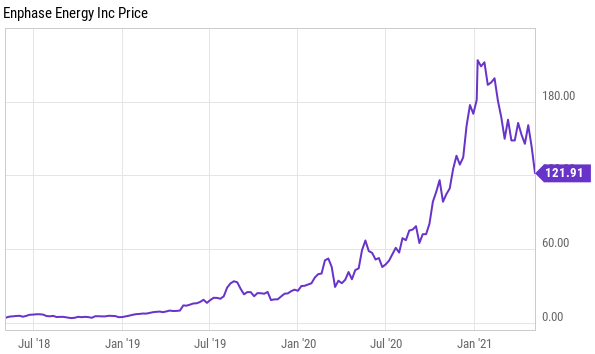

At Blue Harbinger, we look for highly attractive businesses to invest in, and if those businesses are also incrementally better for the environment—that’s important and a good thing. In this report, we review a growing leader in the sustainable energy space. The market opportunity is large and the company’s growth trajectory is impressive. And the recent share price pullback (thanks to the growth stock pullback and the recent semiconductor chip shortage) makes now a compelling time to consider adding shares. In this report, we analyze the company’s business model, its market opportunity, financials, valuations, risks, and finally conclude with our opinion on investing.

Overview: Enphase (ENPH):

Enphase Energy is a leading provider of microinverters and batteries used for solar energy generation and storage. It also offers a cloud-based software platform to remotely monitor and control solar panels on a real-time basis. Since 2016, Enphase has demonstrated an impressive turnaround rising from the verge of insolvency to becoming one of the leading pure-play solar companies in the US. The company has delivered strong growth in recent years, driven by increased adoption of its offerings primarily due to falling solar costs along with favorable government measures to push green alternative energy solutions.

To get more into the nuts and bolts, Enphase considers itself a home energy solutions company. It manufactures software-driven components that make solar power work including semi-conductor based microinverters for solar energy generation, batteries for energy storage, and a cloud-based software platform for real-time remote monitoring of its hardware system.

Incorporated in 2006, the California-based energy firm went through more than a decade of financial turmoil driven by an excessive debt load, operational losses, and negative cash flows. However, since a management shakeup and appointment of Badri Kothandaraman as the CEO in 2017, the company has turned the corner as a result of continuous cost cuts and product improvements that have led to robust expansion in revenue and margins. And recent strong financial performance has also been supported by favorable state and federal income tax regulations, which have promoted solar energy adoption in the US. Enphase shipped more than 32 million microinverters, and approximately 1.4 million residential and commercial systems in over 130 countries last year.

Enphase derives more than 90% of its revenue from microinverters, accessories, and storage solutions through a one-time sale. Its cloud-based real-time remote monitoring solution is sold either on a subscription basis or through one-time upgradation charges. More recently, it is also in the process of launching its “Enphase Ensemble” an all-in-one grid agnostic solution including microinverters, storage solutions, and monitoring solutions, in a suite by the end of 2021. Its customers include solar distributors who resell its products to large solar installers and integrators who in turn integrate Enphase’s offerings at residential and commercial solar projects. Enphase also sells its products directly to large installers, Original Equipment Manufacturers (OEMs), strategic partners, and homeowners. Geographically, Enphase derives almost 82% of its revenue from the US, while 18% comes from other international markets.

Long-term secular tailwinds from decreasing solar energy costs and government incentives

Over the last 3 decades, the cost of solar power equipment has decreased by more than 95% primarily driven by improved technology due to consistent R&D, economies of scale, supply chain competitiveness as well as favorable initiatives, such as tax credits introduced by federal agencies to promote green energy. In fact, the gross cost per watt for solar panels has reduced by almost 21% from H1 2016 to H2 2020 as shown below. According to a recent report published by IEA, new utility solar projects cost around $30 to $60/MWh in Europe and the US, which is significantly lower than gas and coal. Furthermore, the same report estimated that electricity generation from non-hydro renewables including solar and wind will reach 12,872 Terawatt Hours (TWh) by 2040 significantly higher than other sources. This increase is estimated to be primarily driven by a 43% expansion in solar energy projects and only a 16% share is expected to come from wind energy. Enphase, being a pure-play in solar space through its unique microinverter technology catering to both residential and commercial customers, is expected to leverage this long-term secular tailwind in the coming years to fuel its business growth. Also, it is important to note here that the Biden administration has recently announced proposals to extend tax credits which if put into law will be a major positive for the sector.

Source: Energysage, Carbon Brief

Leveraging semiconductor-based microinverter technology to drive growth

The basic principle of solar electricity generation is the conversion of Direct Current (DC) produced inside the solar panels to Alternating Current (AC) through an inverter. Traditionally, this process was executed using “string inverters” also known as Centralized inverters. These inverters are installed in the basement of the house and are directly connected to the solar panels through “strings” or wires which transfer the DC flow. While it has long been hailed for its cost effectiveness, there are many drawbacks associated with this technology which include a reduction in a system’s overall power output equivalent to its weakest panel when it comes under shade, less flexibility in terms of solar panel deployment, and safety issues.

To tackle these limitations, the solar industry came up with advanced technology alternatives such as “microinverters” and “DC optimizers”. Investors must note that Enphase Energy is a pioneer in “microinverter” technology and was the first in the market to commercialize the technology. Microinverter technology eliminates the “central inverter” and deploys a microinverter under each solar panel converting DC to AC right on the roof thus eliminating the risk of “single point” failure and excessive DC power on the ceiling. These solar panels are connected independently with the grid and the right voltage is found through Maximum Power Point Tracking (MPPT). Since MPPT is applied at the panel level, if one of the panels gets shaded, it will not affect the overall power output of the system. Moreover, microinverter technology provides more flexibility in terms of solar deployment which in turn enables maximum capacity utilization. Since 2016, sales of Enphase’s microinverter have grown at a CAGR of about 25% from 13 million to more than 32 million.

DC optimizers on the other hand are an upgraded version of the traditional string inverter. Despite being a low-cost option as compared to microinverters, it lags behind microinverter technology in two major aspects. The first is the presence of a “central inverter” that increases the risk of single-point failure and higher additional repair costs as central inverters generally carry lower warranty times. The second is the existence of almost 600-1000 volts of DC on the roof, which can lead to significant damage in the case of overheating. A detailed analysis of the three methods is presented in the table below. Investors must note that microinverter prices are only 10% to 20% more than DC optimizers. Moreover, the price of microinverters is expected to drop further considering robust demand across commercial and residential setups and lucrative income tax benefits.

Source: Solar Quotes, Research Gate, Enphase, Solar Surge

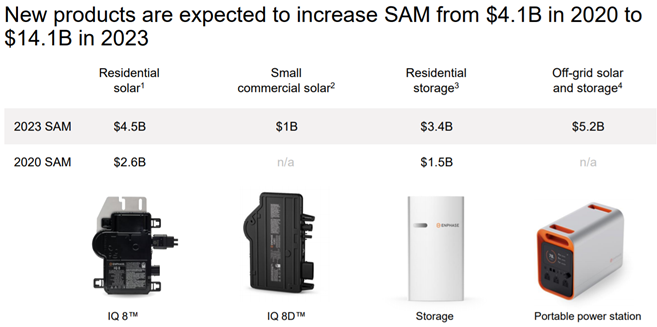

Large and growing Serviceable Available Market (SAM)

According to the company’s estimates, its total SAM stood at $4.1B in 2020 and is expected to reach $14.1B by 2023, thereby growing at a CAGR of over 50%. This expansion in SAM is primarily driven by increasing adoption of company’s smart AI-based Enphase storage system as well as continuous introduction of additional products. During Q4 2020, the company shipped 32 megawatt-hours of storage systems which represents a growth of 35% Q-o-Q. Moreover, Enphase is planning to significantly ramp up deployment of its residential storage system outside the US by the end of 2021 as explained by Badri Kothandaraman in the Q4 2020 earning conference call.

“We will also be introducing our Enphase Storage System for the European market later in the third quarter of 2021, adding yet another growth driver. In Australia, we built on our strong Q3 results and achieved record quarterly sell-through and record installer count in Q4. The results were fueled by the launch of our Enphase Installer Network or EIN as well as growing demand for our high-power IQ7A microinverters plus a favorable competitive environment as regulations continue to shift toward safer and smarter solar. We expect to introduce our Enphase Storage system for the Australian market during the fourth quarter of 2021.”- Badri Kothandaraman, CEO

The growth in SAM is also driven by “Off-grid Solar and Storage” as the company plans to gain a strong foothold in the Indian rural market. According to the company’s estimates, providing farmers with a reliable source of energy in the form of a “Solar water pump” presents a large SAM of $2 billion by 2022. Moreover, mitigating energy poverty through its stand-alone storage systems and extreme heat through its solar energy fueled air coolers also present $1.5 billion and $0.5 billion of SAM respectively by 2022.

Source: Investors Presentation

Consistent growth in top-line and bottom-line. Temporary negative impact from semiconductor shortage

Since 2016, Enphase’s top-line has experienced significant YoY growth driven by organic initiatives as well as through inorganic means. Recent revenue growth is also attributable to favorable government policies and growing sustainable energy awareness among people. Enphase reported total revenue of $302M in Q1 2021, which represents a top-line yearly growth of 47% primarily driven by robust demand across both its solar microinverters and energy storage solutions. On the profitability front, the company’s adjusted gross margin improved by 160 bps from 39.5% in Q1 2020 to 41.1% in Q1 2021 as a result of increasing average selling price along with effective cost management by the company as they shifted a part of contract manufacturing to Mexico to bypass China tariffs. Operating margins largely remained flat at 27% because of increased R&D and other payroll costs during the quarter.

Going forward, while there is no shortfall in demand, the company is expected to face supply constraints as it is facing a shortage of semiconductor components that are used in its micro-inverters. Although management has taken initiatives to expand production capacity and streamline supply chains, it expects component constraints to remain for rest of the year. Further, margins will narrow in coming quarters due to an increase in expenses associated with semiconductor supply constraints and operating expenses related to hiring, and sales, and marketing as explained by Eric Branderiz, CFO in Q1 2021 earning conference call: -

“Even as component availability starts to improve this quarter, we must rush to get those components into final products into our customers' hands. As a result, our GAAP and non-GAAP gross margin guidance incorporates a material sequential increase in expedite expense. Next, I would like to touch upon our opex guidance. Our non-GAAP operating expenses are increasing from Q1 to Q2 due to hiring to support our growth plans, the consolidation of acquisitions and necessary investments in software, branding and the development of IQ 9 and IQ 10 microinverters.” – Eric Branderiz, CFO

Robust financial position and strong free cash flow generation

Enphase’s ability to generate free cash flows has significantly improved since the management reshuffle in 2016. Its FCF increased from a mere $12M in 2018 to almost $200M in 2020 primarily fueled by growing product shipments as well as expanding margins. In Q1 2021, Enphase reported an FCF of $82M as compared to $36M in the same quarter last year. As a percentage of sales, FCF margins improved from 17% in Q1 2020 to 27% in Q1 2021. The company reported $1.5B in cash and cash equivalents for Q1 2021 up by almost 151% from Q1 2020. The massive increase is due to the net proceeds of almost $1.2 billion from the issuance of notes partially offset by a $305M outflow for partial repurchase and conversion of outstanding convertible notes. The fact that Enphase’s total debt of $1.32B is completely covered by cash gives us some comfort regarding its ability to withstand any near term economic challenges. Besides, it also provides the company with the necessary liquidity to seek inorganic growth through acquisitions. It recently completed the acquisition of SofDesk and DIN engineering, which according to management will simplify the sales process and enhance the buying experience for homeowners. Also, the company is actively looking for M&A opportunities to fuel its growth.

Premium valuation but recent correction is helpful

Enphase is currently valued at a forward Price-to-Sales ratio of 17.4x which is significantly higher than its peers. Having said that, the stock has fallen over 30% from its peak in January this year as a result of a broad sell-off in growth stocks. While the current valuation is still at a premium, the risk reward is more attractive than it was a couple of months back.

Risks

Semiconductor supply shortage: Enphase relies more heavily on semiconductor chips due to its highly advanced microinverter technology as compared to its peers. More recently, the company has been facing an extended period of chip shortage which it expects to continue for rest of the year. This constraint can result in near to medium-term revenue and margin headwind for the company going forward. Having said that, the semiconductor shortfall is likely to be temporary and does not impact the long-term growth story.

Expiring solar tax credits: As per a recent report from the US energy department, homeowners claimed a 30% solar tax credit if they installed a solar PV system before December 2019. For the systems installed in 2021-22 and 2023, homeowners can claim up to 26% and 22% of solar tax credits respectively. These credits are scheduled to expire in 2023 which will impact demand. Having said that, Biden administration’s highly supportive stance towards green energy means we are optimistic about subsidies for the sector continuing in one form or the other. In fact, the recently unveiled American Jobs plan by the administration calls for a 10-year extension to tax credits and an increase in tax credit rate from 26% to 30%. The proposal needs to be passed by congress so it remains to be seen what the final decision will look like in this matter.

Conclusion

Enphase Energy is one of the most attractive plays in solar space. Operating in the fast-growing sustainable energy solutions industry, the company has demonstrated strong top-line growth and expanding margins over the last few years. While the company’s valuation is at a bit of a premium, Enphase’s microinverter technology and its highly integrated grid agnostic solar deployment with storage and real-time remote monitoring presents a strong moat. We like the opportunity here for long-term oriented investors, especially on the recent price pullback.

Note: We currently own shares of Enphase (ENPH).