If you are looking to add a steady growing dividend to your portfolio, this diversified natural gas company is worth considering. It has increased its dividend for 50 consecutive years (it currently yields 3.9%), and it offers the potential for healthy price appreciation. In this article, we review the health of the business, cash flows, balance sheet strength, dividend safety, valuation and risks. We conclude with our opinion on why it’s worth considering if you are a long-term income-focused investor.

Overview:

National Fuel Gas Co. (NFG) is a diversified energy company primarily involved in the production, gathering, transportation and distribution of natural gas. The company has upstream, midstream and downstream operations, as follows:

Exploration & Production (Upstream): is the largest segment accounting for ~40% of EBITDA. It is focused on developing acreage positions in the Marcellus and Utica shale regions.

Gathering, Pipeline & Storage (Midstream): this segment contributes ~39% to NFG’s EBITDA. It is focused on building pipeline infrastructure in the Appalachian region.

Utility (Downstream): this segment accounts for 21% of NFG’s EBITDA. It provides natural gas utility services to ~747,000 customers in western New York and northwestern Pennsylvania.

One advantage of NFG’s integrated business model is that it can adjust to changing commodity price environments. Specifically, the midstream and downstream businesses provide steady cash flow during periods of downturn in natural gas prices. As another advantage, the company’s common geographic footprint (of its various subsidiaries) allows them to share management, labor, facilities and support services across various businesses.

Worth noting, NFG faced challenges during fiscal year 2020 (due to adverse COVID-19 impacts), but expects significantly improved performance in fiscal year 2021. For starters, in Q121 NFG grew production by 36% over year despite curtailed Appalachian volumes. And management now expects strong production growth in fiscal 2021 (~33% growth over FY20) and raised its guidance for EPS to $3.55-$3.85 (earlier $3.40-$3.70), implying a growth rate of 27% YOY at the mid-point.

Solid Growth Prospects

Consistent with management guidance, NFG is well positioned to grow earnings in the near to medium term. For example, the acquisition of Tioga County assets in the Appalachian region during Q420 is likely to drive strong growth in production and gathering this fiscal year. The company also added a second rig in January 2021 which will focus principally on Tioga county. Further, management expects net production in Seneca to grow 32% and gathering volumes to grow 35% in fiscal 2021. Looking beyond fiscal to 2022, Seneca's program will likely average between 1.5 and 2 rigs, which will keep production flat to slightly growing.

E&P Net Production (Bcfe)

Source: Company Presentation

Additionally, NFG expects its upstream and gathering businesses to generate ~$115 million to $125 million in free cash flow in 2021. And as production grows in 2022 and 2023, the company expects the level of free cash flow to similarly increase. Importantly, to a large extent, the ability to generate cash is heavily dependent on the direction of commodity prices.

Source: Company Presentation

While pricing has not been strong so far this year, supply and demand fundamentals remain constructive over the next 12 to 18 months. For example, looking to fiscal year 2022, strip pricing is anticipated to be $2.80 per Mcf, a price where NFG will realize strong returns from its Appalachia program. Additionally, NFG has a useful hedging program in place for FY 2022 (with nearly 189 Bcf of fixed price firm sales, NYMEX swaps and costless collars). Thie program provides downside protection, but leaves the potential to generate significant additional free cash flow, should prices move up.

Production supported by strong hedge positions

Source: Company Presentation

Healthy Growing Dividend

NFG has increased its dividend for 50 consecutive years, putting it in the elite category of Dividend Kings (companies that have raised their dividend for at least 50 consecutive years). The most recent raise was in July 2020 wherein the dividend was increased dividend by ~2.3% to $0.445 per share.

The company current dividend yield (~3.9%) is highly attractive and sustainable. For fiscal 2021, the company expects funds from operations to exceed capital spending by ~$50 million. This coupled with the with the proceeds from the sale of timber properties, NFG expects to be able to cover dividend without any material incremental short-term borrowings. Further, it is well hedged for the remainder of the year, so any changes in commodity prices should have a muted impact on earnings and cash flows.

Also, the company has been generating EPS well in excess of the dividend. For 2021, EPS is expected to be $3.55-$3.85, well above the dividend of $1.78 per share and implying a payout ratio of ~48% at the mid-point.

50 Years of Consecutive Dividend Increases

Source: Company Presentation

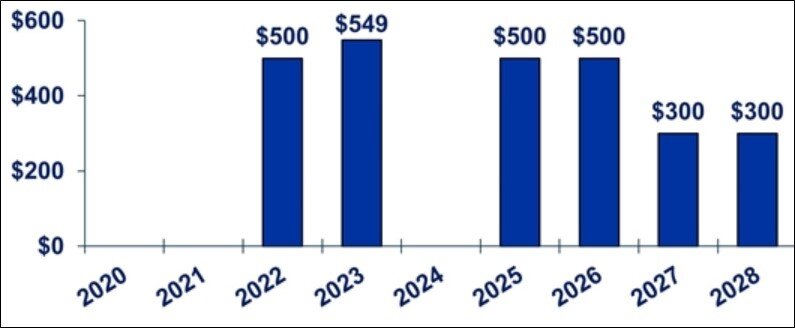

While NFG has significant debt on its balance sheet (~$2.6 billion), it is very manageable given the staggered maturity schedule (see graphic below). And with a high cash generative business, the company should be able to easily covering upcoming maturities without impacting the dividend.

Debt Maturity Profile

Source: Company Presentation

Valuation:

NFG currently trades near the lower end of its historical EV to EBITDA (forward) range (a good thing—especially considering the very strong dividend coverage ratio).

Further, Wall Street analysts increasingly rate the shares as a “Buy” with an aggregate price target implying the shares have approximately 11.9% upside (which is a lot for a steady dividend grower like NFG).

Risks:

Commodity price risk: As noted earlier, NFG’s earnings and cash flows are dependent on natural gas prices. However, with an extremely strong dividend coverage ratio, a solid hedging program, and gas prices looking constructive, we view this risk as mitigated in the near to mid-term to a large extent.

Execution risk: The company has an ambitious long-term growth program. This includes aggressive expansion plans across its multiple segments as well as pursuing M&A opportunities. NFG’s future cash flows are therefore dependent on the ability of management to execute on its capital spending plans.

Conclusion:

NFG’s diversified business operations have helped it deliver solid cash flows and a healthy growing dividend for 50 years. It has also left the company in a strong financial position going forward. We do not expect NFG to be a “multi-bagger” return in the short-term, but we do expect it to keep paying its healthy growing dividend. And we also expect the share price to go higher (especially with expectations for natural gas prices to increase in 2021 and 2022). If you are looking for an opportunity to add some solid dividend growth to your portfolio, these shares are worth considering.