image source: WSJ

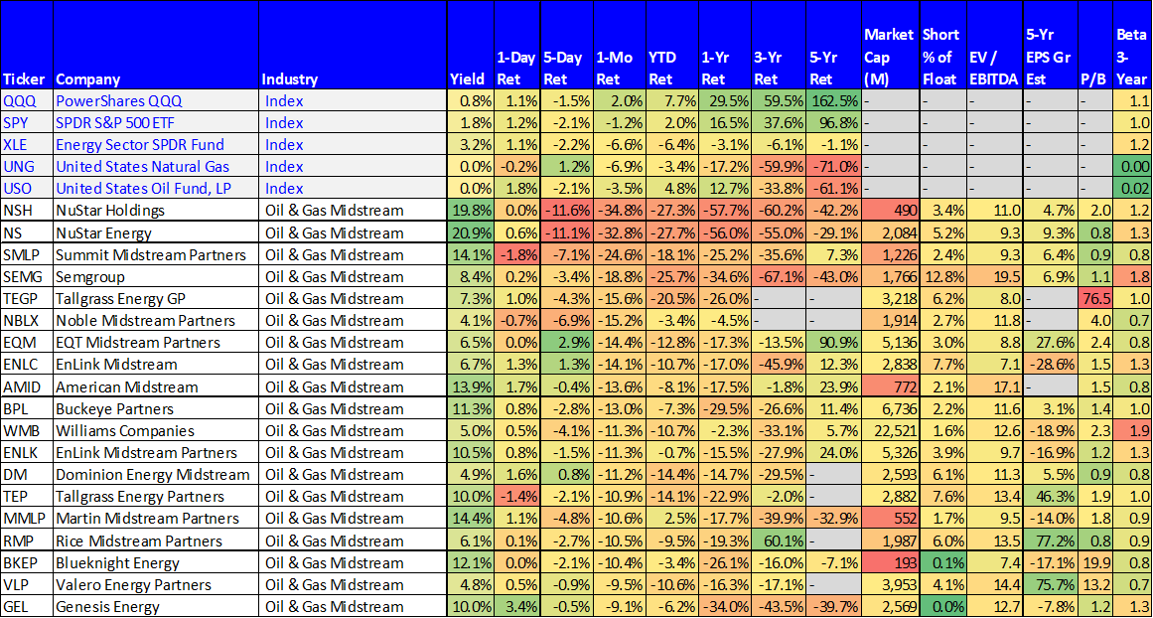

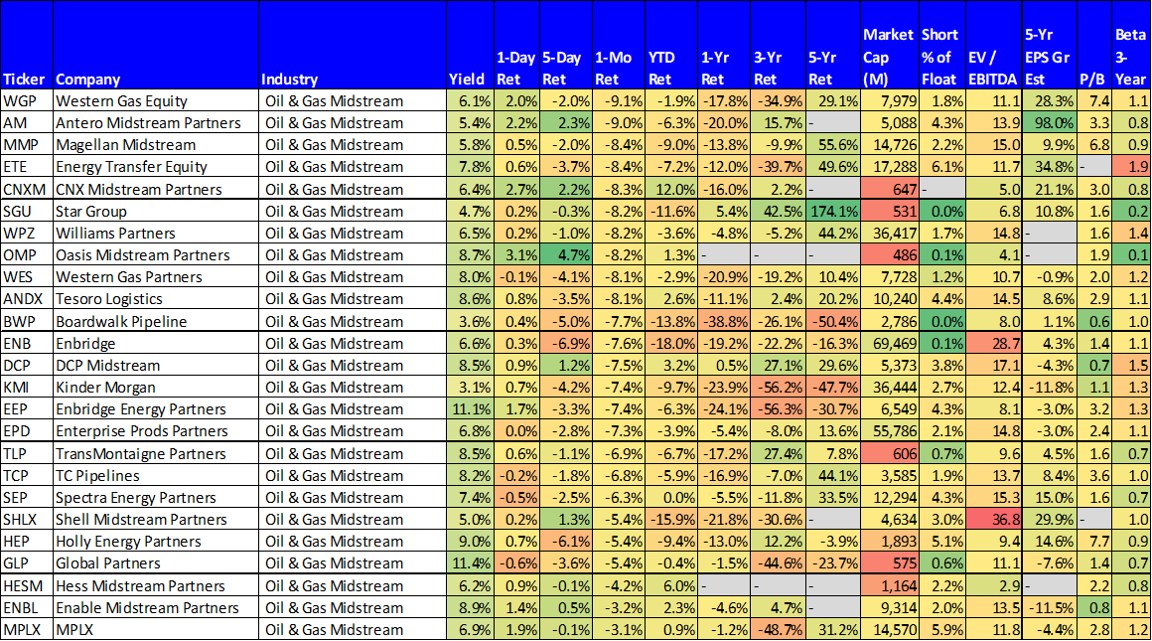

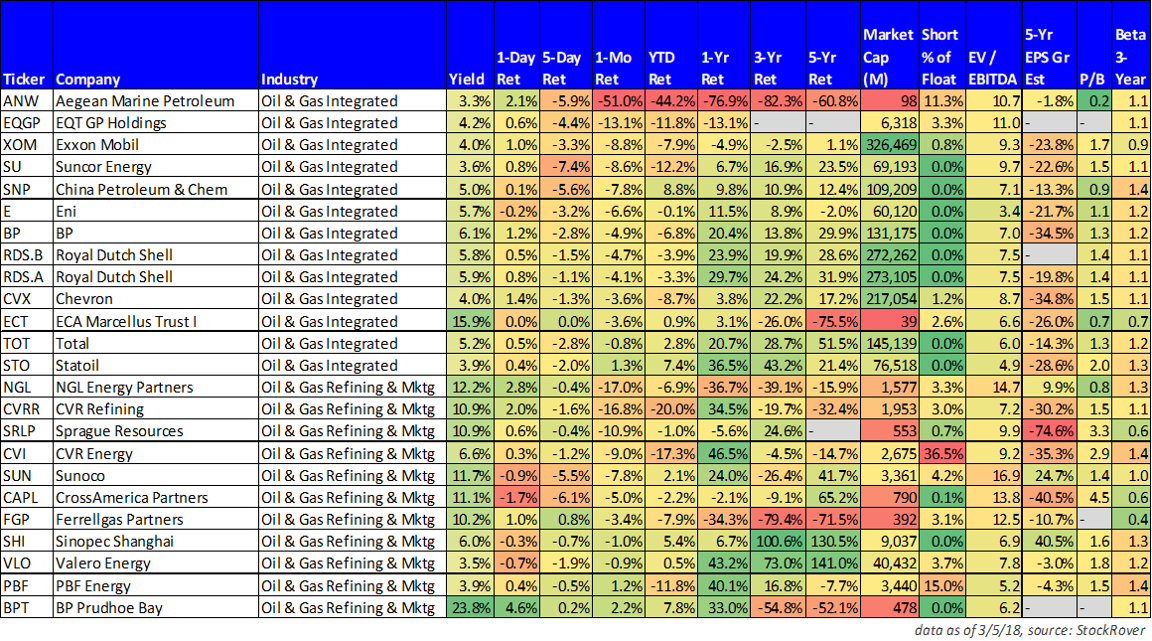

Despite the uptick in volatility this year, the S&P 500 (SPY) has still posted a +2.0% total return, with the Nasdaq up even more, +7.7%. Yet the energy sector (XLE) has sold-off 6.4%, with multiple names selling-off significantly more.

As shown in the following chart, the market has been mounting a rebound since selling-off in early February, but the energy sector has not.

Arguably, energy companies will be impacted more negatively by new fed chair Jerome Powell's comments that recent market volatility will not prevent interest rate hikes, considering the relatively higher levels of debt among energy companies which are generally more capital-intensive businesses. Nonetheless, we believe the recent sell-off has created some more attractive investment opportunities that are worth considering.

Before getting into specific companies (and their high yields), it’s worthwhile to consider what is driving the energy markets. For example, on Monday, the International Energy Agency forecast that the US will overtake Russia to become the world’s largest oil producer by 2023, thanks in large part to the shale boom.

However, not everyone agrees with growth expectations. For example, Mark Papa (former CEO of EOG Resources) thinks shale may not surge to the extent most everyone is expecting due to too much optimism and potential logistical challenges.

75 High-Yield Energy Companies that have Sold-Off Recently

Here is look at over 75 energy companies with yields of 3% to over 20%, that have sold-off recently, organized by industry.

You’ll also notice natural gas (UNG) and oil (USO) listed in rows 4 and 5, whose prices impact different energy companies differently. For example, the Exploration & Production companies are often more directly and immediately impacted by oil prices than are refiners (refiners are more concerned with the crack spread). Also worth noting, the table includes information on short-interest (investors betting against a security) as well as basic valuation metrics (e.g. EV/EBITDA and price-to-book).

Four High-Yield Energy Companies Worth Considering

1. Enterprise Products Partners (EPD), Yield: 6.9%

Enterprise Products Partners is one of the companies on the list as its price has declined more than 7% in the last month. If you don’t know, EPD is one of the largest vertically integrated midstream energy companies with top-quality assets along essentially every point of the value chain. It also enjoys a relatively high credit rating compared to peers (Baa1/BBB+) that keeps its cost of capital low. And EPD’s big distribution (currently a 6.8% yield) has been raised for 54 consecutive quarters. Further, EPD’s price has recently pulled back (after climbing to its 52-week high in January) thereby making for a more attractive entry point.

We last wrote about EPD in May of 2017 where we described it as offering “Big Yield, Stable Growing Income.” Enterprise Products Partners: Big Yield, Stable Growing Income Since that time EPD has raised its distribution multiple times, a trend we expect to continue, especially based on its expansion into Gulf Coast petrochemical activities (EPD transports and processes natural gas, natural gas liquids, crude oil, refined products and petrochemicals). It is organized as a Master Limited Partnership (“MLP”), and its business arrangements are backed by long-term contracts (10+ years) which help ensure stable long-term income for the firm and its investors.

On an EV to forward EBITDA basis (see chart above), EPD could reasonably trade back up to 14x, giving the MLP units attractive upside (in addition to continued distribution increases). If you’re looking for steady growing income, EPD is worth considering.

2. Exxon Mobil (XOM), Yield: 4.1%

Exxon Mobil is an integrated energy company, and it is an outstanding allocator of capital relative to peers, as shown in the following chart.

Further, the share price has recently sold-off thereby making for a more attractive entry point for investors, in our view.

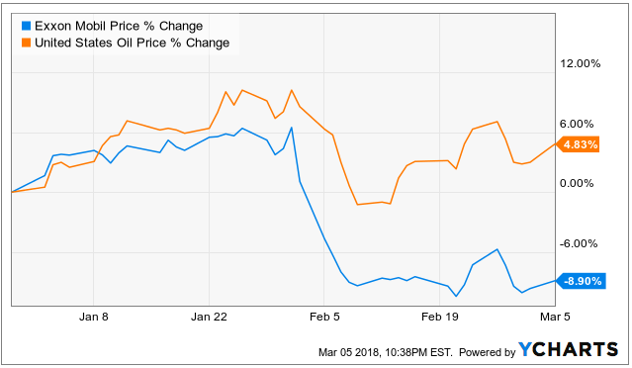

Specifically, XOM was down over 10% in early February following an earnings announcement the market didn’t like, combined with a decline in crude oil prices:

Oil has largely since rebounded, whereas XOM has not.

Further, Exxon has enjoyed 35 consecutive years of dividend growth, and is the only integrated major with positive free cash flow in recent years.

XOM will likely continue its healthy trend of dividend growth as well as share repurchases. If you’re an income-focused investor, Exxon Mobil is worth considering at this lower price.

3. FerrellGas Partners (FGP) 2020 Bonds, Yield: 12.9%

FerrellGas is a propane distributor, and the price of its 2020 bonds has perked up nicely so far this year because of the spat of relatively cold weather across the US. We currently own these bonds, and we believe they have continued price appreciation potential, in addition to big coupon payments.

The company announces earnings this week on Thursday, March 8th. You can read more about these bonds in our recent report:

4. Energy Transfer Equity (ETE) Yield: 7.8%

Energy Transfer Equity is the general partner (and has incentive distribution rights) in Energy Transfer Partners, which owns an integrated platform of crude oil, natural gas, and natural gas liquids assets in most active basins. ETE separately owns 100% of Energy Transfer LNG, which is developing a gas liquefaction facility at Lake Charles, Louisiana.

The company is completing a multi-year capex program, and expects continued EBITDA growth through mid-2019 (it has more than $10 billion of major growth projects coming online).

ETE’s yield is attractive not only because it is large (7.8%) but also because it is steady. Specifically, the company has a business mix that is primarily fee-based, and based on long-term contracts, thereby providing stable cash flows.

Further, ETE has been improving its financial position by reducing leverage as EBITDA grows.

EBITDA has grown as a result of the continued shale boom, and ETE’s pipelines helped deliver inexpensive gas to centers of demand.

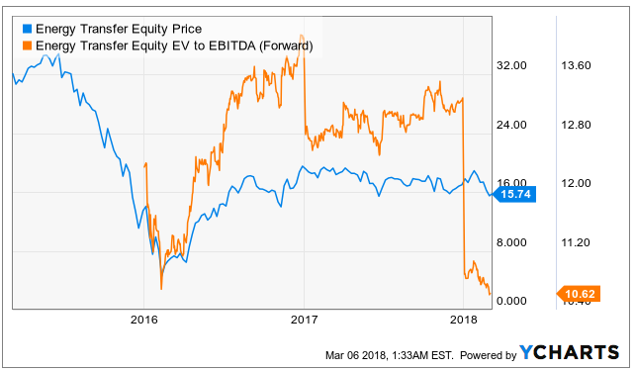

ETE’s price has recently pulled back moderately, and its valuation (EV/EBITDA) has become more attractive.

We believe the equity (ETE) is attractive and worth considering if you are an income-focused investor, but if you prefer debt, we’ve also recently written about ETE’s bonds too in this article: Market Rover: 20 High Yield Bonds Selling-Off, These 5 Are Worth Considering.

Technical Trading Indicators:

In addition to fundamentals, we pay attention to short-term technical indicators when entering new positions. For example, the “Money Flow Index” is a technical measure of price and volume, or money flow over the past 14 trading days with a range from 0 to 100. An MFI value of 80 is generally considered overbought, or a value of 20 oversold. XOM’s Money Flow Index is currently 39 and EPD’s is 28 (both bullish indicators if you are a contrarian).

And for more technical trading perspective, be sure to check out Jeff Miller’s Stock Exchange report from this week: Do You Trade the 50 Day Moving Average? We edit this weekly report for Jeff using data provided by his models, and it provides very good perspective on different ways to think about technicals when entering and exiting positions, ranging from near-term mean reversion to powerful momentum opportunities. For reference, here is a look at the 50-day moving average for both XOM and EPD.

More Perspective On The Market:

Outside of Blue Harbinger, we manage investment accounts for individuals and institutions. And these in-person interactions often provide very good perspective for the things we write about at Blue Harbinger. For example, this week we spoke with a private investor, five years away from retirement, and he reminded us that investors can sometimes get so focused on dividends that they forget about other “outside the box” opportunities—such as taking full advantage of the corporate benefits of a working spouse. Specifically, those 401k matches are often like free money! Plus, many large companies offer additional life insurance coverage (for both spouses) at deeply discounted group rates (and without a physical)… This is like solid gold if you’re in the market for coverage. Not all of these things are applicable to all investors, but the point is that when you’re looking to grow your nest egg—there’s more to it than simply chasing after the biggest and safest yields. Our goal is for this weekly Market Rover report to be a resource for idea generation (whether inside or outside the box!).

Conclusion:

We don't know where the price of oil and natural gas will be next year, next week, or even tomorrow. However, some energy companies (such as those highlighted in this articles) have opportunities to keep delivering big steady income payments to investors, regardless of the daily commodity price fluctuations. And if you are an income-focused investor, we believe the four specific opportunities in this article are attractive and worth considering.