Let’s face it, stocks are likely to be volatile in the weeks ahead. The market fear index (VIX) has been jittery, arguments can be made that social-distancing stocks have rallied too far (and not far enough), and there is this little thing in the United States called the upcoming presidential election on November 3rd. My investment philosophy is to always buy good businesses and then hang on (despite potential volatility) the for long term. And in this article, I will rank my top 10 growth stocks. However, I’ll also share specific options trading strategies that I believe are particularly compelling (based on current market conditions), potentially very lucrative and also consistent with my long-term philosophy. But before we start counting down the Top 10, it’s worth considering the tremendous and wide-ranging recent performance, valuation and expected revenue growth for top growth stocks.

The Market Has Been Volatile

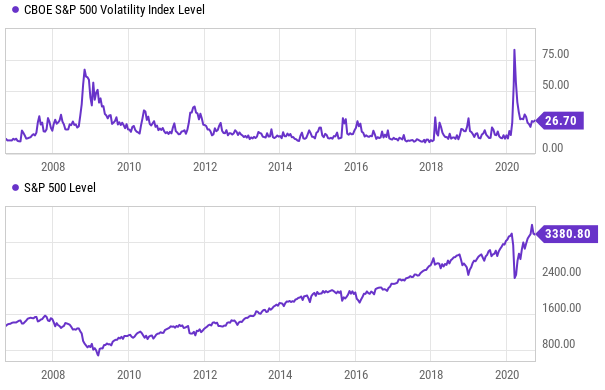

If you have not been paying attention to the market this year (which may actually be a good strategy for some easily panicked investors), it’s been a wild ride, and this month has been no exception. For your reference, here is a look at recent market performance.

In particular, the S&P 500 (SPY) was up to start the year, it plummeted during the COVID-19 selloff, it rebounded, and now it is having a tough September. And those moves were even more dramatic for the tech-heavy Nasdaq 100 (QQQ), and even more dramatic still for “cloud computing” stocks (WCLD) which have been particularly popular among many of the most aggressive growth stock investors and traders.

Valuation: Is Now a Good Time to Buy?

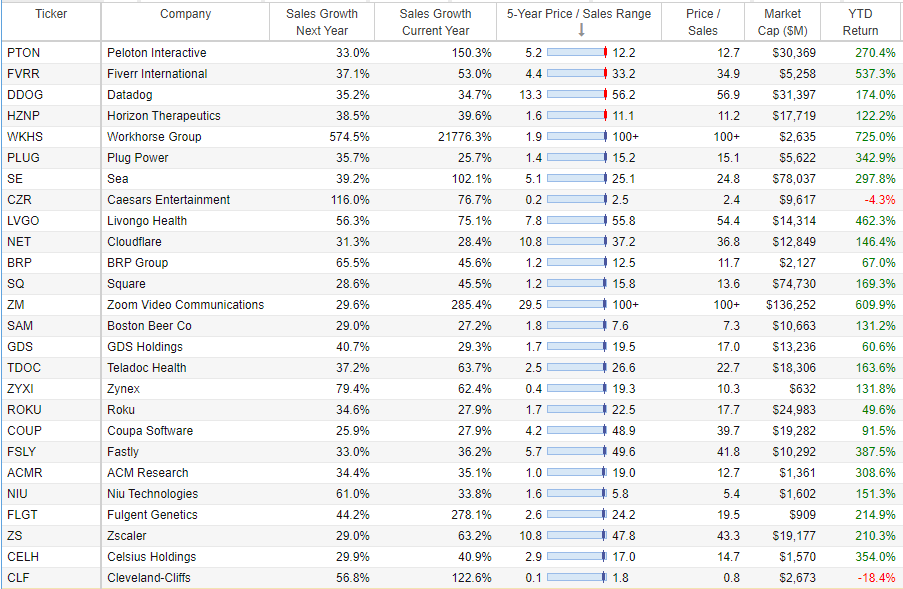

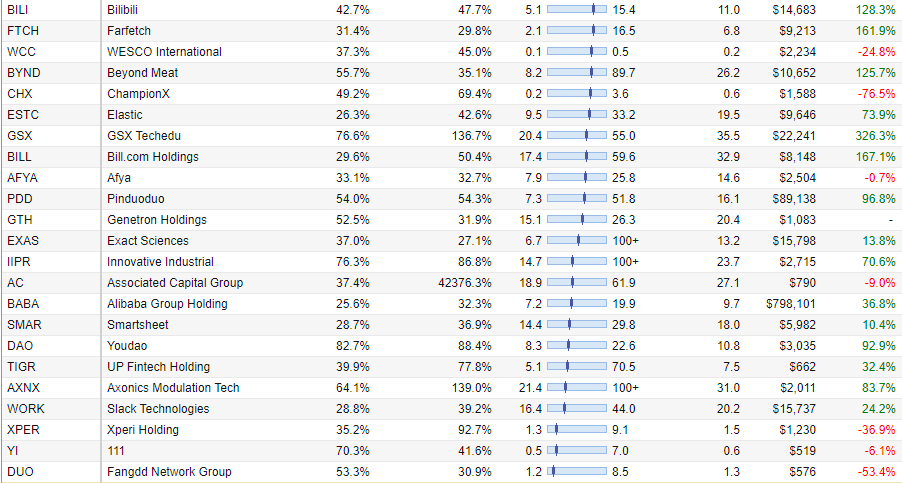

And if you are wondering if this month’s latest price pullback (for top growth stocks, in particular) provides enough margin of safety for you to add shares to your portfolio, consider this price-to-sales valuation table (below). It shows the top sales growth stocks are still generally expensive on a price-to-sales basis.

source: Stock Rover, data as of 01-Oct-20

However, these high price-to-sales ratios are not necessarily a bad thing for all of the companies on the list, especially when you consider their high expected sales growth rates this year and next (as shown in the table), plus their high potential growth for many more years into the future based on their leadership positions in their respective large and growing total addressable markets

In particular, it’s worth mentioning, Wall Street analysts chronically underestimate the long-term potential of top growth stocks because they are too focused on modeling the latest quarterly earnings announcements and guidance, instead of the actual long-term potential (this is why, sadly, most Wall Street Analyst price targets just follow the sensationalized short-term information flow instead of the actual long-term opportunities).

Long-Term Investors: Buy and Hang On

One simple strategy for long-term investors is to selectively buy the best top growth stocks now (we’ll highlight 10 of them in this article) based on your conviction that the individual businesses will eventually drive the share prices much higher.

This is actually a very good strategy if you are a long-term investor with the stomach to handle a lot of potential volatility in the weeks, months and years ahead. For example, as you can see in the chart below, over the last 15 years, every time fear and volatility spike (as measured by the VIX), the market sells off but then ultimately rebounds thereafter.

Options Trading Strategies: Volatility Can Be Good

Another strategy for investing in these top growth stock opportunities is through the use of simple options trades. For example, if there are businesses you really like, but you are nervous that near-term valuations are too high, you could sell out-of-the money put options now, which generate very attractive upfront income (that you get to keep no matter what) and give you a chance to own shares at an even lower price (if they fall even further—below your strike price—and get put to you before expiration). And importantly, the upfront premium income you receive for this type of trade is likely to keep increasing leading up to the November election because as volatility increases—so does upfront premium income. For a little more perspective on volatility (in addition to the jittery VIX mentioned earlier) check out this note I received from Interactive Brokers just last week.

This is another clear indication that volatility could rise—a good thing for some options trades. I will review specific examples of compelling options trade opportunities based on the current market environment as I count down my Top 10 Growth Stocks in the remainder of this report.

The Top 10 Growth Stocks:

before getting into the official top 10, I start with an honorable mention…

*Honorable Mention: Microsoft (MSFT)

You might be wondering how a behemoth like Microsoft makes it onto a top 10 growth stocks list when there are so many smaller high-growth businesses (we cover many in this report) where accelerating the business might seem easier to achieve and sustain. However, Microsoft has done an amazing job transforming itself into a constantly innovating, high-growth, cloud company with the critical mass to keep capitalizing on the massive global digital transformation that has only just begun.

As you can see in our earlier table, Microsoft’s growth trajectory is expected to remain high (this year’s sales growth is expected to be 13.0%, and next year at 11.5%), and its valuation remains attractive (it trades at 10.9 times sales, EV/Sales is 10.3x) after the recent sell off (the shares have been dragged ~13% lower along with the high-growth cloud sell off that has been transpiring this month.

We believe the shares have attractive sustainable long-term upside appreciation potential, and you can read all the details in our recent Microsoft report, here:

Furthermore, if you are simply too nervous to purchase shares of Microsoft now (i.e. heading into an election, and considering elevated market volatility may likely elevate further), you might consider one of two options trading strategies. The first is simply selling out-of-the-money put options with an October 16th expiration (we like the $200 strike price) because it generates attractive upfront income now (currently $1.32 upfront premium income), and because it gives you a chance to pick up shares at an even lower price.

And if you like to get slightly more complex with your trading strategy, you can consider the following Microsoft bullish vertical put spread strategy (as we wrote about in the link below) because it also generates attractive income, and gives you a chance to own at a lower price, but it also requires less upfront income, and it gives you insurance on the extreme market price downside.

Overall, we like Microsoft’s businesses, the opportunity that lies ahead, the price (even though there could be increasing near-term volatility), and we currently own shares.

10. Exact Sciences (EXAS)

If Microsoft’s huge market cap and high (but not super high) growth rate turned you off, you might want to consider shares of molecular diagnostic company (focusing on early detection and prevention of various cancers), Exact Sciences. It’s market cap is only 14.2 billion (tiny compares to Microsoft), and it’s expected growth rate is 27.1% this year and 37.0% next year. Furthermore, the shares have recently pulled back already (we explain why in our article linked below), which is compelling for those of you who like to buy very high growth at a more reasonable price. You can read all the details about Exact Sciences in the following recent report.

However, if you don’t have the stomach to buy shares of Exact (ahead of what could be a lot of upcoming election-related volatility), you might consider implementing an out-of-the-money put option selling strategy (such as the one we described for Microsoft in the previous sections). We like the $95 strike price with an October 16th expiration, for upfront premium income of around $0.98 (because it generates attractive upfront income and gives us the chance of owning shares at an even lower price). However, if you have the fortitude to buy and hang on through possible volatility, we believe these shares are going dramatically higher in the long-term, and a lot of those gains could come in the next 6-12 months (as we wrote in our Exact Sciences report, linked above). Overall, Exact Sciences is one of the few names on our list that we don’t currently own, but we may add shares soon.

9. Fiverr (FVRR)

Fiverr (FIVRR) is a global marketplace connecting freelancers and businesses for their digital service needs. It offers sellers and buyers over 400 categories ranging from digital marketing, to writing and translation, to programming and technology, to name a few. Fiverr is still only a $4.75 billion market cap company, but it has been growing revenues very rapidly and it has a very large total addressable market. However, many investors are nervous considering the recent strong price performance, high valuation and the expectation of high market volatility in the weeks ahead. Rather than purchasing shares outright, we like the extremely high upfront premium income available in the options market (for selling puts) because it gives us a chance to own the shares at a significantly lower price, and we get to keep that extremely high upfront income, no matter what. You can access my recent report on Fiverr here:

8. DocuSign (DOCU)

This is a powerful growth stock (next year’s expected sales growth is 31.2% and this year’s is 41.7%), that recently sold off significantly, and the valuation has become quite attractive relative to the business. DocuSign was recently added to the Nasdaq 100 index (replacing American Airlines), and a few of the things we like about it are the large total addressable market, the significant tailwinds from Covid, it’s first mover advantage, and its expanding margins (thanks to its growing scale). You can dig into all the DocuSign details in this recent article from Left Brain Investment Research:

(full disclosure: I frequently share investment research ideas with Left Brain, and I am currently long shares of DocuSign in my Blue Harbinger Disciplined Growth portfolio).

Overall, DocuSign is another stock you might consider just buying outright (without implementing any options trades). I am currently long shares of DocuSign.

7. Paylocity (PCTY)

Paylocity is in the right business, at the right time, and with the right strategy. This is a cloud-based, payroll processing company that has been (and will continue) benefiting tremendously as an increasingly number of businesses move towards digital cloud-based automation for simplicity and cost-savings purposes. And the current share price is very attractive relative to the valuation.

More specifically, the share price has somewhat struggled this year (relative to where it should be) as many of its smaller and mid-sized clients have been hit hard by the pandemic, and the company’s expected revenue growth rate this year is “only” 12.5% (I say “only” in quotes because that is still an impressive number, even if it is lower than prior years and below the rate of other names on this list). However, the growth rate is expected to snap back to 22.5% next year, and it trades at a lower price to sales ratio (14.5x) than many other companies with similar expected high growth (the EV/Sales number is only 13.5x for those of you that prefer that metric).

I have owned Paylocity since 2015 (I owned it when it traded below $30, now it trades at $162) and my last full report on the company was in April (see report link below). Here is how I concluded my original Paylocity report back in September 2015:

“Based on the market opportunity, this company could turn extremely profitable within the next five years. And any signs of improvement in the near term should cause the stock price to increase towards our price target of $40 to $50 per share. Realistically, this company could greatly exceed our growth targets and continue to grow dramatically for many years to come.” -Sept 2015

In my view, given the market’s short-term reaction to this year’s covid headwinds on revenue growth, this one could rally sharply higher in the months and years ahead (it could also get acquired at a significant premium to its current price, which wouldn’t be the worst thing in the world either).

6. Magnite (MGNI)

This is a tiny, beat up, digital advertising firm with a massive amount of upside if it can get its ducks in a row (which the company appears to be doing). More specifically, the total addressable market is huge, and this specific opportunity has been magnified recently, not only by the pandemic, but also by the firm’s own specific challenges and now recent merger. In fact, advertisers have significantly reduced digital ad spend in the short-term (which has magnified pressure on these shares), but as we head into 2021, digital ad spend is expected to resume rapidly, and it could slingshot these shares higher, especially considering the improved long-term business model and enormous market opportunity.

From a financial metrics perspective, sales are expected to grow at just over 23% this year and next, yet the shares trade at a price-to-sales valuation of only ~4x. And given the large market opportunity in this space—this is quite attractive. Furthermore, considering the low share price, if you want to get ultra aggressive, you might even consider buying some naked calls on this one (we’d suggest doing it on a down day, as the shares are volatile). For your reference, here is our recent full report on Magnite:

5. Facebook (FB)

Facebook is a magnate for media and political frustrations (for example the US Senate is set to subpoena them again), and given its very large market cap, you probably wouldn’t expect to see it on a top growth stocks list. However, Facebook is an absolute money printing machine, and there are reasons to believe we may get some very good buying prices in the coming weeks.

Specifically, Facebook has significantly dialed back on digital advertising leading up to the US election (by its own decision, and by the decision of many companies (big and small) that have chosen to advertise far less leading up to the election and coming out of the coronavirus pandemic). And this means lighter near-term revenues compared to what they could be.

Furthermore, as we head into the election (and just past the election) if we get the big sell off that fear mongers are advocating for, we could get a chance to purchase more shares of Facebook (we already own shares) at a very compelling price. You can read our last full Facebook report below, but it’s worth mentioning that this stocks is a highly compelling stock for selling out-of-the-money income-generating put options because increasing volatility increases the amount of upfront premium income available in the options market, and it also means we could have the shares put to us at a much lower price (if volatility drives the share price lower and they get put to us before expiration). For example, we like the $245 strike price on the October 16th contract for upfront premium income of $1.50 per contract. Furthermore, if you’re not comfortable with setting aside the cash to secure this trade, you could consider implementing a bullish vertical put spread, which also offers upfront income and a chance to buy lower, but with a smaller cash requirement and a little insurance too.

Overall, we believe Facebook is an attractive long-term growth stock (sales are expected to grow at 9.3% this year and 24.1% next year), and it trades at a price to sales of 9.6x (not bad for this kind of long-term growth). We currently own shares, and you can read our previous Facebook report here.

4. Sea Limited (SE)

Sea Limited is a powerful consumer internet company, operating a leading digital entertainment business, as well as an e-commerce platform and a digital financial services operation, in Southeast Asia (i.e. some of the fastest growing economies in the world). And Sea is benefiting significantly from the tailwinds of global “Stay-at-home” orders.

Sea is also one of the hottest stocks in terms of sales growth (sales growth is expected to be just over 100% this year, and 39.2% next year), and especially considering it has a very large total addressable market (see our full Sea report, linked below). The shares currently trade at a price-to-sales ratio of 23.2x (EV/Sales is almost identical at 24.1x) which is frightening to some investors, but it shouldn’t be when you consider the large total addressable market (i.e. big long-term growth potential).

We currently own shares of Sea, but considering the highly volatile nature of this stock (and the overall market as we head into an election in the US) , you may want to consider selling out-of-the money puts (instead of buying the shares outright) because it generates very high upfront income (thanks to expected market volatility) and it gives you a chance to buy the shares at a lower price (if they fall below your strike and get put to you before expiration). In fact, this is the exact strategy we wrote about in our recent full report on Sea Limited.

3. Square (SQ)

As the world continues to transition to a cashless economy, Square is at the forefront (and benefiting) from this large (and expanding) total addressable market, thanks to it Square ecosystem. Square operates in two distinct segments (seller services and Cash App), and the company has been growing rapidly.

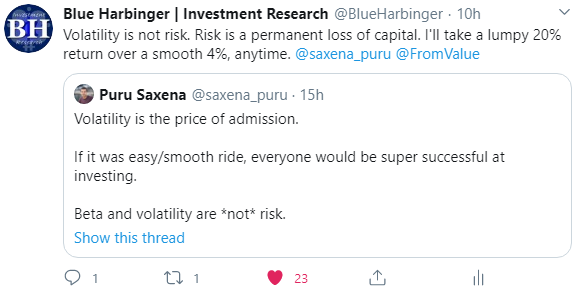

This year’s sales growth rate is expected to be 45.5% and next year’s is expected to be 28.6%, but we anticipate next years figure could be higher as more small and mid-sized businesses (Square’s bread and butter) re-open following the coronavirus shutdowns. However, more importantly, it is Square’s long-term opportunity that is more important as it leads the way into a growing cashess global econconmy. You can read more about Square in the recent article from Left Brain Investment Research (a firm I work with frequently). I am currently long shares of Square in my Blue Harbinger Disciplined Growth portfolio, and I have no plans to sell anytime soon, despite any potential volatility because, as stated previously, as a long-term investor, I’ll take a lumpy 20% return over a smooth 6%, anytime.

2. CrowdStrike (CRWD)

CrowdStrike is a cybersecurity company (it provides endpoint detection and response (EDR) solutions), the business is in the right place at the right time (the need for cybersecurity grows and evolves constantly), and it is growing very fast (with A LOT more room to grow). For a little perspective, CrowdStrike’s revenue is expected to grow at an astounding 70.3% this year (thanks in large part to the pandemic-induced dramatic rise in work-from-home), and its revenues are expected to grow at 36.6% next year. But what makes this opportunity so great, is that the market opportunity is so large, and CrowdStrike is proving to be a clear leader, that it can grow at a rapid pace for MANY years into the future. It currently trades at a price-to-sales ratio of around 43.1x, which is terrifyingly expensive to some investors that don’t understand the business, and are used to investing in lower growth old school large caps (such as Procter & Gamble or Johnson & Johnson for example, both great businesses in their own right—just not fast growers). However, relative to the long-term growth opportunity, CrowdStrike is still dramatically UNDER-valued by the market. For example, here is a chart of the average Wall Street analyst price target for CrowdStrike versus its current price, and as you can see even these overly conservative analysts believe the shares have a lot of upside.

However, these analysts are chronically too short-term focused (their price targets generally just reactively follow the actual share price around), and they never accurately capture the true long-term value of powerful long-term growth stocks such as CrowdStrike. For a more detailed analysis of this business, and why I like it, here is my recent CrowdStrike report.

I currently own shares of CrowdStrike in the Blue Harbinger Disciplined Growth portfolio, but if you are nervous about near-term market volatility in the upcoming weeks, consider selling out-of-the-money puts to generate attractive upfront income and to give yourself a shot at picking up shares at a significantly lower price (if the share price falls below your strike price before the options contract expires).

1. Livongo-Teladoc (LVGO) (TDOC)

Livongo is one of the fastest-growing health tech companies and among the select few that have seen their value propositions become dramatically more evident as a result of the COVID-19 outbreak. And in very big news last month, Livongo has agreed to merge with another rapidly growing health tech company, Teladoc. Both companies continue to grow rapidly and have very large total addressable markets. And for a little perspective, Livongo sales are expected to grow at 75.1% this year and 56.3% next year. These are HUGE numbers. And with a very strong showing in its own right, Teladoc revenues are expected to grow 63.7% this year and 37.2% next year. These are both amazing companies in the right place at the right time as the global digital transformation has been accelerated by the coronavirus and work-from-home practices.

I currently own shares of both Livongo and Teladoc in the Blue Harbinger Disciplined Growth portfolio. And for a little perspective on the merger, each share of Livongo will be exchanged for 0.5920x shares of Teladoc plus cash consideration of $11.33 for each Livongo share. And the transaction is on track to close by the end of Q4.

If you are nervous about upcoming volatility in the market, you could consider the attractive benefits of implementing a bullish vertical put spread on shares of Livongo as I wrote about in great detail here.

However, you might also just consider picking up a handful of shares of Teladoc and hanging on for the long-term because the growth potential of the combined entity will be dramatic and potentially very lucrative (assuming you have the fortitude to hang on to your shares, through potential volatility, in the long-term years ahead).

The Bottom Line:

There are a lot of very attractive long-term growth opportunities in the market, despite the potential for heightened volatility in the weeks and months ahead. If you have the emotional stength to deal with higher volatility, then many of the growth stock ideas listed in this report may be right for you (I currently own most of them, with the exception of Exact Sciences, Magnite and Fiverr, which I may buy soon. You might also be interested in taking advantage of the growing volatility in the market by utilizing some of the options trading strategies described in this article. And overall, you can view all of the current holdings in my long-term Disciplined Growth Portfolio here: