A lot of investors scoff at the absurdity of big-yield investments under the assumption that markets are fairly efficient and anything with a big-yield (defined loosely as a 6% to 12% yield) is a “yield trap” and should be avoided at all costs. However, Business Development Companies (BDCs) are one of the few “big-yield” categories that has consistently produced top total returns (despite their massive dividend payments—which some investors dismissively view as too risky).

For reference, BDCs typically provide financing (mostly loans) to smaller (middle market) companies. Here is some current BDC market data for you to consider.

data as of Mon, April 8th (source: StockRover)

And here are 5 reasons why BDCs are special…

1. BDCs: No Corporate Taxation:

For starters, BDCs don’t pay tax at the corporate level as long as they pay out their income as dividends. This gives BCDs a big advantage over other companies, and this advantage was created by an act of Congress in the 1980’s because they wanted to make it easier for the small businesses BDCs serve to thrive.

2. BDCs: Less Regulation:

Another reason BDCs are special is because they are allowed to take on “risks” that traditional banks are not allowed to due to stricter banking regulatory rules (and reserve requirements) following the great financial crisis.

Generally speaking, this enables BDCs to invest in attractive opportunities that traditional banks are not able to. This is amazing because (as you can see in our earlier table) some BDCs have actually outperfomed the market (e.g. the S&P 500 over the last 5 and 10 years) which is a lot more than you can say for other big-yield investment categories (such as bond closed-end funds and many REITs). It’s doubly amazing because the S&P 500 includes many top growers like the “Magnificent 7” megacaps (which have dominated market performance).

3. BDCs: Mostly Non-Qualified Dividends:

In some cases, it can be helpful if you own BDCs in a non-taxable account (e.g. IRA) because most of their dividends are generally NOT qualified (meaning they don’t qualify for the lower dividend tax rate). For example, in 2023, approximately 8% of the dividend of popular BDC Main Steet Capital (see our earlier table) was taxed as qualified and approximately 92% was taxed as ordinary income.

4. BDCs: Ready for Credit Spread Risk:

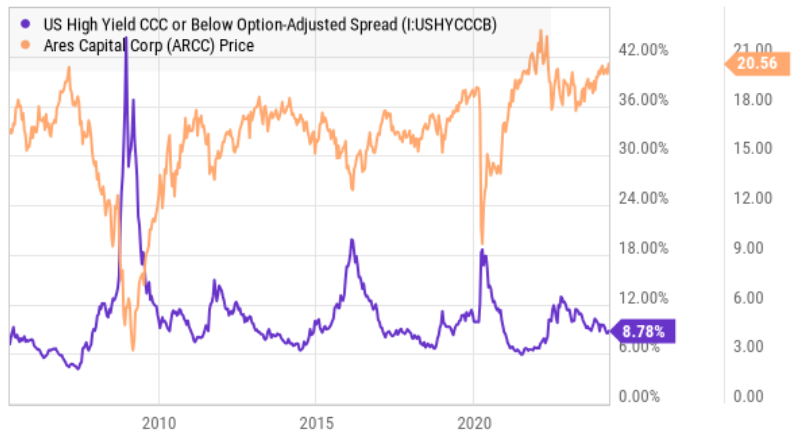

BDCs have developed unique competencies to handle the challenges and risks of investing in smaller (middle market) businesses. For example, to get an idea of how much current market risk is priced into BDCs we can look to credit spreads. Credit spreads are the difference in yield between low risk loans/bonds (such as US treasuries) and higher risk loans/bonds (such distressed debt and BDCs).

As you can see in the chart above (we’re using industry leader Ares Capital as a proxy), BDC prices tend to rise and fall with credit spreads, and the market is currently NOT pricing in too much risk (which can be an indication of subdued price returns going forward). Said differently, now may not be the best time to invest in BDCs if you are looking for strong price gains, however most people invest in BDCs for the big dividend income (as we describe in the next section). And to support this point, you’ll notice in our earlier table that a lot of BDCs do NOT currently trade at big discounts to book value (instead they trade at small premiums versus history).

5. BDCs: Historical Price Gains Verus Dividend Income

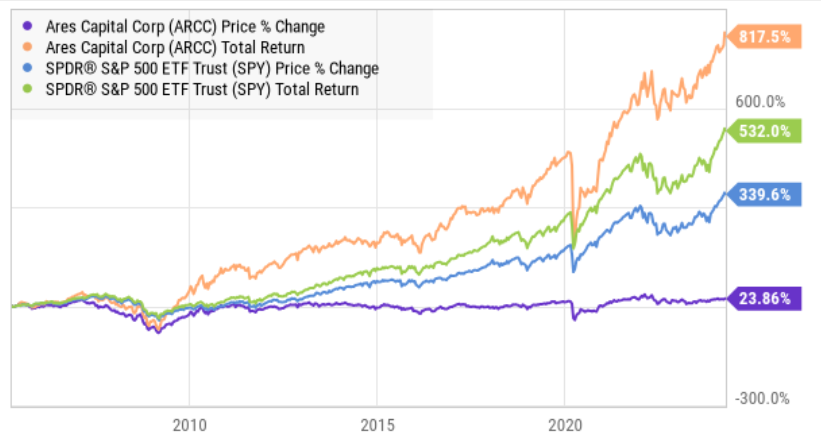

Sticking with Ares as an industry proxy, you can see that historically most of BDC returns have come from dividends NOT price gains (i.e. Ares’ price has been relatively flat over time, which means those big longer-term total returns have come from the big dividend payments—which is exactly what a lot of investors are looking for).

And Ares’ total return has easily beaten the S&P 500 over this time period (see above).

The Bottom Line:

If you are an income-focused investor, BDCs are one of the few areas of the market that has actually performed relatively well (much better than bond CEFs and REITs, for example, many of which have been terrible). And despite current low credit spreads (perhaps an indication that not enough risk is priced in, and price returns may be subdued going forward), investors like BDCs for the big dividend payments, not the price returns. And the big dividends have been steady (and in many cases, growing) over time.

If you are an income-focused investor, big-dividend BDCs have been special, and they are one of the few big-yield areas of the market that may actually be worth considering.