If you are afraid the market is due for a significant pullback in the near-term, you might be considering moving to cash. However, and depending on your goals, you might instead want to consider the attractive 8.1% dividend yield blue chip stock described in this article. Specifically, no one knows when the next pullback is coming, but the stock described in this report has a very healthy dividend (with over 50 years of dividend increases), and the shares have significantly less volatility risk than the rest of the market (as per its 0.6, 3-year beta). Furthermore, we like the company’s aggressive share repurchase program. In this report, we review the business, valuation, dividend safety and risks, and then conclude with our opinion on who should invest.

Altria (MO) Dividend History:

Overview:

Altria Group Inc. (MO) is one of the world’s largest manufacturer and seller of cigarettes, tobacco and related products. Altria is structured as a holding company, and operates via its subsidiaries - Philip Morris USA, U.S. Smokeless Tobacco Company, John Middleton Co., Ste. Michelle Wine Estates Ltd. and Philip Morris Capital Corporation. The company also has a 10% equity stake in Anheuser-Busch InBev (BUD), a 35% stake in e-cigarette maker JUUL (JUUL), and a 45% stake in the cannabis company Cronos Group (CRON). Some of its major brands include Marlboro, Black & Mild, Copenhagen, Skoal.

Altria’s reportable segments are smokeable products, smokeless products and wine. Smokeable tobacco products comprise the majority of Altria’s revenue (~88% of total) and operating profit (~92% of total). This segment has been the primary driver of cash flow for the business and has allowed the company to a pay dividend for 51 consecutive years.

However, with the decline in smoking rate in the US, Altria has been trying to diversify into other product lines including smokeless tobacco, wine and other related products. The company purchased a 45% equity stake in Canada-based cannabis producer Cronos Group (CRON), a 35% equity stake in e-vapor manufacturer Juul Labs, and 80% stake in oral nicotine pouch manufacturer, Burger Sohne Group.

Altria generated steady profits in 2020 (they just reported at the end of January). Altria's full-year adjusted diluted EPS grew 3.6%, driven by strong performance from tobacco businesses. And it expects to deliver 3% to 6% growth in EPS in 2021 as well. The company is guiding for full-year 2021 adjusted diluted EPS in a range of $4.49 to $4.62.

Strong competitive advantages; Recession Proof Business

Altria enjoys strong competitive advantages which have allowed the company to deliver high profits despite falling or stagnant revenue over the last decade (2010-2020). Revenues have marginally grown form ~$24.4 billion in 2010 to $26.1 billion in 2020; however profits have doubled during this period (from $4 billion in 2010 to $8.1billion in 2020). This is primarily attributable to pricing power that Altria enjoys as it has been able to continuously increase prices to offset the decline in smoking volumes.

One of the reasons that the company has been able to raise prices is due to high brand loyalty among consumer. The market share for its flagship Marlboro cigarette brand has remained over 40% for many years.

Marlboro Retail Market Share

Source: Company Presentation

Also, Altria’s business is highly recession proof. Cigarette and alcohol sales typically do not fall too much amid recession and this is evident from Altria’s performance during periods of downturn. It grew its EPS every year during the great financial crisis from 2008-2010 ($1.66 in 2008 to $1.87 in 2020).

This ability to produce steady earnings growth even during downturns enables the company to maintain distributions to shareholders which should appeal to income seeking investors. With the declining preference for smokeable tobacco, the company is diversifying into non-combustible categories. Altria has put forward a 10-year vision to expand its non-combustible category and actively convert smokers to them. This is a long-term plan to adjust the company’s portfolio as the tobacco consumer dynamics is changing.

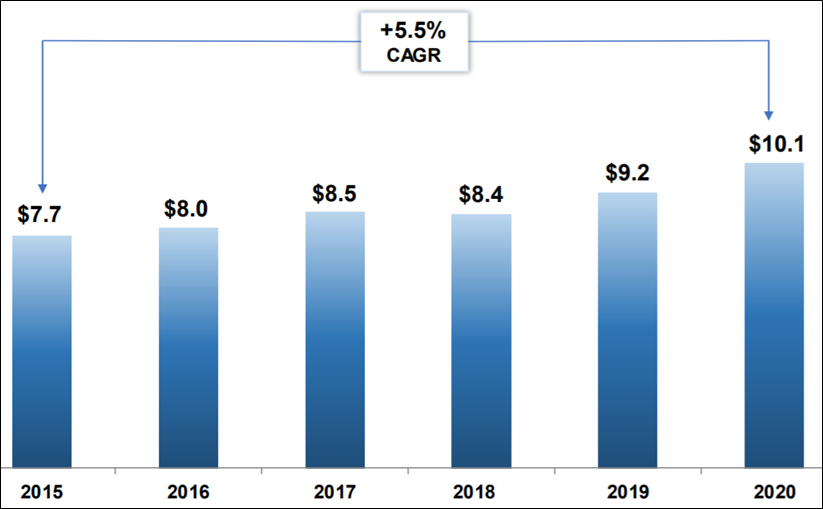

However, in the near to medium term, smokeable products will continue to drive profitability. Over the last five years, the smokeable segment’s adjusted operating income has grown by 5.5% on a compounded annual basis.

Smokeable Segment Adjusted Operating Income ($ bn)

Source: Company Presentation

Safe & Sustainable Dividends

Altria has increased its dividend for 51 consecutive years, putting it in the elite list of Dividend Kings (companies that have raised their dividend for at least 50 consecutive years). The most recent raise was in July 2020 wherein Altria increased Q320 dividend by ~2.4% to $0.86 per share.

Altria’s CEO noted in the Q4 earnings call transcript :

“We returned nearly $6.3 billion in cash to our shareholders in the form of dividends. And our Board increased the dividend for the 55th time in the past 51 years. And our long-term objective is a dividend target payout ratio of approximately 80% of adjusted diluted earnings per share. We believe our dividend target payout ratio provide significant shareholder return.”

The current market price of ~$42.60 implies a dividend yield 8.1% which is extremely attractive for income investors. We think that the dividend is sustainable given that Altria has significant competitive advantages to generate the cash flows needed to support distribution to its shareholders. For fiscal 2020, the company generated $8.3 billion in cash from operating activities. After adjusting for capital expenditure, the free cash flow was nearly $8.1 billion which far exceeds ~$6.3 billion paid out as dividend during this period.

Also, the company has been generating EPS well in excess of dividend. For 2020, EPS was $4.36, well above the dividend of $3.40 per share and implying a payout ratio of ~71%. With EPS expected to grow around mid-single digits in 2021, we expect the company to keep increasing its divided.

Share Repurchase Program

Supplementing the high dividend is Altria’s share repurchase program. The company recently announced a $2 billion share repurchase program which is expected to be completed by June 30, 2022. This will further add to returns for investors.

While Altria has significant debt on its balance sheet at ~$29 billion, we think it is manageable given staggered maturities. Long-term debt maturities during the next three years are as follows: $1.5 billion in 2021, $2.9 billion in 2022 and approximately $1.8 billion in 2023. With a high cash generative business, the company should be able to take care of any upcoming maturities without impacting the dividend. In fact, we like to see some debt on the balance sheet, especially considering the low interest rate environment and the steady nature of cash flows.

source: Company data

Valuation:

Altria currently trades at ~8.6x FY 2021E EPS. This is towards the lower end of the 10-year historical P/E ratio, wherein the stock has typically traded above 10x. We do note that the current multiple factors in heavy dependence on the smokeable segment which is declining. If the company is able to successfully transition to non-combustible tobacco products, then we might see expansion in the multiple. Until then, investors should consider Altria primarily as income generating stock. With dividend yield of 8.1%, it is an outstanding bet for income-seeking investors.

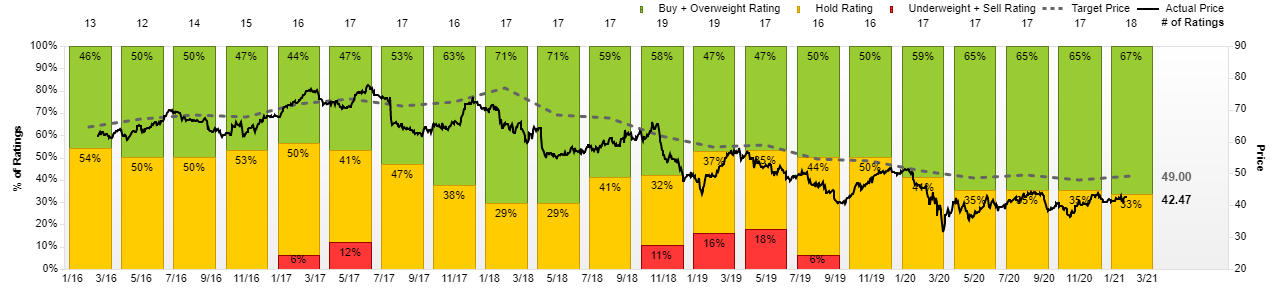

For a little more perspective, here is the average rating and price target for Altria by the 18 Wall Street analysts covering it and reporting to Factset

Specifically, these analysts believe the shares are underprice and have ~15% upside. And the majority of the analysts rate the shares a “Buy.”

Risks:

Highly regulated: Altria operates in an industry that is heavily regulated. And it is exposed to headwinds including efforts aimed at reducing the incidence of tobacco use and seeking to hold tobacco companies responsible for the adverse health effects and environmental concerns.

Heavy taxes: Tobacco products are subject to substantial excise taxes, and significant increases in tobacco product-related taxes are likely to continue within the United States at the federal, state and local levels. Tax increases are expected to continue to have an adverse impact on sales of the tobacco products.

Execution risk: Altria is trying to shift away from smokeable tobacco products to non-combustible categories. This includes heavy investments made in adjustment products such as e-vapor, oral nicotine pouches and others. If the company is unable to execute its strategy, it could have an adverse impact on revenue growth.

Conclusion:

Altria is not an aggressive growth stock that will post huge share price returns in the months and years ahead. However, if you are afraid such growth stocks are becoming increasingly overvalued (and due for a pullback in the near term) you might consider owning shares of Altria instead. Altria has increased its dividend 51 years in a row, and a healthy 8.1% dividend yield is nothing to roll your eyes at—especially in our current low interest rate environment.

At the end of the day, you need to decide what investments work best for you based on your own individual long-term investment goals. And if you are looking for a little more stability in your portfolio (and a very high dividend yield) Altria is absolutely worth considering.