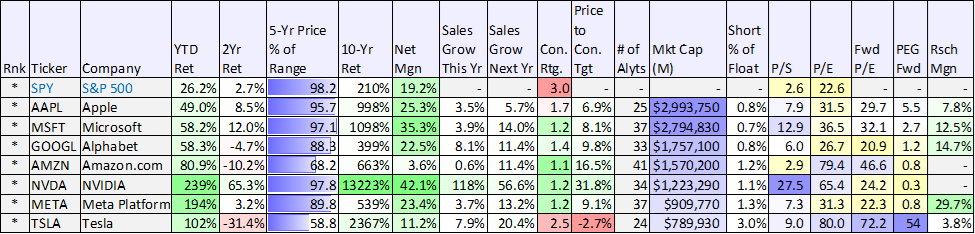

2023 was largely a tale of two markets. The “S&P 493” (roughly two-thirds of the index, by market cap) was up 20.3% (on average), while the seven largest mega-cap stocks (i.e. the “Magnificent 7”) were up ~100%, on average (see table below). In this report, we rank each of the Magnificent 7 stocks for 2024, with a special focus on Amazon (including an update on its business, its four big growth opportunities, valuation and risks). We conclude with our stern opinion on investing in Amazon (and the Magnificent 7) in 2024, especially as compared to non-mega-cap growth stock opportunities.

The Magnificent 7

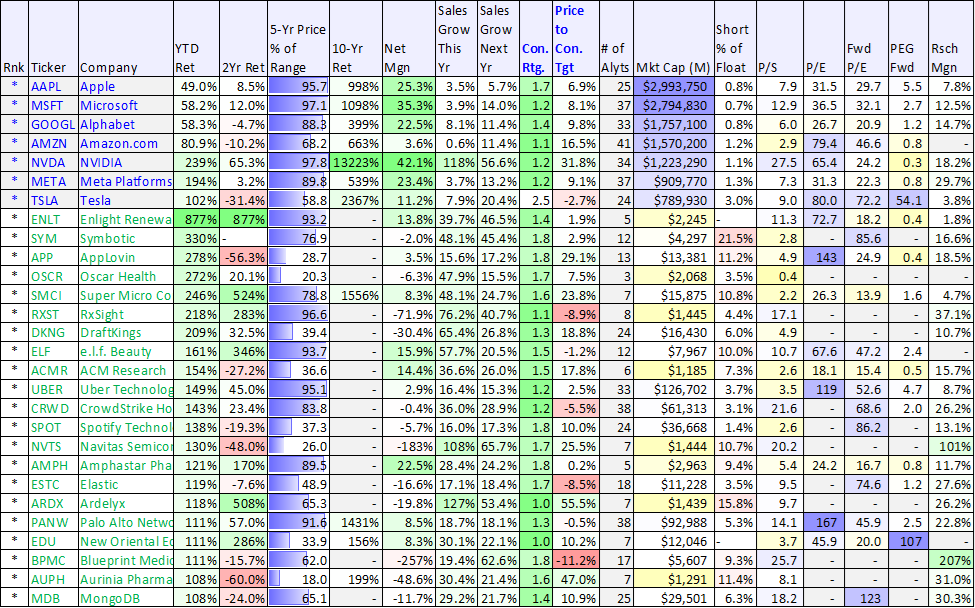

For some perspective, here is a look at the performance of the Magnificent 7 for 2023 (they are ranked by market cap in the table). They all dramatically outperformed the S&P 500 for the year, but this comes after a weak 2022 (see the 2-year total returns column).

You’ll also notice in the table above that Wall Street’s consensus rating for all of these stocks is significantly better than the S&P 500 (note: a 1.0 rating is a “strong buy” whereas a 5.0 rating is a “strong sell”). Also worth mentioning, you can see how they compare on various valuation metrics, such as price-to-earnings and price-to-sales, but there is always more to the story than just those numbers (more on this later).

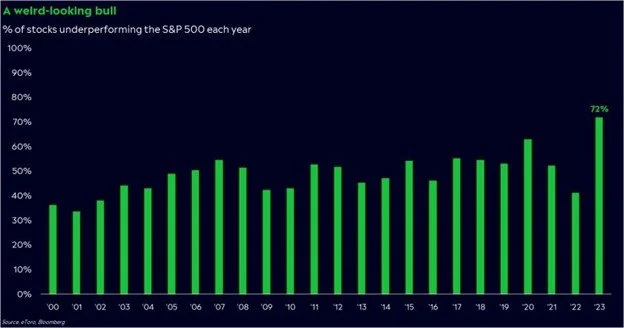

Also, for a little more perspective, here is a look at just how lopsided performance was in 2023 (i.e. an unusually large percentage of individual stocks (72%) underperformed the S&P 500 because the gains were dominated by the “magnificent 7” representing ~one-third of the total market cap).

Next, we’ll take a closer look at one of the magnificent 7 stocks in particular, Amazon (AMZN).

Amazon

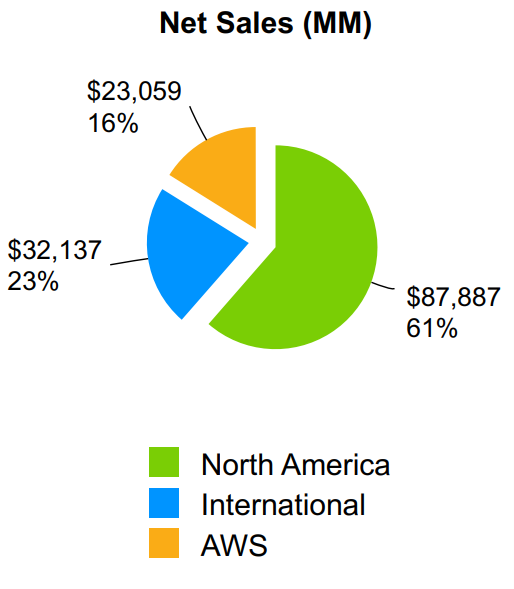

Many people think of Amazon as the website where you search for whatever you want, click “buy,” and then it shows up at your home or office some days later. And while that part of its business generates the majority of its revenues (84%), basically all of the profits come from its cloud-data hosting service (Amazon Web Services, AWS), which makes up only 16% of the revenues.

So with that high-level backdrop in mind, let’s get into the four big factors that we see driving growth for Amazon in 2024 and beyond.

1. Amazon Web Service (“AWS”), Despite Competition

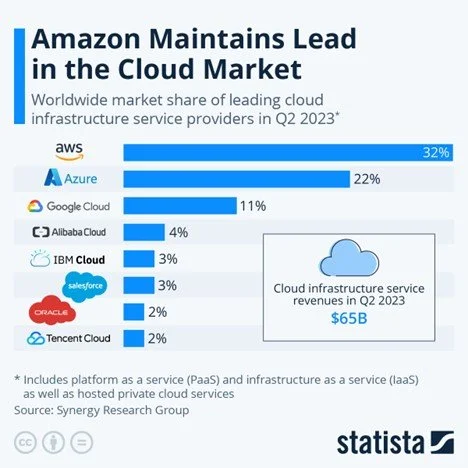

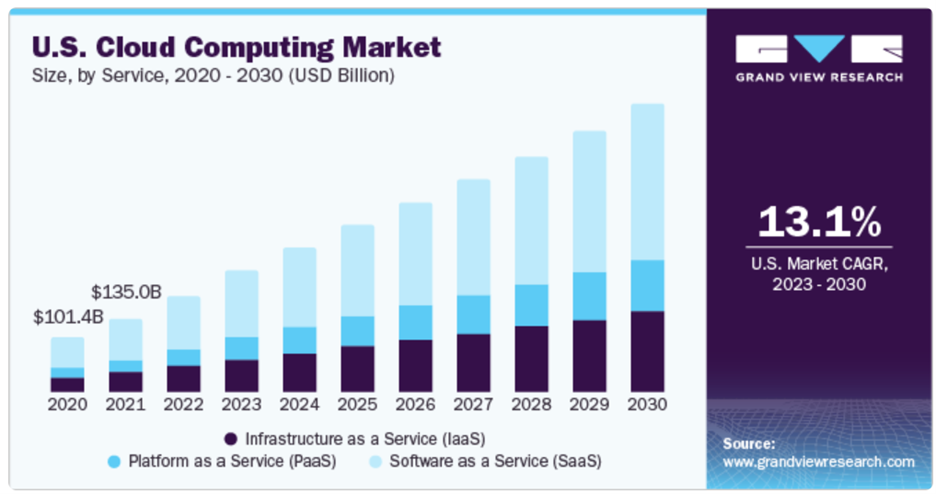

Amazon Web Service is the leader in the cloud market because Amazon had the foresight to recognize the massive secular opportunities ahead of the traditional big boys, like Microsoft, Google and the others (and because Amazon had an infrastructure head start via its online marketplace). You can see recent worldwide cloud market share in the following graphic.

source: Statista

However, Microsoft and Google have been gaining on Amazon in this space. For example, according to estimates from Synergy Research Group (see Statista link above):

Amazon’s market share in the worldwide cloud infrastructure market stood at 32 percent in the second quarter of 2023, down from 34 percent a year ago. Amazon's main rivals Microsoft and Google saw slightly stronger year-over-year growth, resulting in both increasing their market share by a percentage point compared to last year's June quarter.

Cloud competition is absolutely a concern for Amazon, but it is important to keep it in perspective. Specifically, Amazon is still the worldwide cloud leader, it is very profitable in this space, and it is still growing rapidly. Moreover, the cloud opportunity (and the digitization of everything) remains perhaps the biggest technology secular trend in the world, expected to continue growing rapidly for many years, and recently being accelerated by Artificial Intelligence (more on Amazon AI later).

2. Ads Are Coming to Prime Video

The next big theme that will impact Amazon’s business in 2024 and beyond is the addition of advertising to Amazon Prime videos (expected to begin near the end of January). Amazon Prime is a subscription service that gives users access to additional services (including faster delivery, streaming music and videos and more).

According to this article, customers will be able to pay an additional $2.99 per month to avoid ads (a prime membership costs $14.99 per month or only $139 if you pay annually). According to the company

“We aim to have meaningfully fewer ads than linear TV and other streaming TV providers. No action is required from you, and there is no change to the current price of your Prime membership."

Considering the large size of Amazon Prime (over 200 million customers worldwide), ads have the potential to meaningfully move the revenue needle for the company.

3. Artificial Intelligence Is Here

With technological advances in artificial intelligence, it has become a major theme (and growth driver) across businesses in every sector. And Amazon is also looking to capitalize on AI opportunities. According to the company:

The number of companies building generative AI apps in AWS is substantial and growing very quickly, including Adidas, Booking.com, Bridgewater, Clariant, GoDaddy, LexisNexis, Merck, Royal Philips and United Airlines, to name a few. We are also seeing success with generative AI start-ups like Perplexity.ai who chose to go all in with AWS, including running future models in Trainium and Inferentia. And the AWS team has a lot of new capabilities to share with its customers at its upcoming AWS re:Invent conference.

Given the profound impact AI is expected to have on the economy, it’s important that Amazon stays at least on pace with the curve so as to not be left behind (as many slower movers inevitably will be). The company says it is also use AI beyond AWS, including helping customers better discover products that meet their needs, forecasting inventory levels and improving delivery, to name a few.

4. The Andy Jassy Factor

Andy Jassy joined Amazon in 1997, he founded AWS, and he became CEO (succeeding Jeff Bezos) in 2021. Bezos wisely left near the peak of the pandemic bubble (he went out on top), and Jassy has been at the helm while the market bubble burst, and we believe he now has something to prove.

Specifically, Jassy is a winner (he went to Harvard and founded the largest cloud service in the world, AWS), but his compensation has been terrible because it has been tied to the stock price (which has not been great during his short-term as CEO so far).

For example, Jassy’s pay was just $1.3 million in 2022 (tiny for a mega-cap CEO) because, again, it is tied mainly to stock performance (which was terrible in 2022). Jassy’s compensation will likely be much bigger for 2023 (Amazon shares were up 80%), but we suspect he still has a lot more to prove. We like Jassy as CEO and suspect he will do big things with success in the years ahead (such as grow AWS, succeeding with advertising initiatives and prudently implementing AI initiatives).

Amazon’s Valuation

As you can see in our earlier table, Amazon has the second lowest forward PEG ratio among the Magnificent 7 (second only to Tesla, which we view as a much more volatile and risky business). Also, don’t be misled by Amazon’s low price-to-sales ratio (its not that attractive considering the low margins on the Amazon online marketplace business). However, the forward revenue growth rate is strong, Wall Street rates the shares very highly versus mega-cap peers and (unlike most other mega caps) Amazon shares are still well below their all-time high. In our view, Amazon is a healthy growing business, benefiting from large secular trends and with a highly competent CEO at the helm.

Amazon’s Risks

Like any company, Amazon faces a variety of risks. For example, the introduction of ads on Prime could backfire. The company may lose customers over it if not done correctly (especially considering there are a variety of streaming competitors). Initially, the magic of streaming was that there were no ads, but as that now changes and competition has increased, Amazon Prime Ads may not be a slam dunk.

Another risk is that Microsoft Azure and Google Cloud are both growing faster than AWS. Fortunately, the cloud is a very big place (that is expected to keep growing rapidly for many years, see our earlier chart from Grandview Research) so there is room for multiple big winners. Nonetheless, AWS competition is a risk.

Another risk is share price volatility. Recall these shares were down dramatically in 2022, up dramatically in 2023, and they could again be volatile in 2024.

So with that information on Amazon, let’s briefly consider the other Magnificent 7 stocks, before drawing a few final conclusions.

The Other Magnificent 7 Stocks:

Nvidia (NVDA): If you’ve been paying attention at all, you know that Nvidia just had an incredible year following the explosion of AI in 2023. Nvidia makes chips that are used in the cloud (data centers), and that have proven superior to other chips in many scenarios and use cases. As such, the demand for Nvidia chips have been spectacular. What’s more, Nvidia is still the cheapest Magnificent 7 stock on a forward PEG basis because its grow is expected to remain so high in the years ahead. We could absolutely see more high volatility in the near future for these shares, but we could also see a lot more upside in the years ahead.

Microsoft (MSFT): Microsoft is one of the widest wide-moat businesses around (unlike the US Government, Microsoft still has an AAA credit rating) with Microsoft Windows, Microsoft Office and Microsoft Azure. It is a high margin business that continues to spend heavily on innovation (see high research margin in our earlier table) and it is supported by massive secular trends (i.e. the cloud and AI). And despite recent price gains, it still trades at a reasonable 2.7x forward PEG multiple and 32x forward PE ratio. In the years ahead, Microsoft will likely be trading much higher.

Meta Platforms (META): Meta (Facebook, Instagram, WhatsApp) is an absolute money-printing machine (courtesy of its advertising sales). It has an extraordinary 35% net profit margin despite its astronomical spending on research and development (nearly 30%). These shares had a great 2023 (after a terrible 2022). CEO Mark Zuckerberg is a bit of a wildcard, but I wouldn’t bet against this company over the next decade.

Tesla (TSLA): We predicted Tesla had huge upside this time last year (see article), but after the company’s powerful gains since that time, the investment has become a little bit less of a homerun (especially in the near term). CEO Elon Musk will have his hands full with distractions, especially considering he owns Twitter (now X) and this is an election year. Wall Street Analyst like Tesla the least of the Magnificent 7 (see ratings in our earlier table), but that’s been the case for most of its history, and Musk has consistently proved them wrong.

Google (GOOGL): Google basically owns the Internet. It has a wide moat, a reasonable valuation, and the business is supported by the massive cloud secular trend. With a 1.2x forward PEG, and even after a +58% return for 2023, it’s hard not to consider owning shares, especially considering it is such a large part of the economy.

Apple (AAPL): Famous value investor Warren Buffett owns a huge amount of Apple through his Berkshire Hathaway (BRK.B). He loves the truly massive free cash flow generated by this largest company in the world. We view Apple as the least disruptive and the least innovative of the Magnificent 7 (Tim Cook is great, but the company is not the great innovator it once once), but it’s also a very prudent repurchaser of its own shares and growing pays a growing dividend to investors.

Ranking The Magnificent 7:

We wouldn’t bet against the Magnificent 7 in 2024, but we do believe some may perform meaningfully better than others, and that investors may want to reconsider the size of their allocations to these stocks in their portfolios. For 2024, we’re breaking the Magnificent 7 into three tiers:

Tier 3: If the market’s aggregate taste shifts from growth to value in 2024, Apple may be the winner. It is arguably one of the steadiest Magnificent 7 stocks (people aren’t going to get rid of their iPhones, even if the market crashes). But Apple has the lowest expected growth rate, and trades at a fairly rich forward PEG ratio. The business is still better than most companies in the world, just not necessarily better than the other Magnificent 7 stocks, in our opinion.

Tier 2: We’re putting Tesla in this group as the valuation has gotten stretched, and Elon will need to pull another rabbit out of his hat (in an election year, no less, when he’ll inevitably be putting out fires at Twitter (now “X”)). We could end up being very wrong on this one, but Tesla is Tier 2 here.

Tier 1: We like Amazon, Alphabet, Microsoft, Meta and Nvidia, but the question is how much of them you want to hold. They make up a truly enormous percentage of the global economy, and it could be quite risky to avoid them altogether. However, considering the tremendously strong performance in 2023, you may or may not want to be “overweight” these names for 2024. For a little more perspective, we offer a few non-mega-cap growth stock alternatives and ideas below.

Non-Mega-Cap Growth Alternatives

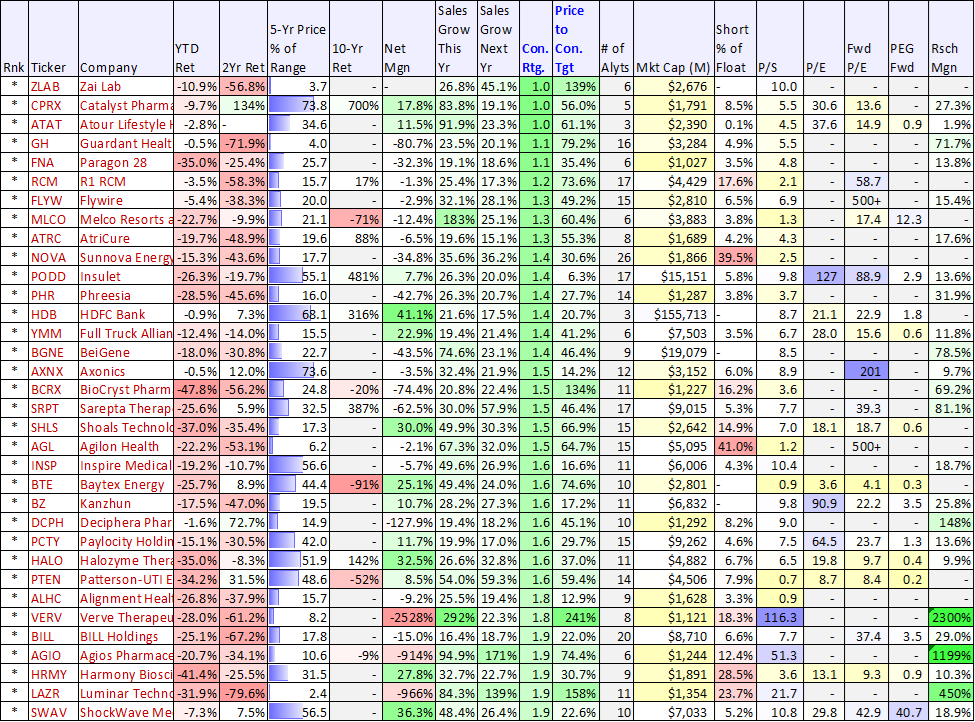

We noted above how the Magnificent 7 dominated the markets in 2023, but if you actually look closer, there were plenty of non-mega-cap growth stocks that also performed extremely well (in most cases, rebounded very hard), and may be poised for strong gains again in 2024.

For example, check out the following table which includes top performing non-mega-cap growth stocks in 2023, that are are also rated very highly by Wall Street. In fact, many of them have dramatically more price appreciation potential than the Magnificent 7, as per Wall Street analysts, as you can see in the following table.

data as of 12/31/2023, source: StockRover

Also, here are the same data points for highly rated non-mega-cap growth stocks that underperformed the market in 2023. These names have a ton of upside potential in 2023, as per Wall Street, as you can see in the table below.

If you are looking to diversify away some of your exposure to the Magnificent 7 (especially after the incredible 2023 performance), you might find a few worthwhile ideas in the data above.

Conclusion

Despite the strong 2023 performance, Amazon (and the Magnificent 7, in general) remain extremely attractive businesses. Amazon in particular, is the only Magnificent 7 stock that still sits well below its all time high (other than Tesla, which we view as a wildcard, especially considering the distractions CEO Elon Musk increasingly faces). And despite Amazon’s incomplete price rebound (so far), it has some extremely attractive qualities, such AWS, the launch of advertising, AI, current valuation and CEO Andy Jassy.

Some investors believe the market’s infatuation with “The Magnificent 7” has gone too far, and now prefer to focus on smaller, lessor-known, growth stocks with potentially much more upside (such as those we shared in the tables in this report). However, considering the Super 7 makes up such a large (and important) part of the global economy, we’re absolutely not willing to completely sell out of them altogether. Regarding Amazon, we’re currently long-shares (in our Disciplined Growth Portfolio) and have no intention of selling anytime soon.