If you like to invest in powerful secular growth opportunities, Super Micro Computer (SMCI) has likely caught your eye. This developer and manufacturer of high-performance servers and storage systems is benefitting dramatically from explosive secular growth in artificial intelligence (“AI”) and high-powered computing. The total addressable market opportunity is enormous. In this report, we review the business, the market opportunity, financials, valuation and risks, and then conclude with our strong opinion on investing.

Key Takeaways:

Comprehensive Product Portfolio and Green IT Innovation.

Leveraging Artificial Intelligence Opportunities.

Secular Tailwind of Digitalization and Cloud Migration in thriving Server Industry.

Promising Revenue Growth coupled with continued Profitability.

Healthy Balance Sheet supporting Business Expansion.

A PDF version of this report is available here.

Overview

Super Micro Computer was founded in 1993 as a five-person operation run by Charles Liang, alongside his wife and company treasurer, Sara Liu. It has since grown into a significant player in the IT industry, with a focus on innovative designs and efficient solutions. The company is headquartered in San Jose, California and has manufacturing facilities in the U.S., Taiwan, and Netherlands, and a new facility in Malaysia which will be operational in the next 12-15 months.

Supermicro was started with a vision to develop servers and storage solutions with modular and open architecture designs, which would allow for greater customization and scalability. It has been able to adapt quickly to changing technology trends and Supermicro is now a preferred choice for customers seeking powerful, flexible, and energy-efficient computing solutions. The company has expanded its solutions to cater to a diverse set of market verticals, including high-growth markets, such as enterprise data centers, cloud computing, AI, 5G and edge computing. In each of the last three fiscal years, it has sold to more than 1,000 direct customers in over 100 countries. In addition, it serves thousands of end users through its indirect sales channel.

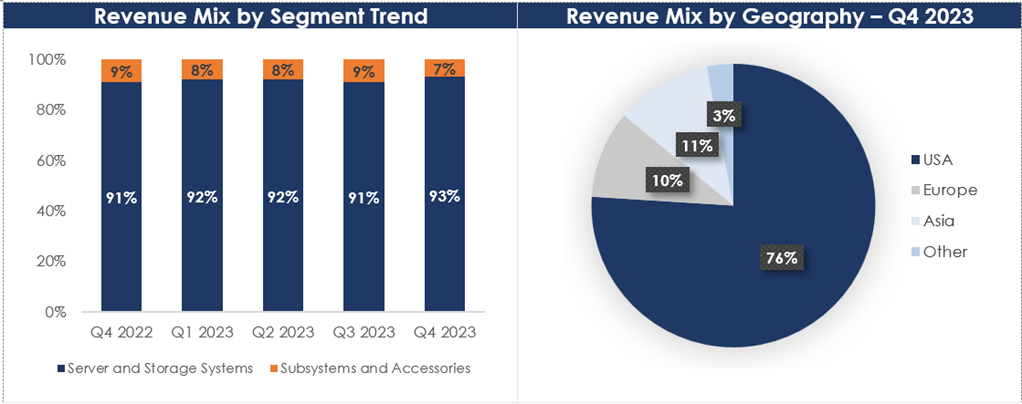

The company’s sources of revenue are server and storage systems and subsystems and accessories (see chart below). Revenue from server and storage systems is derived from assembly and integration of servers and storage systems and related services to help set up, maintain, and support these systems. Subsystems and accessories revenue includes sales of server boards, chassis, and accessories.

In Q4 2023, server and storage systems made up 93% of total revenue, while subsystems and accessories revenue made up the remaining 7%. In terms of geographical distribution, the company earned a substantial portion of its Q4 2023 revenue in the USA, as shown in the chart below.

Source: Investor Presentation

Comprehensive Product Portfolio

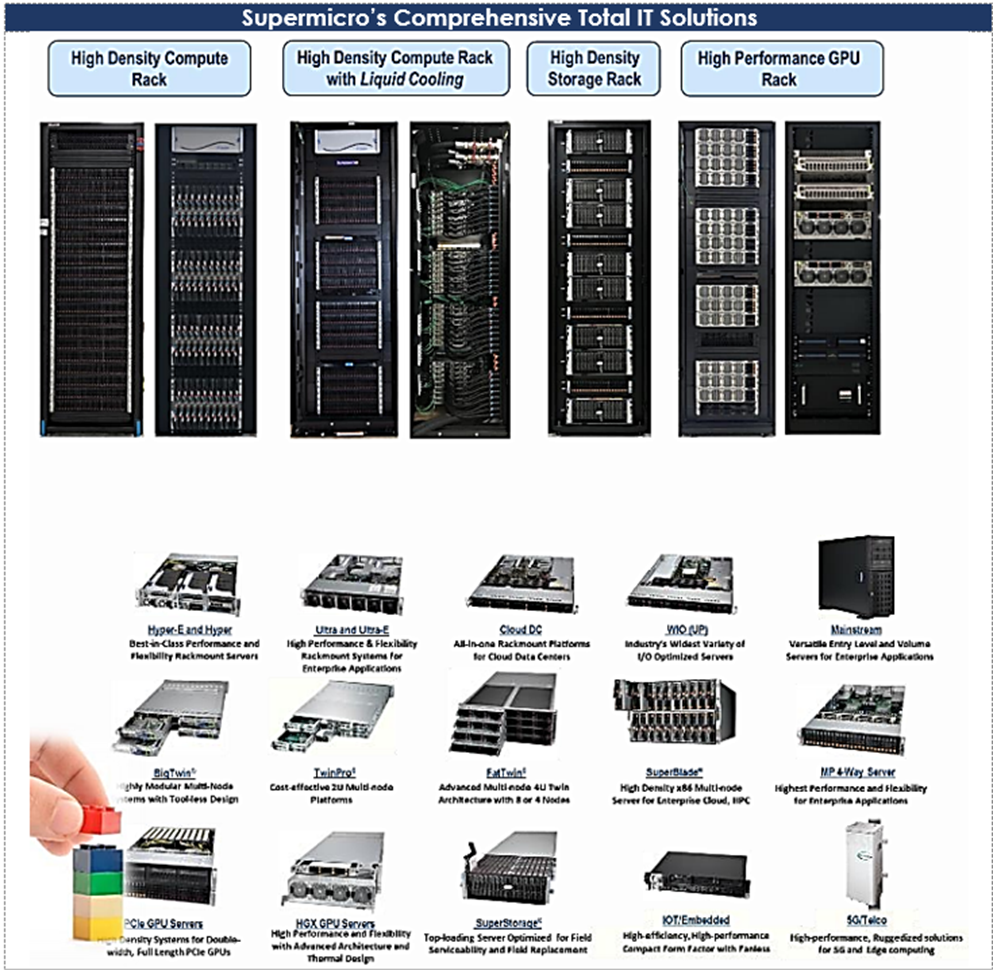

In recent years, there has been a noticeable shift in server systems and storage racks towards adopting advanced technologies such as energy management and seamless cloud integration, with a primary focus on software. Supermicro, with its innovations in open architecture rack designs and modular solutions for data centers, has emerged as a leader in this domain.

The company’s comprehensive Total IT Solutions approach offers a complete package, encompassing AI, servers, storage, networking, software, racking, cabling, power, cooling, integration, validation, management features, and services. This approach allows customers to entrust their IT hardware solutions to Supermicro and concentrate more on their applications and new software functions.

The newly introduced solutions (liquid-cooled rack-scale solutions and production lines, product auto configurator and online business automation) enhance value provided to customers (in a fast and high-quality manner). Additionally, the company is working on improving its cost efficiency by expanding operations in Taiwan and the upcoming Malaysia campus.

Supermicro has now reached a stage where, given there are no hindrances in supply, it can design, construct and validate complete systems, and deliver ready-to-use rack-level solutions to customers in only a matter of weeks after an order is placed. This is a much faster timeline compared to its competitors (which often take months). The company is currently on track to support 4,000 racks per month of global manufacturing capacity by year end.

Source: Investor Presentation

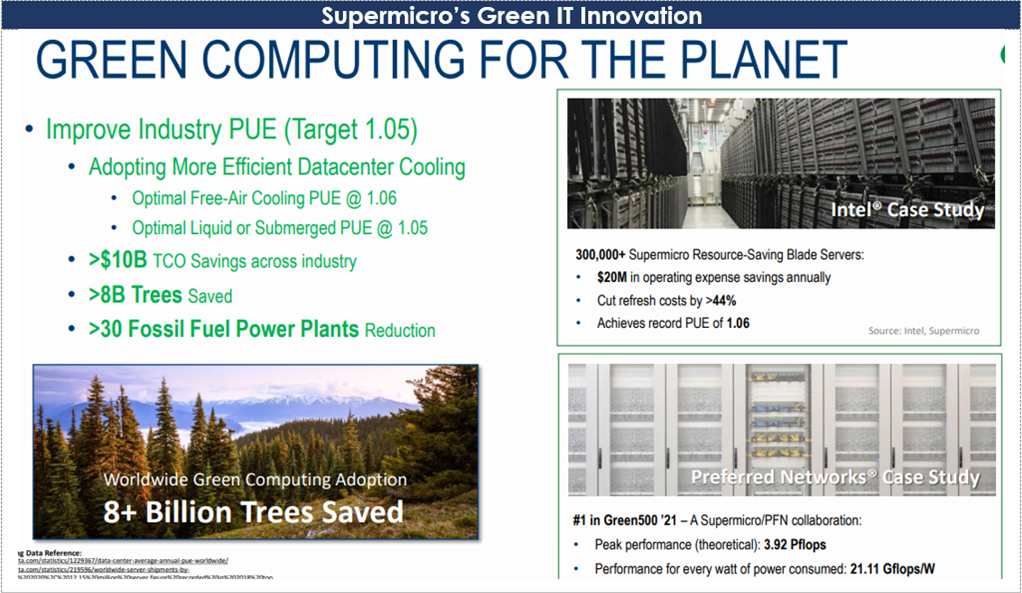

Green IT Innovation

One standout feature of Supermicro’s approach is its focus on environmentally friendly solutions. The company's architecture allows for independent refreshing of different system components, which reduces energy consumption and e-waste. By sharing computing resources, Supermicro's products also help save space and power, aligning with the growing importance of energy-efficient computing in modern data centers. According to the company’s estimates, if the IT industry adopts its Green Computing solutions, it’s possible to save close to $10B in electricity costs per year, which is equivalent of eliminating about 30 fossil fueled power plants and equating to the preservation of up to 8B trees for our planet.

Source: Investor Presentation

Benefitting From Artificial Intelligence Opportunities

In 2022, the global AI market was worth ~$454B. It's projected to significantly expand and reach ~$2.6T by the year 2032, at a CAGR of 19%. The increasing need for AI technology in different industries like automotive, healthcare, banking and finance, manufacturing, food and beverages, logistics, and retail is predicted to strongly contribute to the expansion of the global AI market in the coming years. A significant milestone was the introduction of ChatGPT 3.0 in 2022, which brought attention to the potential of generative AI, which has led to a noticeable rise in interest in generative AI.

Due to the surge in demand for large-scale GPU-driven systems essential for handling data-intensive generative AI and machine learning tasks, Supermicro finds itself in the right place at the right time. In the last quarter, the company showcased remarkable speed at which it was securing important design contracts for cutting-edge GPUs, and the backlog of orders also rose steadily. One major edge that SMCI holds over its rivals is its strong collaborations with key chip industry leaders like NVIDIA (NVDA), Intel, and AMD (AMD).

Source: Precedence Research & Investor Presentation

And according to Super Micro Computer CEO, Charles Liang:

“With applications like ChatGPT that heavily count on large language models or LLM and generative AI, the state of AI infrastructure business has grown rapidly. This AI momentum has benefited Supermicro greatly as we are deploying many of the world’s leading and large-scale GPU clusters.

In addition, we have built a close and collaborative relationship with NVIDIA over the years by co-developing and offering the most optimized and the fastest time-to-market GPU platform on the market. Aligning new generation product designs with partner ecosystems is highly complex.” - Charles Liang, CEO

Secular Tailwind of Digitalization and Cloud Migration in thriving Server Industry

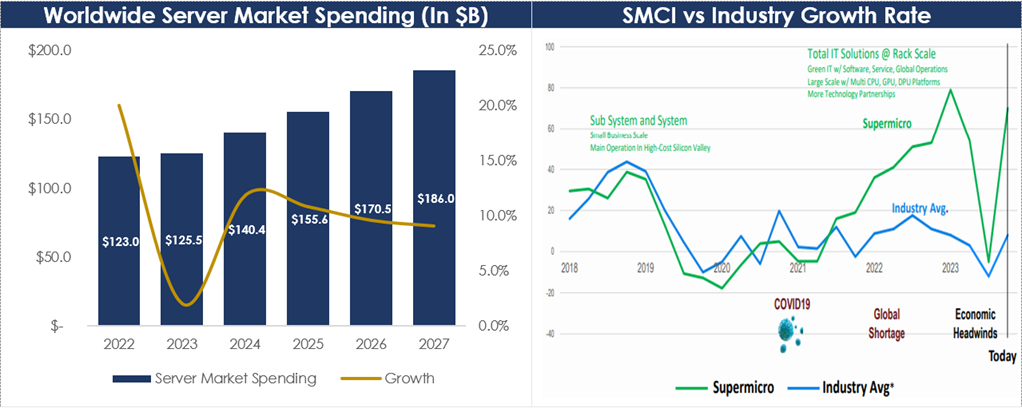

The market for servers, storage, and associated IT solutions is benefiting from a prolonged trend of digital transformation, as companies across the globe seek to enhance their IT systems to accommodate high computing workloads. Although there are short-term headwinds due to elevated inflation, economic activity slowdown, disturbances in the supply chain, and geopolitical tensions, the server market has displayed continued resilience in recent years, as IT infrastructure has become progressively vital for many enterprises.

According to IDC, worldwide server market spending was at ~$123B in 2022 and is expected to touch ~$186B by 2027, with a CAGR of 8.6% in the five-year period. Owing to swift transformations, susceptibility to emerging technological advancements, and shifting customer preferences, the industry is marked by intense competition. Supermicro has several distinctive attributes that set it apart from its competitors. These encompass reduced expenses, quicker market entry, and a significant emphasis on environmentally friendly computing. Supermicro has also benefitted greatly from the generative AI boom and its key partnership with NVIDIA, outperforming the industry average growth rate over the past three years.

Source: IDC & Investor Presentation

Promising Revenue Growth coupled with continued Profitability

In Q4 2023, total revenue increased 34% YoY to $2.2B. Revenue from Server and Storage Systems grew 37% YoY to $2B and accounted for 93% of total revenue. Subsystems and Accessories revenue made up the remaining 7% and was flat at $153M. The strong growth was driven by the demand for Supermicro’s leading AI platforms, particularly the NVIDIA HGX-based Delta Next solution, which is tailored for optimal performance of Large Language Models (LLM) like ChatGPT.

Through its in-house Building Block Server (BBS) system, Supermicro possesses one of the most comprehensive ranges of GPU solutions required for AI infrastructure. The company has plans to further solidify its market position with the forthcoming MGX platforms, which represents a shared vision for AI computing developed collaboratively with NVIDIA. Numerous customers have already expressed interest in these new MGX platforms, and they are expected to enter mass production shortly. With nearly half of revenues this quarter derived from AI-related designs, the positive momentum in AI growth is expected to persist and expand the company’s TAM across diverse customer categories.

Supermicro has outperformed management guidance in each of the last five quarters, except Q3 FY23, which was marked by economic headwinds and component shortages. The company is in a much better position going forward and for the full year 2024, management expects total revenue to be in the range of $9.5B - $10.5B, representing growth of 33% to 47%, as the demand environment for LLMs and other AI applications continues to be robust.

Source: Investor Presentation

On the profitability front, Supermicro reported a Non-GAAP gross profit margin of 17.1% in Q4 2023, down 50 basis points as compared to last year. This was due to the company’s focus on securing new designs and expanding market share. However, for FY 2023, Non-GAAP gross profit margin improved to 18.1% from 15.4% in the preceding fiscal year. This was driven by an increased mix of rack-scale products and customers, coupled with enhanced manufacturing efficiencies. Non-GAAP operating margin also improved to 11% in Q4 2023 (vs 10.7%) and 11.4% in FY 2023 (vs 7.2%). This is attributed to increased operating leverage from higher revenues and expense controls.

The largely stable and double-digit gross and operating margins reflect the strength of Supermicro’s business model. Benefitting from enhanced economies of scale and increased Average Selling Prices (ASPs), the company is expected to continue to exhibit similar profitability levels going forward.

Healthy Balance Sheet supporting Business Expansion

Supermicro ended FY 2023 with $440M in cash and cash equivalents and $120M in long-term debt. The company generated $627M in Free Cash Flow (FCF) in FY 2023, improving significantly from negative $486M in FY 2022, as supply chain disruptions due to the pandemic and other macroeconomic headwinds eased. Ample liquidity and low debt level put Supermicro in a strong position to weather near-term uncertainties and it has the potential to consistently generate favorable FCF going forward.

Valuation

Supermicro emerged as one of the standout performers in 2022, in the midst of an overwhelmingly negative sentiment prevailing in the markets. This trend has extended into 2023, with SMCI capitalizing on the AI-driven surge in stock prices and the stock is up ~200% YTD.

Historically, SMCI has traded on notably low valuation multiples. The company faced reputation challenges and accusations that led to years of subpar performance. However, over time, the controversies have subsided, and thorough investigations have failed to unearth any significant incriminating evidence against SMCI's products.

Now, with AI taking centre stage, SMCI’s prospects have improved significantly. The company stands out for providing some of the most energy-efficient server solutions in the market, and despite the recent steep run-up in stock price, we believe the risk-reward ratio is favorable for long-term investors.

Source: Seeking Alpha

Risks

Intense competition: The server market is marked by intense competition. There are swift transformations, and Supermicro remains susceptible to emerging technological advancements, shifting customer preferences, and novel product launches. Market players are continually investing in R&D to introduce more powerful and efficient servers. The company’s primary competitors are major suppliers of general-purpose servers and components based on the x86 architecture. Smaller suppliers that specialize in marketing server components and systems also compete. In recent times, the company has experienced increased competition between original design manufacturers ("ODMs") who capitalize on their size and highly economical manufacturing capabilities.

Supply Chain disruptions: The server industry is susceptible to various risks stemming from supply chain disruptions. Shortages of critical components result in delayed production and increased costs, affecting the ability to meet customer demands. Fluctuations in supply chain availability also result in increased working capital requirements leading to reduced cashflows. To mitigate these risks, diversifying supplier base, building contingency plans and maintaining buffer inventory is of prime importance. Although Supermicro’s close collaboration with key suppliers is a compelling competitive moat, the company is not completely immune to supply chain disruptions.

Share Price Volatility and Short Interest: As with any big disruptive secular trend (in this case “Artificial Intelligence” and “The Cloud,” shares of Super Micro Computer have been very volatile and short-interest (basically people betting against the shares) is high (recently over 10%). High volatility (and differing market opinions) is often the price you pay for the best long-term returns. The recent share price pullback may provide opportunity for disciplined long-term investors to begin building a position in the shares.

source: YCharts

Conclusion

Supermicro designs and manufactures pioneering servers and storage solutions for businesses. The company’s applications not only reduce costs and minimize environmental effects but also provide distinctive systems that align with customer requirements. The razor sharp focus on quickly implementing changes at the fundamental infrastructure level and being the “first-to-market,” plus the robust collaborations forged with the likes of NVIDIA and others, sets Supermicro wide apart from its competitors. Overall, we believe Supermicro can sustain its strong momentum, driven by continued growth in the TAM, stable margins and healthy cash flows. Considering the current risk and reward dynamics, we view this as an attractive opportunity for patient, long-term investors.