The DNP Select Income Fund (DNP) is an income investor favorite, offering a steady monthly distribution (current yield: 7.6%) by investing in utility sector stocks and investment grade bonds (both known for safety and stability). However, the shares currently trade at a large 23.2% premium to the fund’s net asset value (“NAV”). In this report, we review the strategy, the leverage, the distribution, the distribution reinvestment plan and the performance. We conclude with our opinion on whether this fund is worth considering for investment, or not.

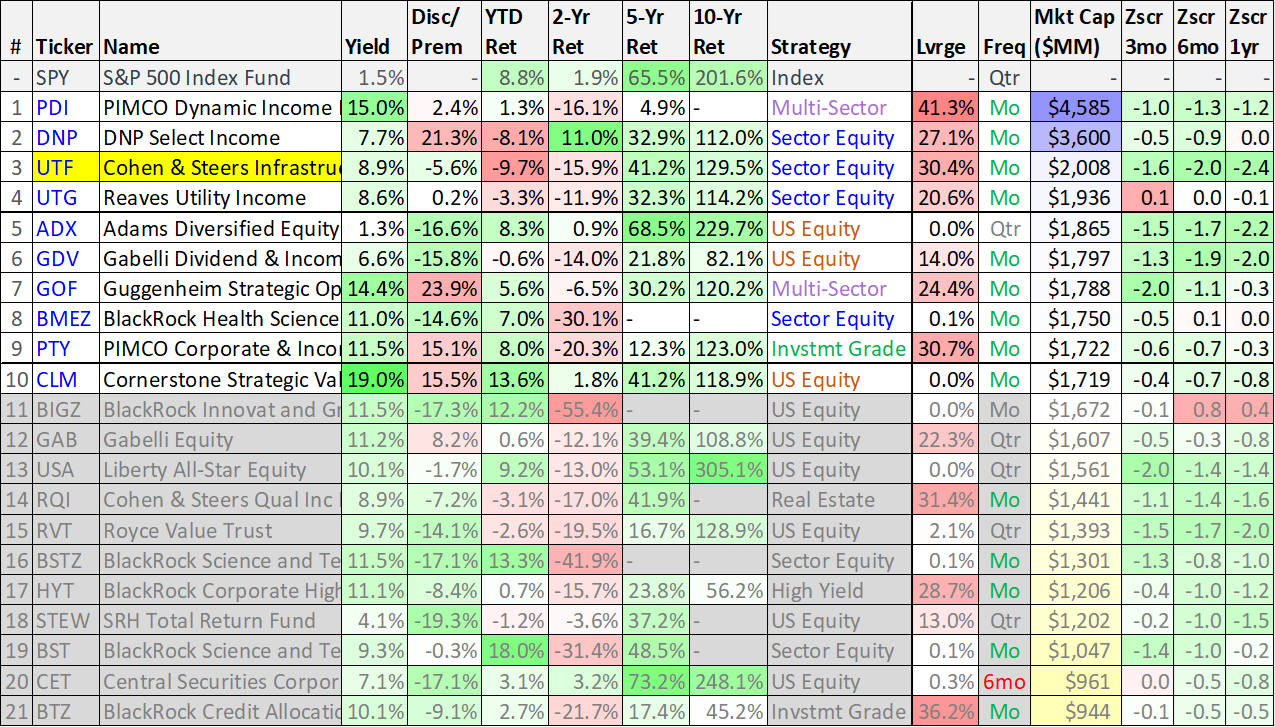

Before getting into the details on DNP, here is a quick look at 20 of the largest Closed-End Funds (“CEFs”), including DNP. The data is one week old (it’s from our recent article on (UTF)), but still provides important perspective, particularly with regards to performance, yield and just how large DNP’s market price premium (versus NAV) actually is.

The fact that so many people continue to invest in this fund, despite the massive premium, suggest it’s worth a closer look, as we do in the following paragraphs.

About DNP:

According to the DNP website:

The DNP Select Income Fund Inc. is a diversified, closed-end management investment company that first offered its common stock to the public in January 1987. The Fund's primary investment objectives are current income and long-term growth of income. Capital appreciation is a secondary objective…

The Fund seeks to achieve its investment objectives by investing primarily in a diversified portfolio of equity and fixed income securities of companies in the public utilities industry. The Fund's investment strategies have been developed to take advantage of the income and growth characteristics, and historical performances of securities of companies in the public utilities industry.

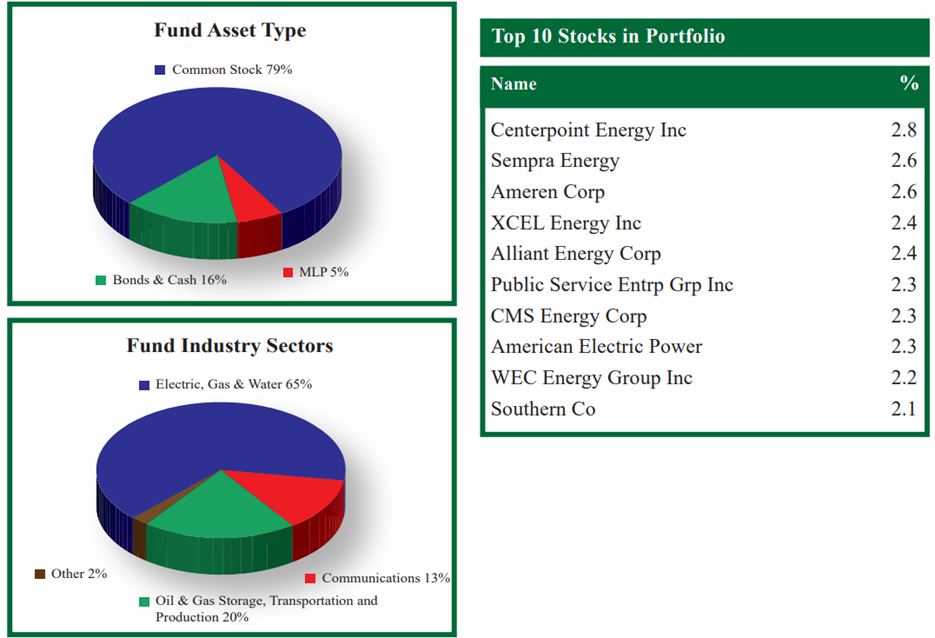

Here is a look at the fund’s recent holdings.

Under normal conditions, more than 65% of the Fund's total assets will be invested in securities of public utility companies engaged in the production, transmission or distribution of electric energy, gas or telephone services…

The Fund may invest in the securities of domestic and foreign issuers as well as in securities of companies of any market capitalization, including small and mid cap common and preferred stocks. The Fund may not invest more than 25% of its total assets (valued at the time of investment) in securities of companies engaged principally in any one industry other than the public utilities industry, nor have more than 20% invested in foreign issuers. The Fund will purchase a fixed income security only if, at the time of purchase, it is rated investment grade by at least two nationally recognized statistical rating organizations.

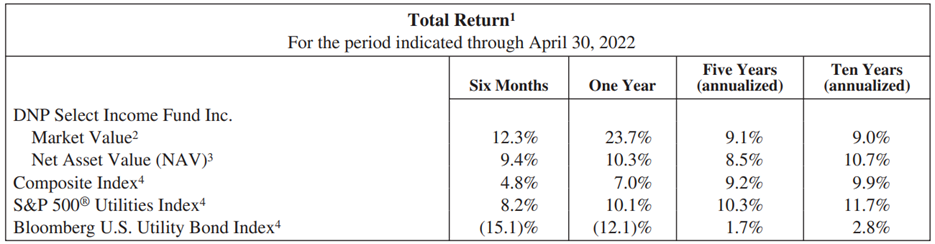

DNP Performance

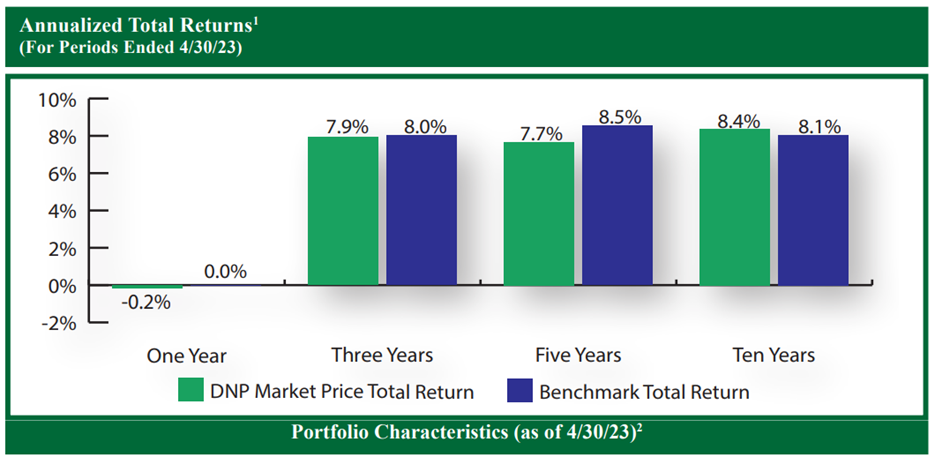

DNP recently held 139 position, and it benchmarks itself to a composite index of both stocks (i.e. the S&P 500 Utilities Index) and Utility Bonds (i.e. the Bloomberg U.S. Utility Bond Index). You can see in the table below, performance has been roughly inline with the composite index over time.

The above chart (from the annual report) is just over 1-year old, and it looks similar (but slightly different) when taken from this year.

Leverage:

Perhaps concerning to some investors, DNP has performed similar to its benchmark over time, despite the fact that the fund uses a significant amount of leverage (or borrowed money) to magnify its income and total returns. Specifically, DNP recently had approximately 27% leverage. According to DNP’s annual report, it recently achieved its leverage as follows:

As of April 30, 2022, the Fund had $1.105 billion of total leverage outstanding, which consisted of: (i) $75 million of floating rate preferred stock, (ii) $132 million of fixed rate preferred stock, (iii) $300 million of fixed rate secured notes and (iv) $598 million of floating rate secured debt outstanding under a committed loan facility. On that date the total amount of leverage represented approximately 25% of the Fund’s total assets.

Leverage can help returns in the good times, but can hurt returns in the bad times (for example, when bond prices are falling, like they have been over the last year as the fed raised rates).

Steady Monthly Income

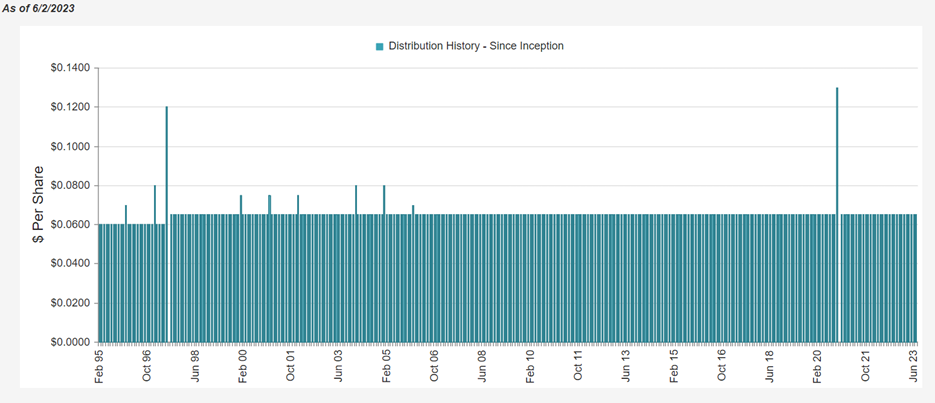

Despite share price volatility, DNP has continued to deliver steady monthly distribution payments to investors, as you can see in the following chart.

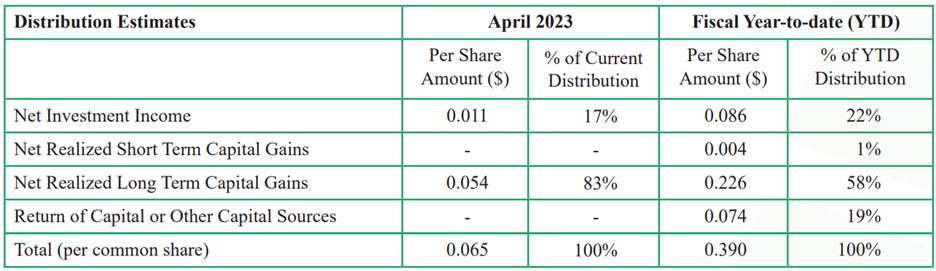

This steady monthly income is why many people own DNP, however there are a few things you should know. For starters, the distribution doesn’t come 100% from dividends or interest payments on the underlying stocks and bonds that it holds (we wouldn’t expect this either). Rather, some income comes from capital gains and return of capital (“ROC”), as you can see in the following table.

Under the terms of the DNP’s Managed Distribution Plan:

The Fund seeks to maintain a consistent distribution level that may be paid in part or in full from net investment income, realized capital gains, and a return of capital, or a combination thereof. The Fund is permitted to distribute more than its income and capital gains; therefore, a portion of your distribution may be a return capital. A return of capital could occur, for example, when some or all of the money that you invested in the Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.”

A little ROC is fine periodically (to keep the distribution big and steady), but too much ROC over time can create challenges in terms of maintaining the distribution. We’re comfortable with DNP’s recent ROC (especially considering the historically rapid pace of interest rate hikes) and its ability to maintain its NAV over time.

Distribution Reinvestment (“DRIP”) Program.

DNP has an attractive program in place to allow investors to reinvest their distributions back into the fund at a competitive rate (especially considering the shares currently trade at a large premium). Here is how DNP describes it in their fund fact brochure.

How Reinvestments are Made By participating in the plan, you authorize the Agent to reinvest all of your cash distributions in additional common shares. The total number of reinvestment shares will be allocated among you and the other plan participants on a pro rata basis, and will be determined by dividing the dollar amount of the distribution to be reinvested by the applicable price per share, determined as follows:

(a) If the current market price of the shares equals or exceeds their net asset value, the Fund will issue new shares to the plan at the greater of current net asset value or 95% of the then current market price, without any per share fees (or equivalent purchase costs).

(b) If the current market price of the shares is less than their net asset value, the Agent will receive the distributions in cash and will purchase the reinvestment shares in the open market or in private purchases for the participants’ accounts.

Each participant will pay a per share fee, (or equivalent purchase costs) incurred in connection with such purchases. Purchases are made through a broker selected by the Agent that may be an affiliate of the Agent.

And this works well right now, because the fund trades at a significant price premium to NAV, as we describe below.

Premium to NAV:

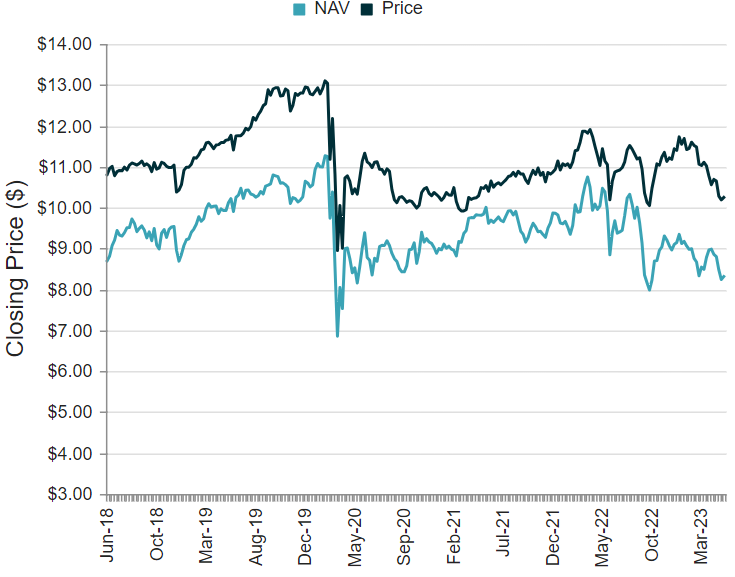

DNP currently trades in the market at a significant price premium to its NAV (~23.3% as you can see in the graph below), and the fund addresses this through its distribution reinvestment program (as described above). Specifically, if you reinvest your distributions now you get more shares below the current market price (a good thing!).

Specifically, the DRIP currently gives you more shares at 95% of the market price, so you’re still paying above NAV, but less then the current market price. DNP issues these shares new, so in theory they are constructing them by buying mores stock and bond shares for the fund in the open market, so all shareholders benefit.

Fund Expenses:

Per the fund’s annual report, DNP’s gross expense ratio was recently 1.9%, and excluding the cost of leverage, the expense ratio would have been 0.98%. These fees absolutely detract from your bottom line income and total returns, however they are fairly typical for a closed-end fund.

Interestingly, the fund has performed fairly consistently with its benchmark over time, despite the leverage ratio (which might lead you to believe it should outperform over time considering the market has gone up—DNP should have gone up more). But if you are simply looking for the type of steady income you would expect from utility stocks and investment grade bonds, DNP has not been terrible.

The Bottom Line:

So who should invest in DNP? If you are looking for the type of steady income you would expect from utility stocks and investment grade bonds, DNP is worth considering. Despite the leverage (which adds risk and expenses), and despite the big price premium (which is a risk because there is no guarantee the premium won’t disappear—which would hurt the value of current DNP investors), DNP has performed reasonably well, and has continued to provide the monthly income that a lot of investors want. We don’t currently own shares of DNP, but it is on our watch list (for our Blue Harbinger “High Income NOW” portfolio), and we wouldn’t fault anyone too much for owing it (even though it does trade at a very large premium to its NAV).