As the “pandemic trade” continues to unwind (i.e. high growth stocks continue to sell off), we have placed a new batch of trades (in both our Disciplined Growth and Income Equity portfolios) to take advantage of attractive buying opportunities that have emerged. This report highlights the trades, as well as provides commentary on the continuing powerful performance of the two strategies.

Before getting into the details of the new trades, here is a link to our updated top idea portfolios (the newly purchased names are highlighted in green, and the complete sales are highlighted in red):

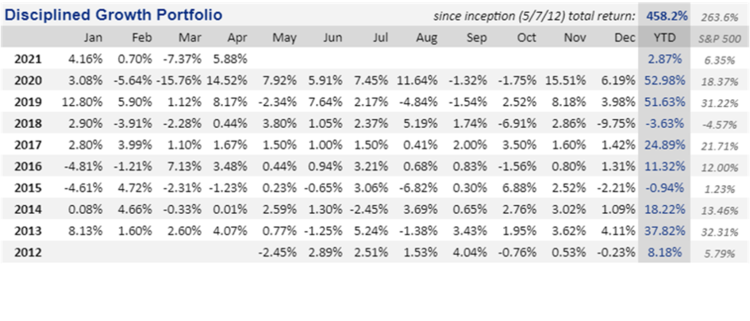

Disciplined Growth Portfolio

The Disciplined Growth portfolio continues to post strong long-term performance and was up 5.88% in April.

However, so far May has been a volatile month for growth stocks, and we have used this volatility to take advantage of attractive opportunities. Specifically, here are the trades:

To simply make room for better opportunities, we sold the following positions:

Fastly (FSLY):

Alteryx (AYX)

Beyond Meat (BYND)

Fortinet (FTNT)

And we added the following positions:

Futu Holdings (FUTU): Read the report.

Accolade (ACCD): Read the report.

These trades take our total holdings in the Disciplined Growth portfolio back down to 33 (a level we are comfortable with because it provides enough diversification, but still leaves room for strong performance). In aggregate, the trades described above reduced our exposure to aggressive high-growth technology stocks, and increased our exposure to financials (FUTU) and healthcare (ACCD), sectors we like based on the ongoing pandemic trade unwind). You can view all of our current portfolio holdings here.

Income Equity Portfolio

The Income Equity portfolio also continues to post strong long-term performance. The strategy was up 4.35% in April, and it currently offers a 6.0% yield, following our latest batch of trades.

There are five new batches of trades in the portfolio (which is more than normal). The trades are described below.

Trade 1: REIT Reboot

We made a variety of trades among our current real estate investment trust (REIT) holdings, as described below.

Sold Eastgroup Properties (EGP): We sold industrial REIT Eastgroup Properties (EGP) mainly based on valuation. EGP has had an impressive run for us in the roughly 5 years we have held it, and we replaced it with Prologis.

Bought Prologis (PLD): Prologis is a big blue chip industrial REIT. The yield is not particularly large (the current yield is 2.2%), but the dividend is growing and so is the share price as PLD is a leader in the industrial space—a segment of real estate poised to keep growing, especially with e-commerce.

Sold CyrusOne (CONE): We sold data center REIT CyrusOne because it is not the leader in the space and does not have the same economies of scale as other larger players (such as DLR—which we continue to own). Plus, the data center REIT space may experience slowing growth and multiple contraction as the pandemic trade unwinds.

Sold Welltower (WELL): We sold this healthcare REIT to make room for other RETI opportunities. This one was hit hard by the pandemic, and may well have room for more rebound ahead, however we see better REIT opportunities and redeployed the cash.

Bought Kilroy (KRC): Kilroy is an office REIT, and it may seem absurd to invest is this space with the explosion in “work from home” as a result of the pandemic. However, this west coast REIT has attractive young properties that will be a winner as part of the continued re-opening. Where other office REITs may slowly bleed to death, Kilroy will be a winner and we expect dividend increases down the road

Bought Cohen & Steers Quality Real Estate CEF (RQI): This is an opportunity to add higher yield (the current dividend yield is 6.5%) and exposure to a monthly dividend payer that trades at a discounted price (versus NAV). The fund also has a 23.9% leverage ratio which we view as prudent and it will help magnify long-term returns.

Trade 2: High Yield Shuffle:

We shuffled a few holding among our high yielders. Specifically, we sold two high-yield preferred shares (we took profits as they were trading significantly above their $25 “par values.” We replaced them with two different, yet very attractive high-yielders.

Sold Teekay LNG Partners preferred shares (TGP-B) on valuation.

Sold Triton International Preferred shares (TRTN-A) on valuation.

Bought Double Line Yield Opportunities (DLY): This is an attractive closed-end fund offering a high 7.1% yield, paid monthly. We wrote it up recently, and we like that it trades at a discount (to NAV), it uses a prudent amount of leverage (20.3% recently) to magnify long-term returns, and the holdings (actively selected bonds) are compelling.

Bought Altria (MO): We wrote this one up recently, and we bought this attractive high yielder (6.8%) based on valuation, and because we wanted to rotate into a steadier long-term business.

Trade 3: Utilities Change

Sold Evergy (EVRG): We sold this utility stock after holding it for about 5 years. It’s been through a merger, dividend increases, and now valuation led us to sell (we sold at an attractive price) to make room for different opportunities.

Bought Reaves Utility Income (UTG): There’s lots to like about this Utility Sector focused closed-end fund, including its 6.2% yield (paid monthly), the steadiness of the sector and prudent use of leverage (recently 15.7%) to magnify long-term returns.

Trade 4: Blue Chip Adjustment

Bought Apple (AAPL): The biggest change here is we took a large stake in shares of Apple. This may seem like an odd choice given the lower yield and the fact that it is in the Technology sector, however there are lots of attractive qualities to like here. Apple pays a very steady, well-covered (they have tons of cash) growing dividend. And Apple is basically a value stock given the strength of the business. The yield may seem low, but look back on this one years down the road and watch your “yield on cost” grow as the dividend rises and the share price rises too.

Sold Blue Chips (VZ), (WMT), (ACN): We sold our positions in blue chip stocks Verizon, Accenture and Walmart, even though we continue to like all three business. Simply put, we wanted to make room for better (more compelling) opportunities).

Trade 5: Energy

Bought Enterprise Products Partners (EPD): With energy prices up, yet sector valuation still extraordinarily low, it’s hard not to be interested in the sector. And EPD is a preeminent blue chip midstream player offering a big yield and an attractive price. As the market continue to shift out of the pandemic trade, the energy sector has legs, and EPD is an outstanding way to play it. We recently completed a detailed report on EPD if you want more information (see the portfolio holdings link provided earlier).

The Bottom Line:

We say it all the time, and you are probably sick of hearing it, but it’s still worth repeating:

Know your goals as an investor, and stick to your strategy. That doesn’t mean buying and holding the exact same stocks forever. Rather, you can be opportunistic when market opportunities present themselves so long as you stay consistent with and true to your goals. Disciplined long-term investing is a time-testing strategy for success. Be smart.

You can view all of our current portfolio holdings here.