If you're looking for an attractive dividend plus continuing price appreciation, the natural gas compression equipment companies are worth considering. Specifically, this niche industry is booming thanks to an ongoing secular trend of increasing natural gas volumes due to relatively recent technological advances as well as environmental concerns. This detailed write-up is from Darren McCammon of the highly successful Cash Flow Kingdom (a membership service of which we are a paying member).

What follows is Darren's write-up...

Booming Natural Gas Volumes: Compression Companies Profit

Summary

- Natural Gas prices can be volatile, but volumes are going nowhere but up.

- Compression equipment forms the backbone of the natural gas network in much the same way routers formed the backbone of the internet.

- Publicly traded companies which stand to benefit from supplying this equipment include USA Compression Partners, Archrock, and CSI Compressco. Of these three we think Archrock the best choice.

- This article was released to Cash Flow Kingdom members Monday morning at the open, and will be released publicly on Seeking Alpha this weekend.

I’ve been long Archrock (AROC) since late February, and ArchRock Partners (APLP) before that. This has been one of my largest and strongest performing positions this year, up about 70% overall (20% APLP premium + 44% price gain + nearly 6% in dividends received).

This report will discuss the macro tailwinds driving the natural gas compression sector, the three main publicly traded companies in that sector, and why we think Archrock (AROC) continues to be the best choice of the three. Although AROC has been very profitable during 2018, I believe there continues to be significant upside remaining.

Macro Tailwinds

A significant part of the reason I was so positive on Archrock and the compression sector in general is because I see a secular shift occurring in North American natural gas production and export. To put it succinctly, while natural gas prices will likely remain cyclical, I see North American natural gas volumes as going nowhere but up (as does the EIA and many others).

Source: US Energy Information Administration (EIA)

The first period in the chart above is primarily due to new production techniques commonly referred to as “fracking.” Prior to this period, US natural gas production was flat, 1980 production averaged almost the same 1.9 MMcf as 2005.

The second period was the oil crash. What is remarkable here is natural gas prices fell approximately 60% at one point (with oil prices declining as much as 70%), yet overall natural gas production volume only declined 2% per year.

The third period brought new export facilities, pipelines to Mexico, and the first LNG export facility at Sabine pass. These new outlets provided a sort of relief valve effect for natural gas volumes. Suddenly, excess gas production had a place to go. Fracking, infrastructure, and export capability worked together to raise the natural gas volume growth rate to 9% per year. This relief valve affect continues today with Sabine adding trains and additional new facilities coming online in Cameron Parish, Corpus Christi, and Cove Point.

Worldwide volumes transported are also increasing due to technological improvements (i.e. fracking, FSPOs, FRSUs, FLNGs, etc.) combined with ongoing environmental concerns. China is also a major player as they shift towards pollution control (e.g. the recent surge in Chinese LNG powered heavy trucks sold: 2016 19,600; 2017 96,000; 2018 ?).

Together, natural gas technology improvements and environmental concerns are starting to change the way we use energy in much the same way the internet changed the way we communicate. However, where Cisco (CSCO) routers were the key backbone component of the internet paradigm shift; natural gas compressors are the key backbone component of the natural gas paradigm shift.

I frequently get the question, “Yes, but what about CSI Compressco (CCLP)?”, or “How about USA Compression Partners (USAC)?” To which I would typically respond, “I choose to stay away from CCLP as long as they have VWAP based convertible financing.”, and “USAC should do fine, but Archrock is the best choice. It trades for a cheaper multiple than USAC, and has the necessary excess cash flow to better take advantage of the opportunity.”

Now that both the Archrock and USA Compression Partners mergers are complete with a full quarter of data behind them, I can elaborate on these statements further with the numbers to back them up.

CSI Compressco:

CSI Compressco (CCLP) fabricates, sells, and leases compression equipment. Although they are ranked #3 in the space, they have less than 1/3rd the compressor horsepower under contract of either Archrock or USA Compression Partners, and they trade at less than 1/6th the market cap. On the surface it may seem like a good deal, trading at a cheaper multiple than USAC while also having the highest distribution yield; however, don’t be fooled. CCLP financed itself with toxic convertible preferred that has a Variable Weighted Average Price (VWAP) feature. These are potentially highly dilutive and poisonous, something I don’t want to fool with.

With VWAP convertible financing, the conversion price is not determined until the holder exercises. Thus, if the convertibles have a 5 day 95% VWAP feature, that means the price to convert will be 95% of the average price of the stock for 5 trading days prior to when the holder elects to convert.

- This means if there is $1 million dollars’ worth of preferred being converted and the stock averaged $100 per share the previous 5 trading days, the conversion price is $95. $1 million in preferred becomes 10,526 shares at $95 per share. Doesn’t sound so bad.

- However, what if the stock falls to $10 per share? Well if the stock averaged $10 per share in the 5 days prior to conversion, the conversion price is now $9.50 and 105,260 shares are issued. Ten times the share dilution, not so good.

- But it can get worse, much worse. If the stock averages $1 the conversion price is 95¢ and 1,052,600 shares are issued. 100 times the dilution.

- If the stock is 10¢ the conversion price is 9.5¢ and 10,526,000 shares are issued. 1,000 times the dilution.

As you can see, VWAP based convertibles are dangerous and can be extremely dilutive. I believe CCLP is a clear avoid until they sort out their busted balance sheet. Furthermore, just the knowledge these VWAP convertibles exist can cause the stock to slowly decline in a downward spiral. VWAP shares create a situation where the lower the stock goes, the better for the holder of the convertibles. When the parent company, management, or some other insider holds some of these shares, as is the case with CCLP, particularly troubling incentives can ensue. There’s a reason VWAP convertibles are widely considered toxic financing. My advice: stay away, it is just not worth it.

USA Compression Partners or Archrock?

For all intents and purposes, USA Compression and Archrock do essentially the same thing. One tends to have a bit more service business than the other, but for the most part, they are very similar. For both, the basic business is to obtain equipment (natural gas compressors) and lease these to end users. Both companies also tend to deliver about the same product breadth to the same customers at a similar price. In my opinion they also both have competent management. Measured on a compressor horsepower basis, they are even roughly the same size. Both firms are almost perfect comps operationally.

Source: ArchRock Presentation, author combined USAC & ETP bars together

Together, USA Compression Partners and Archrock form a duopoly, dominating the compressor leasing niche with nearly a 70% combined market share. This means if the two are smart (and I believe both sets of management are savvy) they won’t compete too heavily on price (lease rate to customers). Instead, they will tend to compete on things such as availability, reach, service level, and effectiveness, while also trying to be as efficient as possible in servicing their niche. In fact, we have already seen numerous comments from a variety of sources that these two leaders are indeed enjoying improved pricing power,

“…the market is very tight and continues to tighten across all horsepower classes. The overall macro environment is very supportive of continued demand… large units are by and large completely sold out…Pricing continued to tick upwards during the second quarter reflecting the attractive market. While we deploy new large horsepower units out to customers, with units coming at very attractive pricing, we also continue to monitor the market and make price increases across our operating regions for existing units already operating on month-to-month contracts. Looking to the future, we think sector activity levels and the tight supply demand dynamics for both new and used large horsepower equipment will continue to support enhanced pricing going forward…“

– USAC CEO, Eric Long in Q2 2018 conference call

This effective duopoly, with its pricing power and one year or longer backorders on high horsepower compressor units, is a good place to be. You want to invest here. Book to bill is strong, and getting stronger. EBITDA is increasing. The base macro environment, North American natural gas volumes, continue to increase at one of the highest rates in history (9% per year on a large market). Both AROC and USAC should continue to do fine. But which will do better, which will make the better investment?

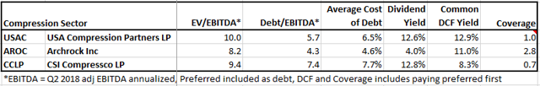

Since the two are so similar operationally, we need to look at factors other than running the business to discern between the two. Operational structures are similar, but the financial structures, cost of capital, and valuations are quite different. USA Compression Partners (USAC) is valued over 20% higher than Archrock on an EV/EBITDA basis. This is primarily because USAC pays out a much higher dividend than AROC, leading many investors to prefer it. After all, a 12.4% dividend is better than an 4% dividend, isn’t it?

Sometimes it is, but we prefer growth and sustainability. Both USAC and AROC are in a growing business tied to North American natural gas volume produced and moved. The more volume, the more compressors are needed. AROC and USAC are both in a high growth industry, which means the company best able to serve this growing market is poised to dominate.

Compressors are a capital intensive good, it costs a lot of money to buy them, a large and increasing amount of money as manufacturers of this equipment are also seeing heavy demand, long backorder times, and thus pricing power. (Side note: Caterpillar (CAT) makes a very popular high horsepower compressor engine.)

What this means for USAC and AROC is they need to invest significant amounts of cash to buy compressors and service the growing demand, or one is going to lose market share to the other. USAC, as we have already seen, pays out a high dividend to its investors. In fact, USAC historically pays out almost all its Distributable Cash Flow ‘DCF’ to investors retaining very little for compressor purchasing (i.e. DCF coverage was 1.09x in Q2-18 if you don’t include any distribution cost for common series B shares, 1.01x inclusive). This means USAC either needs to borrow more or issue shares in order to raise the necessary capital to serve growing demand; if they don’t, they will lose market share to Archrock.

Archrock on the other hand has gone a different route. In their “simplification transaction” merger between Archrock Partners (APLP) and Archrock (the C-corp), AROC effectively cut the combined dividend. In fact, the combined AROC now pays out less than 37% of its Distributable Cash Flow ‘DCF’, while the other 63% goes to buying compressors (or paying down debt or potential dividend raises).

Over time, this difference in funding is going to lead to very different DCF growth rates on a per share basis. In fact, we can see this already starting to happen. On a price only basis, AROC is up 44% since April 2nd* while USAC is only up 1%. I believe this trend will continue.

Source: Yahoo Finance* April 2nd is used as the start of the comparison because it is the first day when both the AROC-APLP merger, and the USAC-CDM merger transactions were complete (CDM was a division of Energy Transfer Partners (ETP) which merged with USAC on April 2nd).

Compressor Placement – Advantage: AROC

To further understand the significant difference financing makes for USA Compression Partners vs. Archrock’s bottom line, I’ve included an equipment purchase example.

Let’s suppose both buy $100 million worth of compressors, and are able to lease them to clients for $3.8 million dollars per quarter of contract revenue (Quarterly Contract Revenue as a % of Assets before depreciation average 3.8% for both firms in Q2). After paying contract operations costs (i.e. initial placement of unit, monthly servicing costs, etc.) gross margins are about 60%, or about $9 million in gross profit on an annual basis.

USAC, however, has a very different financing cost for that $100 million worth of capex. For instance, the entire $100 million would probably be borrowed at USAC because essentially all cash flow is paid out in distributions with none kept for compressor purchase. With an average cost on debt of 6.5%, this means USAC must pay $6.5 million annually on $100 million of Capex purchases. Subtract the $6.5 million in financing from the $9 million gross margin and you are left with only $2.5 million to fund other corporate expenses (i.e. $9 million gross margin minus $6.5 million financing cost).

In AROC’s case, the situation is different. First of all, because AROC doesn’t pay out all cash flows, it should be able to fund approximately half of its $240 million in purchases of capex this year solely from retained cash flow (estimated at $120 million for 2019). This means only $50 million out of the $100 million of capex in our example needs to be financed at $2.3 million annual financing cost (AROC’s average cost of debt is 4.6%). This means that $6.7 million is left to fund other corporate expenses (i.e. $9 million gross margin minus $2.3 million financing cost). That’s more than two and half times the net profit after cost of goods sold and financing that USAC produces on the same lease. All else being equal, Archrock should produce more than 2.5x the net free cash flow that USA Compression Partners does on the same lease.

Financing Advantage: AROC

The other important difference to keep in mind is USAC got creative in order to fund capex growth. Its debt not only carries a higher interest rate, but they had to give up warrants in order to get the rates they did, potentially diluting the stock at $17.03 (5M units) and $19.59 (10M units) conversion prices. Additionally, they created a new series of B shares, making sure they didn’t pay distributions the first year, and Preferred shares whose interest can be paid-in-kind (“PIK”) the first year (i.e. even more dilution). They needed to do this creative funding in order to ensure they retained enough cash flow in year one to make the deal work while also keeping the common A share distribution. If they hadn’t used this approach, USAC likely wouldn’t have been able to cover their large distribution while still funding growth.

Source: AROC and USAC 10Qs and author calculations

In fact, I was pretty concerned that management selling half its shares back in June was an indicator the necessary asset-backed-loan (“ABL”) extension to $1.6 billion was only going to come along with some onerous terms. Terms which could have included a significantly higher rate, a sizeable hold back beyond which the distribution had to be cut, or even potentially a forced distribution cut requirement from the get go. This fear however proved fruitless, the ABL increase ended up relatively innocuous (4.56% rate as of June 2018, a $100 million holdback beyond which the distribution must be cut, and a 5.75x Debt/EBITDA covenant through March 2019 which then goes to 5.5x until December 2019, and 5x thereafter).

This was pretty good financing, significantly better than I feared. However, it does not change the basic problem: USAC continues to pay out essentially all available cash flows via distributions. Indeed, it’s pretty clear the common B units were negotiated with no payment the first year, and the Preferred with a PIK option the first year, specifically because cash flow was going to be tight. Once these full payments kick in next year, USAC will hopefully be making enough additional profit from increased pricing and a larger installed base to cover the extra cash flow needed. If not, the distribution will once more come into question.

In the meantime, the capex for this growing base will have to come from piling on more debt or diluting the stock through additional share issuance. There is just no meaningful alternative; that is if management wants to continue to avoid a distribution cut and not lose significant market share.

Conclusion: Avoid Toxic CCLP, Watch USAC, Buy AROC

Regardless of other financial figures and performance, I think CCLP should be avoided while it continues to have VWAP convertibles outstanding. The potential dilution risk just isn’t worth it.

USAC can be a reasonable hold for those who feel they must have the higher distribution. However, investors need to realize it is this very distribution which is most limiting the company’s growth. Paying out almost all cash flow to support it in a strongly growing, capital intensive industry like natural gas compression limits the company’s ability take advantage of the macroeconomic situation. In 2019, when the Preferred and B shares are both also paying cash distributions, USAC may once again be faced with tight cash flow and have to make some tough financial decisions.

USAC management has worked hard, been creative, and done a good job with its financing in order to keep supporting the distribution (honestly the CFO deserves a bonus). However, in the end, this creative financing is likely to reduce overall long-term investment returns due to the constraint it also puts on growth opportunities. Share dilution and/or even higher levels of debt will be required to fund growth while keeping current distributions. Times are good right now, but this high and increasing debt load could make the company more susceptible to future interest rate increases and/or some other negative change in the environment. If I was the CFO of USAC, I frankly wouldn’t have worked so hard to avoid a distribution cut. Instead I would have recommended one, not because I had to, but rather because over the long run this is what would allow the company to flourish the most. In this high growth sector, you need excess cash flow to provide the greatest long-term return to investors.

Despite AROC’s significant price increase (+53%) since April relative to USAC (0%) and CCLP (-16%), I think they still remain the best current investment choice for total return. AROC’s price is growing because EBITDA per share is growing. That in turn is happening because there is strong growing demand for compression assets which it has the excess cash flow to fill. Even though AROC has increased so much since April, they still trade at a surprisingly cheap range of 8-9x EV/EBITDA. That AROC still trades at a lower multiple than USAC, 8.2x EV/EBITDA vs. 10x EV/EBITDA for USAC, is market inefficiency. Mr. Market should probably be assigning AROC a higher valuation multiple than USAC due to its much better potential to grow EBITDA and cash flow for investors.

I believe USAC is ‘fairly priced’ around $16 -$18 given the current market strength, offset by their weaker balance sheet. However, if USAC is at 10x, then AROC should also trade at least at 10x EV/EBITDA, which suggests a current ‘fair value’ of around $17/sh, upside of over 40%.

Disclosure: Darren (the author of this article) is long AROC.