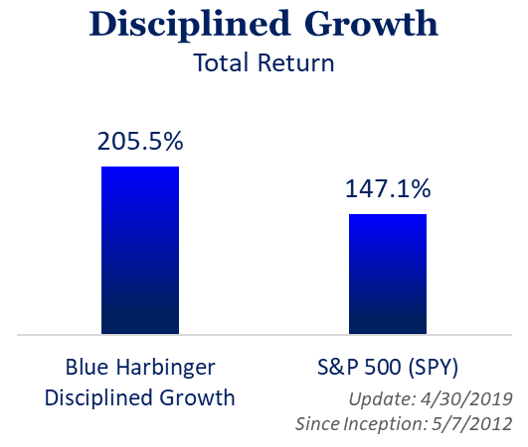

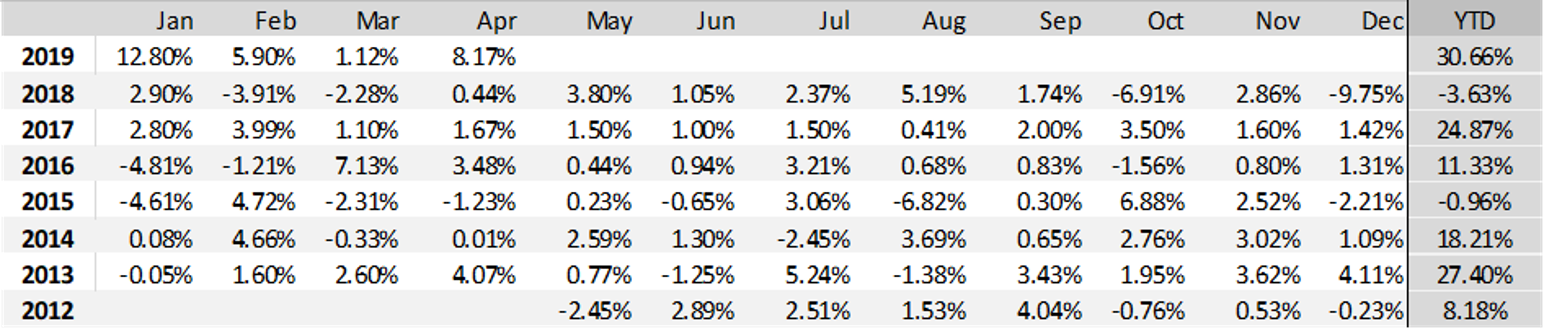

All Blue Harbinger strategies delivered healthy gains in April, thereby extending their long-term outperformance. The strategies are positioned prudently to achieve their long-term goals, ranging from attractive income to powerful long-term growth. This report reviews performance (including specific holdings) and where we’re seeing the best opportunities going forward. Importantly, don’t get greedy—this year’s gains have been nice, but stick to your disciplined long-term strategy.

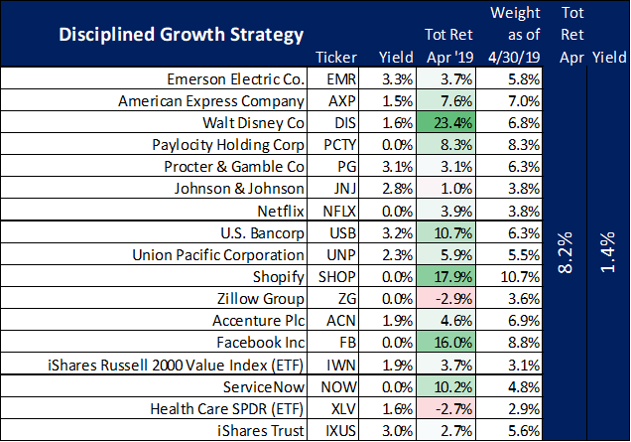

Holdings and Performance:

For starters, here is a look at the performance and holdings for each of our Blue Harbinger strategies, which continue to deliver market beating performance.

Portfolio Winners and Losers:

And here is a look at the biggest gainers and decliners in March. Keep in mind, 1-month is a short time period when it comes to long-term investing, and we’ll gladly take some volatility in our individual holdings in exchange for powerful long-term results (portfolio growth and income).

Disney (DIS): gained an impressive 23.4% during April, as the market liked the news of its new streaming service, which will start at a price point lower than Netflix. Disney has an impressive library of content which can help make this service a success. And despite the fact that the price of Disney and Netfix is considerably lower than cable, these services still don’t have much in the way of live content. However, Disney’s ownership of ESPN could prove to be an important differentiator. We’ll see how the streaming industry plays out over time, but the market likes Disney’s strategic direction.

US Bank (USB): Shares gained 10.7% in April as the bank announced net interest margins had improved and lending was on the rise. A strong US economy bodes well for banks and financials, particularly more-Main-Street-banks like USB. Interest rates are a bit of a wild card, as net interest margins usually do better when interest rates rise, but a strong economy is usually the best thing for well managed dividend paying banks, such as US Bank.

Shopify (SHOP): Revenue growth continues to be on fire, with no real competition in sight. Plus, the company posted a surprise Q1 profit—an added bonus for an aggressive growth company like Shopify. Volatility and high valuations make many investors uncomfortable with this type of growth stock, but if you can hang on for the long-term, you’ll likely very be pleased considering the dramatic ongoing growth potential.

Facebook (FB): gained 16% during April, which was largely a rebound after last year’s Q4 sell-off combined with extremely negative press related to data privacy concerns. However, daily active users and revenues have continued to grow, and the valuation is still more attractive now than it was last year when the shares traded 15% higher than they do now.

ServiceNow (NOW): continues to generate impressive growth from a very “sticky” and growing customer base. Further, there are no real competitive threats to ServiceNow and the total addressable market is large (i.e. there is room for lots more growth) and share price increases.

First American Financial (FAF): gained 10.8% in April, and the strong economy (combined with renewed pressure to keep interest rates low) gives the housing market (and this stock) more room to run. According to CEO Dennis Gilmore: “As we’ve entered the spring selling season, we’re becoming more optimistic about the housing market given the positive economic backdrop and the recent decline in mortgage rates.”

AmeriGas Partners (APU): gained 17.5% in April thanks to the announced deal whereby UGI Corp. (UGI) agreed to acquire the 69.2M common units of AmeriGas that it does not already own for a combination of cash and stock valued at ~$2.44B. This will result in a new ticker, company, and dividend when the deal is complete. Investors have until Q4 to decide what to do with their APU positions because that’s when the deal is expected to be complete. Under the terms of the agreement, AmeriGas unitholders will receive 0.50 shares of UGI common stock plus $7.63 in cash consideration for each common unit of AmeriGas. AmeriGas unitholders will continue to receive a $0.95 per unit distribution for each quarter completed prior to the closing of the merger.

Microsoft (MSFT): gained 10.7% in April after announcing another strong quarter, beating analyst estimates, thanks in large part to its Azure cloud business—which, by the way, has been becoming an increasing competitor for the number one cloud services provider—Amazon Web Services. The cloud is a huge and growing business, and under Satya Nadella’s leadership—Microsoft has continued massive growth opportunities ahead—particularly in the cloud.

Teekay Offshore Series B Preferred Shares (TOO-B): these big dividend preferred shares were due for a rebound and gained 13.9% in April. As we wrote back on April 28th (right before Teekay Offshore announced the earnings that drove these preferred shares higher “Teekay Offshore is a good business with an improving balance sheet—thanks in large part to deep pocketed investor Brookfield which has relatively recently taken a majority ownership position in the business. This helped improve the credit profile of Teekay right off the bat, and it continues to improve as the group works to actively deleverage. Specifically, they’re paying down debt, which has been challenging for common shareholders but it’s good for bondholders and preferred stock owners, in our view.”

GrubHub (GRUB): shares drifted lower over the last month, which makes them even more attractive, considering revenue keeps growing and the most recent quarterly earnings announcement was good. GrubHub’s competitor Uber (Uber Eats) is expected to IPO in early May, and this could create enough industry buzz to be a catalyst to drive GrubHub’s shares higher—we believe GrubHub shares should go higher given the large opportunity and growth.

Conclusion:

The strong market continued higher in April, as did our portfolio strategies. We continue to believe that prudently-diversified actively-managed goal-oriented portfolios is the best strategy for long-term success. Not only do they avoid the expensive fees and mistakes of day trading, but long-term investing is a proven strategy for success. Just because the market is up—don’t try to get cute with your trades or overly aggressive with your investments—stick to your disciplined long-term plan.