Teekay LNG Partners’ business has been improving, and there are reasons to believe the common shares have significant price appreciation ahead. However, if you prefer a similar high yield without as much risk, you might also consider the preferred shares (they too offer price appreciation potential, just not as much). In particular, and despite the highly cyclical LNG shipping industry, Teekay LNG Partners’ has an impressive history and opportunity for consistency in the quarters and years ahead, stemming from its fully-fixed fleet for the remainder of this year and 94% fixed for 2021 (thereby largely insulating it from the current weak short-term LNG shipping market). In this article, we review the health of the business, cash flow position, balance sheet flexibility, valuation, risks, dividend safety, and conclude with our opinion about why TGP may be worth considering if you are a long-term income-focused investor.

Overview: Teekay LNG Partners (TGP)

Teekay LNG Partners LP (TGP) is a master limited partnership (“MLP”) that owns, operates and acquires LNG carriers. It was created by Teekay Corporation (TK) in 2004, which currently owns ~32.5% of limited partnership (LP) units and a 2.0% general partner (GP) interest. The MLP structure often comprises two entities: a limited partnership (LP) that owns the underlying assets and a general partner (GP) that is responsible for managing day-to-day operations of business.

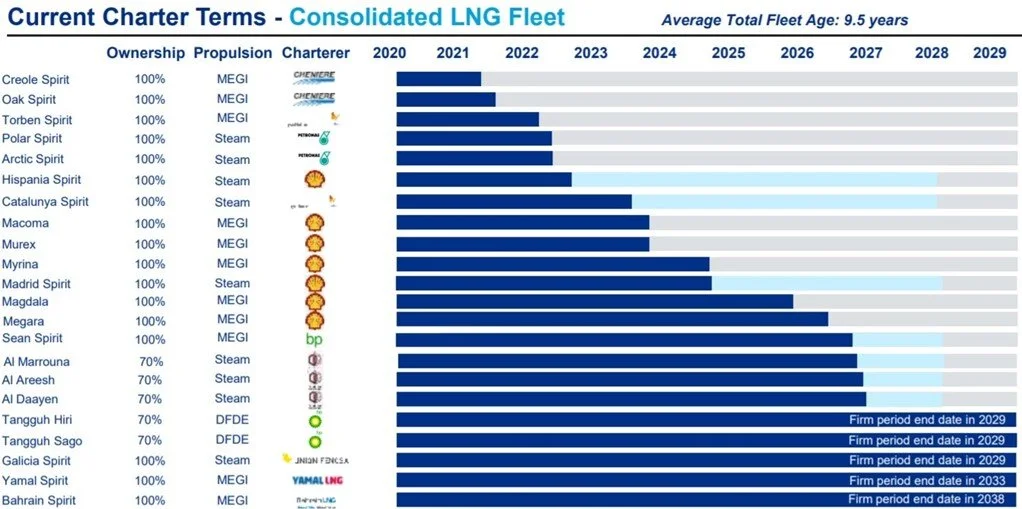

As of Q220 (June 30, 2020), TGP’s fleet consisted of 47 LNG carriers and 30 LPG and multi-gas carriers. Additionally, TGP owns a 30% interest in regasification terminal in Bahrain. The fleet is relatively young and has an average age of just 9.5 years, compared to world averages of 10 and 15 years.

Long-Term Fixed-Rate Contracts Provide Revenue Visibility

Currently, all 47 vessels are chartered under long-term contracts which provides cash flow visibility. The LNG fleet is 100% fixed for 2020 at nearly $80,000/day. This is far higher than the current spot LNG carrier market rates of $35,000 to $40,000 per day. Further, TGP’s fleet is 94% fixed for 2021 as well which again is very encouraging in the current environment where the LNG markets have been volatile and unpredictable. These fixed rate contracts are not impacted by LNG prices or cargo cancellations.

Importantly, the LNG carriers have a remaining fixed contract life in excess of 11 years, and these contracts are servicing the needs of blue-chip customers such as Shell, BP and Cheniere. Thus, we do not see any significant risks to future revenues (knock on wood). Based on the remaining tenure of its long-term contracts, TGP expects to generate total forward fee-based revenue of ~$9.3 billion. This will translate to adjusted EBITDA of ~$7 billion (given an EBITDA margin of around 75%). This level of EBITDA compares favorably to its current total adjusted net debt balances of $4.5 billion, which includes the company’s proportionate net debt of its JV interests.

Financials Continue to Improve

The company’s financial performance has been improving over the past two years. For example, second quarter adjusted net income increased to a record $62.6 million and total adjusted EBITDA also reached a new record level of $192.3 million. As shown in the graphs below, both adjusted EBITDA and adjusted net income have remained on an uptrend during the last eight quarters. And despite the pandemic, TGP reaffirmed its previously provided 2020 guidance. It expects earnings per unit to be in the range of $2.40 to $2.90 for 2020.

(source: Company Presentation)

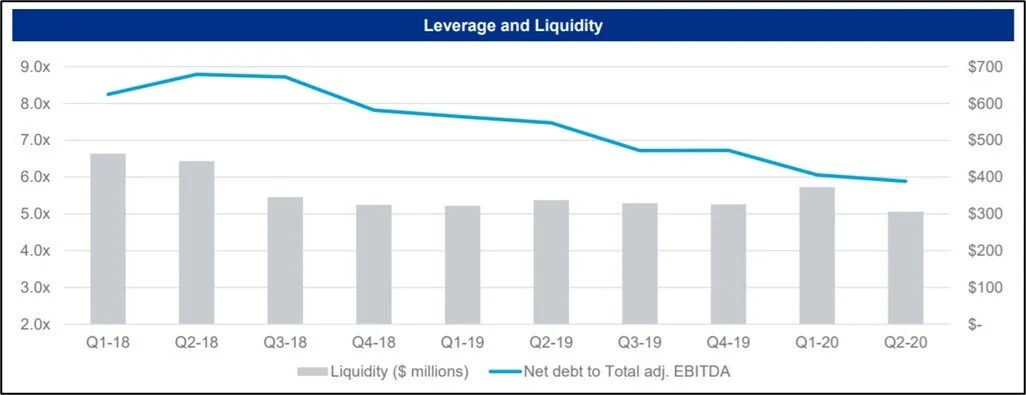

Additionally, the leverage continues to decrease which further highlights the stability of its cash flows. The company has reduced its total adjusted net debt by $428 million or nearly 10% since the end of 2019 and expects it to be within its targeted leverage range in 2021. The leverage moved from an annualized 6.7x one year ago to 5.9x as of the end of Q2 2020 on an annualized basis. The current debt profile is very manageable. TGP has current liquidity of over $305 million and no further debt maturities in 2020.

(source: Company Presentation)

High Distribution Coverage Ratio Supports the Dividend

TGP’s cash distributions (or dividends) to shareholders have grown at an average annual rate of over 30% in each of the last two years. The current annual dividend payout of ~$1.00 per share, implies a yield of ~9.7% which is very attractive in our view. TGP has signed multi-year charters with multiple high-quality customers, including Shell, Cheniere Energy, Inc. and BP. The leases provide predictable cash flows and allow TGP to return cash to investors on a regular basis. In fact, because the company is structured as a master limited partnership (MLP), it is required by law to distribute most of its available cash to unitholders.

It is important to note that the distribution coverage ratio as of Q220 was 4.1x. A ratio of greater than 1 indicates that the company generates more cash than that is required for distributions and shows strength of the company’s business. We are encouraged by high distribution coverage ratio as it validates our view that the dividend is relatively quite safe, and TGP will not only be able to maintain its payout but also increase it going forward.

Preferred Shares Have Benefits Versus Common Units

TGP has issued two classes of Preferred shares so far – 9.00% Series A, and 8.50% Series B. Both the classes were issued with liquidation preference of $25.00 per unit, at a price to the public of $25.00 per preference unit. These units are senior to the common units and as such receive priority over the common units in distributions and liquidation.

The Preference Units are listed on the New York Stock Exchange under the symbol “TGP PA”, and “TGP PB”. TGP-PA is currently trading at a slight discount (0.32%) to its liquidation preference and is callable in October 2021. TGP-PB is currently trading at a relatively higher discount (9.52%) to its liquidation preference and is callable in October 2027. When the preferred stock is callable, it means that the issuer (in this case TGP) has the right to call in or redeem the stock at a pre-set price (liquidation preference) after a defined period (callable date).

Of the two preferred stocks, we like Series B (TGP PB) given great price appreciation potential and higher yield. When looking at historical prices, we see that the Series B preferred was trading above $25 range pre-COVID. We expect it to go back to those levels again as normalcy returns and this will imply decent price appreciation for investors. While the Series B preferred shares have a slightly lower dividend yield when compared to the common units, the preferred units exhibit much lower price volatility compared to common units. Thus, they are particular attractive for investors seeking steady income with low volatility.

(source: Yahoo finance)

Valuation:

From a valuation standpoint, TGP looks fairly valued compared to other LNG shipping MLPs, but could have significant upside as it pays down its debt and as LNG market conditions improve. For example, on most measures (such as EV to EBITDA, Price to Distributable Cash Flow and Dividend Yield), TGP appears valued competitively considering its relatively higher leverage. We believe there is scope for the common units to appreciate significantly but the path is risky and will likely be volatile. For those seeking similar high yield with less risk, the preferred shares are attractive and worth considering (we currently own TGP.B).

(source: Thomson Reuters)

Risks:

High leverage: TGP noted that its current adjusted net debt is ~$4.5 billion (including its portion of JV debt). The leverage at the end of Q220 was 5.9x. This could be a cause of concern if there are any disruptions to its expected cash flows. We believe TGP has its debt and liquidity under control, especially considering there are no near-term debt maturities and TGP is well positioned to refinance its debt payments due in 2021.

Industry risk: The LNG sector is a cyclical industry that has historically been volatile. This impacts all shipping companies. Additional risks to the LNG sector include commodity prices, global GDP growth, natural gas demand, weather and environmental regulations.

Conclusion:

If you are looking for high yield, without all the volatility, you might want to consider owning Teekay LNG Partners preferred shares (we like the series B). By investing in the preferred shares, instead of the common units, you’ll likely avoid a significant amount of volatility (a good thing if you’re looking to sleep well at night), but you’re also forgoing some upside price appreciation potential (the preferred shares have a little upside potential, the common shares could achieve a lot). The company as a whole is largely insulated from the current weak short-term LNG shipping market considering its fleet is fully-fixed for the remainder of 2020 and 94% fixed for 2021. If it’s is high income that you are seeking, along with some price appreciation potential, Teekay LNG Partners is worth considering for a spot in your portfolio. We are currently long TGP.B.