In the short-term, the market is a voting machine, and in recent trading sessions high-growth stocks have been voted down indiscriminately. However in the long-term, the market is a weighing machine, and top business eventually rise to the top. In this report, we share an options trade that generates a lot of upfront premium income, and the trade is on a highly attractive long-term growth stock. This trade not only puts attractive upfront cash in your pocket (that you get to keep no matter what), but it also gives you a shot at picking up shares of this highly attractive business at an even lower price (if the shares get put to you before the contract expires in a matter of weeks). We believe this is an attractive trade to place today (and potentially over the next few trading sessions) as long as the price of the underlying shares doesn’t move too much before then.

Palantir (PLTR)

The attractive company we are referring to is big data software company, Palantir (PLTR). This stock has become highly emotional for many people with widely different view points, and these differing viewpoints have contributed to the highly volatile share price (in addition to the market’s indiscriminate sell off of growth stocks in recent sessions).

Palantir Share Price:

However, a look under the hood of this company reveals a highly successful amount of very “sticky” business with the US government (to create custome software). Furthermore, Palantir has been having great success explanding its business into the corporate realm (which unlocks a massive amount of further growth potential—i.e. an additional massive total addressable market (“TAM”) opportunity.

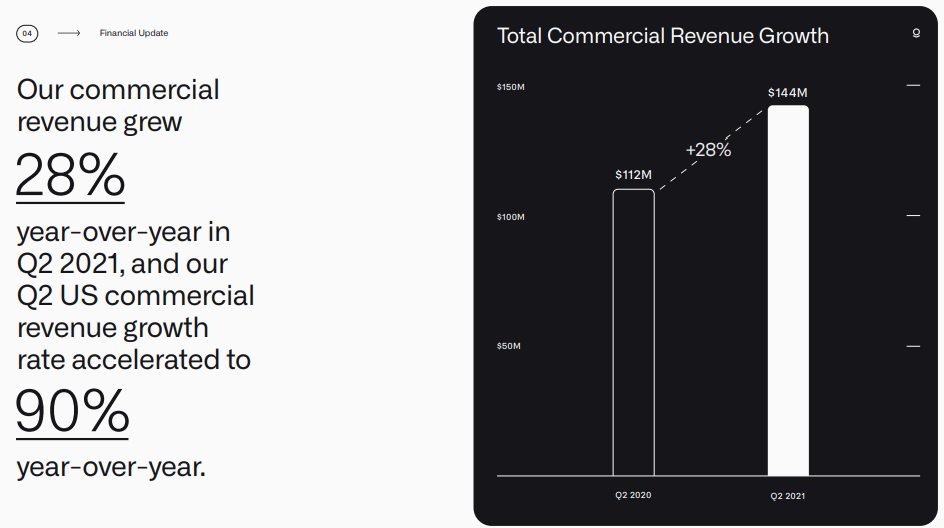

For a little perspective, here is a recent look at recent revenue growth (and based on the large TAM, this high rate can continue for many years)

The Trade:

Sell Put Options on PLTR with a strike price of $21 (~9.4% out of the money, it currently trades at ~$23.17), and an expiration date of October 15, 2021, and for a premium of at least $0.24 (or $24 because options contracts trade in lots of 100). This comes out to approximately 1.14% of extra income in less about 10 days—which may not sound like a big return—but it is very significant for such a short time frame (it’s approximately 42% of extra income on an annualized basis, if you could implement similar trades throughout the year). And this trade not only generates attractive upfront premium income for us now, but it gives us a chance at buying shares of this attractive long-term company at a significantly lower price ($21—the strike price) if the market price falls below $21 and the shares get put to us before this option contract expires in just 10 days. And we get to keep the upfront premium income no matter what.

Important to note, you can adjust the strike price of this trade (for example to $22) depending on how badly (and at what price) you want the shares put to you, and to generate a different amount upfront income as shown in the table above). You could also even consider selling the November puts (as you can see the very high premium in the table below, but keep in mind Palantir has an earnings announcement before the November puts expires, and this complicated the trade a bit—more on this in a moment).

*Also note, market prices are constantly moving, and you will have to “work” this trade a little to get a price you like. Regardless, the current high premium income is attractive.

Your Opportunity:

We believe this is an attractive trade to place today, and potentially over the next few trading days, as long as the price of PLTR doesn't move too dramatically before then and you’re able to generate enough premium income to your liking.

Our Thesis:

Our overall thesis is simply that PLTR is an attractive long-term business, despite the near-term volatility, and we’d love to own (more) shares (as a long-term investment) if they fell to a purchase (strike) price of $21. But if these shares do not get put to us, then we’re also happy to simply keep the very high upfront premium income that is generated by this trade.

We previously went into great detail about our views on Palantir in this report.

Important Trade Considerations:

Two important considerations when selling put options are ex-dividend dates and earnings announcements because they can both impact your trade. In PLTR’s case neither one is a concern because PLTR doesn’t pay a dividend, and because it isn’t expected to announce earnings again until November (after this trade expires). If the company announced earnings before this contract expires—that would add significant uncertainty risk to the trade, and we’d have to take that into consideration when decided what amount of premium we’d be willing to accept. As the trade stands, the high premium income more than compensates us for the volatility risk, in our view (especially considering if the shares get put to us, we like them as a long-term investment).

Conclusion:

PLTR is an attractive business. It has a very lucrative government contract business that is growing rapidly, and can keep growing rapidly for a long time based on the large total addressable market. It is also working to grow its corporate client business too, and is having increasing success with these newer initiatives in this additional large total addressable market opportunity.

For these reasons, we believe the trade described in this report is very attractive. Specifically, it puts a high amount of upfront income in your pocket right away (that you get to keep no matter what) and it also gives you a chance to pick up shares of this attractive business at a significantly lower price if they fall below the strike price and get put to you before the options contract expires (in just 10 days).