Often an income-investor favorite, 2021 continues to be an interesting year for PIMCO’s lineup of big-distribution, monthly-pay, fixed-income CEFs. We’ve seen the launch of a new winner, a distribution cut from a perennial favorite, and now an imminent merger and sharply declining premiums for three classic PIMCO funds. In this report, we focus on the Dynamic Income Fund (PDI), its 10.1% monthly distribution and its significantly shrinking premium (versus NAV) as the big merger looms imminent. And regarding PDI’s once large premium, it is our opinion, as Arnold Schwarzenegger’s Terminator character once said, I’ll be back! We conclude with some important takeaways on who might want to invest and how.

PIMCO Dynamic Income Fund (PDI), Yield: 10.1%

PDI invests in a diversified mix of fixed-income funds (such as mortgage securities, high yield bonds and non-US markets, to name a few), as we wrote about in great detail a few months ago in this report. You can also view the fund’s latest portfolio composition on the PIMCO website, here.

PDI’s primary objective is high income (it currently yields an impressive 10.1%, paid monthly), and the secondary objective is capital appreciation. Throughout its history, the fund has an impressive track record of delivering on both. For example, PDI has never reduced its dividend, it has occasionally paid additional special dividends, and its total return since inception (May 2012) has been over 13% annually (price return and NAV return). PDI has made a lot of income-focused investors very happy for a long time.

Premium Price

One of the unique things about closed-end funds, or CEFs (such as PDI) is that unlike mutual funds and exchange traded funds, there is no mechanism in place to keep the market price close to the value of the underlying holdings (net asset value, or NAV), and as such CEFs can trade at wide premiums and discounts to their NAV.

We generally prefer to buy funds trading at a discount to NAV (why wouldn’t you buy something attractive when it’s on sale if you got the chance), but not always. For example, some funds (such as those brought to market by PIMCO) are almost always in such high demand that they trade at big premiums to NAV. And in the case of attractive PIMCO funds, we prefer to buy at a smaller discount than a bigger one.

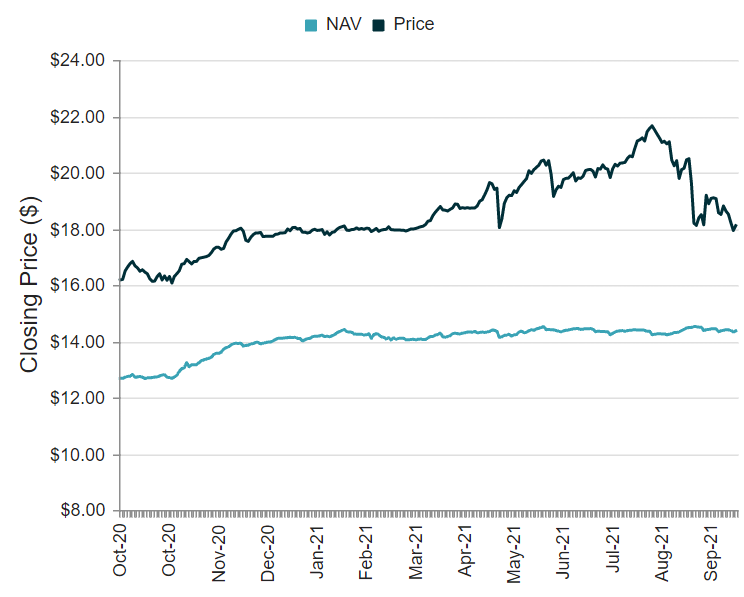

Here is a look at the historical premium by which PDI trades in the market above its NAV.

source: CEF Connect

As you can see above, PDI tends to trade at a pretty large premium to its NAV, although that premium has come down significantly recently.

There are a couple reasons for the premium decline. First, part of the reason for the recent PDI price decline is the recent increase in interest rates. Specifically, PDI has a duration (interest rate risk) of approximately 4.9 years, and as rates rise, prices fall, and this has likely increased selling pressure among investors.

However, we believe another big reason for the recent premium decrease is related to selling pressure by fearful investors uncertain about the looming imminent merger between the Dynamic Income Fund (PDI), the Dynamic Credit and Mortgage Income Fund (PCI) and the Income Opportunity Fund (PKO). For reference, you can see the declining premium for those two additional PIMCO funds (PCI and PKO) below:

PCI Premium (above), per CEF Connect

PKO Premium (above), per CEF Connect

Why the Upcoming Merger?

PIMCO announced the potential merger of these three funds earlier this year, and recently announced that they received the requisite shareholder approval, and the merger is imminent. Per PIMCO’s August 6th press release:

The reorganizations are currently expected to occur in approximately two to three months (and in any event not earlier than in two months), subject to PIMCO’s market outlook and operational considerations and the satisfaction of applicable regulatory requirements and customary closing conditions

This means the merger/consolidation of PCI, PDI and PKO could take place as soon as next week.

In our previous report (PIMCO CEFs: Cracks in the Dam) we speculated that the merger is likely due to a variety of risks and stresses on these funds stemming from high leverage ratios (borrowed money), high dividend payout ratios (among the highest of all PIMCO funds), and unexpected interest rate moves (rates are likely higher than expected, and the underlying holdings of these funds trade at discounts to par value (around 95 cents on the dollar for PDI and PCI), thereby placing further stress on leverage ratios and fund flexibility). Furthermore, by combining the three funds (PDI, PCI and PKO) it affords PIMCO more flexibility (through economies of scale) and the opportunity to do a little window dressing (i.e. if these funds are in jeopardy of a dreaded dividend reduction, why not brush it under the rug with the fund merger/reorganization news).

Whatever the reasons may be for the consolidation (we believe its because the fund distributions got a little too far out over their skis, and now PIMCO is trying to save face), we don’t yet know how severe (if at all) the collateral damage of the merger may be (will there be a distribution “rightsizing? How big?).

Is the Market Predicting a Distribution Cut?

We noted the shrinking premiums of the three funds above, citing negative investor sentiment (with regards to interest rates and the imminent fund consolidation), but is the market predicting a distribution cut? We’d not be surprised one bit if the consolidated fund (PDI) ends up with a lower aggregate distribution as a result of the consolidation (as we explained in our previous report, linked earlier), but only time will tell. And the time is rapidly approaching (i.e. the consolidation could potentially occur within the next week).

What Is PDI Really Worth?

One of the nice things about CEFs is that we know what they are actually worth, as the daily NAV is simply an aggregation of the value of the underlying holdings. However, investors are rightly concerned about the upcoming consolidation, and the impacts it will have on future fees (PDI and PKO are getting a bit of a waiver), leverage (will PIMCO use this event as an opportunity to reduce leverage and thereby lower future returns and distributions?), and perhaps most importantly investor sentiment (how will the market react, and what will this do to the premium and/or discounts going forward?).

There are plenty of unknowns with this upcoming merger, but what we do know is that even if the distribution is reduced (it’ll likely be a small reduction if it is), the underlying holdings will keep paying big income payments, and the surviving fund (PDI) will use these income payments to support a big distribution going forward. We also know that the current premium assigned to PDI is relatively smaller as compared to its own history and to the history of PIMCO funds in general.

What are some PDI Alternatives?

PIMCO’s Corporate & Income Opportunity Fund (PTY) is one popular big-distribution, monthly-pay CEF that already recently experienced a distribution reduction this year (announced about 1-month ago), and as you can see in the chart below, the market reacted negatively. Specifically, the share price (and the premium versus NAV) both fell sharply.

PTY price vs NAV, per CEF Connect

Interestingly, even though the share price and premium fell sharply, the NAV (the value of the underlying holdings) wasn’t impacted and remained steady. PTY currently yields around 7.9% (paid monthly), and some investors consider it worthy of investment. However, the premium still remains very high on PTY, as it trades at a price 26% greater than the NAV—yikes!

PIMCO’s Dynamic Income Opportunities Fund (PDO) is new a CEF this year, with a 6.9% distribution (paid monthly). It also still has a pristine track record in the sense that it’s never cut its distribution, it pays distributions only from income (no capital gains or return of capital yet), and its premium is only around 1.4% (quite attractive for a PIMCO fund).

source: CEF Connect

PDO is currently focused heavily on corporate bonds, as well as securitized assets and banks loans, but this may change over time as the “dynamic” and “opportunities” part of its name suggests. Like the other PIMCO funds we’ve highlighted, PDO’s primary objective is also current income, and its secondary objective is capital appreciation.

Conclusion:

We know what PDI is worth because we can see the NAV every day. However, investors are rightfully concerned about the outcome of the merger (will there be a big distribution cut?), as well as concerned about the high payout ratio, high leverage and discounted price versus par for the underlying holdings. As a result, the once big premium versus NAV has fallen significantly. However, this is still PIMCO (essentially the best large fixed income investor in the world), and the upcoming merger gives them a chance to correct the growing stresses and risks (created by the high leverage and high payout ratio versus the underlying holdings). And once the dust settles, the underlying holdings will keep paying high income, PIMCO will still be a great manager, and eventually—the once big premium versus NAV for PDI—will be back!

Note: We currently own eight high-income CEFs, including shares of PCI (which will convert to shares of PDI in the near future) and we have no intention of selling. View all of our current holdings here.