You might think a stock yielding over 8% is a red flag (perhaps a company in distress), but the one we review in this report is surprisingly compelling if you are an income-focused investor. The industry is in a slow secular decline, but revenues and the dividend are set to keep growing steadily and the shares also appear undervalued. In this report, we review the business, consider the cash flows (including dividends and share repurchases), the valuation and the risks. We conclude with our opinion on investing.

Altria Group (MO): Overview

Cigarettes (mainly under the premium Marlboro brand) are the main driver of Altria’s earnings. However, the company also manufactures and sells cigars and pipe tobacco (mainly under the Black & Mild brand) and moist smokeless tobacco products (such as Copenhagen, Skoal, Red Seal, and Husky brands). Furthermore, Altria provides “on!” oral nicotine pouches, and has strategic investments in ABInBev (e.g. Anheuser-Busch), Juul (vaping) and Cronos Group (cannabis).

Altria sells its tobacco products primarily to wholesalers, including distributors; and large retail organizations, such as chain stores. Altria Group, Inc. was founded in 1822 and is headquartered in Richmond, Virginia.

Industry Overview and Competitive Advantages:

Altria and Philip Morris International (PM) are the main US-based tobacco companies. Altria was spun off from PM in 2008 as a way to protect the faster-growing overseas tobacco business (which is now PM) from potential US lawsuits. As mentioned, Altria operates mainly in the US-only and includes the additional brands and business segments as described above. Philip Morris USA (not to be confused with Philip Morris International) is one of Altria’s multiple operating companies.

Fortuitously, regulation in the US has helped create a seemingly insurmountable competitive advantage for Altria in the US tobacco and nicotine markets. For example, advertising is significantly restricted in the US making it very challenging for new entrants. Also, regulatory approval requirements make it difficult for competitors to launch new products, thereby essentially eliminating competition and eliminating the need for Altria to spend heavily on innovation. And of course nicotine (found in tobacco) is addictive, thereby keeping customer retention rates high.

And even though the US tobacco industry is in slow secular decline (more on this later), Altria is able to keep growing revenues in multiple ways. First, Marlboro (Altria’s main cigarette brand) is a premium brand and it has significant room to keep raising its prices steadily over time (the price in the US is still low relative to premium brands in other countries, and market studies show customer demand in highly inelastic to price). Additionally, Altria’s smokeless brands and investments have room to keep growing and to contribute more meaningfully to earnings over time. As you can see below, Altria’s revenues and cash flows keep growing.

Cash, Dividends and Share Repurchases:

Altria generates a lot of profits and free cash flow, and uses it to support its very large dividend as well as share repurchases. Interestingly, many other companies have much smaller dividend payouts (as compared to Altria) because they are retaining earnings and cash flow to innovate and to grow their businesses; however Altria doesn’t need to do much innovating (because there is not much competition, and customers are addicted to their products anyway). Furthermore, as the US cigarette industry is in secular decline (it’s expected to shrink by around 4% per year by some estimates), the shrinkage is more than offset by steadily increasing prices (Marlboro can keep steadily increasing its prices for a long time without losing customers) and by share repurchases. Altria continues to steadily buyback shares over the years, thereby reducing the number of shares it needs to pay dividends on (i.e. the share buybacks help increase earnings per share).

Also, critically important in the minds of some investors, Altria has grown its dividend payout every year for 53 years in a row! That is an impressive “flex” with regards to its powerful (and steadily growing) cash flow generation per share. And even more important, Altria is positioned to keep supporting and growing its dividend in the future.

Valuation:

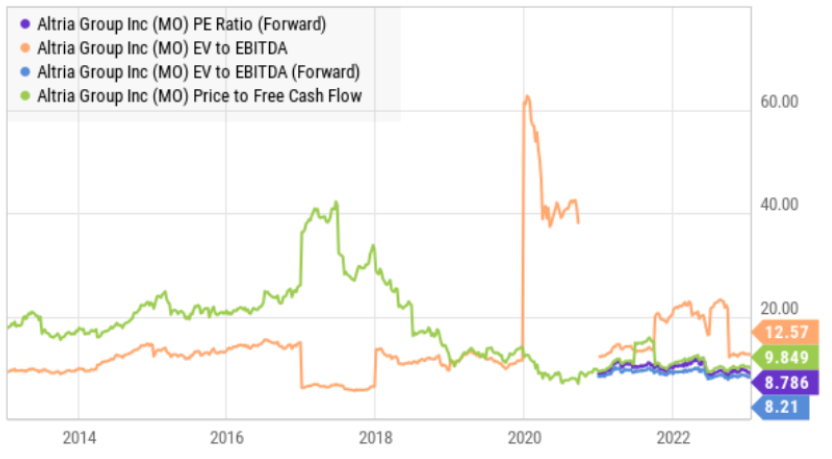

Altria currently trades at around 8.8x forward earnings and around 8.2x EV/EBITDA (forward). These are simply too low in our opinion. To put that in some perspective, the inverse of P/E is Earnings Yield (i.e. how much net income will you earn in a year compared to the price you pay for a share); Altria’s forward earnings yield is 11.4x—that’s a great return on investment—especially considering there is so little volatility to the business. In our opinion, Altria can easily trade at around 10x forward earnings and 10x EV/EBITDA, thereby creating a healthy margin of safety for investors.

Also noteworthy, Altria’s net profit margin is over 22% (impressive), and the price of the shares versus free cash flow per share is also compelling (see above).

Risks:

The biggest risks for Altria are those related to litigation, legislative or regulatory action. For example, here is what the company had to say in its annual report:

Unfavorable litigation outcomes could materially adversely affect the consolidated results of operations, cash flows or financial position of Altria or the businesses of one or more of its subsidiaries or investees and Altria’s ability to achieve its Vision.

Legal proceedings covering a wide range of matters are pending or threatened in various United States and foreign jurisdictions against Altria and its subsidiaries, including PM USA, as well as their respective indemnitees, indemnitors and Altria’s investees. Various types of claims may be raised in these proceedings, including product liability, unfair trade practices, antitrust, tax, contraband-related claims, patent infringement, employment matters,

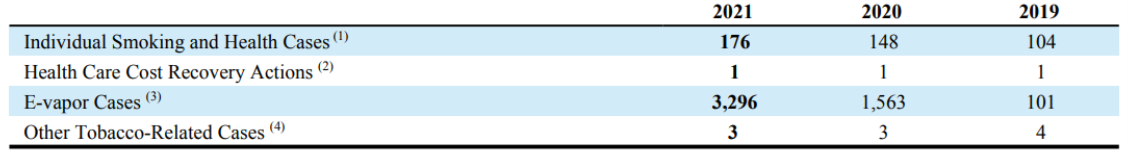

To add some perspective to this risk, here is a look at the number of certain tobacco-related cases pending in the U.S. against PM USA and/or Altria:

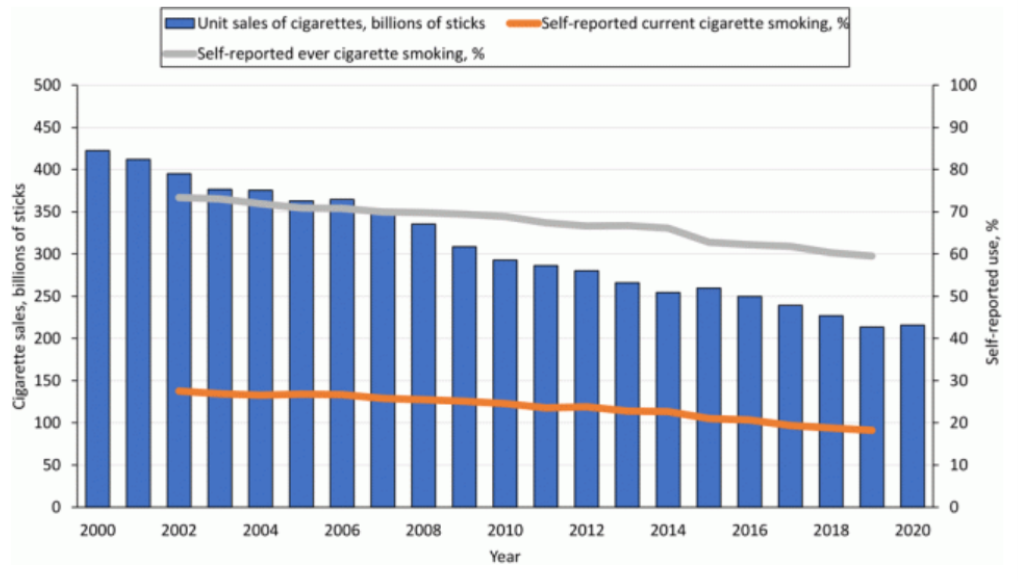

Another big risk is simply that the tobacco industry (Altria’s main business) is in secular decline as investor are increasingly averse to the health risks of the product. The following graph shows ongoing declines in US cigarette sales.

However, as mentioned, Altria’s revenues continue to grow as its premium product (mainly Marlboro) remains in demand and benefits from price increases (and the brand has continued room for price increases going forward, as compared to cigarette prices in other countries and the price inelasticity of demand for cigarettes). Furthermore, Altria continues to reduce shares outstanding (through ongoing share repurchase) thereby adding to earnings per share (all else equal). Further still, Altria’s new products and investments have the potential to contribute meaningfully to revenues and profits in the future.

Conclusion:

At the end of the day, Altria offers a very steady business and a very attractive 8.2% dividend yield (and the dividend has been increased for 53 years in a row!). And the business is positioned to keep growing the earnings per share and the dividend per share (plus the current share price offers some margin of safety as compared to the current valuation). The big risks, however, are a declining cigarette industry (which Altria offsets by raising prices on addicted customers, by buying back shares and by investing in wider future opportunities as described) and the risks of litigation and regulatory changes.

If you are an income-focused investor, Altria is absolutely worth considering—but if you are going to invest—we recommend doing so within a well diversified portfolio (to offset some of the Altria-specific risk factors). We believe that prudently-diversified long-term investing will continue to be a winning strategy.