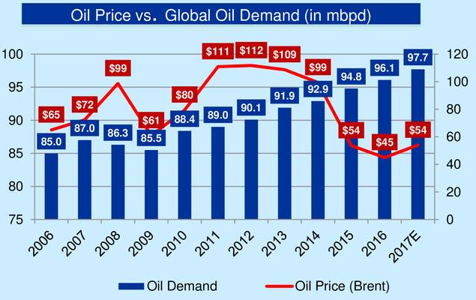

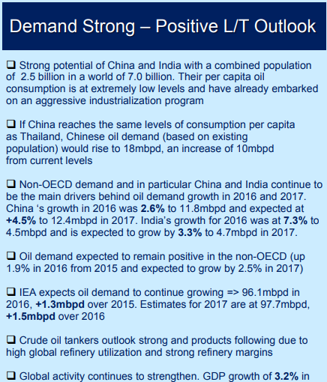

For starters, from a macroeconomic standpoint, low oil prices, and supply and demand disruptions (in both energy markets and the shipping industry) have wreaked havoc across the shipping industry with multiple companies dramatically cutting their dividends (e.g Nordic American Tanker) and some shippers filing for bankruptcy altogether, such as Hanjin (despite differing cargos, shipping company prices can trade with a high degree of correlation). However, the cycle may be about to turn upwards considering worldwide oil demand continues to grow, and supply/demand challenges have thinned the herd, with many of those remaining (such as Tsakos) now more operationally efficient (according to management: “we are proud that our G&A expenses must be one of the lowest in our peer group just starting a $1,000 or a little bit above for everything that has to do with running TEN). For perspective, here is a look at the continuing strength in global oil demand.

For more perspective, here is a look at some of the positive demand considerations from Tsakos investor presentation.

These positive conditions are positioning Tsakos to benefit from the next upturn in the market cycle, which is expected to begin soon. However, despite the improving outlook, the market continues to extrapolate Tsakos’ previous bad performance into the future.

Tsakos’s Recent Performance Looks Worse Than It Really Is:

We believe there are three reasons why Tsakos future prospects are better than they look. First, even though Tsakos missed expectations by two cents when it announced earnings at the end of November (note, it announces again before the market opens on 3/12), it did beat on revenues (a good thing). It missed earnings because they included $2.5 million of special survey costs that would normally have been incurred at a later stage and have been spread over a longer period (according to management: “we took advantage of the very weak market of the third quarter to bring forward three of our surveys.”). But on a go-forward basis, it’s good they’ve gotten this out of the way. Also earnings suffered from refinery outages, and high inventories and OPEC cuts. These negative events are exceptions, not the norm (Tsakos will benefit from not having them every quarter).

Secondly, Tsakos just completed a large capital expenditure cycle that positions it for more growth and higher free cash flow in the future. Per the following graphic, the newbuilding vessels are expected to increase revenues by 30%.

With this newbuilding capex largely behind them, a large amount of free cash flow will be generated from increased revenues and simply from not spending so much on capex. This will be helpful to the dividend (more on this later).

Thirdly, many investors are ignoring the expected turn upward in the market cycle (as described in the previous section) and instead they’re incorrectly extrapolating recent weak performance into the future.

Tsakos Overall:

Tsakos has performed poorly because of market-cycle and company-specific challenges. However, we believe investors are incorrectly interpreting and extrapolating poor past performance, and there are multiple reasons to believe Tsakos will experience significant gains in the future, such as its improved operational efficiency, the completion of a large capex spend (which will increase future free cash flow), and indications the company is about to benefit from an upturn in the market cycle. If you are an income-focused investor, we believe Tsakos common and preferred shares are worth considering (note: Tsakos is expected to release earning on Monday, March 12th before the market opens).

Seaspan Cumulative Preferred (SSW-G), Yield: 8.6%

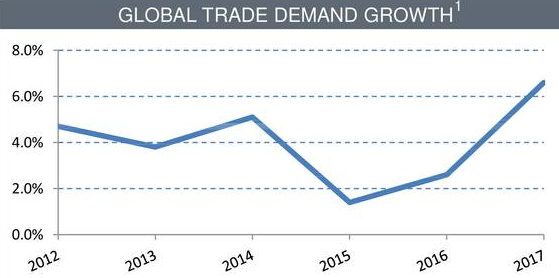

Seaspan is an independent charter owner and manager of containerships (it operates a fleet of 88 containerships and has entered into contracts for the purchase of an additional eight new building containerships). Like the shipping industry in general, Seaspan has faced challenges in recent years. However, the company has taken several important steps to further improve its financial strength and enhance its capital structure. Specifically the company has significantly reduced leverage and accessed new capital and secured financing for of its new built vessels. The company believes it is now in an strong position to take advantage of growth and opportunities that are emerging in the market. For example, global trade demand is picking up after declining sharply in the second half of 2014, as shown in the following chart.

As another indication of Seaspan’s future prospects, Seaspan recently entered an agreement (in January) where Prem Watsa's Fairfax Financial which will invest $250M in the company in exchange for 5.5% interest-bearing debentures and class A share purchase warrants. That $250M will be used for "future growth initiatives, debt repayment and for general corporate purposes." This is a very good sign that Seaspan’s future prospects are improving, and now they have the financial support to take advantage of the opportunities.

One of the things we like about these preferred shares (besided the company’s improved financial strength) is that Seaspan still pays a significant dividend on its commons shares (they yield 8.7%). This means if Seaspan does face more financial challenges, they have the cushion of being able to eliminate the common dividend to support the preferred dividends (preferreds are higher than common in the capital structure). Also important, the preferred shares are eligible for the preferential lower income tax rate, which is nice at tax time.

Overall, if you’re looking for higher income, and lower volatility, from a company whose business is improving, these Seaspan preferred shares are worth considering.

4. Rexford Industrial Realty, Series A (REXR-A), Yield: 6.5%

Rexford is an industrial REIT, owning and operating properties in Southern California, and it continues to deliver strong results. The company recently announced continued growth in Core FFO ($0.26 per diluted share), growth in NOI, and stable occupancy at 98.1%. It also announced an increase to it’s common stock dividend, which now yields 2.25%. If the 2.25% common share dividend yield is not attractive to you, you might want to consider the Series A preferred shares which offer a 6.5% yields and trade below the $25 redemption value (the shares become redeemable by Rexford starting in August of 2021.

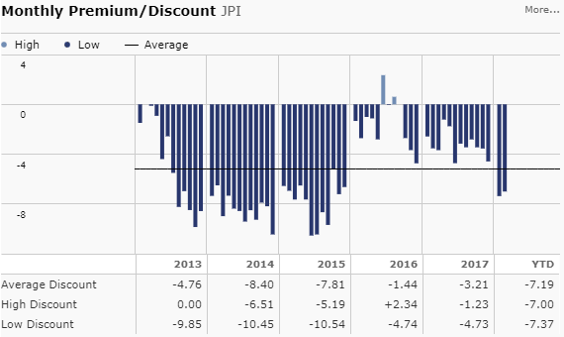

Nuveen Preferred and Income Fund (JPI), Yield: 7.1%

This closed-end fund seeks a high level of current income and total return through investing at least 80% of its assets in preferred securities (and other income producing securities issued by US and non US companies). We like this CEF for six main reasons.

First, this fund is trading at a larger than normal discount to it’s net asset value (-6.28% discount). This is an attractive CEF quality because it allows investors to pick up shares at a discounted price, thereby earning a higher yield than they could on the open market.

In addition to the discount to NAV, we also like this fund because preferred stocks in generally have recently sold-off thereby making now a more attractive entry point, in our view.

Further, we also like this fund because it charges a very low fee for a CEF (0.67%), it consists of diversified actively managed holdings, and it is able to borrow at low institutional leverage rates (lower rates than you or I could get in the open market). Lastly, we like this fund because its distribution payments to investors have historically come from investment income, not capital gains or a return of capital (these are important for tax purposes). If you are looking for high-income, diversification, and lower volatility, this CEF is worth considering.

Teekay Offshore Partners Preferred Shares (TOO-B), Yield: 9.0%

International shipping company, Teekay Offshore, 8.5% Series B Preferred Stock (TOO-B) is attractive. These shares offer a coupon payment of 8.5% and they currently offer a 9% yield because they are trading at a discounted price of $23.60. The shares are redeemable by Teekay starting on 4/20/2020 at $25 per share (see all the details here). This means we are locking in a roughly 11.5% total return in each of the next two years if Teekay redeems the shares (which seems increasingly likely given the high yield, and Teekay’s improved and improving financial position, combined with the fact that the company is likely about to redeem and replace the high yielding Series A shares (TOO-A) (which become redeemable on 4/30/2018) using the proceeds they just raised by issuing the new (arguably less desirable) floating rate Series E preferred shares (TOO-E)).

You can read our write-up/thesis for TOO-B here:

Conclusion:

Overall, Preferred stocks offer a variety of attractive qualities for both investors and the companies that issue them. If you are an income-focused investor looking to add high-yield and lower volatility to your investment portfolio, the 10 ideas highlighted in this article are worth considering.