If you are looking for a high-yield preferred stock that just sold-off inappropriately (i.e. a baby that’s been thrown out with the bathwater), and one that also offers protection again the risks of rising interest rates, you might want to consider these fixed-to-floating preferred shares, currently yielding 9.8% and having just sold-off following the FERC’s MLP ruling on Thursday.

NuStar Energy Fixed-to-Floating Preferred (NS-C): Yield: 9.8%

NuStar Energy (NS) is a master limited partnership (“MLP”) based in San Antonio, Texas. NuStar has more than 9,300 miles of pipeline and 81 terminal and storage facilities that store and distribute crude oil, refined products and specialty liquids. The partnership’s combined system has more than 96 million barrels of storage capacity at its facilities around the world, and NuStar has operations in the United States, Canada, Mexico, the Netherlands, including St. Eustatius in the Caribbean, and the United Kingdom.

Two Good Reasons the Shares have Sold-Off:

Both the ordinary and the series C preferred units of NuStar have sold-off significantly recently for two main reasons.

First of all, the price sold-off in early February because management announced they’d be reducing the big quarterly distribution on the common units from $1.10 to $0.60. NuStar describes the reduction as a “reset” which will reduce the annual distribution outflow by $200 million per year. And this is actually a good thing for the preferred units because it frees up more cash to support these cumulative preferred payments, and because there is still plenty of cushion left from the common units (i.e. the common unit still pay a significant dividend that can be cut in the future to support the preferred unit distributions, if need be, because preferreds are higher in the capital structure than common units).

The second reason the price has sold-off is because of a Federal Energy Regulatory Commission (“FERC”) announcement on Thursday that was misinterpreted by the market, in our view, and in the view of many Wall Street analysts as well. For example, this article explains, according to Wells Fargo:

“The broad-based selling Thursday was overdone.”

And according to Cowen:

“Any selloff related to FERC’s ruling [is] a buying opportunity.”

And according to Evercore:

“It’s likely to hurt MLPs with large amounts of “cost of service” exposure and particularly those with large amounts of interstate natural gas pipelines… the sector selloff is likely overstated.”

Keep in mind, NuStar does have interstate assets, but most assets are oil and refined products, not natural gas.

For reference, here is a look at Thursday's performance of NuStar common units compared to the Alerian MLP index:

Also for your reference, here is a link to the FERC press release that caused the sell-off. However, keep in mind, the FERC’s mandate is not only to protect consumers, but also to provide an opportunity for regulated entities to recover their costs and earn a reasonable return. Here are a couple relevant quotes from the FERC's strategic plan:

"Using traditional ratemaking authority, FERC will encourage efficient operations of public utilities and interstate natural gas and oil pipelines, while also ensuring that regulated entities have the opportunity to receive a reasonable return on their investments in infrastructure."

"FERC determines the appropriate approach balancing two important interests: protecting consumers against excessive rates, and providing an opportunity for regulated entities to recover their costs and earn a reasonable return on their investments."

The FERC is NOT in the businesses of destroying MLPs, and Thursday's MLP sell-off was a significant overreaction, in our view.

Why NuStar’s Business is Attractive:

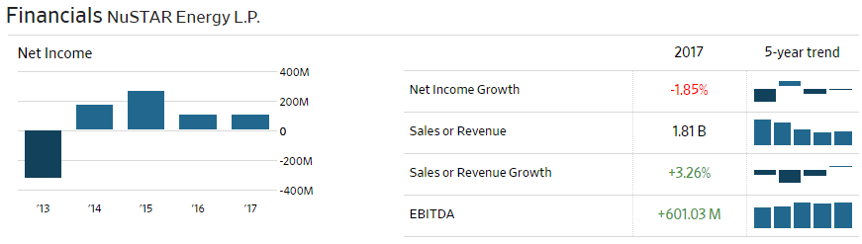

To cut right to the chase, NuStar’s business has been challenged like the rest of the industry in recent years following the big decline in oil prices that began in the second half of 2014. However, unlike many peers (and already bankrupted peers), NuStar is profitable. For example, here is a look at NuStar’s net income in recent years, as well as its sales growth and EBITDA.

Importantly, those are the recommendation for the common units, and the preferreds are higher in the capital structure.

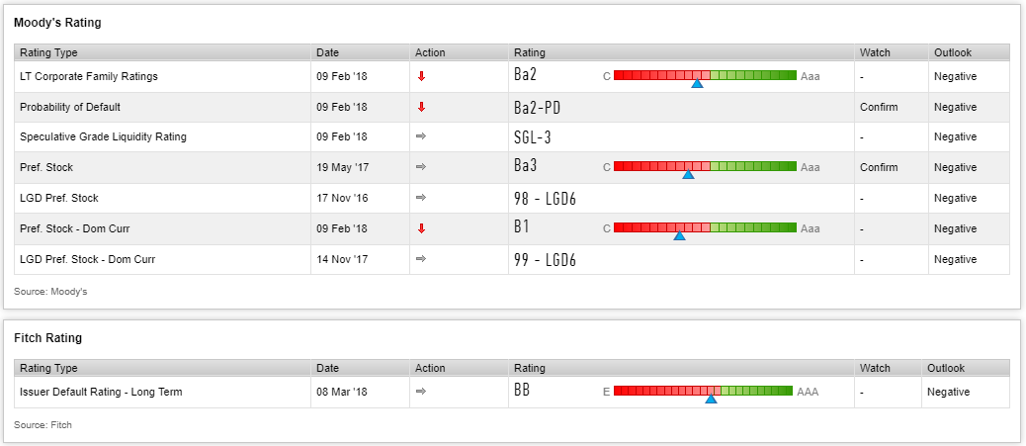

Also, NuStar’s credit ratings sit just below investment grade, which is normal for the industry, as shown in the following charts.

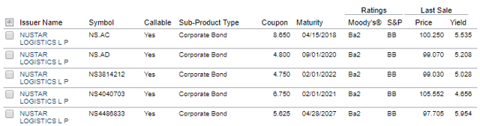

And for example, here...

Also worth noting, short interest on the common units is only 3.99% according to The Wall Street Journal, which is far lower than many of its peers.

And finally, as we mentioned previously, the distribution reduction announced earlier this year is actually a good thing for debt and preferred equity (because they're higher in the capital structure than common units) because it frees up more cash.

Why We Like The Preferreds, In Particular:

We like the series C preferreds because they are currently on sale (they sold-off inappropriately yesterday, as described above) and also because they have some protection against rising interest rates (i.e. they have less interest rate risk than “non-floating” future rate preferreds).

For starters, here is a look at the performance of the Series C preferreds this year.

For reference, here is a description of important information about these preferreds from quantumonline:

"NuStar Energy L.P., 9.00% Series C Fixed-to-Floating Rate CumulativeRedeemable Perpetual Preferred Units, liquidation preference $25 per unit, redeemable at the issuer's option on or after 12/15/2022 at $25 per unit plus accrued and unpaid dividends, and with no stated maturity. Cumulative distributions of 9.00% per annum ($2.25 per annum or $0.5625 per quarter) will be paid quarterly on 3/15, 6/15, 9/15 & 12/15 to holders of record on the record date that will be the first day of the month the payment date falls (NOTE: the ex-dividend date is at least one business day prior to the record date). On and after 12/15/2022, distributions on the units will accumulate at an annual floating rate of the $25 liquidation preference equal to the three-month LIBOR plus a spread of 6.88%. At any time within 120 days following the occurrence of a Rating Event the issuer may redeem the Units in whole, but not in part, at a redemption price in cash equal to $25.50 (102% of the liquidation preference of $25.00) plus an amount equal to all accumulated and unpaid distributions, whether or not declared (see prospectus for further information). Upon the occurrence of a change of control the company will have the option within 120 days to redeem the preferred units at $25 per unit plus accrued and unpaid dividends. If the company has exercised their redemption right, the holders will NOT have the following conversion right. Upon the occurrence of a change of control, and the company has NOT provided notice that they intend to redeem the preferred units, the holder will have the right to convert the preferred units into common units under certain circumstances (see the prospectus for details). Holders of the Preferred Units will receive specific tax information from the company, including a Schedule K-1 which generally would be expected to provide a single income item equal to the preferred return (see page S-36 of the prospectus for details). This security was rated as Ba3 by Moody’s and B by S&P at the date of its IPO. In regard to the payment of dividends and upon liquidation, the preferred units rank junior to the company's senior debt, equally with other preferreds of the company, and senior to the common units of the company."

A few more very important characteristics of these preferreds are that they’re cumulative, they trade below par (i.e. redemption price), and they cannot be redeemed by NuStar until on or after 12/15/2022.

Further still, because these fixed-rate prefers convert to a floating rate in the future, investors have some protection against rising interest rates. Specifically, rising rates can have a negative impact on the prices of fixed income securities, especially bonds and preferred stocks (i.e. interest rate risk), however these risks are significantly reduced by the future floating rate provision of these preferreds, as described in the above description.

High-Yield Fixed-to-Floating Rate Preferreds:

And for your reference, here is a list of more fixed-to-floating rate preferreds that you may want to consider if you like high income and the low volatility of preferreds, but you are concerned about interest rate risk...

(note: the above list includes prices from mid-day on Tuesday 3/14).

Conclusion:

Income-focused investors are often looking for high-yields with low volatility. Preferred stocks are often considered as a solution for this high-yield low volatility need, but the problem with many preferred stocks is that they are exposed to significant interest rate risk (i.e. as interest rates keep rising--as they are expected to do--the price of preferred stocks will keep falling). The concept of a high-yield fixed-to-floating rate preferred can be attractive because if offer the the attractive high-yield and low volatility that investors seek, but it does not have the same interest rate risk because as interest rates rise, so too will the dividend payments on the preferred (this will help keep the price of the preferred from falling).

We like NuStar Series C preferreds in particular because they meet the needs of high-yield, low volatility, and significantly reduced interest rate risk, but also because they have sold-off inappropriately following the distribution reset on the common equity (which is actually a good thing for the preferred units because they're higher in the capital structure), and also because they sold-off inappropriately on Thursday following the market's overreaction to the FERC announcement. Overall, if you're looking for high income, lower volatility, and a discounted price, NuStar Series C Preferred units are worth considering.