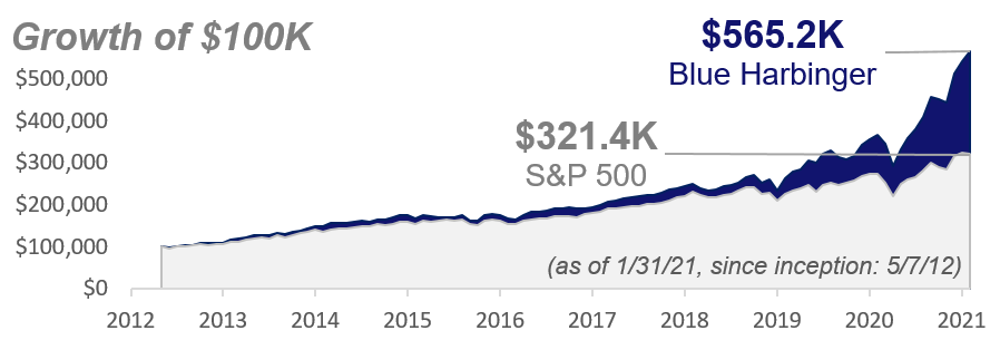

After a strong +53.0% gain in 2020, the Blue Harbinger Disciplined Growth portfolio added another 4.2% in January, while the S&P 500 was down 1.0%. In this brief update report, we review the holdings, weightings, price targets and ratings changes for the Disciplined Growth portfolio, as well as the 6.0% yield on the Income Equity strategy.

Disciplined Growth Portfolio

For starters, here is the long-term performance of the Disciplined Growth Portfolio.

And here is the link to the current portfolio holdings. There were no major changes to the portfolio holdings over the last month (you can see the target (and actual) weights of each position towards the right side of the spreadsheet. However, there have been updates to the “buy under” prices of a variety of positons. Specifically, the buy under prices in green have been raised since last month, and the ones in red have been lowered. These “buy under” prices are subjectively determined based on our review of each position (and then “spot checked” against the average Wall Street price targets as per Factset, for what that’s worth). And as a reminder, the ratings are based on a mathematical formula based on how far the current market price is from the “buy under” price. As such, the ratings change in real time, and this can be useful for investors trying to determine where to raise and/or allocate cash.

Notably, we have significantly large positions (above the target weights) in Roku (ROKU), Magnite (MGNI) and Crowdstrike (CRWD) that have been driven by strong price performance in those names. The weights are NOT large enough to warrant an immediate rebalancing of those positions (to bring them back down closer to their price targets), but we are watching them closely. Roku and Crowdstrike are GREAT businesses, and Magnite is attractive but still has a lot to prove.

Income Equity Strategy

The Income Equity portfolio continues to kick off high income (6.0% yield) as it was designed to do. The long-term performance is strongly positive, but lags behind the Disciplined Growth portfolio as expected considering the focus is on generating steady high income with some capital appreciation too.

January saw strong performance for small cap companies, such as our current Small Cap CEF holdings, including Royce Small Cap and Micro Cap funds (RMT and RVT). Small businesses were hit hard by pandemic, and continue to present an attractive contrarian opportunity going forward as the vaccine rollout continues and provides some some signs of light. The same is true of many real estate investment trusts (REITs) which were also particularly hard hit. Here is a look at January (and 1 year) performance by market sectors and styles.

And not surprisingly, as oil prices have continued to improve, so too has the energy sector—which was a terrible laggard in 2020.

Going forward, if you are looking for steady high income (that is paid monthly) we particularly like the 8.8% yield of mortgage REIT AGNC Investment Corp (AGNC) because of the attractiveness of its Agency MBS holdings, which are particularly safe; as well as PIMCO’s Dynamic Credit and Mortgage CEF (PCI) which yields 9.7% and has price appreciation potential based on the discounted prices of its underlying bond holdings (attractive). Both are currently rated “Strong Buy” within the portfolio, and are excellent sources of high income if you are looking to do something slightly more risky than “under your mattress” with your cash.

Our Watchlist

And if you are looking for more reports, and investment ideas, be sure to check out our most recent Investment Idea Reports as well as our Top Growth and High Income idea tracking spreadsheets (the prices update in real time).

The Bottom Line

As always, it’s critically important to know your personal goals as an investor. If you’re only looking for “singles” it doesn’t make sense to bet the farm on 100% volatile growth stocks. But if you do have a long-term horizon—we continue to present attractive ideas that are absolutely worth considering. Whatever your goals, disciplined long-term goal-focused investing has proven to be a winning strategy over and over again throughout history, and it will continue to be this time too. Be smart.