The company we review in this report provides a cloud-based data monitoring platform. The shares are out of favor (~50% below all-time highs) but revenue continues to grow rapidly, it is very sticky (land and expand) and this highly-ranked industry leader is supported by a massive secular trend (digitization and cloud migration). In this report, we analyze the company’s business model, its market opportunity, financials, valuation, risks, and then finally conclude with our strong opinion on whether the shares are worth considering for investment.

Datadog (DDOG):

Key Takeaways:

Land & Expand Strategy: Driving sticky growth through extensive platform capabilities.

Strong dollar based net retention rate and increasing product adoption reflect growing platform engagement.

Strong growth in customer base and revenue contribution by large customers provides revenue stability.

What sets Datadog apart is its comprehensive approach, providing a holistic solution

Healthy balance sheet with sequential improvement in FCF generation.

Ample room for upside as company moves forward in its growth evolution.

A PDF version of this report is available here.

Overview

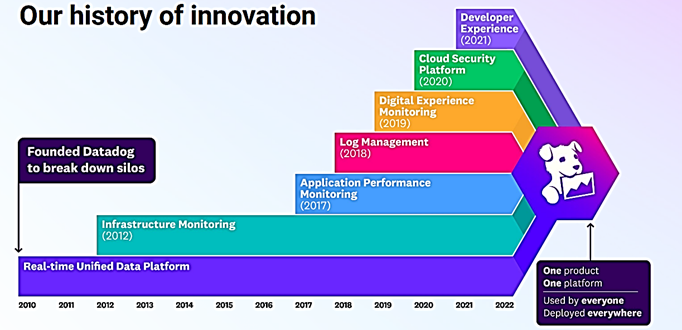

Founded in 2010, Datadog provides a cloud-based monitoring and analytics platform that helps organizations monitor their infrastructure, applications, and services in real-time. This Software as a Service (SaaS) platform delivers a unified solution for the complete technology stack for its customers by integrating and automating various capabilities (such as infrastructure monitoring, application performance monitoring, log management, real-user monitoring, and more).

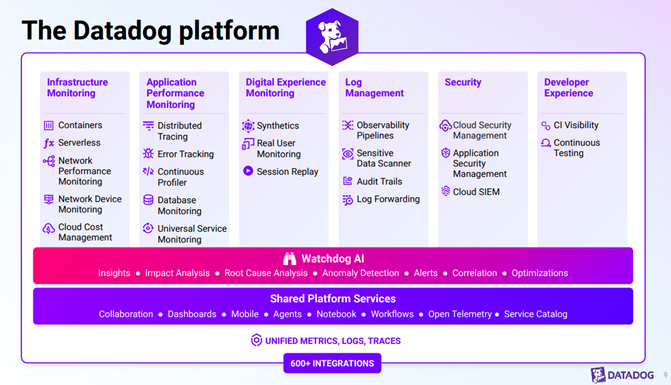

Datadog’s proprietary platform, which allows diverse data types from over 600 integrations, provides a holistic view of an organization’s infrastructure and application performance. Datadog's services are utilized by businesses of various sizes and across various industries and its platform plays a crucial role in facilitating the digital transformation and cloud migration efforts of its customers.

Source: Investors Presentation

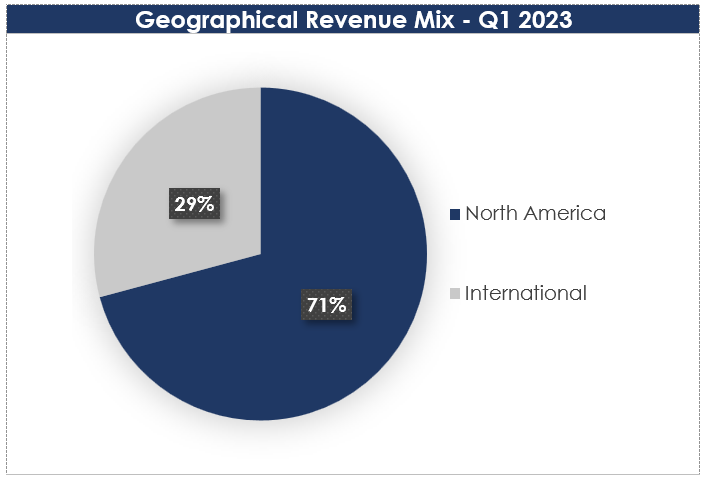

The company generates revenue primarily by selling subscriptions to customers who utilize its cloud-based platform. The subscription agreements typically have monthly or annual terms. Geographically, it derived 71% of its revenues from North America, with the remaining revenues come from other international markets (including Amsterdam, Dublin, London, Paris, Seoul, Singapore, Sydney, and Tokyo; plus plans to expand in EMEA and APAC) in Q1 2023 as shown in the chart below.

Source: Company’s 10-Q

Datadog's Land & Expand Strategy: Driving Sticky Growth Through a Comprehensive Product Portfolio

A “land & expand” strategy (such as the one used by Datadog) involves acquiring customers by getting them to make a small purchase and gradually increasing their commitment over time. It is closely tied to a company's product portfolio strategy, where additional products or services are introduced to expand customer engagement and meet a wider range of needs. This approach enables cross-selling and upselling opportunities, driving customer satisfaction and revenue growth.

Datadog (initially focused on only infrastructure monitoring) now offers a comprehensive monitoring and analytics solution for observability, security, and developer insights. Additionally, the company utilizes AI and machine learning to enhance its monitoring and observability capabilities, allowing customers to gain valuable insights from the vast amounts of data it observes.

The company’s business model prioritizes easily adoptable products for fast value delivery, driving innovation with a portfolio of more than 17 products. Its land & expand strategy, combined with its extensive product portfolio, gives it a competitive advantage over specialized competitors. By continuously expanding its product offerings and consistently delivering value throughout the customer journey, Datadog has successfully deepened its foothold within its existing customer base while attracting new customers.

Source: Investors Presentation

Strong Dollar-Based Net Retention Rate and Increasing Product Adoption Reflect Growing Product Engagement

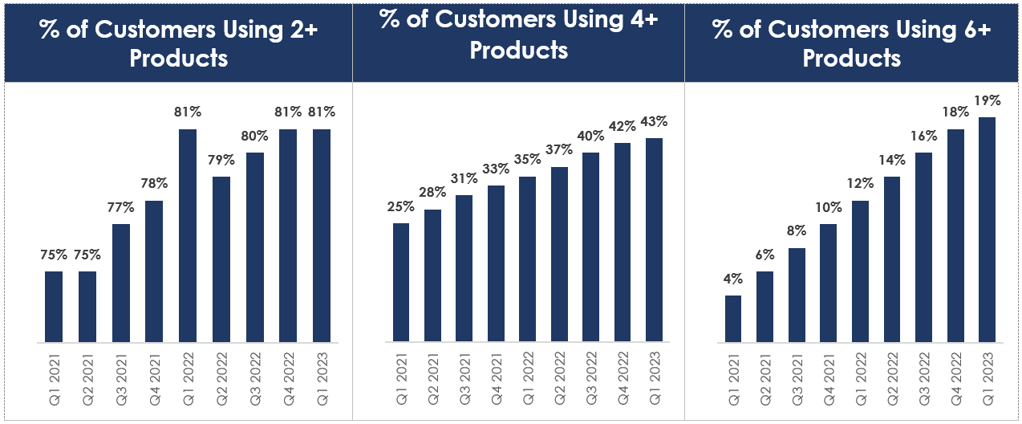

Datadog's dollar-based net retention rate exceeded 130% as of March 31, 2023, and March 31, 2022. This rate demonstrates the company's success in increasing product adoption, cross-selling, upselling, and customer loyalty. It signifies that the company’s revenue growth is not solely dependent on acquiring new customers.

In Q1 2023, approximately 81% of Datadog's customers used multiple products, indicating a higher level of engagement. Moreover, around 43% utilized more than four products (compared to 35% in Q1 2022), and about 19% used more than six products (up from 12% in Q1 2022), highlighting strong growth in product adoption. For example, you can view this data in the charts below.

Source: Investors Presentation

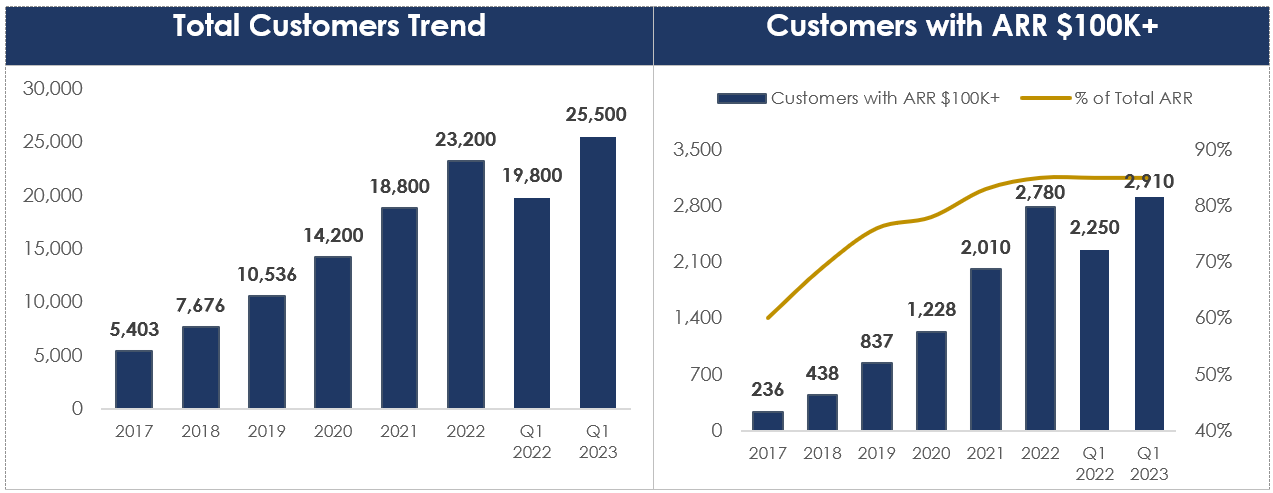

Strong Growth in Customer Base and Revenue Contribution from High-Value Customers Provides Revenue Stability

In Q1 2023, Datadog experienced substantial growth in its customer base, which reached approximately 25,500 compared to around 19,800 in Q1 2022. This increase reflects the growing demand for the company's products. Moreover, the number of customers generating Annual Recurring Revenue (ARR) of $100,000 or more rose to around 2,910 by the end of Q1 2023, compared to approximately 2,250 in Q1 2022. This demonstrates an upward trend in high-value customers and their increased investment in Datadog's offerings. It is noteworthy that the percentage of total ARR contributed by customers with ARR of $100,000 or more has increased substantially, rising from 60% in 2017 to 85% in Q1 2023. This strong revenue contribution from large customers provides stability during market fluctuations, as these customers are generally less impacted by short-term macro factors compared to smaller customers or Small and Medium-Sized Businesses (SMBs). This reinforces Datadog's position in the industry and enhances its ability to navigate market dynamics.

Source: Investors Presentation

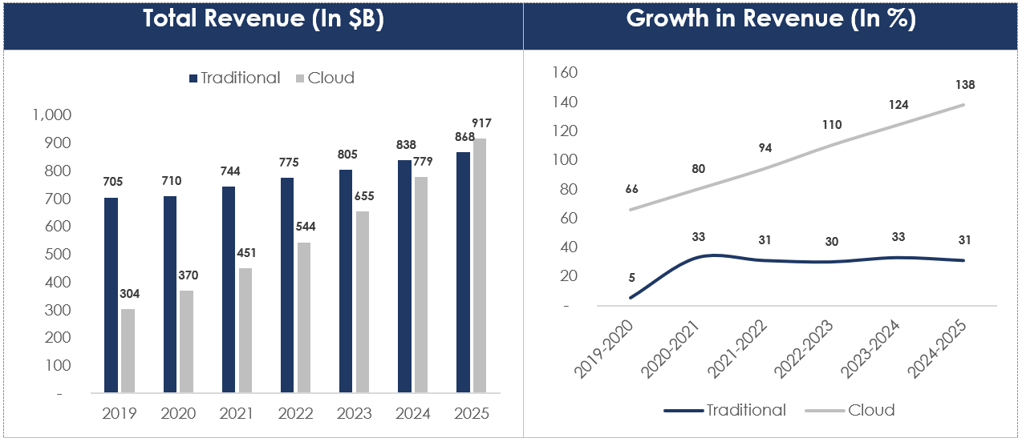

Embracing the Secular Tailwind of Digital Transformation and Cloud Migration in Growing Total Addressable Market (TAM)

Gartner estimates that more than half of Enterprise IT spending (within the application software, infrastructure software, business process services and system infrastructure markets) will shift to the cloud by 2025. The data suggests that approximately 51% of IT spending (or $917B in dollar-terms in the aforementioned markets) will transition from traditional on-premises solutions to cloud solutions. This represents a notable increase from the 41% recorded in 2022. And as the trend towards cloud adoption continues to accelerate, Datadog is well-positioned to benefit from this paradigm shift and meet the increasing demand for its cloud-based offerings.

Source: Gartner

The company’s platform is well-positioned to seize a significant share of the IT Operations Management market, which is projected to reach a value of $62B by 2026. The company acknowledges that a considerable portion of this market comprises legacy on-premise and private cloud setups. However, it believes that the estimate doesn't fully account for the potential in modern multi-cloud and hybrid cloud environments. With a platform specifically tailored to address both legacy and modern setups, Datadog demonstrates its readiness to meet the evolving demands of IT Operations Management across diverse cloud environments.

Source: Investors Presentation

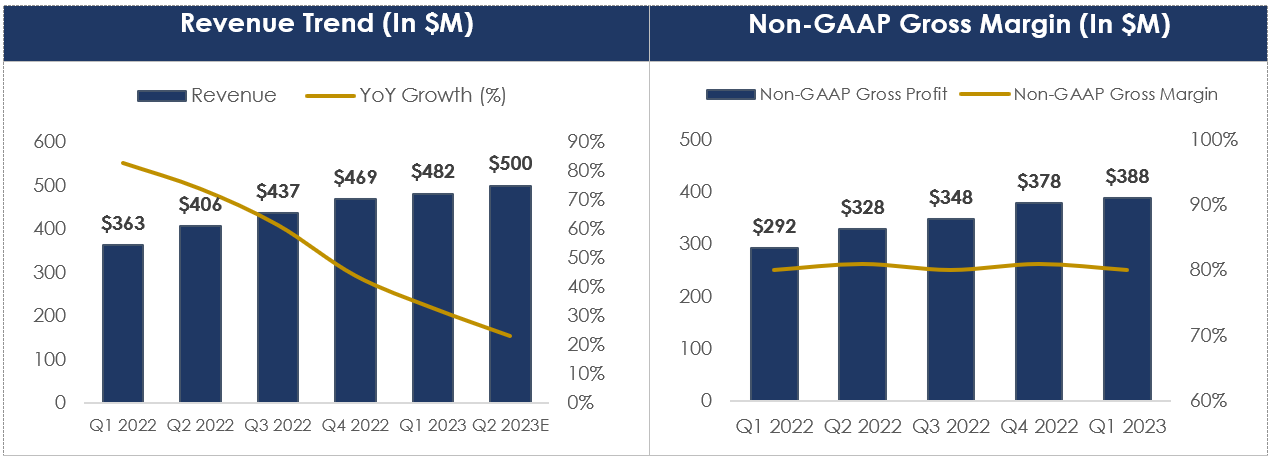

Prioritizing Revenue Growth Over Profit Margins to Expand Platform Capabilities

In Q1 2023, the company’s revenue grew 33% YoY to $481.7M, driven by a combination of an expanding customer base and increased adoption of multiple products. Notably, 65% of this growth was attributed to expansion from existing customers, while the remaining 35% stemmed from the addition of ~5,700 new customers in Q1 2023. Additionally, the Remaining Performance Obligations (RPOs) grew 33% YoY in Q1 2023 to $1.1B, indicating a strong revenue pipeline.

On the profitability front, non-GAAP gross profit increased 33% YoY to $387.6M in Q1 2023. However, the gross profit margin remained steady at 81% led by revenue growing in proportion to the growth of third-party cloud infrastructure provider costs to facilitate more customers on the platform.

Source: Company Filings

In Q1 2023, the company's non-GAAP operating profit showed modest YoY growth of 3%, reaching $86.4M. However, the operating profit margin experienced a decline of 500 basis points (bps) YoY, dropping from 23% in Q1 2022 to 18% in Q1 2023. This decrease can be attributed to higher Research and Development (R&D) spending. Datadog has been increasing its R&D spending to expand its platform and product capabilities, given its early stage in the business cycle. In fact, the percentage of non-GAAP R&D expense to revenue has grown from 27% in 2018 to 31% in the Trailing Twelve Months (TTM) ended March 2023, highlighting significant investments made by the company.

On the other hand, non-GAAP Sales & Marketing (S&M) expenses as a % of revenue have experienced a steep decline, from 44% in 2018 to 25% in the TTM ended March 2023, showcasing Datadog’s success with its land & expands strategy, along with the extensive capabilities of its product portfolio, driving word-of-mouth presence.

Source: Company Filings

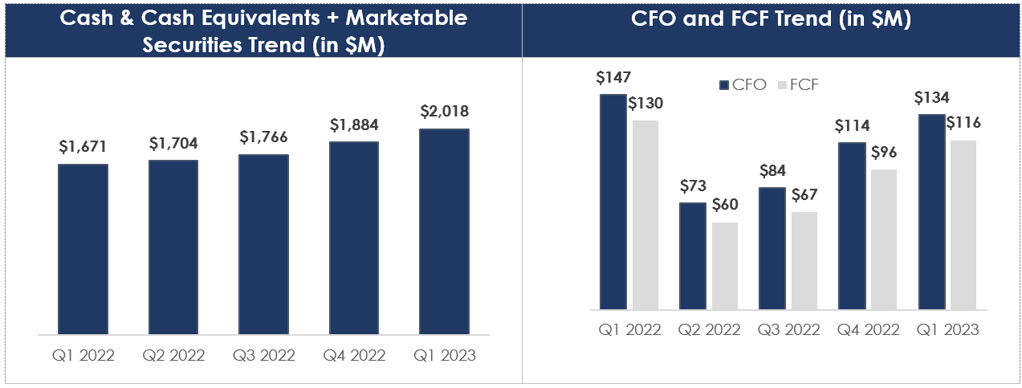

Healthy Balance Sheet with Sequential Improvement in Free Cash Flow Generation

Datadog's liquidity position at the end of Q1 2023 was strong, with $2.0B in total, consisting of $223M in cash and cash equivalents, as well as $1.8B in marketable securities. Importantly, the company had no significant long-term debt, giving it flexibility for future investments and growth initiatives.

In terms of cash flow, the company experienced a 9% YoY decline in Cash Flow from Operations (CFO) in Q1 2023, amounting to $133.8M compared to $147.4M in Q1 2022. This decrease was primarily due to lower profitability during the period. Free Cash Flow (FCF) also declined by 10% YoY in Q1 2023, reaching $116.3M compared to $129.9M in Q1 2022. Despite the decline, the company's liquidity position and absence of major long-term debt provide a strong foundation for financial stability and growth.

Source: Company Filings

Valuation

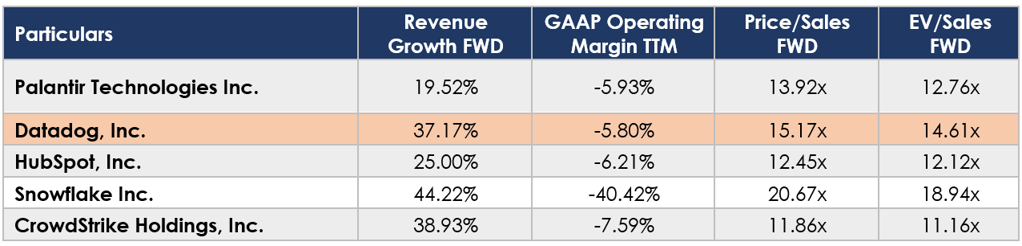

Despite experiencing a 32% year-to-date increase, the company's stock is still nearly 50% below its all-time high in 2021. While the near to medium-term macroeconomic conditions remain uncertain due to concerns such as rising rates and potential recession, the company's sticky platform, along with a substantial revenue contribution from large customers, provide a safeguard against evolving challenges. In terms of valuation, the company's forward sales multiple is currently at 15x, which is in line with its peers but represents a significant discount compared to its 5-year average. Overall, we believe the risk-reward ratio is attractive for investors.

Source: Seeking Alpha

Risks

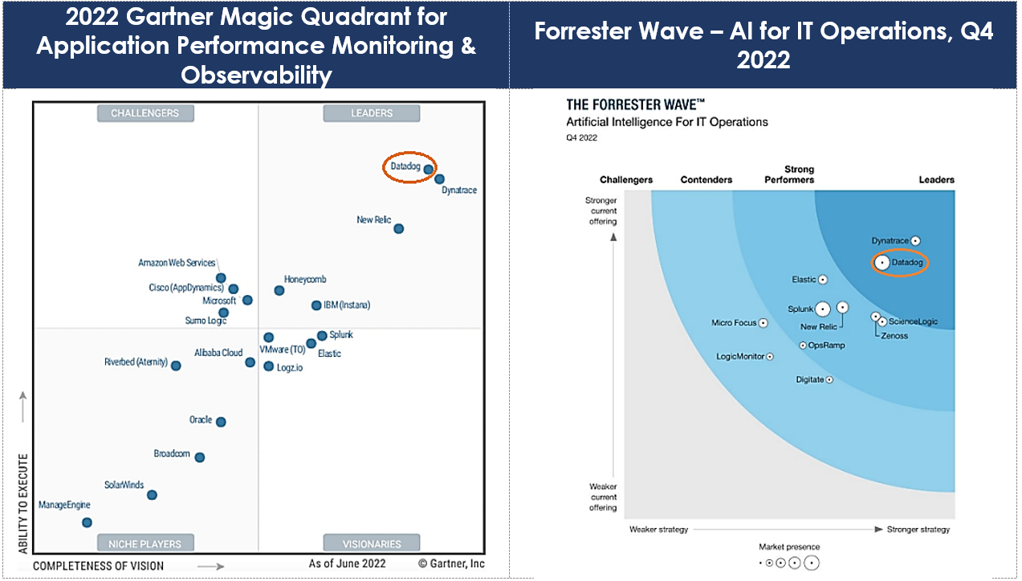

Intense competition: The global market for monitoring and analytics has been fiercely competitive for many years, with each company offering its distinct features and strengths to meet the diverse needs of customers. Datadog faces competition from industry giants like IBM, Microsoft Corporation, SolarWinds Corporation, Cisco Systems, as well as New Relic, Dynatrace Software, Splunk, Elastic N.V., Amazon (specifically, Amazon Web Services), and Google (for Google Cloud Platform). Despite this intense competition, Datadog has been recognized as a leader in the industry by both Gartner and Forrester. In recent reports, Datadog was ranked as a leader in Application Performance Monitoring and Observability by Gartner, and in AI (artificial intelligence) for IT operations by Forrester. These rankings highlight the company's strengths and its ability to provide effective solutions to meet customer needs in a competitive landscape.

Source: Investors Presentation

Conclusion

Datadog is well-positioned for long-term growth, leveraging its effective land and expand model, robust platform capabilities, and strong customer retention. These factors enable the company to capitalize on the ongoing secular digital transformation trend. Despite being a high-growth technology company, Datadog has also maintained a solid balance sheet with minimal debt and a strong cash flow generation profile.

Again, there may be some near-term uncertainties regarding recessionary concerns (which could impact revenue growth and margins), but Datadog's financially strong customer base and comprehensive platform capabilities provide a foundation for resilience and long-term success. We view this as an attractive opportunity for patient, long-term investors.