The Blue Harbinger “Disciplined Growth” portfolio and the “Income Equity” portfolio both posted positive gains (again) in February (thereby extending their growing long-term track records of top performance). However, if you haven’t noticed, the market has been particularly volatile for top growth stocks over the last few weeks. More specifically, the “pandemic trade” is crashing. In this report, we share the latest performance of our top idea portfolios, and offer some tried and true advice (and specific ideas) about current market conditions going forward.

Blue Harbinger Performance:

As a reminder, we share our top idea investment portfolios to help you manage your own investments. These portfolios are just we tool we provide (the others are our top idea reports and our real-time portfolio tracking tool). To get right to it, here is the recent (February) and long-term performance of the two strategies (both were up in February, and both continue to achieve their specific long-term goals).

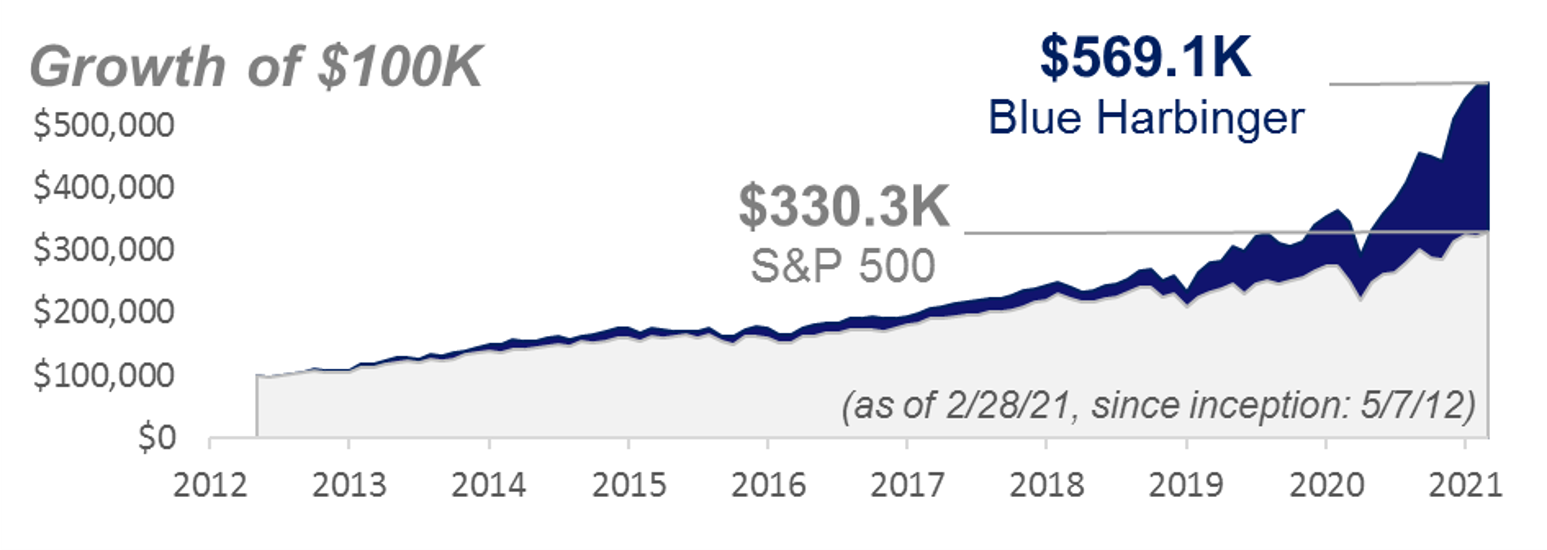

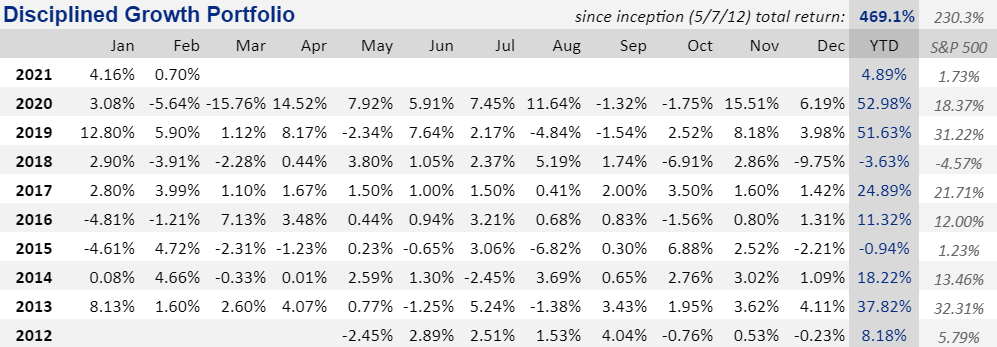

Blue Harbinger Disciplined Growth Portfolio:

This goal of this 30-stock portfolio is long-term capital appreciation, and as you can see in the chart below, it continues to achieve that goal relative to the S&P 500

Blue Harbinger Income Equity Portfolio:

The primary goal of this 40-stock portfolio is to deliver steady high income (it currently yields an attractive 6.0%). The secondary goal is to deliver long-term price appreciation greater than the rate of inflation (which it continues to achieve). Worth noting, and as you can see in the chart below, the strategy has now fully rebounded from the “pandemic lows” (which hit income securities particularly hard), and it kept delivering attractive steady high income the whole time.

To anyone that panicked and sold at the bottom, that was a terrible mistake. You missed out on the income and on the price gains. It’s also an important lesson for growth stock investors based on what is happening in the market right now.

The Pandemic Trade is Crashing:

As mentioned, the pandemic trade has been crashing in the last two weeks. Pandemic stocks (the ones that were big on social distancing—usually cloud-based tech stocks) performed extremely well coming out of the pandemic, but have performed terribly over the last two weeks. For example, here is a look at the recent performance of the S&P 500 versus value stocks (as represented by a Vanguard Value ETF) and versus the ARK Innovation ETF (a very popular growth ETF with some of the hottest “pandemic stocks” over the last year).

And as you can see in the chart above, the “pandemic trade” has been crashing in recent weeks. This is something we have been warning about. Our advice: Don’t panic.

Advice #1: Don’t Panic!

As you will recall, income-focused investors that panicked during the initial onset of the pandemic missed out on a ton long-term returns (in this case 1-year), and they also missed out on a lot of steady high income (as we described earlier). A much better approach is to simply don’t panic. Don’t do anything rash.

Short-term volatility is often the price you pay for the best long-term gains, especially in the case of top growth stocks. And the underlying businesses of the companies that have been crashing haven’t changed. Despite the selloff, there are still many great growth stocks, and their prices are actually MORE attractive now than they were a few weeks ago (see our current holdings and recommendations).

Advice #2: Remain Focused on Your Long-Term Goals.

The second piece of advice is simply to stay focused on your own personal long-term investment goals. There is no short supply of media pundits telling you what to do now. Buy! Sell! Go to 100% Cash! Borrow money to buy the dip!

Ignore them.

They don’t know you or your personal investment goals. Just remember what your long-term investment goals are, and stay focused. Disciplined long-term goal-focused investing has proven to be a winning strategy over and over again throughout history, and it will this time too.

Updates to our Blue Harbinger Portfolios:

Here is the link to our Blue Harbinger Top Ideas Portfolios. As you can see, we have made some small reweighting changes, and also updated our “Buy Under” prices for a handful of positions (green shading represents an increase to the “buy under” price, red means it was lowered). These changes are subjective based on our interpretation of the latest earnings announcements, our long-term outlooks for the businesses, and then spot checked against Wall Street analyst price targets. These portfolios, “buy under” prices, and ratings are just one tool to help you manage your own investments.

What Trades Should You Be Placing Now:

Our main advice here is that it is okay to be a bit opportunistic during times of market volatility (like currently) as long as you stay focused (and are consistent with) your long-term goals. For example, if you have a little extra cash lying around, now is a more attractive time to buy many top growth stocks than it was a few weeks ago (when prices were higher—launch our growth and/or income idea tracker tools for examples). Similarly, if you have been meaning to rebalance your portfolio, now may be a decent time to move out of some of your best relative performers and into some stocks that have sold off a lot but are still very attractive in the long-term (as long as it is consistent with your long-term goals). For example, many of our income stock ideas (and even our more conservative growth stock ideas) have performed relatively well in recent weeks, and you might consider moving some of those investment dollars to things that have been increasingly going “on sale.”

Income-generating options trades is another strategy that some investor really like during times of heightened volatility (like right now). Specifically, the upfront premium income available in the options market increases when volatility increases (like right now). Here is a list of our recent income-generating options trade ideas to give you some ideas and to help you generate some ideas of your own. The overall idea of this trade is to put attractive upfront premium income in your pocked today, and to also give you a chance of picking up shares of attractive long-term stocks at an even lower price (if they fall to your options strike price before expiration (usually in about 1-month) and get put to you).

The Bottom Line:

Disciplined, long-term, goal-focused investing has been a winning strategy throughout history, and it will be this time too. The performance (see above) and holdings (click here) of our Blue Harbinger portfolios is a growing example of this. You may choose to be a bit opportunistic during the current market volatility. But for goodness sake, don’t lose sight of your long-term investment goals! Be smart.