This week’s Weekly highlights an increasingly attractive high-yield, oil & gas, small cap that began trading earlier this year. It’s a case where some investors gave up very big long-term income in exchange for upfront cash via an IPO. It pays monthly, and the shares just sold-off, as shown in the chart. We consider the attractive qualities and the risks, and conclude with our bottom line views.

PermRock Royalty Trust (PRT), Yield: 8.3% (Paid Monthly)

PermRock is an increasingly attractive high-yield, oil & gas, small cap that began trading earlier this year. The share price has recently pulled back sharply (as shown in the chart above) which makes it quite tempting, in our view.

The main asset of PermRock is an 80% Net Profit Interest (“NPI”) in oil and natural gas producing properties in the Permian Basin of West Texas. PRT was formed in 2017 and completed its initial public offering in May of this year (2018).

The primary function of PRT is basically to collect NPI and then then use it to pay monthly distributions to investors (PRT is NOT an MLP, there is no K-1, and its 1099’d to investors). This is an attractive proposition for many investors, particularly those focused on generating monthly income. But of course there are risks too, which we will cover later in this report. But first…

Attractive Qualities:

PRT is attractive and tempting to us for the following reasons:

Valuation:

PRT is relatively inexpensive compared to its income and earnings power. For example, the following charts show forecasts from the 4 Wall Street analysts currently covering PRT (new small caps like PRT don’t usually get much coverage).

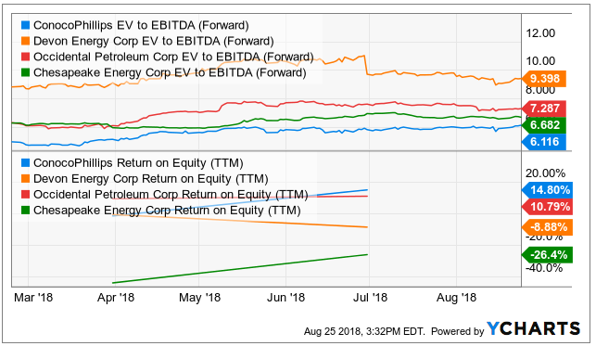

Interesting and attractive, PRT is relatively inexpensive on both a (forward) EV/EBITDA basis and from a Return on Equity (“ROE”) standpoint, as well as a variety of other metrics. For comparison purposes, the following graphics show data for some key players in the industry, and PRT compares favorably.

Certainly, there is a lot going on here, and these are not perfect apples-to-apples comparisons, in terms of risks and business models (more on this later), but they do highlight PRT’s attractive valuation, in our view. And for still more perspective, here are the views of the Wall Street analysts covering PRT (3 buy recommendations, and one hold).

Recent Sell-Off:

The recent sell-off in PRT, as shown in the price chart at the beginning of this report, makes this an even more attractive opportunity, not only because the valuation metrics have gotten more attractive, but because people are looking at this sell-off the wrong way. Here is what Stifel Nicolaus (the only analyst that doesn’t have a buy recommendation, he has a “hold” now) had to say:

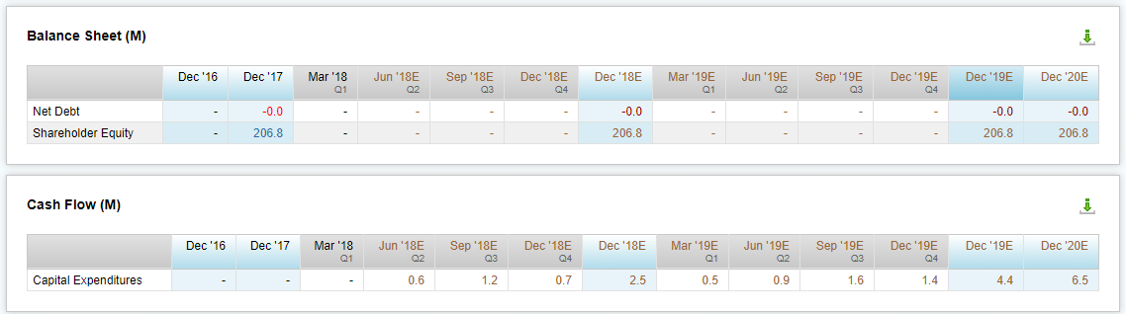

PRT reports their capex spending monthly, and the recent increase noted by the analyst was actually very small in our view, and it also sets the company up for more production in the future. For example, here is what PRT actually had to say about recent capex spend:

Capital expenditures were $0.49 million in the current month. Boaz Energy advised the Trustee that capital expenditures were primarily attributable to the drilling program for non-operated wells in Crane and Ward Counties along with non-operated recompletion projects in Glasscock County, and that due to the success of both programs, Boaz has increased its capital budget for the second half of 2018 to $1.2 million to continue the development programs.

The company is actually spending more because they’re experiencing increasing opportunities. This is a good thing.

The other reason the shares sold-off is because PRT announced its next distribution payment would be approximately $0.09, which is lower than in recent previous months (it was $0.16 in May, $0.11 in June, and $0.13 in July). However, keep in mind the dividend does vary based on business conditions, and it was most recently lowered because PRT is spending more on successful opportunities (as mentioned previously, this is a good thing). In fact, the company is expected to keep increasing capex over time as the business ramps up.

In our view, PRT has the potential to pay very large and increasingly healthy distributions over time (more on this in a moment), and the recent sell-off makes for a more attractive entry point.

The Risks:

Energy Prices: First and foremost, this business is largely at the mercy of energy prices (oil and gas). If prices go up, PRT makes a lot more money. If prices go down, then PRT makes less money. At the time of its IPO, hedges were put in place to protect PRT in 2018 and into 2019, as described in the most recent quarterly report:

“Boaz Energy [the organization that created PermRock] has entered into derivative put option contracts with respect to approximately 100% of expected oil production attributable to the Net Profits Interest, based on the reserve report, during the remainder of 2018 and 76% of such production during 2019. Boaz Energy believes that these put option contracts will provide downside protection to the Trust in the event spot prices for crude oil decline below the applicable strike price, while still allowing the Trust to benefit from increasing crude oil price.”

However and importantly, PRT is not allowed to put any oil and gas hedges in place going forward (only those Boaz put in place at the time of the IPO are allowed). This basically means that PermRock’s future value is largely dependent on the price of energy. If energy prices remain at their current levels (or higher), then PRT will likely keep paying very attractive (and growing) distributions to investors over time. If energy prices decline, then the distribution payments will be pressured.

Also important, based on third-party reserve reports, economic production from the underlying properties is expected for at least 75 years.

Management Conflicts of Interest: Boaz Energy is an owner of the underlying PRT properties, and the operator of substantially all of the properties. And because Boaz owns other, non-PermRock properties, conflicts of interest may arise with regards to the operation, buying and selling of PermRock properties. Situations may arise where Boaz isn’t necessarily incented to act in the best interest of PermRock investors.

Additionally, and very importantly, Boaz de-risked by allowing the IPO earlier his year. Essentially, management/owners received a significant portion of the value of the assets when they IPO’d, but they’ve also essentially reduced their risk to commodity prices by selling off the asset (“Net Profit Interest,” which is volatile) to other investors.

PermRock Bottom Line:

No one knows the future price of oil and natural gas, but if they stay at their current levels (or go higher) then PRT will very likely keep paying attractive (and potentially significantly increasing) monthly distributions to investors. And unlike investing in physical energy commodities (oil and natural gas futures, for example) PRT pays monthly income.

Boaz was willing to give up a very large percentage of future income potential by selling off the Net Profit Interest to PRT investors, in exchange for upfront cash from the IPO. If you’re going to invest in PRT, the question is “are you willing to take the risk of volatile commodity prices, in exchange for potentially very attractive monthly income payments?” It seems clear that Boaz gave up some very attractive future income potential to PRT investors, and we like that the price of PRT just sold-off thereby creating a potentially highly lucrative entry point for new investors.

We have NOT yet hit the buy button on this one, but despite the risks, it could add valuable diversification to an income-focused investment portfolio, and it has the potential to be a very high income payer (with some price appreciation too) in the future.

PRT announces earnings this week on Wednesday August 29th.