We recently received an inquiry from a member about the popular JEPI ETF. Here is our response…

The JP Morgan Equity Premium Income ETF (JEPI) is popular because of its very large dividend yield (11.7%) which is paid monthly, and because it has performed significantly better than the S&P 500 over the last year (and with less volatility). And while JP Morgan’s marketing materials put a very positive spin on this fund (e.g. they know lots of buzz words to get the attention of investors), there are a few very important considerations investors need to keep on their radar. We review all the important JEPI details in this report, and then conclude with our opinion on investing.

JEPI Overview:

Per the fund’s summary prospectus, JEPI is:

“designed to provide investors with performance that captures a majority of the returns associated with the S&P 500 Index, while exposing investors to lower volatility than the S&P 500 Index and also providing incremental income.”

It currently offers an 11.7% yield (paid monthly). And for your information, the fund invests at least 80% of assets in stocks (mainly selected from the S&P 500) while also investing in equity-linked notes to employ a covered call option strategy which enhances income and lowers volatility (more on covered calls later in this report).

Further, JEPI uses an active stock selection process relying heavily on JP Morgan’s research to select attractive individual stocks (typically 90 to 120 positions) mostly from the S&P 500).

Also, the JEPI fund managers expect the fund to have about 35% less price volatility than the S&P 500 (something that can be very attractive to income-focused investors). This is accomplished through stock selection, and the covered call strategy employed by the fund.

JEPI’s Covered Call Strategy:

JEPI pursues its covered call options strategy by purchasing equity-linked notes (ELNs) which “combine equity exposure with call options.” JEPI uses ELNs (instead of writing its own covered calls) because option premium income is not considered bona fide income (it’s considered a gain and/or return of capital), whereas ELNs count as income thereby allowing the fund to produce its very high “dividend” yield. Other covered call strategy funds (that actually use covered calls instead of ELNs) generally report much lower yields, even though the income is similar (although taxed differently—more on this later).

If you don’t know, a covered call strategy is basically the most conservative options trading strategy whereby you collect upfront premium income by selling an out-of-the-money call option on shares you already own. For example, if Apple trades at $150, you may sell a covered call option with a strike price of $160 thereby giving someone else the option to call Apple shares away from you at $160 even if the share price rises to $170 (thereby giving you some share price appreciation potential, but capping that upside gain potential in exchange for the upfront option premium income you received). Essentially, the covered call strategy limits your upside potential in exchange for upfront premium income. The strategy also helps in down markets (like 2022) because your account value won’t fall as far because you will keep collecting that upfront option premium income (as long as you keep writing new call options).

Volatility Matters:

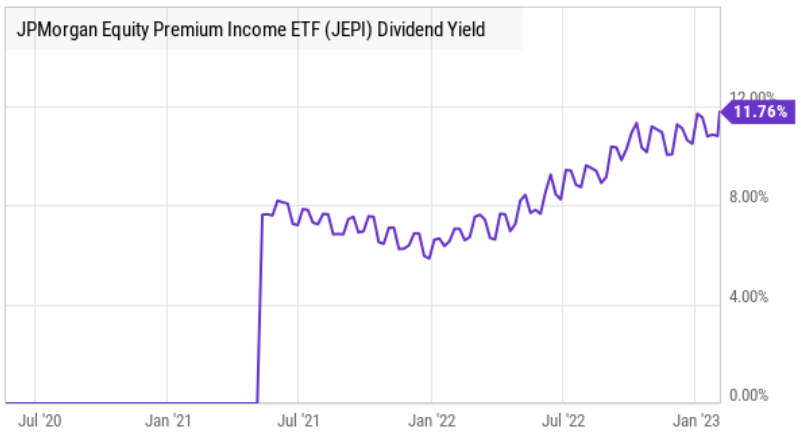

One of the brilliant things (from a marketing standpoint) about JEPI is that it makes more income when the markets are volatile because options premium income goes up when volatility increases (like it did in 2022). To put that in perspective, 2022 was a really good income year for JEPI because volatility was high (see JEPI’s dividend yield chart below), but in a more typical year the fund managers expect the dividend to be in the high single digits—not the 11.7% yield we see currently.

So the brilliant thing about JEPI is that it offered a low volatility strategy (the fund typically has 35% less price volatility than the S&P 500) at a time when market volatility was up (i.e. 2022) and it also offered a bigger-than-normal dividend yield at exactly the same time (a.k.a. a sales and marketing person’s dream when targeting high-income investors).

Important JEPI Characteristics to Consider:

In addition to the uniqueness of JEPI’s strategy, as described above, there are a few more very important things investors should consider, as described below.

Dividend Volatility: Worth repeating, and as pictured above, JEPI’s dividend is volatile. It was high in 2022 because volatility was up. We expect the dividend yield to typically be about half what it is now. As the fund managers described, they expect the dividend to typically be in the high single digits (so above 5% and below 10%, typically).

Weak Long-Term Performance: As compared to the S&P 500, JEPI will likely underperform by a very large amount (in terms of total returns: price gains plus dividends reinvested) over the long-term. JEPI can look really good in down years like 2022 because it was down less than the market (while it also paid huge income). But over the long-term, we expect the S&P 500 to rise (as the economy grows) and JEPI will absolutely underperform considering its covered call strategy limits its upside. Some investors are totally fine with this strategy, but others are in for a rude awakening a few years down the road of they don’t realize JEPI is going to underperform the S&P 500 by a lot over the long term.

ESG Considerations: As part of its investment process, JEPI seeks to assess the impact of environmental, social and governance (ESG) factors on many

issuers in the universe in which the Fund invests. To some investors this is a good thing; to others it is a distraction. Like other strategies, ESG investing goes in and out of favor. For example, it was very popular a couple years ago when JEPI was launched, but is falling out of favor with some investors (as some US states continue to sue large investment managers, such as BlackRock, over their ESG practices which arguably are a clear dereliction of their fiduciary responsibilities to investors). From a marketing standpoint, JP Morgan probably thought the ESG factor was a good marketing strategy when the fund was launched. As an investor, you need to know what is important to you.

Expenses and High Portfolio Turnover: The total expense ratio on JEPI is 0.35%—mostly reasonable for an ETF, but absolutely a detractor from your total returns as an investor. What’s more, the fund has a very high turnover ratio (recently 195%) which can add significant hidden and implicit trading costs that are not included in the total expense ratio. Here is how JEPI describes it in their summary prospectus:

“The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Shares are held in a tax-able account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal year, the Fund’s portfolio turnover rate was 195% of the average value of its portfolio.”

Taxes: Taxes are another important consideration. As you can see in the chart below, after tax returns for JEPI have been significantly lower than before tax returns (and all that high trading described earlier makes things worse).

Here is one way JEPI describes taxes in its summary prospectus (with regards to taxable and non-taxable accounts):

To the extent the Fund makes distributions, those distributions will be taxed as ordinary income or capital gains, except when your investment is in an IRA, 401(k) plan or other tax- advantaged investment plan, in which case you may be subject to federal income tax upon withdrawal from the tax-advantaged investment plan.

The Bottom Line:

In our opinion, JEPI is just an “okay” investment opportunity, but only if you are a unique high-income-focused investor. Our big caveats with this fund are don’t get mesmerized by all the amazing marketing points and buzz words this fund offers (such as “high-income” “low-volatility” “monthly payments”), and don’t chase after past performance. For example, 2022 was a good year for JEPI income and the fund went down less than the S&P 500, but going forward income will likely be significantly lower and the fund’s total returns will likely be significantly lower than those offered by the S&P 500 over the long-term. Depending on your own unique situation, you may be attracted to JEPI, but we have no intention of ever investing in JEPI.