The Saratoga (SAR) decision to defer its dividend led to a sharp decline in share price. We believe fears are overblown given its solid portfolio, liquidity and track record of outperformance. Even after the most recent partial reinstatement of the dividend, the stock is trading at nearly 30% discount to NAV, and we believe it offers an attractive entry point for investors with a little appetite for risk. We do caution that a prolonged and severe downturn remains a risk to our thesis. This article reviews the health of the business, valuation, risks, dividend safety, and concludes with our opinion about investing.

Overview:

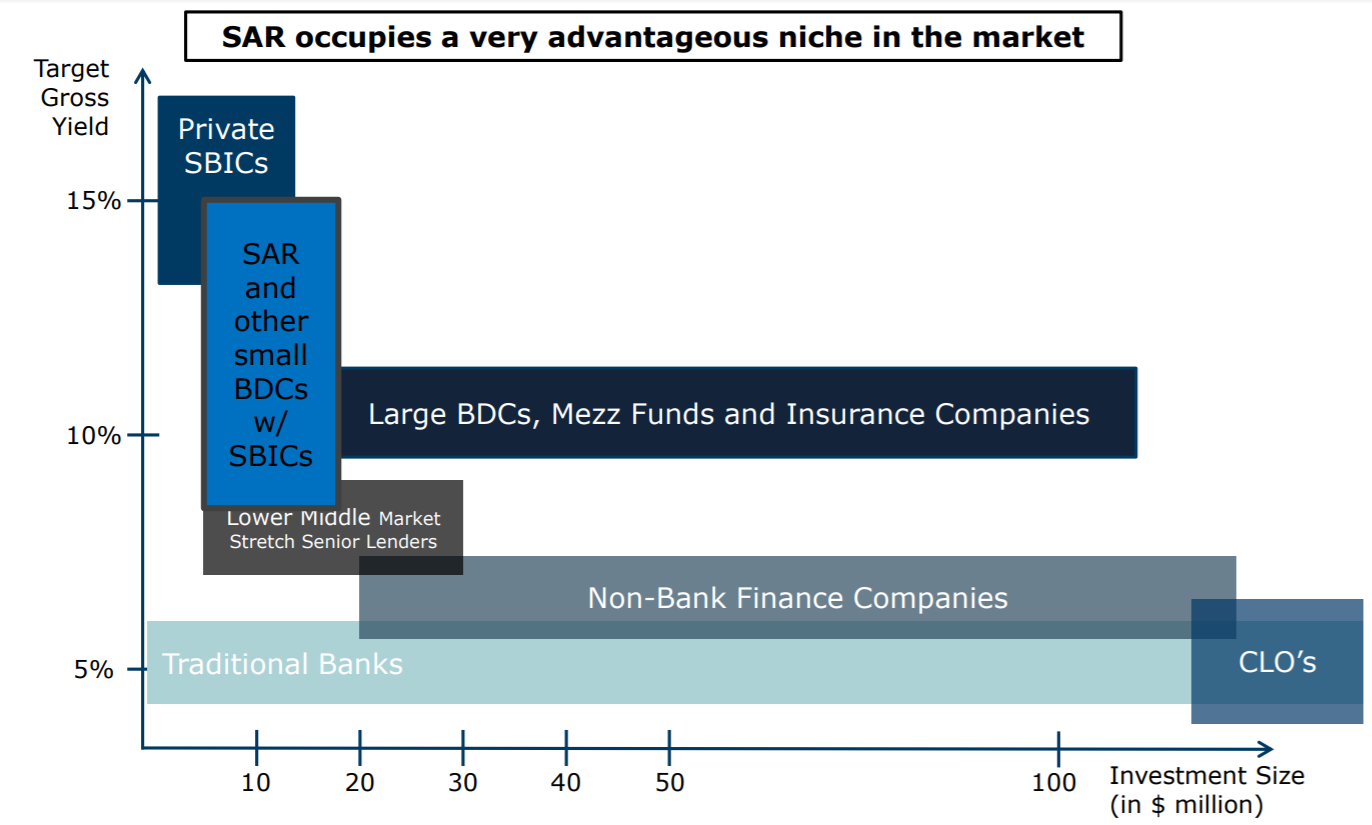

Saratoga Investment Corp (SAR) is an externally-managed business development company (BDC) primarily focused on providing debt financing to lower middle market (LMM) companies (revenue between $8-$250 million) in the US. These investments generally range in size from $5 million to $30 million. SAR’s portfolio is diversified across 35 companies with senior secured (first & second lien) accounting for ~86% of total investments. These instruments rank ahead of other subordinated debt and thus provides some increased safety against default especially during the current COVID-19.

The company’s investment portfolio is diversified across geography and industries which further adds protection to the portfolio, revenue sources, income, and cash flows. Saratoga has investments in nine distinct industries: business services, consumer services, consumer services, education, food and beverage, healthcare services, consumer products, Property management and metals.

(source: Company Presentation)

Recent Dividend Volatility

SAR deferred its dividend for starting with the quarter ended February 29th, citing caution amid uncertainty due to COVID-19 pandemic. CEO, Christian Oberbeck noted in the Q4 earnings call

“in light of the massive uncertainties that currently exist in the economy and to ensure we retain sufficient liquidity to not only support our current portfolio companies during these challenged times, but also to create new important relationships for the near and long term through the provision of critically needed liquidity to small businesses. We believe it is in the best near and long term interest of our shareholders, our portfolio of companies and our constituent community to maintain a conservative approach to our dividend policy at this time of extreme uncertainty.”

However, SAR recently reinstated a reduced quarterly dividend ($0.40, down from $0.56). And the new dividend payout is comfortably covered by Net Investment Income, but has been set conservatively given the novel coronavirus impacts on small businesses, such as those SAR lends to. In prepared remarks during the quarterly call, management explained:

“This dividend has been calibrated at this level, relative to the most recent $0.56 per share dividend, to reflect on the one hand our relatively strong quarterly results and recently improved liquidity profile, and on the other hand the lack of short and long term visibility of the portfolio company and the general economy fundamental earnings levels, given the unprecedented and highly effective amounts of liquidity provided by PPP loans, Fed interventions and fiscal stimulus. We will continue to reassess the amount of our dividends on at least a quarterly basis as we gain better visibility on the economy and fundamental business performance.”

So basically, the business is relatively healthy and improving, but management is being cautious and conservative.

SAR had a growing history of steady dividend payments prior to Covid, and in our view it is encouraging they have been proactive and conservative in the current market environment. Specifically, SAR had maintained a solid dividend payout since 2015. The quarterly recurring dividend had never been decreased and had shown growth of 211% from $0.18 per share in the second quarter of 2015 to $0.56 per share for the third quarter of 2020. And very importantly, the dividend is consistently covered by adjusted net investment income. The adjusted net investment income (NII) for the trailing twelve-month period is approximately 113% of annual dividends. And the most recent quarterly result for SAR exceeded NII expectations by a penny.

Also important to note, nearly 73% of the company’s investments are in business services and healthcare which have remained reasonably more stable during the current crisis. Only 6.2% of its portfolio is in hospitality/hotel and restaurant industries. And it has no exposure to the energy sector which has been badly impacted.

SAR’s CEO noted in the previous earnings call that they are trying to be very conservative taking into account worst-case scenario.

“And so what we're trying to do is just maximize the liquidity. To quote Charlie Munger of Berkshire Hathaway. I mean he said, "When you're headed into the biggest typhoon anyone's ever seen, you want to make sure that you're in a position to emerge on the other side with a lot of liquidity." And so we've taken that to heart.”

Healthy Liquidity

Looking at the liquidity situation of the company, we think it has sufficient liquidity available considering adjusted NII for the most recent quarter was $0.51, easily exceeding the $0.40 dividend declared. Further, SAR has access to two small business investment company (SBIC) licenses – SBIC I and SBIC II, which provides liquidity support. As of Q120, SAR had borrowing capacity remaining under SBIC II to the tune of $175 million. We also note that during Q1, SAR offered additional shares and raised ~$84.5 million. Overall, SAR has access to ~$259.5 million of liquidity as of Q120. Considering the solid portfolio and balance sheet, we think the dividend is healthy and will return to (and exceed) pre-covid levels once the uncertainty settles and more clarity on economy emerges.

source: Company Presentation

Large Middle Market Opportunity

There is a large market of small businesses underserved by traditional asset managers such as banks. There are over 175,000 companies in small business target market in US with revenues between $10 and $150 million. The middle companies generally have annual revenues between $10 million and $150 million. Traditionally, small businesses have relied on banks for financing needs. But over the years, the number of banks in the US have declined considerably due to consolidation. And larger banks typically have been inclined to lend to larger companies. Additionally, increased regulation has made it more onerous for remaining banks to make small business loans. there is consistent decline in small business bank lending due to consolidation and regulation. The underserved nature of the small businesses creates an opportunity for SAR to meet the financing needs of these companies. Currently, less than 8% of private capital is focused on small businesses. The lack of interest in these small companies means pricing inefficiencies which tend to generate outsized returns.

source: Company Presentation

Strong track record of outperformance

SAR has a proven track record of outperforming the BDC industry. It has delivered 5-year total return of 43%, placing it among the top 3 of all BDCs. Even for full year fiscal 2020, SAR delivered outperformance versus the industry across diverse categories, including interest yield on the portfolio, latest 12 months NII yield, latest 12 months return on equity, year-over-year dividend growth and latest 12 months net asset value per share growth.

Though, total return for the last 12 months, which includes both capital appreciation and dividends, stood at negative 36%, in line with the BDC index.

source: Company Presentation

LTM Performance Versus BDC Peers

source: Company Presentation

Valuation:

SAR compares favorably to other BDCs which are focused on middle market companies. As can be seen in the table below, SAR is trading at deep discount to the other BDCs despite having a proven track record of outperformance as mentioned in above. The stock is down ~39% year to date and we see the current price as an attractive entry point for long-term investors.

(source: Company data, Yahoo Finance, SAR dividend represents pre-deferment level. At current $0.40 quarterly dividend, the yield is ~9.4%)

Risks:

Underwriting risk: The company primarily invests in debt and equity instruments of small sized companies which makes its inherently risky. Thus, it is exposed to underwriting risk. Poor underwriting on its part could lead to heavy losses in its portfolio.

Recession risk: BDC companies are often vulnerable to recessions since they comprise portfolio of debt and equity instruments, both of whose value is adversely impacted during such times. The credit spreads widen during recessions causing debt value to go down.

Floating interest rate: are a risk factor for SAR. Nearly 93% of its debt portfolio investments are floating rate. Now this can be a risk as in rising interest rate scenario, the probability of default increases. On the contrary, this also gives SAR a chance to collect higher income on its debt investments. In case of falling interest rates, the investment income for SAR goes down.

Conclusion:

SAR shares have posted gains following this month’s strong earnings announcement and the partial reinstatement of the dividend. The shares continue to trade at a sharp discount to NAV following the covid-sell off, and we believe this present an attractive investment opportunity for long-term income-focused investors that can tolerate a little risk. Specifically, the business is well-managed, the liquidity position is strong and market conditions (and the dividend) are improving. In our view, the full dividend will likely resume in the not-too-distant future. We do caution that a prolonged and sever recession remains a risk, but management has taken a proactive and conservative approach and we like the shares from here.

BDC Note:

(source: Stock Rover, as of mid-morning July 16th).