As COVID-19 progress continues on two fronts (a vaccination and herd immunity), Welltower shares still trade like the world might end. And the panic has caused the upfront premium income available in the options market to remain extremely elevated and attractive. This report shares a compelling option trade that generates high upfront income and gives you the chance of owing shares of this outstanding high-dividend healthcare REIT at a compelling lower price. We believe this is an attractive trade to place today and potentially over the next few days, as long as the underlying stock price doesn’t move too dramatically before then.

The Trade: Welltower (WELL)

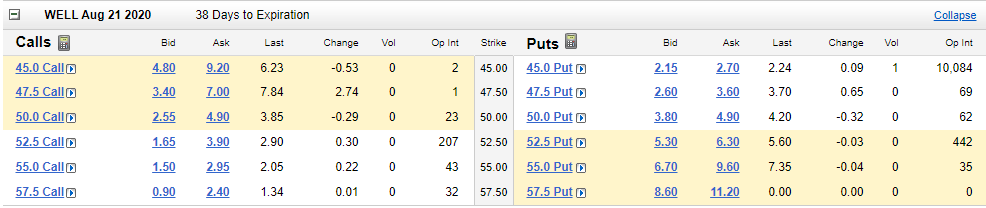

Sell Put Options on Welltower (WELL) with a strike price of $45.00 (~10% out of the money), and an expiration date of August 21, 2020, and for a premium of at least $2.15 (this comes out to ~57% of extra income on an annualized basis, ($2.15/$45.00 x (12 months, annualized). This trade not only generates attractive income for us now, but it gives us the possibility of owning shares of WELL at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be happy to own WELL, especially if it falls to a purchase price of $45.00 per share).

Your Opportunity:

We believe this is an attractive trade to place today and potentially over the next few days as long as the price of WELL doesn't move too dramatically before then, and as long as you’re able to generate annualized premium (income for selling, divided by strike price, annualized) that you feel adequately compensates your for the risks (currently 50%+).

Our Thesis:

Welltower’s senior housing business has had a tough go with the coronavirus, but the business is stabilizing, and we believe it will eventually improve. Furthermore, near-term fear is causing the price to trade too low, and the premium income available in the options market is quite compelling. Our previous full report on Welltower is from March (mainly right before the coronavirus became a full blown pandemic), but the business overview remains the same and it highlights the very strong financial position going into this mess (and it will help them continue to weather this storm).

Investor fear has been driven by fear mongering news stories and the company’s recent dividend reduction (from $0.87 per quarter to $0.61). Further, the company has been buying back (over $400 million) of its bonds in the open market (a smart move in our view). However, all of this uncertainty has investors extremely nervous to the point where they’ve panicked and hit the sell button. At some point in the not too distant future, these shares will be trading significantly higher. And the very high upfront premium in the options market is hard to ignore (premium increases when fear and volatility increase).

Important Trade Considerations:

Please also keep in mind, options contracts trade in lots of 100, so to secure this trade with cash (in case the shares get put to you and you have to buy them) you’ll need to keep $45 times 100 on hand (the strike price times an options contract lot of 100). You’ll also need to be comfortable holding that many shares in your account from a position-sizing / risk management standpoint (Welltower’s recently lower share price makes this trade easier to enter at a lower total dollar amount). Alternatively, if your account is approved for margin (borrowing) you don’t need to keep the cash on hand in case the shares get put to you, just know that if they do get put to you—you’ll buy them “on margin” and get charged the borrowing interest rate in your account (some investors are okay with this, others simply prefer to keep the cash on hand) if you don’t have enough cash in your account to settle up.

Two additional considerations when selling put options are dividends and earnings announcements because they can both impact the share price and thereby impact your trade. In this particular case, both are important factors. Welltower will likely go ex-dividend in mid-August (although the exact date hasn’t yet been declared), and the company will announce earnings next in late July / early August (again, before this options contract expires). However, given the very large upfront premium income we are generating on this trade—we are comfortable with the trade.

Conclusion:

REITs like Welltower are are extremely “out-of-favor” at the moment, and that can be a good time to enter a position (be greedy when others are fearful). We believe a new normal will emerge in the post pandemic world (whether that be a vaccination or herd immunity) and Welltower shares will eventually go much higher. However, if you are not comfortable buying the shares outright, the options trade opportunity described in this article allows you to generate very attractive upfront premium income (that you get to keep no matter what), and it also gives you a chance to own the shares at an even lower price if they fall further before expiration and get put to you. And at a price of $45/share, Welltower is an extremely attractive long-term big-dividend investment.