We do NOT buy or sell often, but this is just a quick update to let readers know we have made two more new purchases (the second and third new buys this week). One in our Income Equity Portfolio and now a second buy this week in our Disciplined Growth Portfolio. We’ll be completing our monthly portfolio tracker sheet updates shortly after April begins, but wanted to let readers know right away of these two additional new purchases.

Disciplined Growth Portfolio:

1. Datadog (DDOG)

We purchased shares of Datadog (DDOG). Datadog is a very high growth “observability and security” platform for cloud applications. Specifically:

Datadog is a performance monitoring and security platform for cloud applications. It’s Software-as-a-Service (SaaS) solutions monitor data across the technology stack to help businesses secure their systems, avoid downtime, and ensure customers are getting the best user experience.

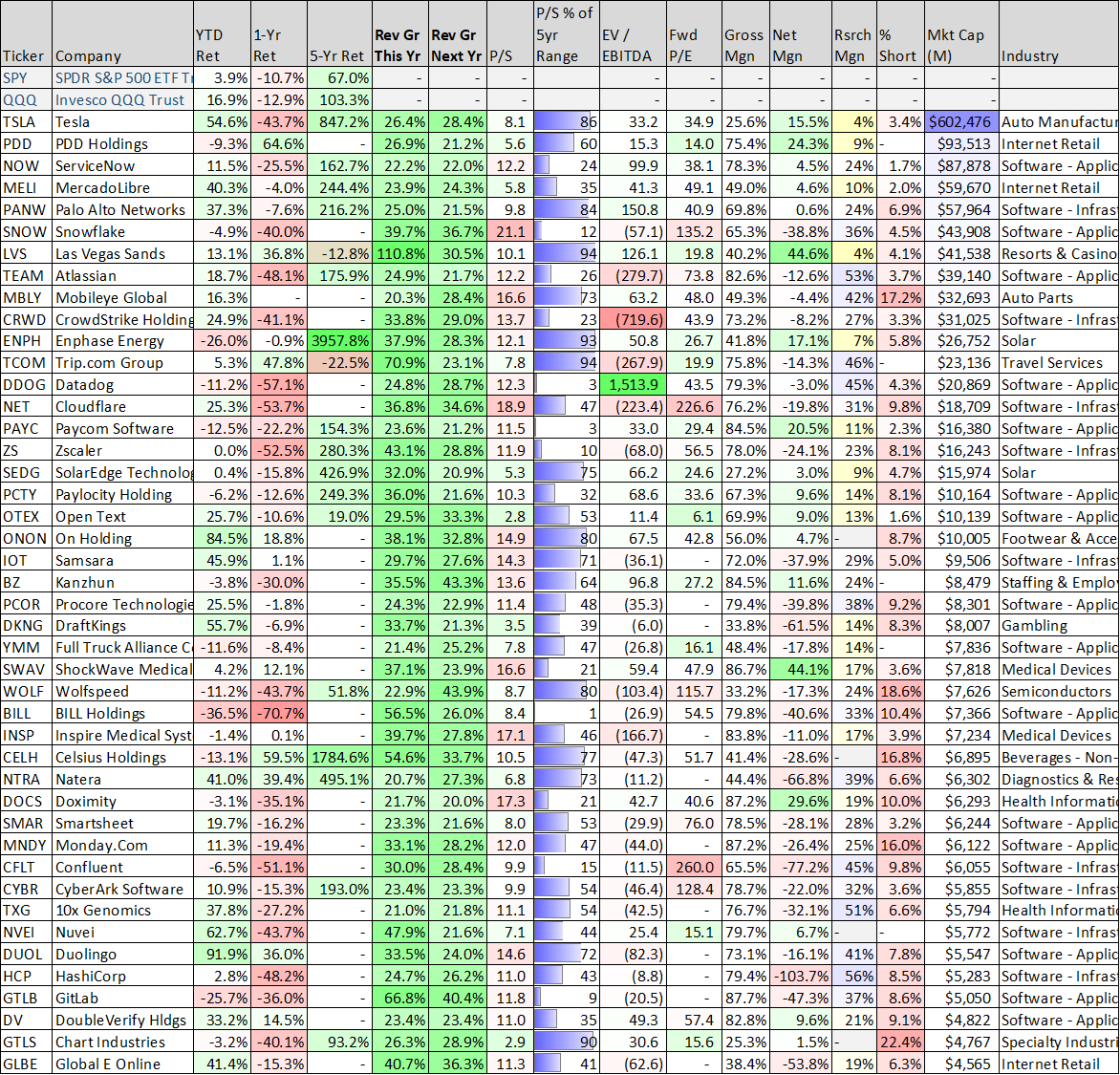

Datadog is a clear leader in a rapidly growing market, and the shares are now trading 65% below there all-time high in late 2021 (during the pandemic bubble). Unlike other high-growth stocks, Datadog has NOT rebounded at all this year as the company provided weaker than expected guidance. However, the high growth trend (and large TAM) are still fully intact. You can see current Datadog metrics in the table below (the table is sorted by market cap, Datadog’s is ~$20.9B), and you can read our previous Datadog report (from back in August) here. Datadog is not yet profitable, but that’s mainly because it keeps spending so heavily on research (see Research Margin in table below) to help it continue to be an industry leader and to help the company continue to capture the massive long-term growth opportunities ahead (from the cloud and digital revolution, that are still just getting started). We like Datadog’s market position, strategy, leadership, long-term growth opportunities, and the current valuation 12.3x P/S is compelling based on the massive growth opportunities ahead for this “high-renewal-rate” sticky software-as-a-service business.

2. Shoals Technologies (SHLS)

As a reminder, earlier this week we initiated a new position in a disruptive solar industry stock, Shoals, and you can read that report here.

Income Equity Portfolio:

3. Hercules Capital (HTGC), Yield: 12.0%

Hercules is a big-dividend BDC. The firm specializing in providing venture debt, debt, senior secured loans, and growth capital to privately held venture capital-backed companies at all stages of development from startups, to expansion stage.

Hercules shares have gotten caught up in the whole Silicon Valley Bank mess. Specifically, Hercules had an extensive working relationship with SVB (as both competitor and collaborative). As such, as SVB failed, panicked sellers sold Hercules, and the shares are now down significantly (and the yield is significantly high).

To be fair, the HTGC selloff is not exclusively related to SVB. The entire market cycle is at a point that does not favor earlier stage high-growth investments (such as the ones HTGC invests in).

We believe Hercules has the financial wherewithal to survive the market cycle, and may even benefit from the SVB demise (in some regards, it means less competition for HTGC).

We recently wrote up the BDC space in more detail (including extensive comments on Hercules, later in the report) and you can access that report here. And you can read our previous long report on Hercules here.

Overall, we’re using this low point in the market cycle to pick up shares of this attractive big-dividend BDC following steep share price declines.

The Bottom Line:

All of these purchases will be reflected in our monthly update to our portfolio tracking sheets shortly after the start of April. Importantly, the purchases an opportunistic and consistent with the portfolio strategies. We believe goal-focused discipline will pay off in the quarters and years ahead. Be smart—invest only in opportunities that are right for you and your own personal situation.