With the economy still barreling towards recession (courtesy of high inflation and interest rate hikes), the industrials company (focused on railcars) that we review in this report is attractive for a variety of reasons, including its stable cash flows, ongoing long-term growth potential, hard assets (book value), operational efficiencies, attractive current valuation and its 10+ year history of dividend growth (the current yield is 3.8%). We review all the details in this report, and then conclude with our opinion on investing.

Overview: Trinity Industries

Trinity Industries is a leading provider of rail transportation products and services in North America. It divides its business into two operating segments:

Railcar Leasing and Management Services Group: This segment provides railcar leasing alternatives and fleet management services designed to optimize the ownership and usage of railcars. Trinity is a top 5 leasing company with opportunities for market share gains.

Rail Products Group: This segment includes leading manufacturers of tank and freight railcars in North America, as well as Trinity’s maintenance business, its tank heads business, and its aftermarket parts business.

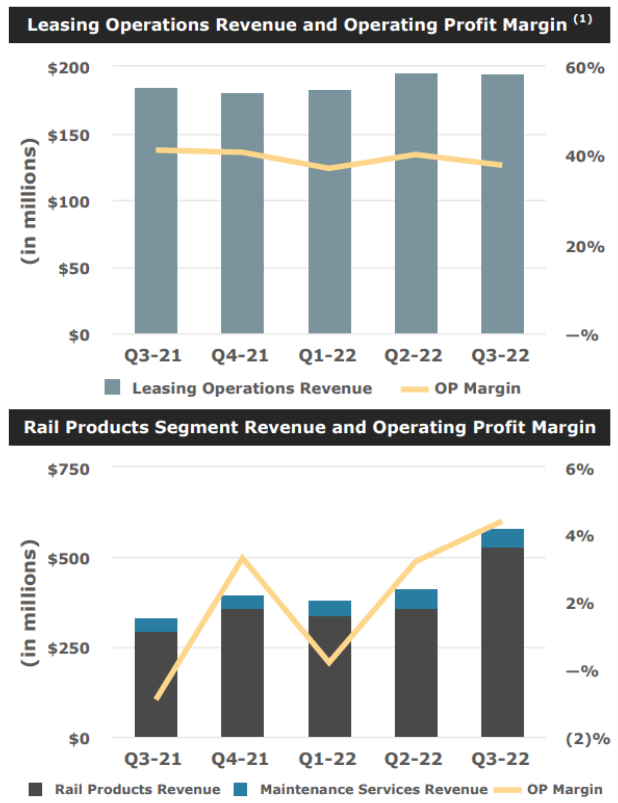

The Leasing segment has slightly less revenue, but higher margins.

In aggregate, the two segments work synergistically to form a unique rail platform that provides a single source for comprehensive rail transportation solutions to optimize customer ownership and usage of railcar equipment; it basically enhances the value-proposition of the rail modal supply chain.

Trinity’s leased portfolio includes ~108,000 railcars. And the business generates attractive recurring revenues as ~15- 20% of the portfolio renews each year (with historical renewal success of 74%).

Ongoing Long-Term Growth:

One of the reasons we like Trinity is because its stable cash flows will continue to grow over the long-term as the economy grows. Historically, Trinity’s growth has been highly correlated with GDP growth. And considering rail transportation remains a vital (and economically attractive) component of commerce in the US, we expect Trinity to keep growing over time. Here is a look at expected growth for the railcar industry in the years ahead.

Also important, Trinity’s “Future Lease Rate Differential” or FLRD was a positive 11% in the most recent quarter, which management believes bodes well and:

“is evidence that the market will continue to support solid increases and renewing lease rates. This is due to a higher fleet utilization in the quarter, 97.9% for our lease fleet, showing that demand remains high and available supply remains limited.”

Further, in the most recent quarterly update, Trinity announced:

“a six-year 15,000 railcar order, which drove our reportable third quarter backlog up to an impressive $4.1 billion and our book-to-bill ratio for the quarter was five times. This order increased our backlog by $1.8 billion.”

This also bodes well for the future of the business. Also worth mentioning, Trinity’s business is widely diversified in terms of transportation load types. For example, Trinity’s railcar portfolio reaches ~900 different commodities through ~270 railcar designs.

Lastly, Trinity recently announced the $70 million purchase of Holden (a manufacturer of market-leading multi-level vehicle securement and protection systems, gravity-outlet gates, and gate accessories for freight rail in North America). The acquisition is expected to:

“strengthen Trinity’s position as the leading manufacturer of autoracks in North America and allows the company to take advantage of an improving automobile end market.”

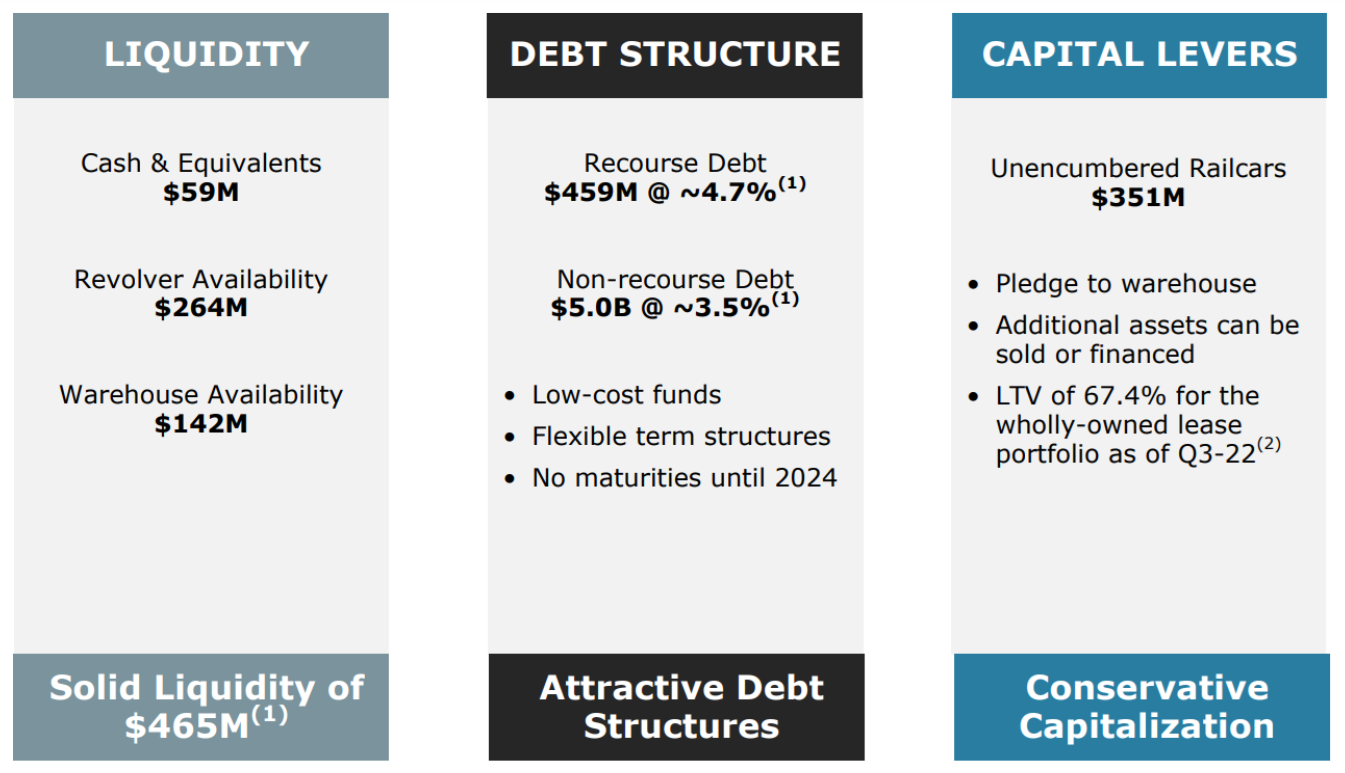

Healthy Balance Sheet

Another thing we like about this business is its significant book value and hard assets (which can act as a bit of an inflation hedge—attractive in the current environment, and over the long-term). For example, Trinity has significant access to liquidity, as described in the graphic below.

Noteworthy, Trinity recently completed $254 million railcar sale to Wafra, resulting in a gain of $25M. Assets on the company’s balance sheet create another liquidity level for the business.

Strong Cash Flows and Dividends

In addition to a strong liquidity position, Trinity continues to have a strong cash flow outlook, which will support the business, the dividend and ongoing shares repurchases. The company’s cash flow has been lumpy recently due to investments and some industry disruption (i.e. Covid and labor shortages), but management remains confident the investments will pay off and the industry will improve (as described previously).

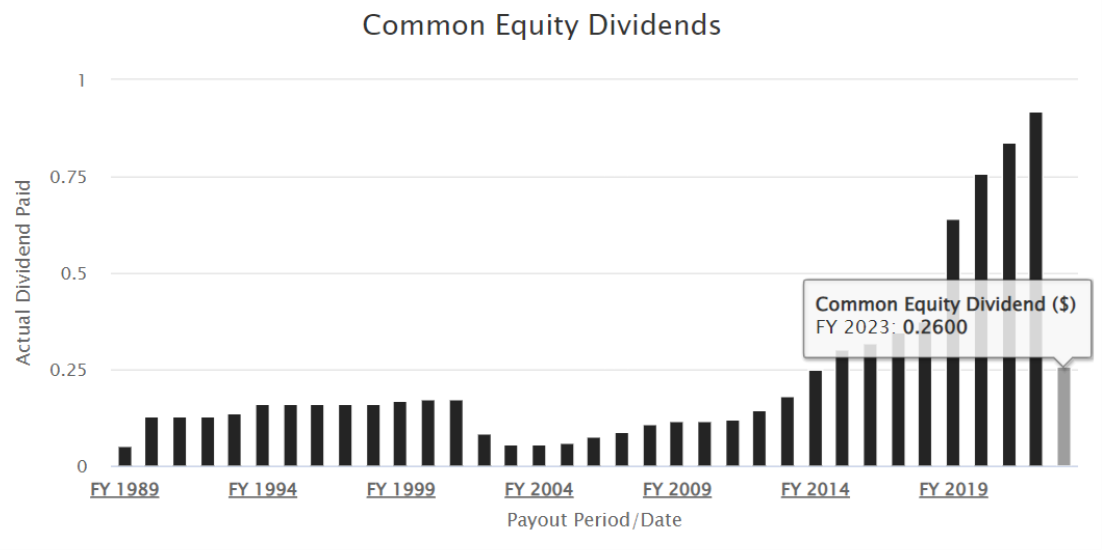

Further, Trinity has paid an annual dividend for 33 years straight, and has increased it for the last 12 years in a row. Currently, the quarterly dividend sits at $0.26 per share (an increase from $0.23 in each of the four quarters of 2022).

Further, Trinity has $34 million of remaining authorized share repurchases; they repurchased $14 million in the most recently reported quarter (an indication that the shares may be undervalued and as a way to return more cash to shareholders).

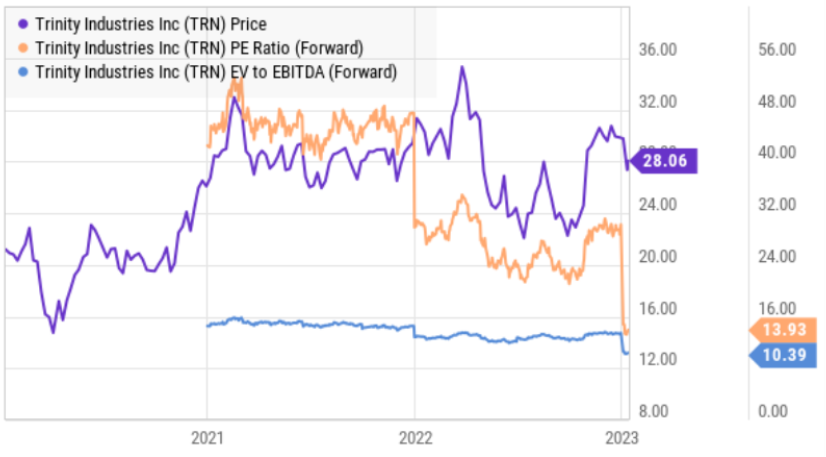

Attractive Valuation

Trinity currently trades at only 8.4x forward free cash flow expectations, and 10.4x EV/EBITDA (forward). And revenue and EPS are expected to grow significantly in the year ahead.

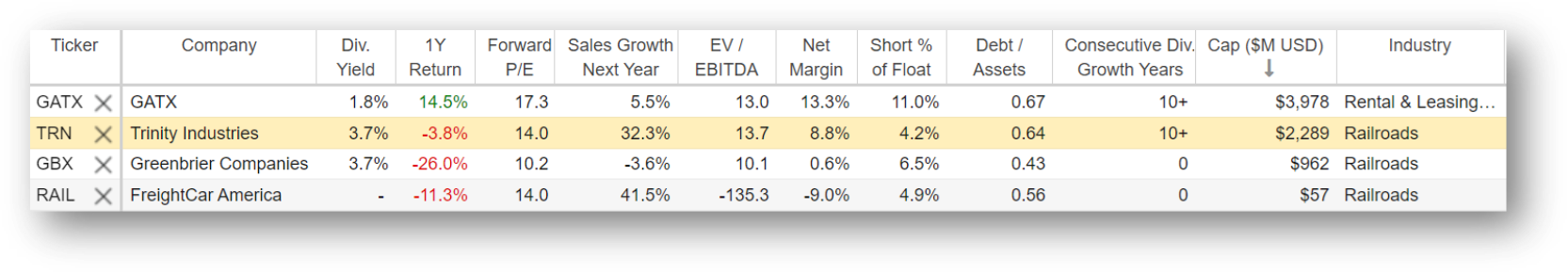

And these positive metrics exist in addition to the company’s recent positive earnings announcement. Further, Trinity compares favorably to competitors (see below).

Risks:

Of course, Trinity faces risks that should be considered. For example:

Macroeconomic Cycle: The market cycle remains a risk factor for Trinity. For example, as noted in the company’s recent quarterly report risk disclosures:

“Our business is subject to the demands of our customers and the broader economy, and we have particular exposure to the cyclicality of energy products, agriculture products, and consumer products.”

Credit Rating: investors should note Trinity’s “BB” credit rating from Fitch, which sits just below investment grade (an indication of risk for the company). However, considering the company’s ongoing growth prospects and financial strengths, we are comfortable with the rating.

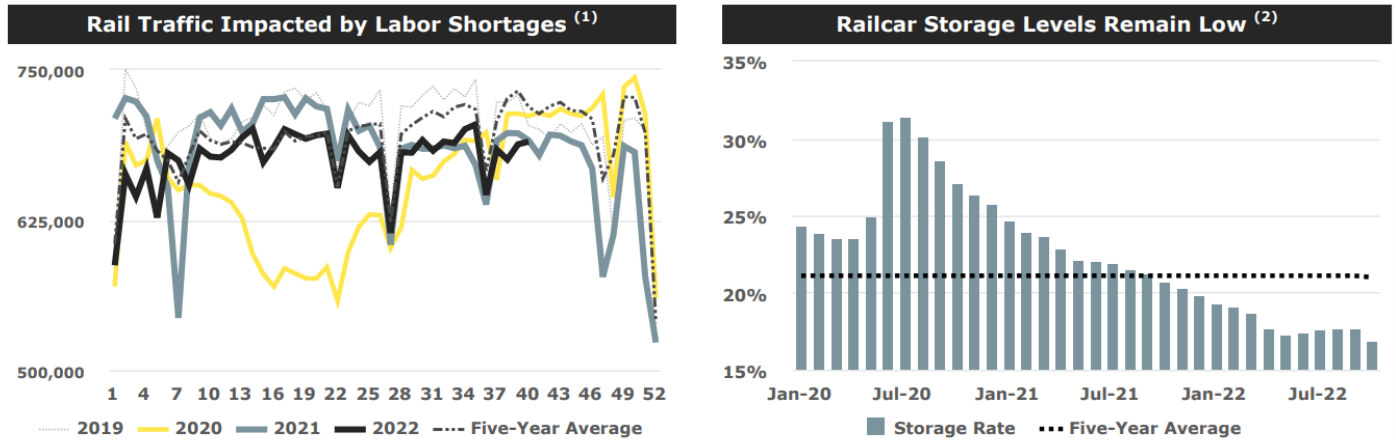

Labor shortages: As you can see in the chart below, rail traffic has recently been impacted by rail shortages, which ultimately impacts Trinity’s business.

However, the current low level of rail car storage also bodes well for Trinity (see above). Also, as management explained on the most recent quarterly call:

“While rail traffic is still impacted by labor shortages and service issues, we are starting to see some easing. Rail traffic is still below pre-pandemic levels, but we continue to see improvements in railroad headcounts and believe this is a needed step to support better rail service. There is no quick solution, but we are in full support of increased efficiency and service in the rail industry.”

Conclusion:

In our view, Trinity’s attractive qualities outweigh the risks. In particular, we believe the dividend is healthy and the business is positioned for gains (especially considering its growth initiatives, the long-term market growth potential and Trinity’s attractive share price—as compared to its value). If you are an income-focused investor (that likes dividend and share price growth), we believe Trinity Industries is absolutely worth considering for a spot in your prudently-diversified long-term portfolio.