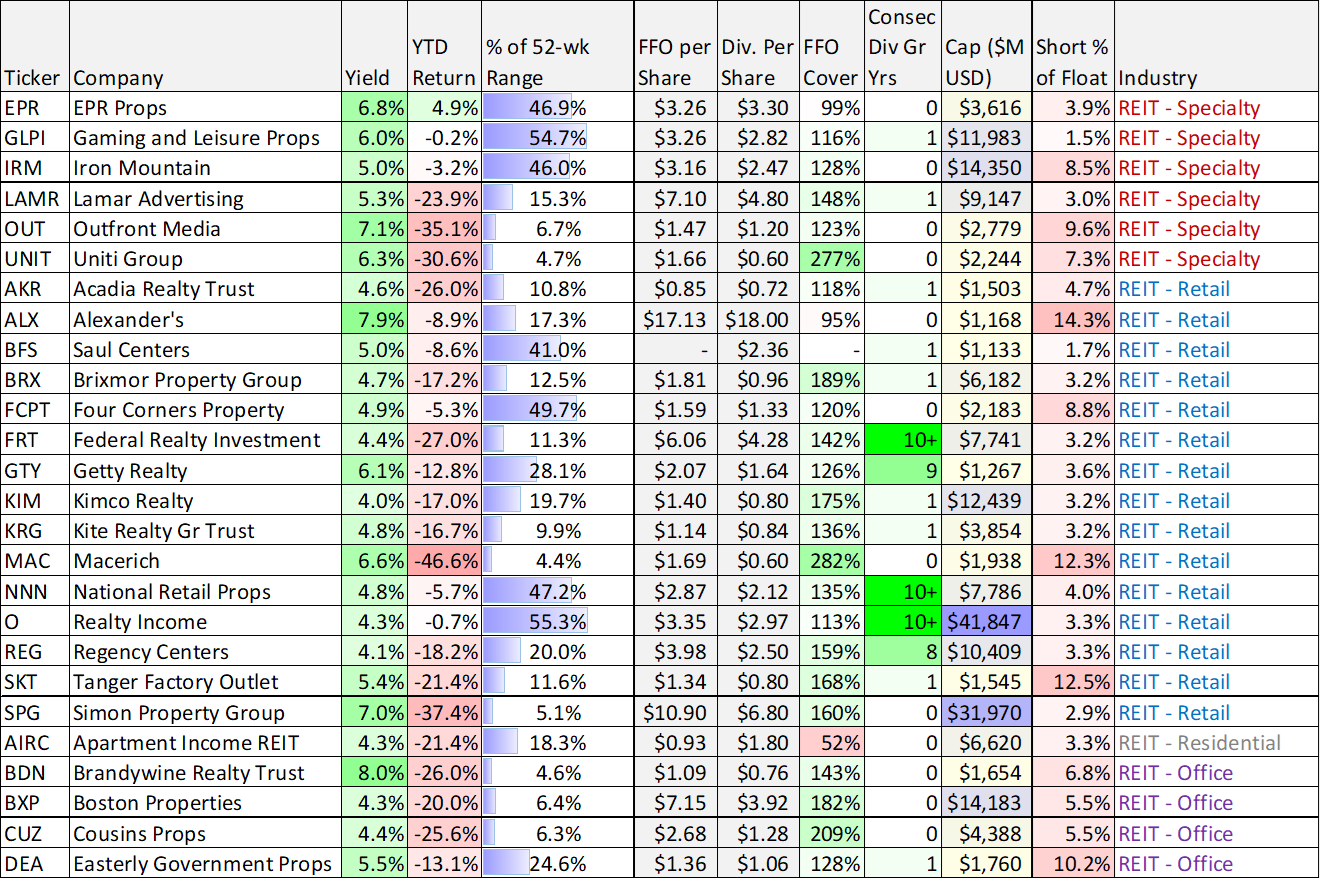

For your reference, this report includes data on 50 big-dividend REITs. The report is sorted by REIT industry, and includes metrics such as performance, valuation, dividend safety and more. Most REITs are down this year, and that has created some interesting big-dividend contrarian opportunities.

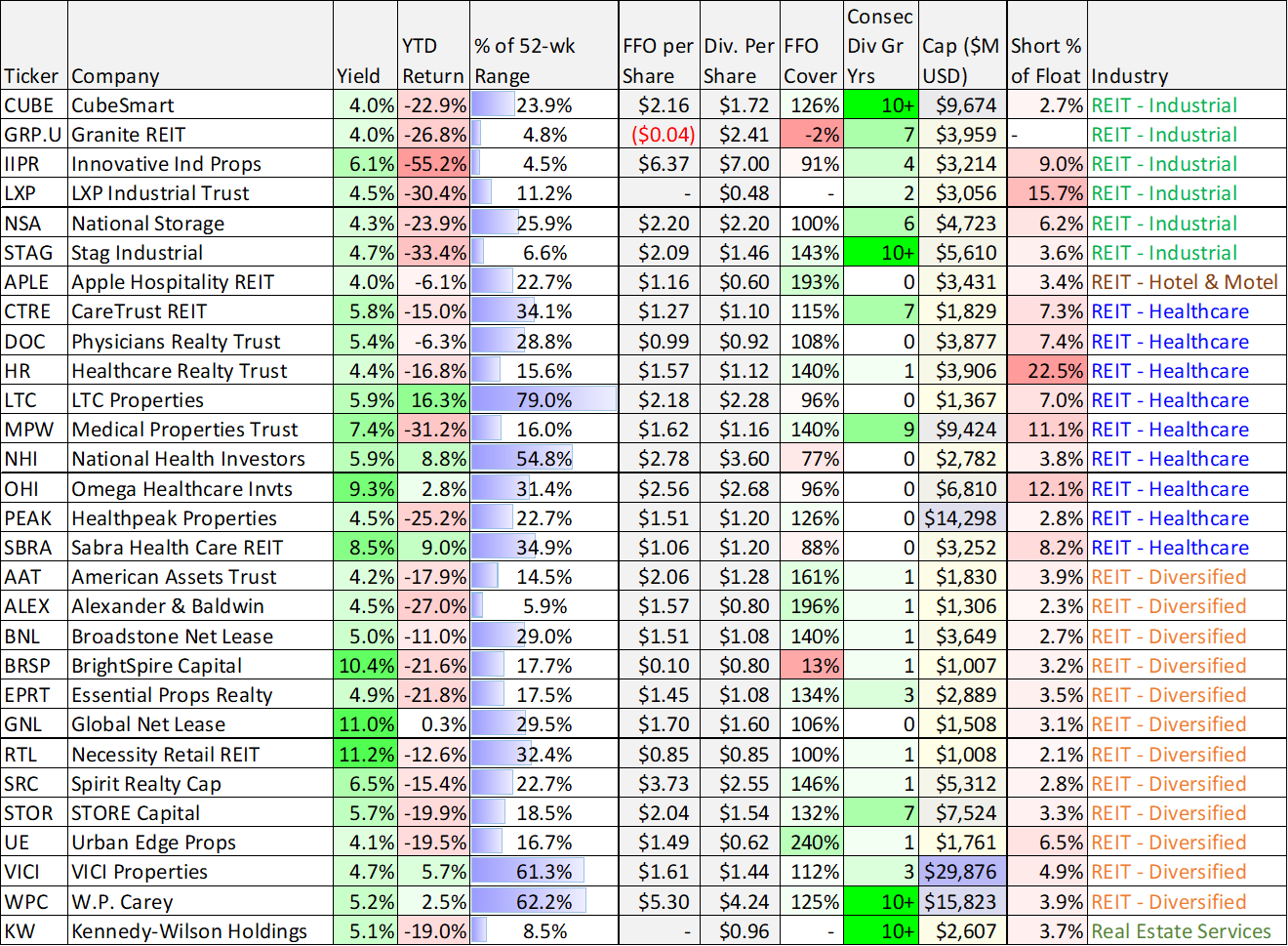

Industrial REITs

You’ll notice in the report that certain REIT sectors have performed worse than others so far this year, such as Industrial REITs which have been dragged down by the pandemic hangover. In particular, the large online shopping disruption to supply chains caused by the pandemic is now normalizing. And big industrial REIT customers (such as Amazon) have come out saying their need for industrial REITs will slow. This has had a big negative impact on Industrial REITs so far this year. For more information, we recently wrote up mortgage REIT, Stag Industrial, and you can read that report here.

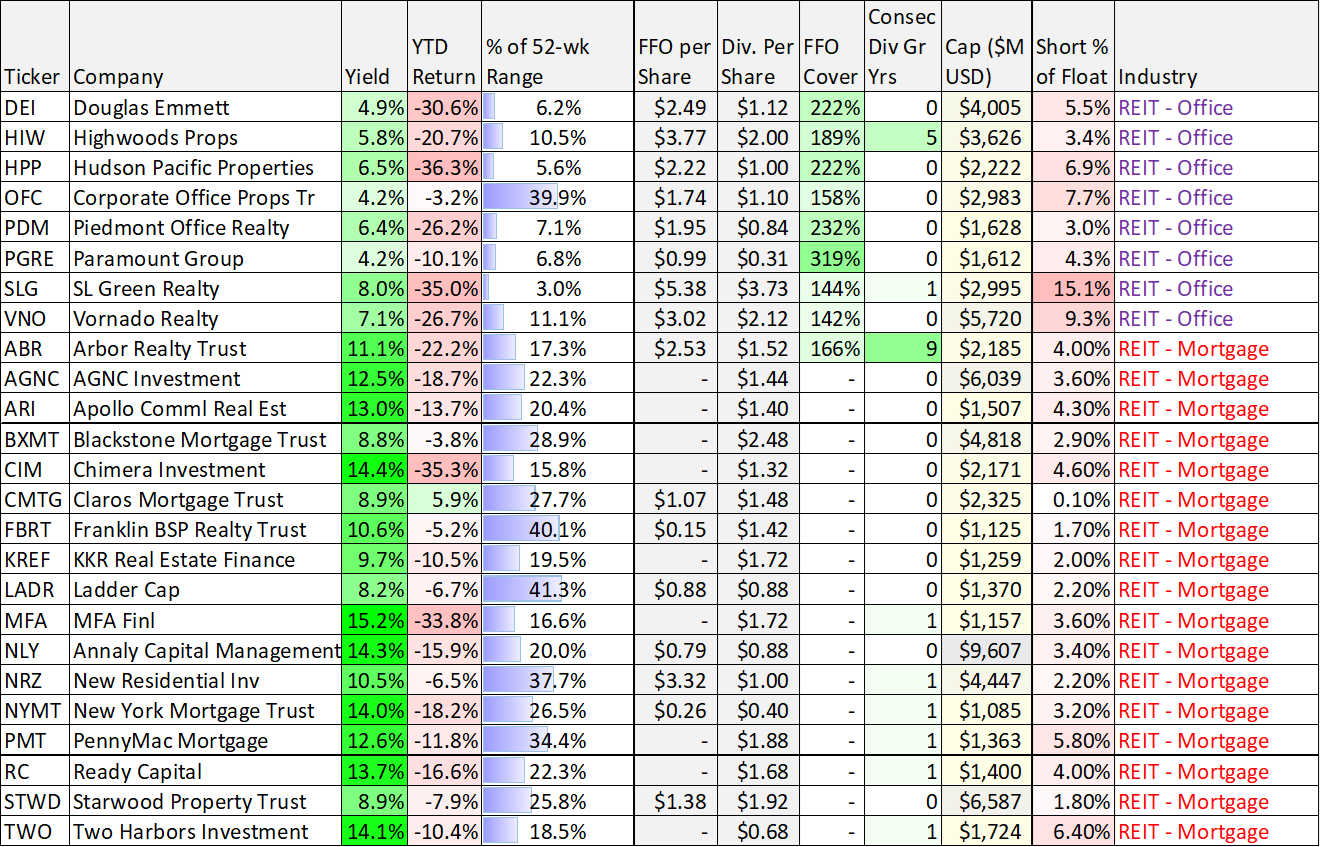

Mortgage REITs:

Another interesting trend has been the recent terrible (and highly volatile) performance of many mortgage REITs. Mortgage REITs use significant leverage (or borrowed money) to invest in mortgage-related assets (such as mortgage-backed US agency bonds) and they also use significant hedging to offset some of the risk. The problem with the hedging is that it is not perfect, and when interest rate expectation change dramatically (like they have this year) many of the hedges proves largely ineffective in the short-term (that’s what we’ve seen so far this year). However, as interest rates rise, that is actually a good thing for mortgage REITs in the long-term (because they earn higher returns on their investments), it’s just that it causes a lot of pain in the short-term (like we’ve seen so far this year).

Individual REIT Performance

You may also notice in the table that certain popular REITs have performed well this year, despite the broader market sell off. For example, we own shares of WP Carey and Realty Income in our Income Equity Portfolio, and both have weathered this year’s challenges well. For example, you can read our recent Realty Income report here.

The Bottom Line

There are a lot of big-dividend REITs that are down big so far this year—and that can grab the attention of income-focused contrarians. Be careful as not all REITs are created equally (in fact many of them are extremely different). We continue to own REITs as one part of our diversified long-term income-focused portfolio, the Income Equity Portfolio.