The specialty REIT we review in this report focuses mainly on cell towers (it has a differentiated strategy versus peers). The dividend is well covered and has a steady history of increases. Further, the company is virtually guaranteed revenue growth from rent escalators, not to mention the growing secular trends of mobile data usage and the Internet of Things. Further still, the company is working to pay down debt and switch to more fixed rate (instead of floating rate) in order to defend its balance sheet and investment grade credit rating. We review all the details, and then conclude with our opinion on who might want to consider investing.

American Tower (AMT), Yield: 3.1%

Founded in 1995, American Tower, one of the largest global REITs, is a leading independent owner, operator and developer of multitenant communications real estate, with a portfolio of approximately 225,000 communications sites, including more than 43,000 properties in the United States and Canada and more than 181,000 properties internationally.

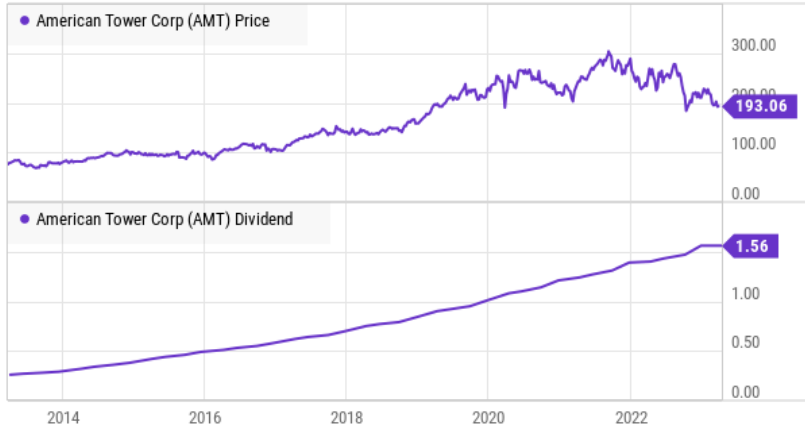

Price Appreciation & Well-Covered Dividend Growth

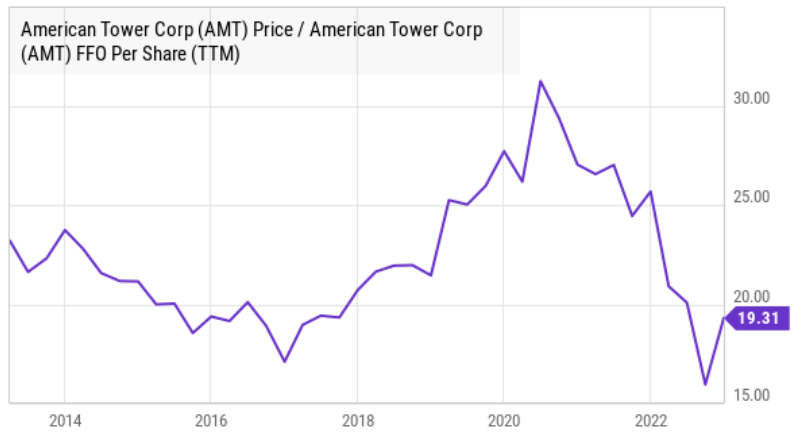

One of the main reasons many investors are attracted to American Tower is because of its long track record of price appreciation and dividend growth (it has increased its annual dividend for 10+ years in a row), as you can see in the chart below. In fact, some investors see the recent price dip as a potential contrarian buying opportunity (more on valuation later).

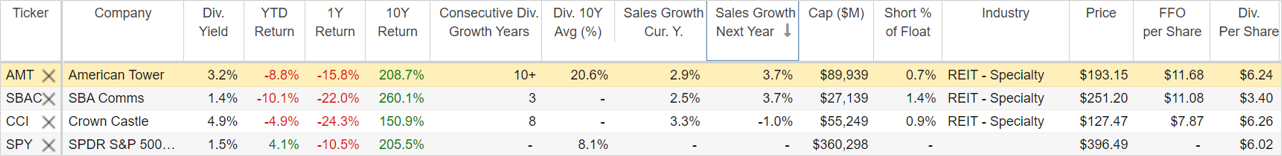

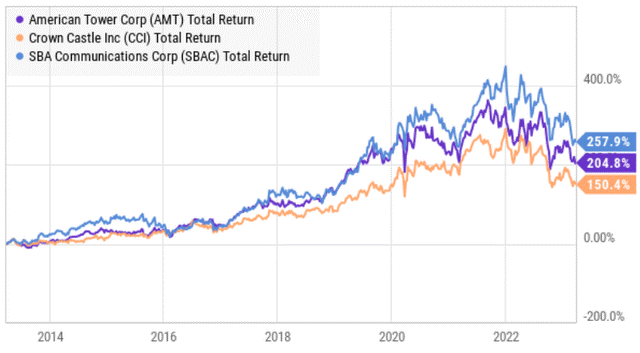

For perspective, on average, the dividend has grown 20.6% per year over the last 10 years, and the company is forecasting another 10% dividend growth in 2023. And when you combine the 10-year price return of AMT with dividends reinvested (i.e. the total return) AMT has held its own versus the S&P 500 (despite the recent steep price decline) as you can see in this next chart.

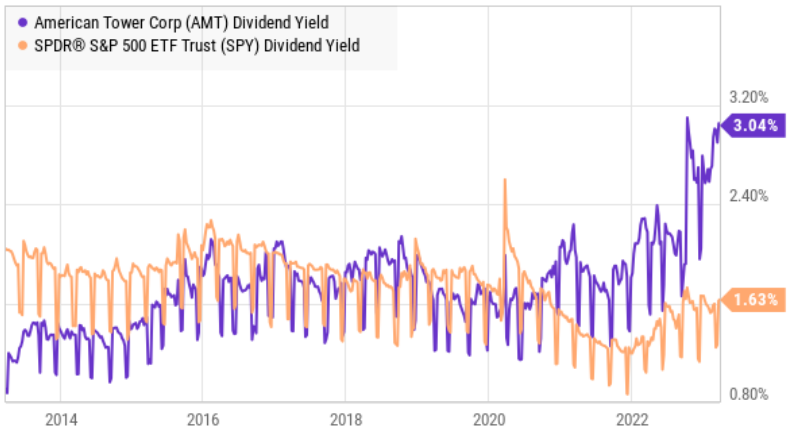

And AMT now yields significantly more than the S&P 500 (as you can see in the chart below), another reason some investors are attracted.

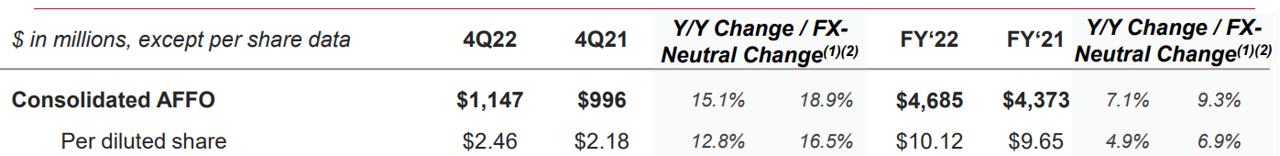

Importantly, AMT’s dividend is well covered by “adjusted” funds from operations (“AFFO”) and FFO (which was $11.68 over the last 12 months). Specifically, the forward annual dividend for AMT is $6.24 per share (well below FFO and AFFO)—a good thing.

Industry Growth:

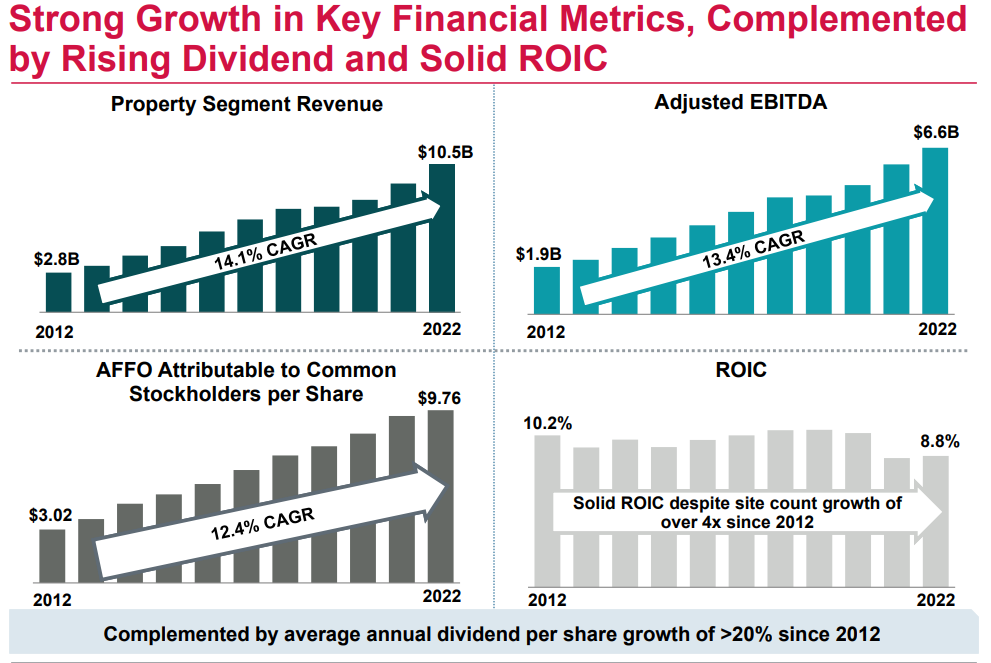

Another reason AMT is attractive to many investors is because of the ongoing (and steady) industry (and revenue) growth. For example, here is a look at how mobile data and smartphone usage is expected to grow.

And here is a look at how that growth has continued to benefit AMT’s financial performance.

And according CEO Tom Bartlett (on the most recent quarterly call), automatic “escalators added another 3%" [to North America revenue growth], consistent with historical trends” and “around 5%, while 6%” internationally. Not a bad business model.

Competition:

AMT’s largest competitor is Crown Castle (CCI). Crown Castle yields slightly more (its current dividend yield is 4.8%), and a different strategy. Specifically, CCI is focused mainly in the US (and thereby misses out on the international growth opportunities of AMT), and CCI is focusing on a “small cell” strategy. For example, according to a recent research note from Morningstar analyst, Matthew Dolgin:

“Crown operates exclusively in the United States and has aggressively invested in fiber to pursue small cell communications sites. We like the prospects for towers more than small cells and therefore prefer the businesses of Crown’s competitors [i.e. AMT].”

Readers can access our previous report on Crown Castle here.

Valuation:

For more perspective, here is a look at AMT’s current valuation versus peers.

For example, per the data in the table above, AMT trades at 16.5x FFO, whereas CCI trades at 16.2x and SBAC at 22.7x. Further, AMT appears in a stronger debt position considering its debt-to-assets ratio is only 0.70x versus 0.72x for CCI and 1.43x for SBAC (plus we appreciate AMT’s strategy over CCI, and AMT’s economies of scale and global exposure). Specifically, AMT’s broad strategy will allow it to benefit from growing mobile data and the Internet of Things for many years.

Risks:

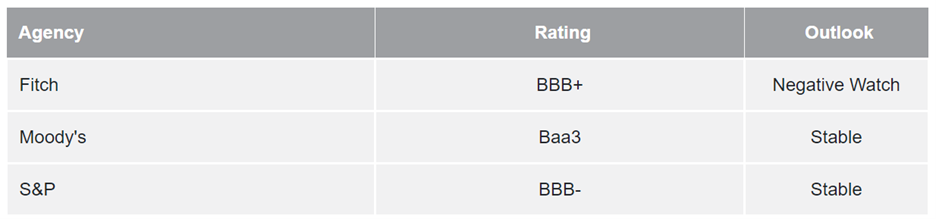

AMT’s significant debt load, especially in a rising interest rate environment, presents a significant risk. However, the company is aware of the risk, and working actively to improve their financial position. For example, as you can see in this next graphic, AMT has been improving its financial position with regards to net leverage, liquidity and fixed-versus-floating rate debt.

AMT currently has an “investment grade” credit rating, and per the latest quarterly call, the company explains:

“We remain committed to our investment-grade credit rating. And our priorities over the course of 2023 and into 2024 remain on deleveraging our balance sheet back down…”

Another risk factor is simply that many international markets simply don’t have the discretionary income to drive the explosive growth in mobile data usage as in the US, for example.

Further, AMT’s acquisition of CoreSite (a data center REIT) a little over a year ago creates new opportunities, but also integration and operational risks.

The Bottom Line:

In our view, American Tower remains an attractive investment opportunity considering its growing (and well covered dividend), combined with its reasonable valuation and ongoing secular growth and leadership position. Rising interest rates create a risk, especially considering the company is just barely hanging on to an “investment grade” credit rating, but AMT is committed to improving its debt position (and has the cash flow to successfully do so).

American Tower is not an aggressive growth stock, but it does have steady growth (and a nice growing dividend too), and this may be exactly what many investors are looking for (especially as we potentially head into a recession). If you are a long-term dividend-growth investor, AMT is attractive. We don’t currently own shares, but it is high on our watchlist, and we may add shares in the near future (and if we do buy, it will be in our Income Equity Portfolio).