The industrial sector business we review in this report continues to grow rapidly as it benefits from the solar energy secular trend. Specifically, it provides electrical balance of system solutions (for solar, battery energy and EV charging applications) to mainly engineering and construction firms. And its valuation is increasingly attractive, especially considering the competitive advantages of this highly profitable $3B+ market cap company. We review all the details, and then conclude with our opinion on investing in this rapidly growing business.

Shoals Technologies (SHLS):

Shoals Technologies Group, Inc. provides electrical balance of system (EBOS) solutions and components for solar, battery energy, and electric vehicle charging applications in the United States. More specifically, it produces EBOS components, including cable assemblies, inline fuses, combiners, disconnects, recombiners, wireless monitoring systems, junction boxes, transition enclosures, splice boxes, and wire management solutions. It sells its products principally to engineering, procurement, and construction firms that build solar energy projects. The company was founded in 1996 and is headquartered in Portland, Tennessee. Shoals Initial Public Offering (“IPO”) was in January 2021.

Disruptive Secular Growth

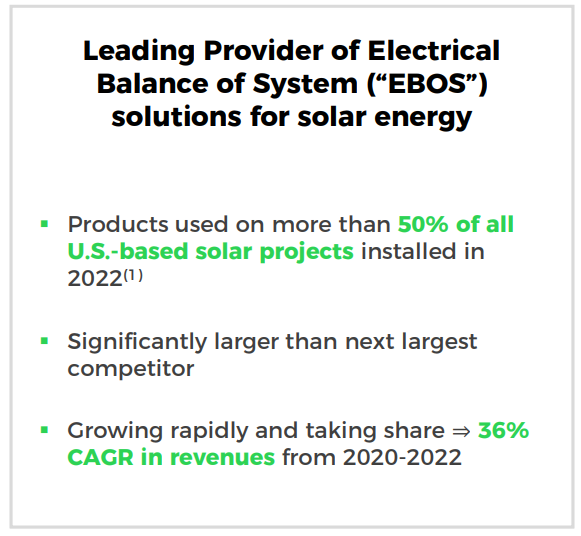

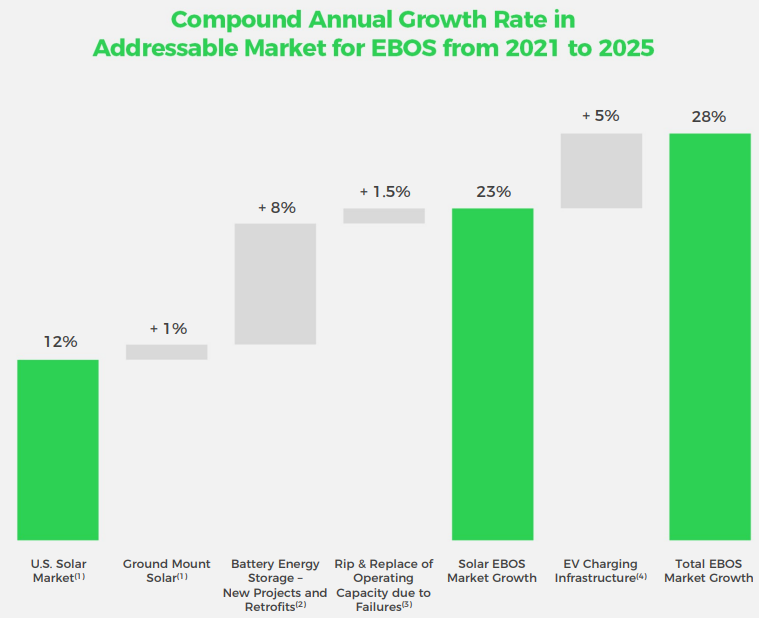

Shoals is positioned to benefit from the disruptive secular growth related to solar energy (as people increasingly look for viable alternatives and complements to fossil fuel). For example, solar is growing rapidly, but Shoals is growing even faster (as you can see in this next graphic).

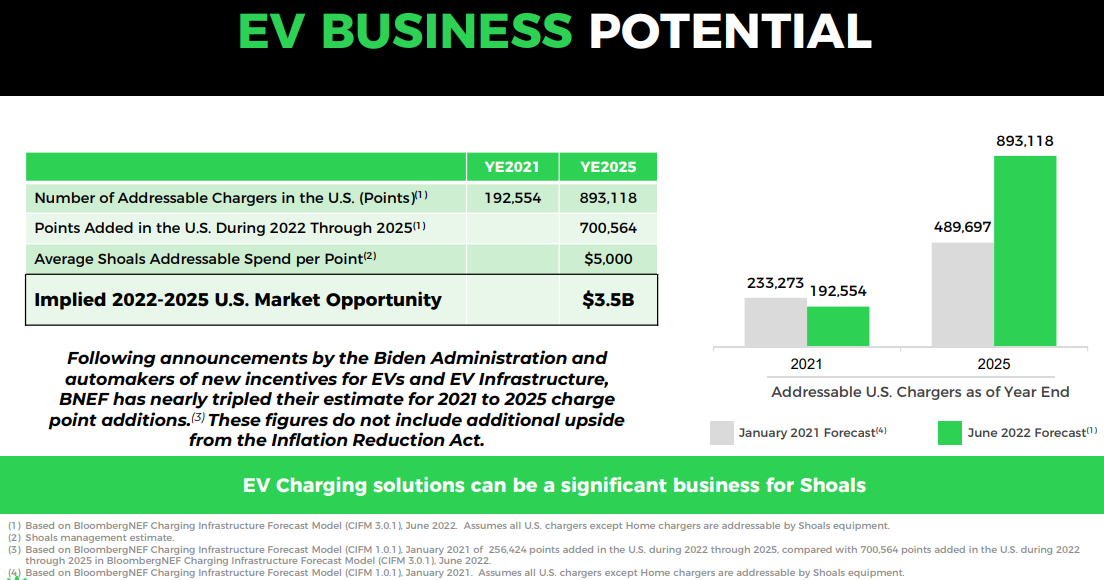

Further still, Shoals management is excited about potential growth related to the Electric Vehicle (“EV”) infrastructure space, especially including the “Inflation Reduction Act” and the latest Biden Administration incentives.

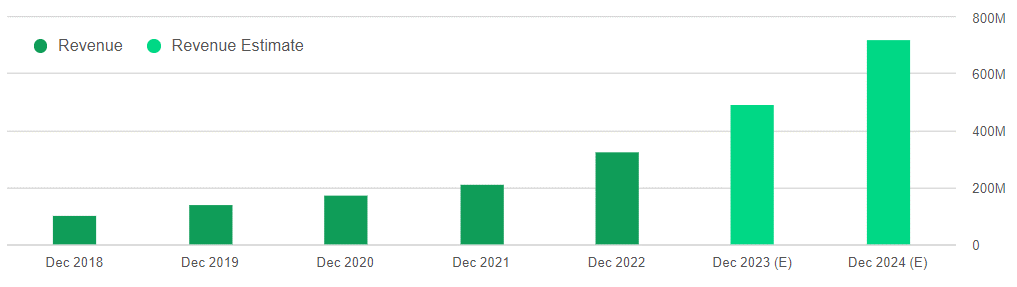

And for perspective, here is a look at Shoals recent and projected total revenue growth (i.e. it is very high—attractive!).

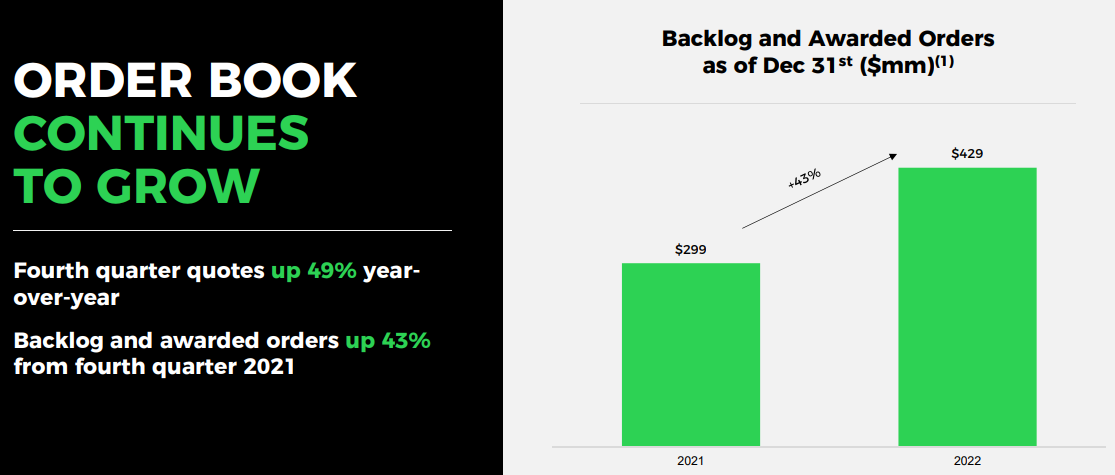

And the revenue growth is supported by a growing backlog of new orders.

Competitive Advantages

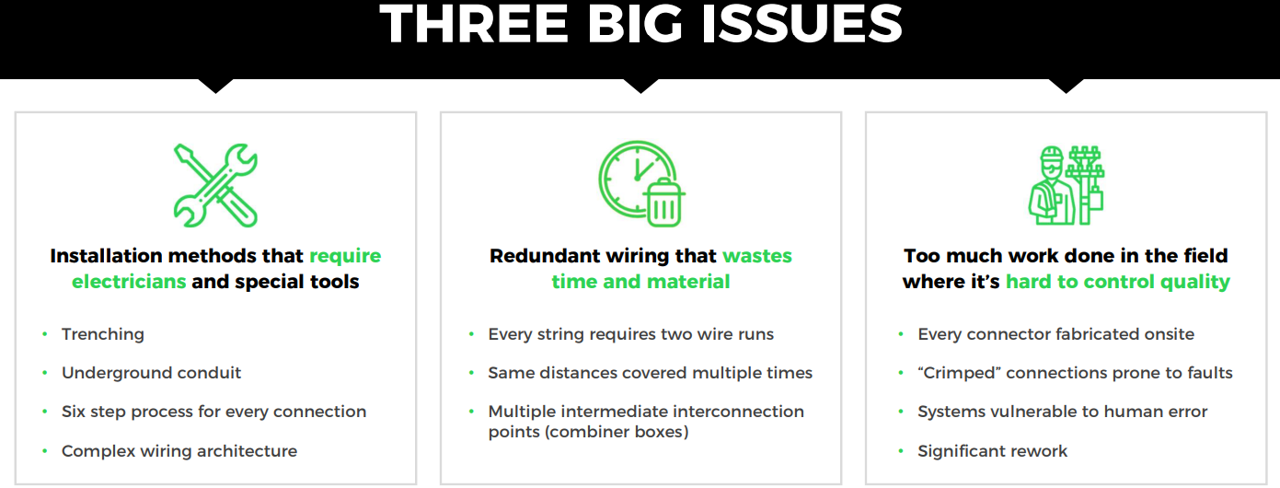

Shoals is the leader in the EBOS space (a space growing even faster than the overall fast-growing solar space, as described earlier), and Shoals has some distinct competitive advantages. First, to frame the EBOS space, it is a solution that is relatively inexpensive to buy, but then significantly expensive to install (as you can see in the graphic below).

However, and more specifically, Shoals has a competitive advantage in addressing the high expense of installing an EBOS solution (as described in this next graphic).

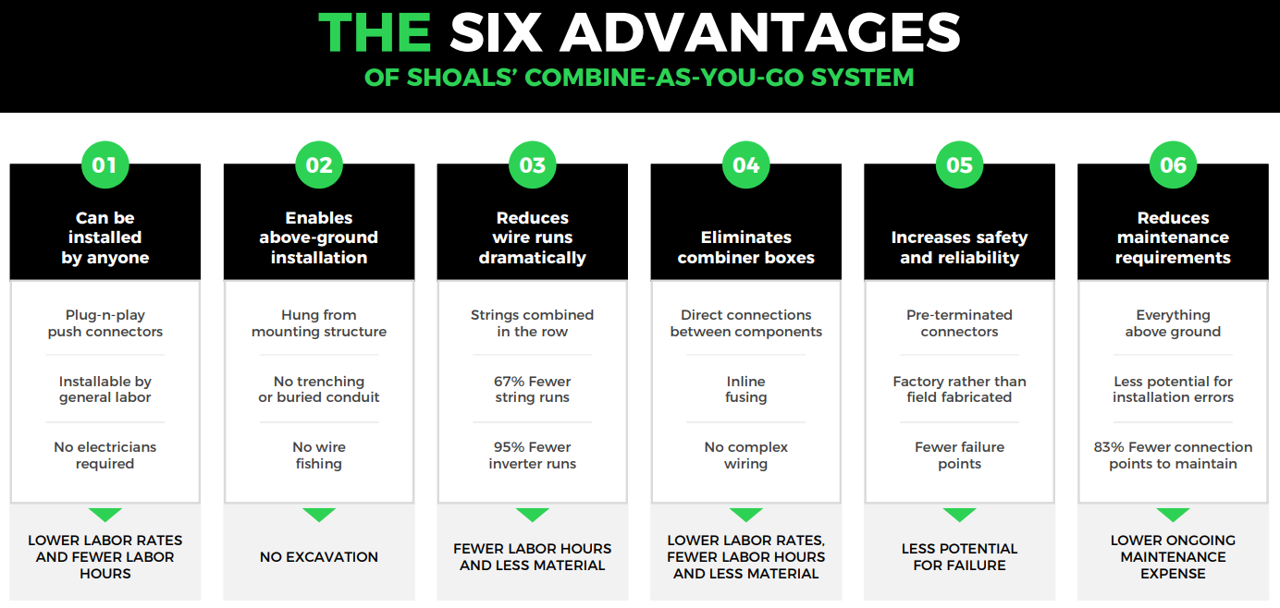

And Shoals has clear advantages over the competition in solving these big issues, through easy installation (no expensive electricians required), reduced materials, and lower maintenance, to describe a few (as described in this next graphic).

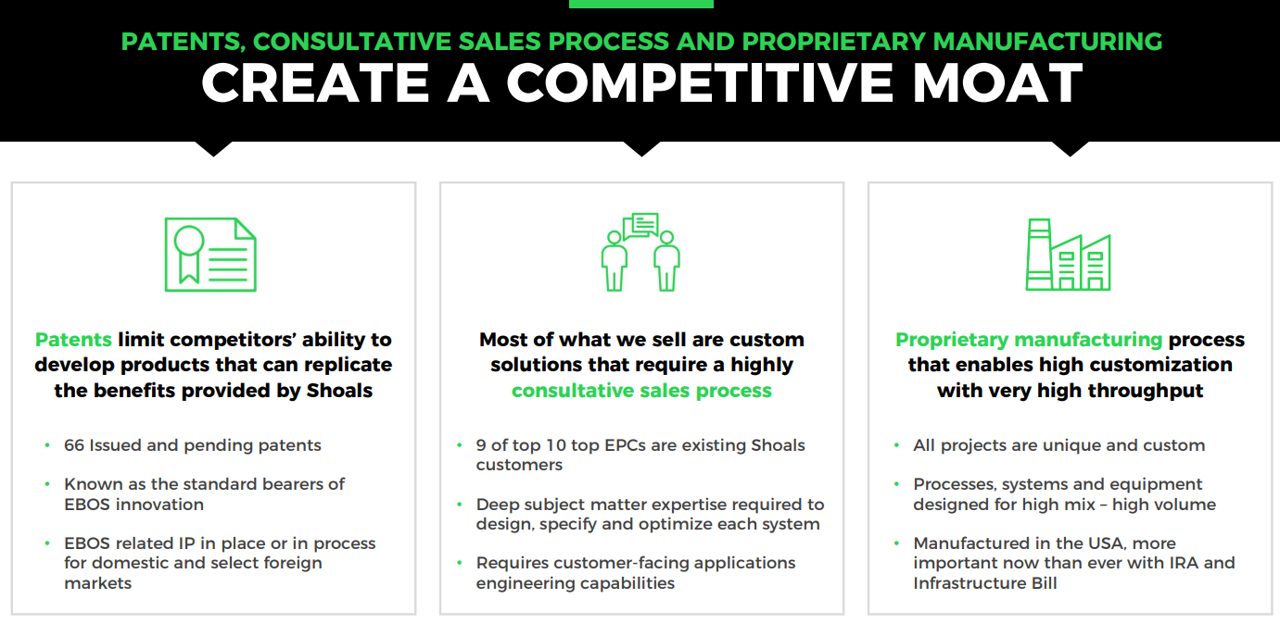

Further, Shoals believes it strengthens its competitive moat through patents, a strong consultative sales process and a proprietary manufacturing processes.

Valuation:

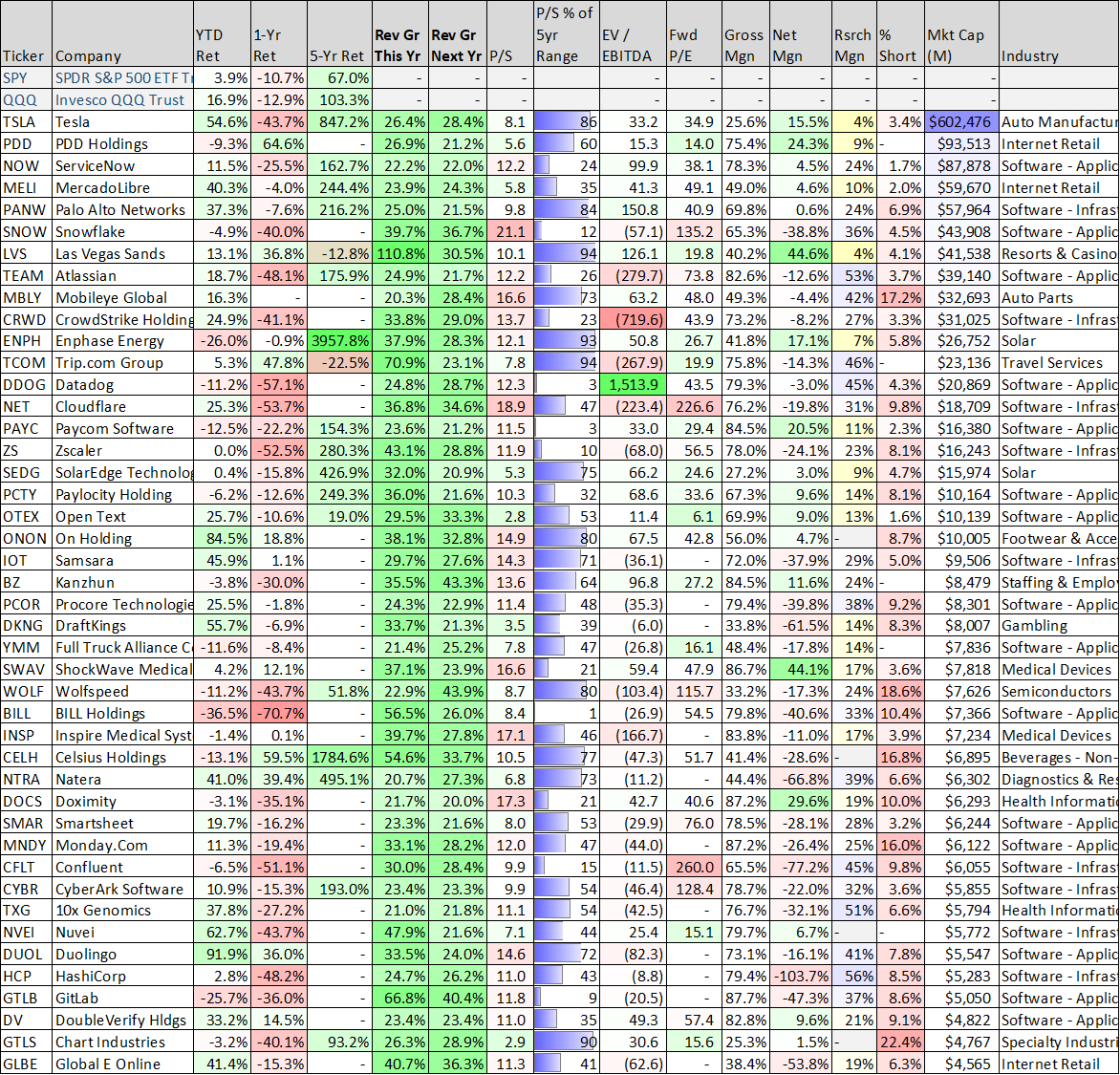

As compared to other high-growth stocks, Shoals stands out on a variety of metrics. For example, here is a look at 100 top growth stocks (those with at least 20% sales growth for this year and next), and Shoals stands out for its particularly high revenue growth (51% and 45%, respectively), plus the fact that it is already profitable (note: the table is sorted by market cap, so you’ll see Shoals on page 2 with a $3.6 billion market cap).

And not only is Shoals growing rapidly (into a secular trend with a large total addressable market), but it is doing so profitably (a good thing considering the increasingly challenging capital market conditions created by rising rates and recession fears), but the share price has pulled back a bit this year and the valuation multiples are low as compared to peers with similar growth rates (price-to-sales is 10.9x, and EV/EBITDA is 21.3x, far lower that some others with lower growth and no profits).

Risk Factors:

Of course Shoals does face a variety of risk factors. For example, many of the other top growth stocks on the list above are Software-as-a-Service (“SaaS”) companies whereby scalability is arguably much easier. For example, despite Shoal’s efficiencies and competitive advantages, every project is still custom and requires significant physical construction/manufacturing to produce. This helps explain why the valuation multiples are lower than some other high-growth companies (particularly those that are SaaS). However, in our view, Shoals shares are still priced dramatically too low.

Market cycle risk is another risk factor. For example, Shoals is a relatively new public company, and the shares have fallen since its January 2021 IPO. Specifically, Shoals IPO’d when the market for “high growth” was higher (arguably very good timing), but the shares have fallen significantly since then as growth stocks have fallen out of favor at this point in the market cycle. And as a higher-beta stock (with a lot of uncertainty about future growth), the shares can be volatile.

Regulation is another risk factor. For example, as shown in an earlier graphic, Shoals benefits from the relatively new “Inflation Reduction Act” as well as the new Biden administration incentives for EV's and EV infrastructure. However, political directions can and do change over time, thereby creating additional risks for Shoals.

Conclusion:

In our view, Shoals is an attractive business that is positioned to benefit from secular growth in Solar energy solutions. It’s already profitable, and is on an attractive trajectory to continue growing rapidly. That said, there are risks that make this a highly volatile stock to own, and if you are going to own the shares—we strongly recommend doing so within the constructs of a prudently-diversified, goal-focused portfolio. In fact, we just initiated a small position in Shoals in our Disciplined Growth Portfolio (and that addition will be reflected in the next monthly update to the portfolio holdings tracker sheet). Overall, be smart—stay disciplined and focused on your long-term goals.